Key Takeaways:

- Blum Video Code November 28: “Crypto Regulations #2”, the code: BLUMRULES.

- EU’s MiCA Regulation: The European Union is implementing the MiCA regulation, which sets a unified legal framework for crypto assets, aiming to protect consumers and prevent market abuse.

- Travel Rule Enforcement: The FATF’s “Travel Rule” is gaining traction, with some regions enforcing it to share transaction data in crypto deals, reflecting a move towards stricter global crypto regulations.

Contents

Crypto Regulations #2 Blum Code November 28

On November 27, Blum Academy unveiled the video “Crypto Regulations #2: Gateway or Barrier to Mainstream Adoption?”. Crypto Regulations #2 Blum video explores how good regulation could open up the crypto world for billions, while bad regulation could risk your hard-earned assets.

Crypto Regulations #2 Blum Video Task:

🎬Video: Crypto Regulations #2

✅Blum Code: BLUMRULES

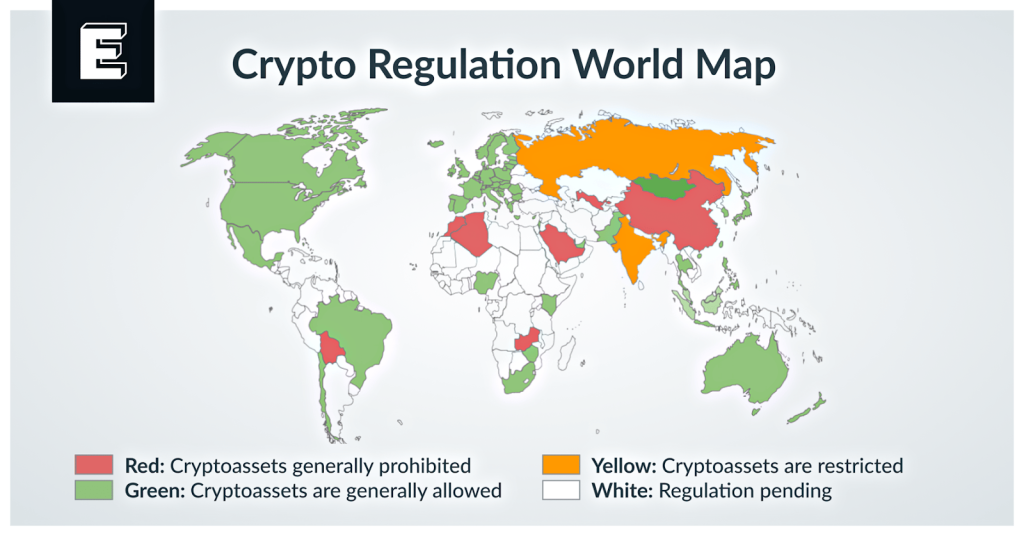

Global Overview of Crypto Regulations

The world of crypto regulations showcase a variety of approaches, reflecting different priorities and strategies in managing the evolving cryptocurrency space. Here’s a look at how different countries are navigating this dynamic landscape:

- United States: The SEC and CFTC lead regulation, with notable cases like Ripple’s partial victory shaping the market. Recent approvals of Bitcoin and Ethereum Spot ETFs in 2024 mark a regulatory milestone.

- China: A strict approach includes banning cryptocurrency mining in 2021 and outlawing cryptocurrencies entirely, emphasizing control over financial activities.

- Canada: Pioneering progressive crypto regulation, it was the first to approve Bitcoin ETFs. Crypto platforms must register under Canadian securities laws, fostering transparency.

- European Union: The MiCA framework provides a unified regulatory structure, ensuring consumer protection and setting standards for crypto service providers across member states.

- Japan: Recognizes cryptocurrencies as legal property under the Payment Services Act, requiring exchanges to comply with AML/CTF regulations and fostering responsible innovation.

- Singapore: Regulates crypto exchanges under the Payment Services Act and has introduced specific guidelines for stablecoin issuers to ensure market stability.

- Brazil: Legalized cryptocurrencies as payment methods in 2023, with the Central Bank regulating exchanges under a comprehensive framework.

- South Korea: Enforces strong user protections under the 2023 Virtual Asset User Protection Act, with exchanges required to register with the Korea Financial Intelligence Unit.

- India: While crypto remains neither fully legal nor banned, heavy taxes on trades and gains reflect cautious regulatory progress without fully embracing the industry.

- Australia: Cryptocurrencies are classified as legal property and subject to capital gains tax, with exchanges operating under AUSTRAC’s AML/CTF regulations.

These diverse approaches to crypto regulations highlight a global effort to balance innovation, security, and compliance, each tailored to the unique economic and legal environments of individual nations.

Key Financial Regulators Influencing Crypto

Major financial regulators play a pivotal role in shaping crypto regulations. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have been instrumental in defining cryptocurrencies as securities or commodities.

In the European Union, the Markets in Crypto-Assets (MiCA) regulation establishes a unified framework, ensuring transparency and reducing market manipulation risks. Meanwhile, in Asia, the Monetary Authority of Singapore (MAS) is setting benchmarks for balanced crypto regulations, fostering growth while safeguarding users.

Real-World Examples of Crypto Regulations

Countries worldwide are adopting varied approaches to crypto regulations, demonstrating how policy frameworks can shape the growth and adoption of digital assets. Here are some notable examples:

- United States: The SEC’s lawsuits against unregistered crypto offerings emphasize the need for compliance with securities laws, highlighting the challenges of defining and regulating digital assets as securities.

- European Union: The MiCA regulation stands as a landmark framework, requiring crypto firms to adhere to strict operational standards, promoting transparency and consumer protection across EU member states.

- El Salvador: By adopting Bitcoin as legal tender, El Salvador has showcased the potential of light-touch regulation to attract global attention and foster financial inclusion, setting a unique precedent.

- Singapore: The government has introduced new rules to safeguard individual traders, such as restricting access to credit for crypto trading and banning incentives that encourage speculative activities.

- Australia: Plans to roll out a regulatory framework by 2024 aim to provide clarity and structure, with a proposed 12-month transitionary period for implementation.

- South Korea: Cryptocurrency exchanges and virtual asset service providers must register with the Korea Financial Intelligence Unit (KFIU), ensuring compliance and enhancing user protections.

These examples highlight the diversity in regulatory strategies—ranging from fostering innovation and financial inclusion to implementing stringent safeguards—that can either propel or restrain the global crypto market’s growth.

Impact of Crypto Regulations on Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) like Uniswap face unique challenges under new crypto regulations regimes. Their open, permissionless nature makes enforcing KYC (Know Your Customer) and AML policies difficult.

Regulators may push DEXs to adopt compliance measures, potentially compromising their decentralized ethos. However, evolving solutions such as on-chain compliance tools could help strike a balance, ensuring that crypto regulations support innovation without stifling the essence of decentralization.

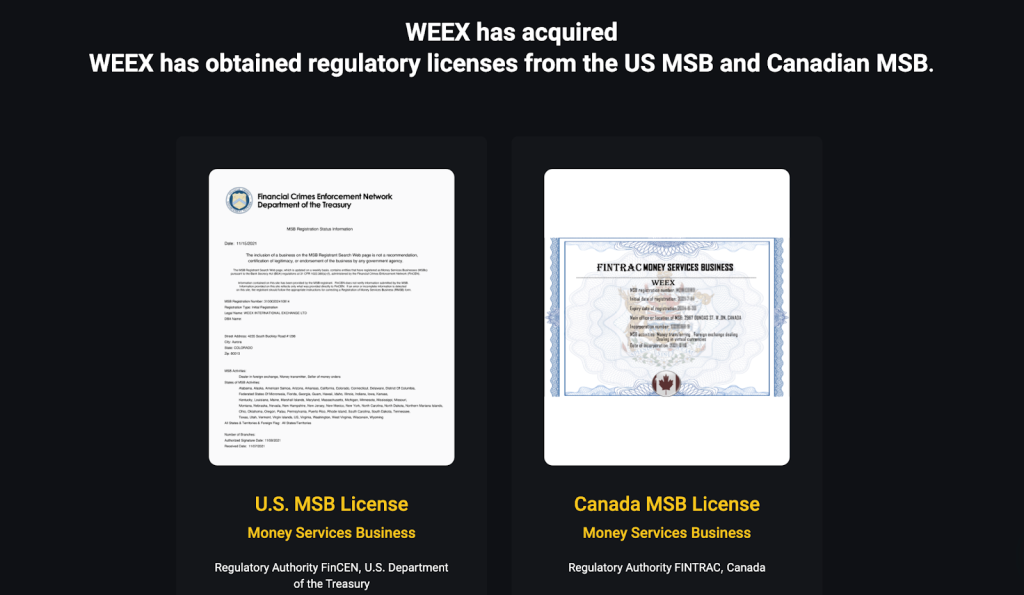

How Exchanges Like WEEX Ensure Safe Trading

WEEX ensures safe trading by adopting comprehensive measures. WEEX, launched in 2018, offers a range of trading options, including spot, futures, OTC, and copy trading. It features advanced security with a publicly disclosed 1000 BTC security deposit pool and offers zero fees for spot trading along with competitive maker/taker fees for futures. Such measures help protect users’ assets and maintain trust in the trading environment amidst the evolving regulatory landscape.

WEEX is a secure and user-friendly platform that supports a variety of cryptocurrencies, including DOGE/USDT, XRP/USDT, and WXT/USDT. Known for its multi-layered protections, such as a BTC/USDT investor protection fund, it ensures a safe trading experience while adhering to financial regulations across different regions.

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: