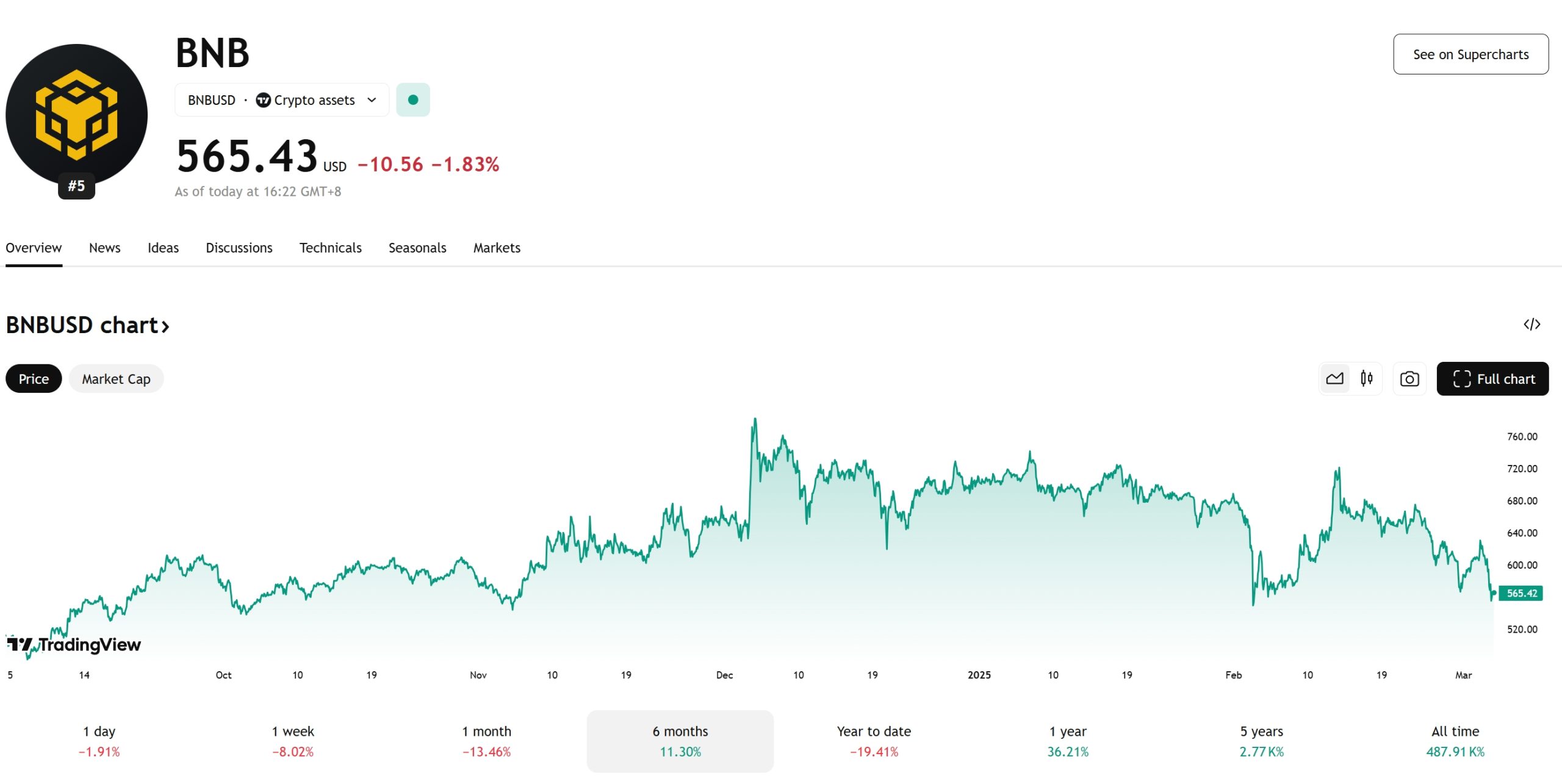

In the ever-evolving world of cryptocurrencies, few tokens have captured as much attention and intrigue as BNB, the native token of the Binance ecosystem. As of February 2025, BNB has been on a rollercoaster ride, experiencing a significant price drop from a historical high of $900 to its current price around $614.33. This article delves into the reasons behind this drop, offers a comparative analysis with another cryptocurrency, and provides insights into what the future might hold for BNB. Whether you’re considering selling BNB or looking into the overall Binance crypto price dynamics, this analysis aims to guide you through the volatility of the market.

Trade BNB USDT on WEEX.

Contents

Can BNB Recover After Dropping to $614.33?

The recent price drop of BNB from $900 to $614.33 has left many investors wondering if the token can recover. To understand this better, let’s first explore the factors that led to this decline. The crypto market has been highly volatile, with regulatory scrutiny and shifts in investor sentiment playing significant roles. For instance, the Binance stock, often referred to as Binnance, has faced scrutiny which indirectly affected BNB’s price. This volatility is a common theme in the crypto space, but BNB’s unique position within the Binance ecosystem adds another layer of complexity.

In analyzing BNB’s potential recovery, it’s helpful to look at a similar cryptocurrency that experienced a comparable price movement. Let’s consider Cardano (ADA), which saw a significant drop in 2022 but later recovered. ADA’s decline was partly due to broader market trends but also because of specific project developments that initially disappointed the community. However, with time and strategic updates, ADA managed to regain its footing and even surpassed its previous highs.

BNB might follow a similar path, given its integral role in the Binance ecosystem. The platform’s ongoing developments, like the expansion of Binance Smart Chain and the introduction of new financial products, could bolster BNB’s value. Yet, it’s crucial to consider the broader market conditions and regulatory environment, which can significantly impact BNB’s trajectory.

What Caused BNB’s Price Drop, and Will It Bounce Back?

Several factors contributed to BNB’s recent price drop. Firstly, the overall crypto market experienced a correction, affecting many major tokens. Secondly, specific to BNB, regulatory concerns surrounding Binance led to a dip in investor confidence. The news of potential regulatory actions had a ripple effect on the BNB/USDT trading pair, leading to increased sell-offs.

However, the question remains: will BNB bounce back? Historical data suggests that BNB has a strong track record of recovery following dips. The token’s utility within the Binance ecosystem, including its use in transaction fees and staking rewards, provides a solid foundation for potential growth. Moreover, the ongoing development of the Binance platform and the introduction of innovative features could drive increased demand for BNB.

To predict BNB’s bounce back, it’s essential to look at technical indicators. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer insights into market sentiment and momentum. As of February 2025, BNB’s RSI is hovering around 45, indicating a neutral position. Meanwhile, the MACD shows a slight divergence, suggesting a potential reversal if the market conditions improve.

Lessons From Cardano: Could BNB Follow a Similar Path?

Drawing parallels with Cardano’s recovery journey can provide valuable insights into BNB’s future. Cardano faced a significant price drop in 2022, primarily due to market-wide corrections and project-specific setbacks. However, Cardano’s team remained focused on development and community engagement, eventually leading to a recovery and new highs.

BNB can learn from this by continuing to innovate and expand its ecosystem. The recent launch of Binance Pay and the integration of BNB into various DeFi platforms are steps in the right direction. These developments not only enhance BNB’s utility but also attract new users and investors.

The key difference between BNB and Cardano lies in their ecosystems. BNB benefits from Binance’s extensive user base and trading volume, which provides a more robust foundation for recovery. However, BNB also faces higher scrutiny due to its association with a major exchange, which could impact its trajectory.

Navigating the volatility of BNB requires a strategic approach. Here are some expert insights for investors looking to manage their BNB holdings:

-

Diversification: Don’t put all your eggs in one basket. Even if you believe in BNB’s long-term potential, diversifying your portfolio can mitigate risk.

-

Technical Analysis: Use tools like RSI, MACD, and Bollinger Bands to gauge market trends and potential entry or exit points. For instance, if BNB’s price approaches a key support level, it might be a good time to buy.

-

Stay Informed: Keep an eye on regulatory news and Binance’s development updates. These can significantly impact BNB’s price. For example, positive developments in the Binance ecosystem could lead to a surge in BNB’s value.

-

Long-Term Perspective: If you believe in the long-term potential of BNB, consider holding through short-term volatility. The token’s role in the Binance ecosystem suggests a strong foundation for future growth.

-

Staking and Yield Farming: Utilize BNB for staking or yield farming on the Binance Smart Chain. This not only provides additional income but also supports the ecosystem’s growth.

Long and Short-Term Predictions for BNB

Looking ahead, BNB’s price predictions vary based on market conditions and the Binance ecosystem’s development. In the short term, if the market remains stable and regulatory concerns subside, BNB could see a recovery to around $700 by the end of 2025. This prediction is based on historical recovery patterns and the token’s utility within Binance.

For the long term, BNB’s price could reach $1,000 by 2026, assuming continued innovation and expansion of the Binance platform. By 2030, if the crypto market matures and Binance solidifies its position as a leading exchange, BNB could potentially hit $2,000. These projections are speculative and depend heavily on market conditions and regulatory developments.

In conclusion, while BNB has experienced a significant price drop, its integral role in the Binance ecosystem and ongoing developments provide a strong foundation for recovery. By understanding the factors behind the drop and learning from similar cases like Cardano, investors can navigate BNB’s volatility with confidence. Whether you’re considering selling BNB or holding for the long term, staying informed and using technical analysis can help you make informed decisions.

Sign up for a WEEX account now and start trading!