- Blum daily video codes October 31: “Defi Risks Key Insights”, code: BLUMHELPS

- DeFi risks key insights Blum video educates viewers on the advantages and risks of DeFi, focusing on stablecoins, MakerDAO, and safety tips.

- WEEX Help offers a comprehensive collection of all Blum codes.

In its latest October video, Blum Academy delves into DeFi risks key insights. With DeFi lending protocols now standing as the second most significant sector in the cryptocurrency landscape—boasting a market value of $31 billion—this discussion is particularly timely. This is the second time Blum Academy has addressed the topic of DeFi, underlining its growing relevance. Complementing this, WEEX has introduced the DeFi Explained Blum code, which clarifies what decentralized finance is and how it functions. This article will focus on the inherent risks, benefits, and challenges associated with DeFi.

Contents

Defi Risks Key Insights Blum Code October

Blum Academy’s latest video, “Risks of DeFi: Everything You Need to Know,” was released on October 30, offering a deep dive into the advantages and potential pitfalls of decentralized finance (DeFi). The video highlights how DeFi is reshaping finance with lower entry barriers and round-the-clock market access, making financial services more accessible than ever. However, it also covers significant risks, including security vulnerabilities, regulatory uncertainties, and the presence of fraudulent platforms. Learn how platforms like Blum are making DeFi more accessible and discover key strategies to help protect yourself in this dynamic and rapidly evolving space.

Defi Risks Key Insights Blum Code Task:

Video: Defi Risks Key Insights

Blum Code : BLUMHELPS

Dai (DAI) is a decentralized stablecoin designed to maintain a stable value of approximately $1. Unlike traditional stablecoins (USDC/USDT), which are often backed by fiat currencies and held in a central reserve, Dai is generated and managed through smart contracts on the Ethereum blockchain. This innovative approach allows Dai to provide users with stability in a volatile cryptocurrency market, making it an essential component of the decentralized finance (DeFi) ecosystem.

The Role of DAI and DeFi

Dai serves as a stable medium of exchange and a unit of account within DeFi applications. Its stability enables users to engage in various DeFi activities, such as lending, borrowing, and trading, without the fear of significant value fluctuations. As a decentralized stablecoin, Dai facilitates seamless transactions, offering users an efficient means to preserve their purchasing power while accessing the diverse opportunities available in the DeFi space.

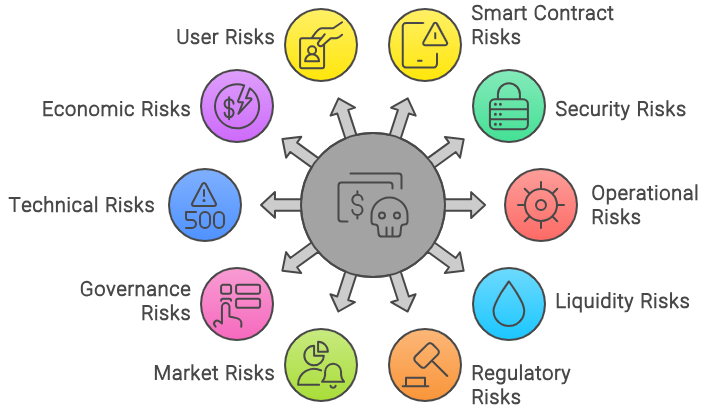

What Are Key Risks of DeFi?

Understanding the risks of DeFi is essential before diving in. Here are some of the main concerns:

- Smart Contract Vulnerabilities: DeFi platforms rely on complex smart contracts, which are self-executing codes that enforce transactions. However, if a smart contract has bugs or flaws, hackers could exploit them, potentially leading to the loss of funds.

- Market Volatility: DeFi tokens and assets like Bitcoin, Ethereum, and Dai are subject to high price volatility. While Dai remains stable, DeFi users who also invest in other cryptocurrencies need to be cautious of potential losses from price swings.

- Lack of Regulatory Protection: DeFi operates without the oversight of regulatory bodies, which can be a double-edged sword. While this allows for freedom and anonymity, it also means users may have limited recourse in the event of fraud or failure.

- Liquidity Risks: DeFi platforms often rely on liquidity pools, which require enough capital to process transactions effectively. During market downturns, liquidity can dry up, making it difficult to withdraw or trade assets.

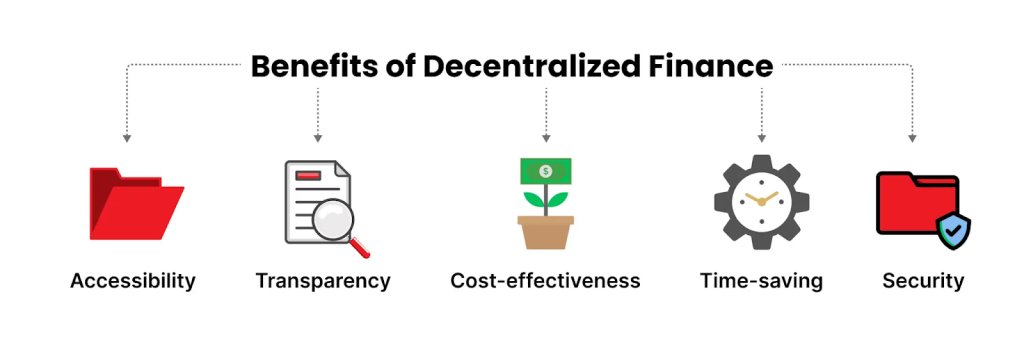

Benefits of DeFi

DeFi (Decentralized Finance) offers numerous advantages that extend beyond conventional, fiat-based financial systems, making it an appealing option for a wide range of users. Here are the primary benefits:

- Financial Freedom and Inclusivity: DeFi provides open access to financial services for anyone with an internet connection and a crypto wallet, breaking down barriers of location and income. This accessibility is especially valuable in regions lacking robust banking infrastructure, offering opportunities where conventional systems fall short.

- Transparency and Security: All transactions on DeFi platforms are recorded on public blockchains, such as Ethereum, which supports over 90% of DeFi traffic. This transparency allows anyone to verify transactions and monitor network activity. Users also maintain full control over their funds through non-custodial wallets or smart contract-based escrow, eliminating dependence on third-party institutions.

- Potential for High Returns: DeFi provides users with passive income opportunities, such as yield farming, staking, and liquidity provision, which often offer significantly higher returns than traditional savings or investment accounts.

- Stablecoin Stability: Stablecoins like Dai introduce stability within the DeFi space, helping users protect their assets from the high volatility common in cryptocurrency markets.

- Permissionless Access: DeFi is permissionless, enabling users to trade assets, make transactions, and move funds without requiring approval or facing delays typical of traditional banking. This allows for faster transactions with minimal fees (though crypto-specific costs like gas fees may apply).

- Real-Time Transactions: DeFi transactions are processed instantly, with the blockchain updating the moment a transaction is completed. Interest rates, too, are updated multiple times per minute, allowing for dynamic interaction with the market.

- Programmable Smart Contracts: DeFi is built on smart contracts that can be programmed to execute automatically under predefined conditions, supporting a range of financial functions based on countless variables.

- Tamper-Proof Data and Security: Built on blockchain technology, DeFi transactions are secure, auditable, and tamper-proof, ensuring a high level of trust and reliability.

- Open-Source Ecosystem: Many DeFi protocols are developed with open-source code, which allows developers to view, audit, and build on existing platforms without requiring permission. This openness promotes innovation and the creation of interconnected DeFi applications, driving continuous improvement and expansion of financial products.

By combining accessibility, transparency, and flexibility, DeFi empowers users with tools and services that traditional finance systems cannot match, marking it as a transformative force in global finance.

To make the most of DeFi’s benefits while managing risks, here are some best practices:

- Research Thoroughly: Before using any DeFi platform, understand how it works, including its smart contract code, security audits, and team reputation.

- Diversify Your Investments: Avoid putting all your assets in one platform or token. Diversifying your investments across different DeFi protocols can reduce exposure to individual risks.

- Use Stablecoins for Stability: Stablecoins like Dai can help protect your portfolio from market swings while still allowing participation in DeFi opportunities.

- Stay Updated on Security Measures: DeFi is an evolving field, so it’s crucial to stay informed about the latest security practices, including using hardware wallets, enabling two-factor authentication, and avoiding sharing sensitive information.

Most Popular Blum Codes on WEEX

What Is On-Chain Analysis Blum Code: Overall Understanding of On Chain Analysis

Understanding On-Chain Analysis with Blum Code and Blumextra

Crypto Slang Part 1 Blum: A Ultimate Guide to Crypto Slang 2024

How to Trade Perps on Blum Code: A Comprehensive Guide

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: