In the ever-evolving world of cryptocurrency, Bitcoin remains at the forefront, captivating investors and enthusiasts alike. As of early 2025, the Bitcoin price has seen a notable drop from its previous highs, prompting a flurry of analysis and speculation about its future trajectory. In this article, we’ll delve into the recent price movements, analyze the market conditions, and offer predictions for Bitcoin’s potential in the coming months and years.

Trade BTC USDT on WEEX.

Contents

Can Bitcoin Recover After Dropping to $64,000?

Bitcoin’s price has recently experienced a significant decline, falling from a high of around $82,000 to its current level of approximately $64,000. This drop has sparked a wave of concern among investors, but it’s essential to understand the broader context and potential for recovery.

What Caused Bitcoin’s Price Drop, and Will It Bounce Back?

Several factors contributed to Bitcoin’s recent price drop. One key influence was the release of the January Personal Consumption Expenditures (PCE) index, which indicated a slight easing in inflation pressures. This data led to a temporary relief rally in Bitcoin’s price, but broader market sentiment remained cautious. Additionally, the distribution of Bitcoin by wallets holding 10+ BTC, totaling 6,813 coins, contributed to downward pressure on the price.

Despite these challenges, historical trends suggest that Bitcoin has the resilience to bounce back. For instance, in 2024, Bitcoin experienced a similar dip but later recovered to new highs. To understand if Bitcoin might follow a similar path this time, let’s compare its current situation to that of another cryptocurrency, Ethereum, which saw a comparable price movement in 2023.

Ethereum’s price drop in 2023 was largely influenced by regulatory uncertainty and a broader market correction. However, it eventually rebounded as the market stabilized and investor confidence returned. Bitcoin’s current situation shares some similarities, particularly in terms of market sentiment and economic indicators. While the paths may not be identical, it’s plausible that Bitcoin could follow a similar recovery pattern, especially if macroeconomic conditions continue to improve.

Lessons From Ethereum: Could Bitcoin Follow a Similar Path?

Ethereum’s recovery in 2023 was driven by several factors, including increased adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs). For Bitcoin, a similar recovery could be spurred by advancements in blockchain technology, increased institutional adoption, and a more favorable regulatory environment.

However, there are also differences to consider. Bitcoin’s narrative is more focused on being a store of value, whereas Ethereum has positioned itself as a platform for smart contracts and decentralized applications. These distinctions could influence the speed and nature of their recoveries.

My hypothesis is that Bitcoin has the potential to recover, but the timeline and strength of this recovery will depend on several variables, including global economic conditions, regulatory developments, and technological advancements within the crypto space.

For investors navigating Bitcoin’s volatility, it’s crucial to adopt a strategic approach. Here are some actionable insights based on the current market analysis:

-

Dollar-Cost Averaging (DCA): The 60-day Realized Value to Market Capitalization Variance (RCV) for Bitcoin is currently at -1.9, signaling an optimal DCA opportunity. This metric has historically indicated low-risk investment periods, suggesting that gradually investing over time could mitigate some of the volatility risks.

-

Long-Term Perspective: Bitcoin’s short-term holder Spent Output Profit Ratio (SOPR) has deviated sharply below the lower Bollinger Band, indicating a potential short-term buying opportunity. Historically, such deviations have led to rebounds between 8% and 42%. Investors with a long-term horizon might see this as a chance to accumulate at lower prices.

-

Stay Informed: Keep an eye on macroeconomic indicators such as the PCE index and the US dollar index, as they can significantly impact Bitcoin’s price. Additionally, monitor developments in the crypto space, such as institutional adoption and regulatory news, as these can also influence market sentiment.

Long and Short-Term Bitcoin Price Predictions

Short-Term Predictions

In the short term, Bitcoin’s price could see some volatility as the market digests recent economic data and the distribution of large Bitcoin holdings. However, if financial conditions continue to ease, as suggested by analysts like Julien Bittel, we might see a recovery in Bitcoin’s price by the end of March 2025. The current RCV value and SOPR deviation support this scenario, indicating a potential buying opportunity for those looking to invest at lower prices.

Long-Term Predictions

Looking further ahead, Bitcoin’s long-term potential remains strong. By 2026, if the market continues to mature and institutional adoption increases, we could see Bitcoin reaching new highs, potentially surpassing $100,000. By 2030, with continued technological advancements and broader acceptance as a store of value, Bitcoin might even approach $200,000.

For longer-term forecasts, such as 2040 and beyond, the trajectory becomes more speculative. However, if Bitcoin continues to establish itself as a global reserve asset, it’s not unreasonable to envision prices reaching into the millions. These predictions hinge on factors like global economic stability, regulatory clarity, and the overall adoption of cryptocurrencies.

Understanding Bitcoin’s Market Indicators

To provide a more comprehensive analysis, let’s look at some key indicators that can help us understand Bitcoin’s market behavior:

-

Relative Strength Index (RSI): Bitcoin’s RSI is currently at 23, indicating an oversold condition. This suggests that the recent price drop might have been overdone, and a rebound could be on the horizon.

-

Moving Averages (MA): The 50-day and 200-day moving averages have crossed in a bearish signal, but if Bitcoin’s price can stabilize above these levels, it could signal the start of a recovery.

-

Bollinger Bands: The price has touched the lower Bollinger Band, which often precedes a price increase as volatility expands.

-

Fibonacci Retracement: Bitcoin’s recent drop has retraced to the 61.8% Fibonacci level from its previous highs, another indicator that a rebound might be imminent.

These indicators, combined with recent market developments, suggest that while the short-term outlook may be volatile, the long-term potential for Bitcoin remains robust.

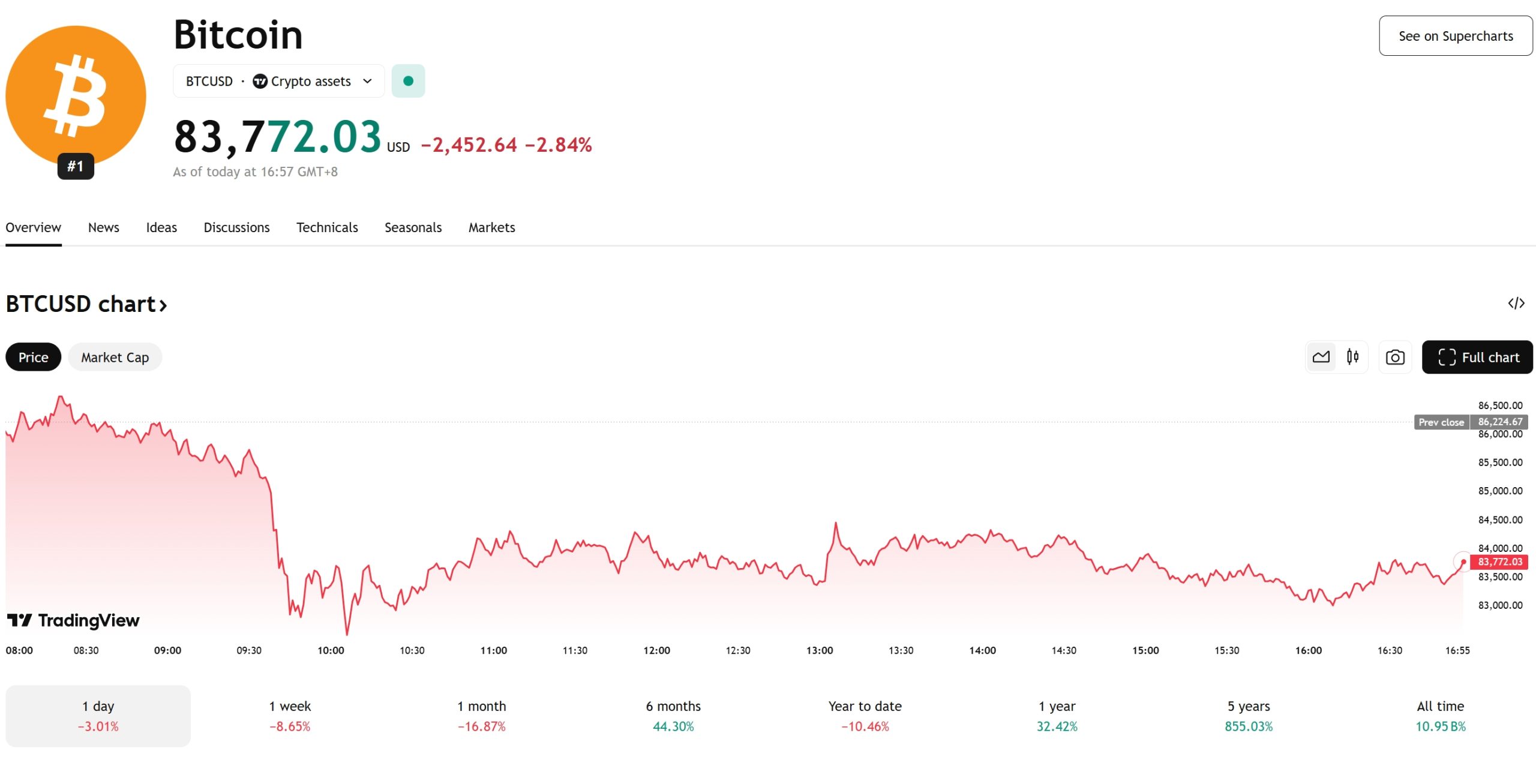

Chart Analysis: Visualizing Bitcoin’s Price Trends

To better understand Bitcoin’s price movements, let’s visualize the data with a line chart using Recharts and styled with Tailwind CSS. This chart will illustrate Bitcoin’s price from January 2024 to February 2025, highlighting the recent drop and potential recovery points.

Conclusion

Navigating the crypto market, particularly with a focus on Bitcoin, requires a keen understanding of market dynamics, technical indicators, and broader economic trends. While the recent drop to $64,000 has raised concerns, the analysis suggests that Bitcoin has the potential to recover and even reach new highs in the coming years. By adopting a strategic investment approach and staying informed about market developments, investors can position themselves to capitalize on Bitcoin’s long-term growth potential.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.