Contents

Key Points

- EigenLayer is a middleware built on Ethereum that introduces restaking.

- The protocol offers various staking methods and implements a slashing mechanism to enhance network security.

- September 30th is not the airdrop date of EigenLayer or EIGEN token circulation unlock date.

- EigenLayer plans to distribute approximately 15% of EIGEN tokens via airdrops, with the first two seasons allocating about 11.9% of the total supply.

This article is brought to you by WEEX Exchange, tailored for both new investors and seasoned crypto enthusiasts seeking to diversify their investment portfolios. WEEX is the world’s leading bitcoin futures trading platform. With a reputation for security and liquidity, WEEX has previously listed tokens such as XRP and DOGS. Find out more at: https://www.weex.com/register

EigenLayer: An Overview

EigenLayer introduces innovative concepts in ETH validator: re-staking and free market governance. These advancements aim to extend Ethereum’s security framework to other systems and enhance governance efficiency. The protocol offers a variety of staking methods, comparable to Lido’s liquid staking and super-liquid staking, including direct staking, LSD staking, ETH LP staking, and LSD LP staking. urthermore, EigenLayer provides two distinct staking modes: solo staking and trust mode. Platforms like Weex Exchange can facilitate access to these staking options, making it easier for users to participate in EigenLayer’s ecosystem.

To bolster network security, EigenLayer implements a slashing mechanism that increases the cost of network disruption. Due to the varying slashing risks associated with different delegated staking choices, the protocol refrains from issuing fungible tokens as staking certificates. Additionally, utilizing fungible tokens to ensure position transparency could lead to conflicts between position owners and node operators.

The re-staking sector shows significant growth potential. Factors such as ETH releases, arbitrage-driven activities, and the evolution of LSD protocols contribute to the anticipated increase in ETH staking rates. With Ethereum’s current staking rate approaching 14% and considering the typical 40-70% staking ratio for PoS public chains, there remains substantial room for expansion. EigenLayer introduces a novel narrative for Ethereum, enabling innovators to leverage ETH re-stakers for security and decentralization through EigenLayer, rather than establishing their own trust networks for new distributed validation modules.

EigenLayer’s key features include:

- Resolution of fragmented trust networks

- Support for multiple staking modes

- Robust risk management mechanism

- Comprehensive ecosystem support, including:

- New application scenarios

- Leveraging staker heterogeneity for massive block space scaling

- Balancing democracy and flexibility

- Advancing Ethereum staker decentralization

- Support for multi-token node clusters

Current Data of EigenLayer

According to official data, EigenLayer currently supports 16 Active Validation Services (AVS), including EigenDA, encompassing areas such as DA, oracles, privacy, DePin, gaming, and ZK verification. Despite the emergence of competing re-staking protocols from various ecosystems like Symbiotic, Karak, Solayer, and Jito, EigenLayer maintains its position as the leading protocol in terms of value scale, development progress, and network effects within the re-staking sector. Regarding valuation, although EIGEN has not yet enabled its transfer function, some pre-market trading platforms, including Aevo, have initiated EIGEN contract trading. As of the latest update, EIGEN is quoted at $2.95 on Aevo. Given EIGEN’s genesis total supply of 1.67 billion tokens, this price suggests a Fully Diluted Valuation (FDV) of approximately $4.9265 billion for EigenLayer.

EIGEN Token Airdrop: Clarifying the September 30th Date

It’s important to address a common misconception about the EIGEN token unlock timeline. Contrary to popular belief, September 30th is not definitively set as the circulation unlock date. This misunderstanding arose from the Eigen Foundation’s May document, which mentioned September 30th in the unlock timeline. The Foundation stated that EIGEN’s transfer function activation depends on “launching new features and further decentralization,” with September 30th as an initial target. To be clear, EigenLayer officials haven’t explicitly confirmed that EIGEN’s transfer function will unlock on September 30th. However, given the progress towards “further decentralization,” it’s reasonable to expect EIGEN’s final unlock shortly after the second season airdrop and incentive program begins.

For those interested in participating in EigenLayer’s ecosystem and potentially benefiting from future airdrops, one option to consider is using Weex Exchange. Weex Exchange offers a user-friendly platform for trading and staking various cryptocurrencies, including those compatible with EigenLayer’s re-staking mechanism. With Weex Exchange, users can easily engage with EigenLayer’s innovative features.

EigenLayer’s Valuation and Profit Projections

Earlier this year, EigenLayer announced that 15% of EIGEN tokens would be distributed via airdrops. The first and second season airdrops are set to distribute 113 million and 86 million EIGEN tokens respectively, totaling approximately 200 million EIGEN, which represents about 11.9% of the 1.67 billion genesis total supply. This allocation suggests that EigenLayer has reserved roughly 3.1% of EIGEN tokens for future airdrop rounds. In addition to airdrops, participants can earn EIGEN through the incentive program scheduled to launch in October, which will distribute EIGEN rewards to eligible stakers and node operators on a weekly basis.

Based on available data, we can estimate the potential yield for staking participants under this incentive program. The program targets two primary groups: stakers and node operators. While EigenLayer has not specified the exact allocation between these groups, we can reference the ratio used in the second season airdrop design. In that instance, EigenLayer allocated 3.7% of the supply to stakers and 0.52% to node operators, approximating an 88:12 ratio. Applying this ratio to the total first-year incentive of 66.95 million EIGEN, we estimate that 59 million EIGEN will be distributed to staking participants. At the current price of $3, this amounts to approximately $174 million. Given EigenLayer’s reported total TVL of $10.79 billion, the estimated potential yield for staking participants under this incentive program is approximately 1.6%.

Participation Strategy for EigenLayer’s Early Airdrop

Liquidity Staking Process:

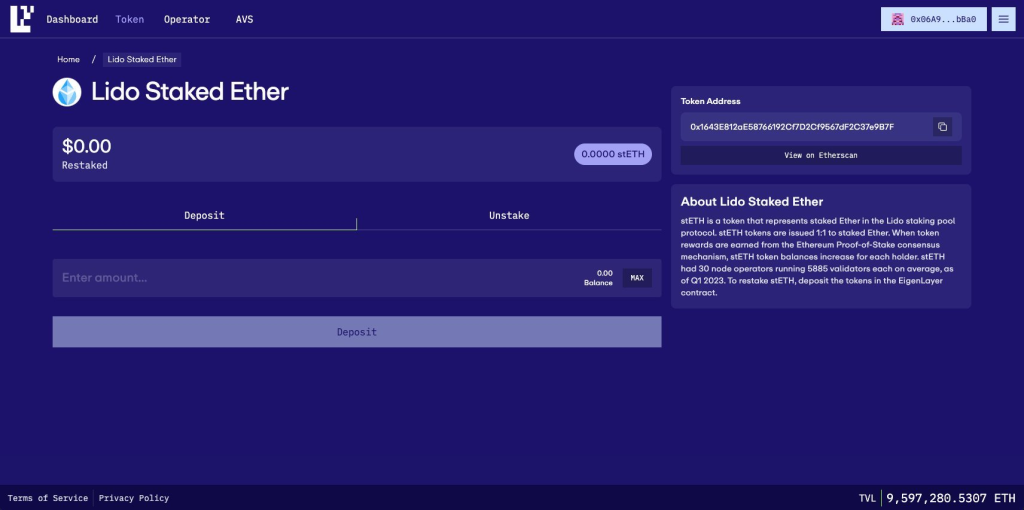

Step1:Access the EigenLayer application at https://app.eigenlayer.xyz/ and connect your Web3 wallet, ensuring you are on the Ethereum mainnet network.

Step2: Choose your preferred token for staking.

Step3: Complete the token approval and deposit process:

- Input your desired deposit amount and proceed.

- For first-time users, approve token spending.

- Grant the dApp permission to transfer specified tokens from your wallet.

- Set your spending limit and continue.

- Confirm the approval.

- Once the approval transaction is verified, confirm the deposit.

- Upon successful completion, you will receive a confirmation message.

- Review your re-deposited balance on the application dashboard.

Step4: Monitor your staking rewards and re-staking ratio on the homepage. Re-stakers accumulate re-staking points based on their total EigenLayer re-staking contribution. These points are calculated according to the amount staked over time, measured in ETH per second. Your re-staking ratio is determined by dividing your re-staking points by the total re-staking points of all participants.

Keeping an eye on WEEX and WEEX Help will not only help you know more details about Eigen Airdrop and EigenLayer actions in Web3 but also allow you better to understand the overall landscape of the cryptocurrency market. Stay tuned for more updates!

Find us on:

Twitter | Telegram | Medium | Facebook|LinkedIn|Blog

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Feixiaohao| Cryptowisser.com| Coingecko|Coincarp