Ethereum ($ETH) has been a hot topic in the crypto world, especially as it continues to navigate through the volatile market conditions we’ve seen in early 2025. With its circulating supply growing and exchange-held ETH increasing, many investors are wary of what March might bring. Yet, amidst the bearish sentiment, analysts suggest that these conditions could set up a strong recovery. Let’s dive into the details and explore what we might expect from Ethereum’s price in the coming months.

Trade ETH USDT on WEEX.

Contents

- 1 Can Ethereum ($ETH) Recover After Dropping to $3,000?

- 2 What Caused Ethereum’s ($ETH) Price Drop, and Will It Bounce Back?

- 3 Lessons From Bitcoin: Could Ethereum ($ETH) Follow a Similar Path?

- 4 How to Navigate Ethereum’s ($ETH) Volatility: Expert Insights

- 5 Ethereum ($ETH) Price Predictions: Short-Term and Long-Term Forecasts

Can Ethereum ($ETH) Recover After Dropping to $3,000?

Ethereum ($ETH) has recently experienced a significant price drop, falling from a high of $3,500 in January 2025 to its current price of $3,000. This downward trend has left many investors wondering whether a recovery is on the horizon. To understand this better, let’s compare Ethereum’s situation to that of another cryptocurrency, Bitcoin (BTC), which faced a similar price movement in the past.

Back in 2023, Bitcoin saw a sharp decline from $60,000 to $40,000, largely due to regulatory concerns and market corrections. However, Bitcoin managed to recover over the following months, reaching new highs by mid-2024. The recovery was driven by increased institutional adoption and clearer regulatory guidelines. Ethereum’s current situation shares some similarities, with regulatory pressures and market corrections playing a role in its price drop. However, Ethereum also faces unique challenges, such as the ongoing development of its Ethereum 2.0 upgrade, which could impact its recovery timeline.

Given these factors, it’s plausible that Ethereum might follow a similar recovery pattern to Bitcoin, albeit with its own nuances. The key will be the successful implementation of Ethereum 2.0 and the market’s response to these developments. If Ethereum can navigate these challenges effectively, we could see a rebound in the coming months.

What Caused Ethereum’s ($ETH) Price Drop, and Will It Bounce Back?

The recent price drop of Ethereum ($ETH) can be attributed to several factors, including increased selling pressure from a growing circulating supply and a rise in exchange-held ETH. According to data from Ultrasound.money, Ethereum’s circulating supply grew by 66,350 tokens in the past 30 days, which has contributed to the bearish sentiment. Additionally, exchange-held ETH rose by 2% in the past week, indicating potential selling activity that could sustain the downward momentum.

However, historical patterns suggest that these conditions could also set up a strong recovery. In the past, periods of increased selling pressure have often been followed by significant rebounds, as seen in the aftermath of the 2022 market downturn. Analysts point to Ethereum’s strong fundamentals, including its leading position in the decentralized finance (DeFi) and non-fungible token (NFT) sectors, as reasons for optimism.

To assess the potential for a bounce back, let’s look at some key indicators. The Relative Strength Index (RSI) for Ethereum is currently at 30, indicating that it may be oversold and due for a correction. Similarly, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, but historical data suggests that such signals can precede bullish reversals.

Lessons From Bitcoin: Could Ethereum ($ETH) Follow a Similar Path?

Drawing lessons from Bitcoin’s past performance can provide valuable insights into Ethereum’s potential recovery. When Bitcoin dropped to $40,000 in 2023, it faced significant selling pressure and regulatory scrutiny, similar to what Ethereum is experiencing now. However, Bitcoin’s recovery was driven by several factors, including increased institutional investment, clearer regulatory guidelines, and a growing adoption of cryptocurrencies in mainstream finance.

Ethereum, too, is seeing increased institutional interest, with major financial institutions like Goldman Sachs and JPMorgan exploring Ethereum-based products. Moreover, the anticipation around Ethereum 2.0, which promises to enhance scalability and efficiency, could act as a catalyst for recovery. While Ethereum faces unique challenges, such as the need to transition to a proof-of-stake consensus mechanism, the parallels with Bitcoin suggest that a recovery is within the realm of possibility.

Navigating Ethereum’s volatility requires a strategic approach, especially for those new to crypto investing. One key strategy is to focus on long-term trends rather than short-term fluctuations. Ethereum’s price may be volatile in the short term, but its long-term potential remains strong, given its pivotal role in the Web3 ecosystem.

For instance, Ethereum’s dominance in DeFi and NFTs positions it as a leader in the blockchain space. These sectors are expected to grow significantly in the coming years, which could drive Ethereum’s value higher. Additionally, keeping an eye on key technical indicators, such as the RSI and MACD, can help investors identify potential entry and exit points.

Another strategy is to diversify your crypto portfolio. While Ethereum is a strong contender, investing in a range of cryptocurrencies can help mitigate risk. Platforms like WEEX offer a variety of cryptocurrencies and trading tools that can assist investors in managing their portfolios effectively.

Ethereum ($ETH) Price Predictions: Short-Term and Long-Term Forecasts

Looking ahead, let’s explore some short-term and long-term price predictions for Ethereum ($ETH). In the short term, analysts at BeInCrypto suggest that Ethereum’s current price levels could present a buying opportunity, with historical patterns pointing to potential rebounds. Given the recent price drop to $3,000, some analysts predict that Ethereum could see a recovery to around $3,500 by the end of March 2025, driven by the oversold conditions and the anticipation around Ethereum 2.0.

For the long term, Ethereum’s price could be influenced by several factors, including the successful implementation of Ethereum 2.0, increased institutional adoption, and the growth of DeFi and NFTs. By the end of 2025, some analysts predict that Ethereum could reach $4,000, while more bullish forecasts suggest it could hit $5,000 by the end of 2026. By 2030, Ethereum’s price could potentially soar to $10,000, driven by its continued dominance in the blockchain space and the broader adoption of Web3 technologies.

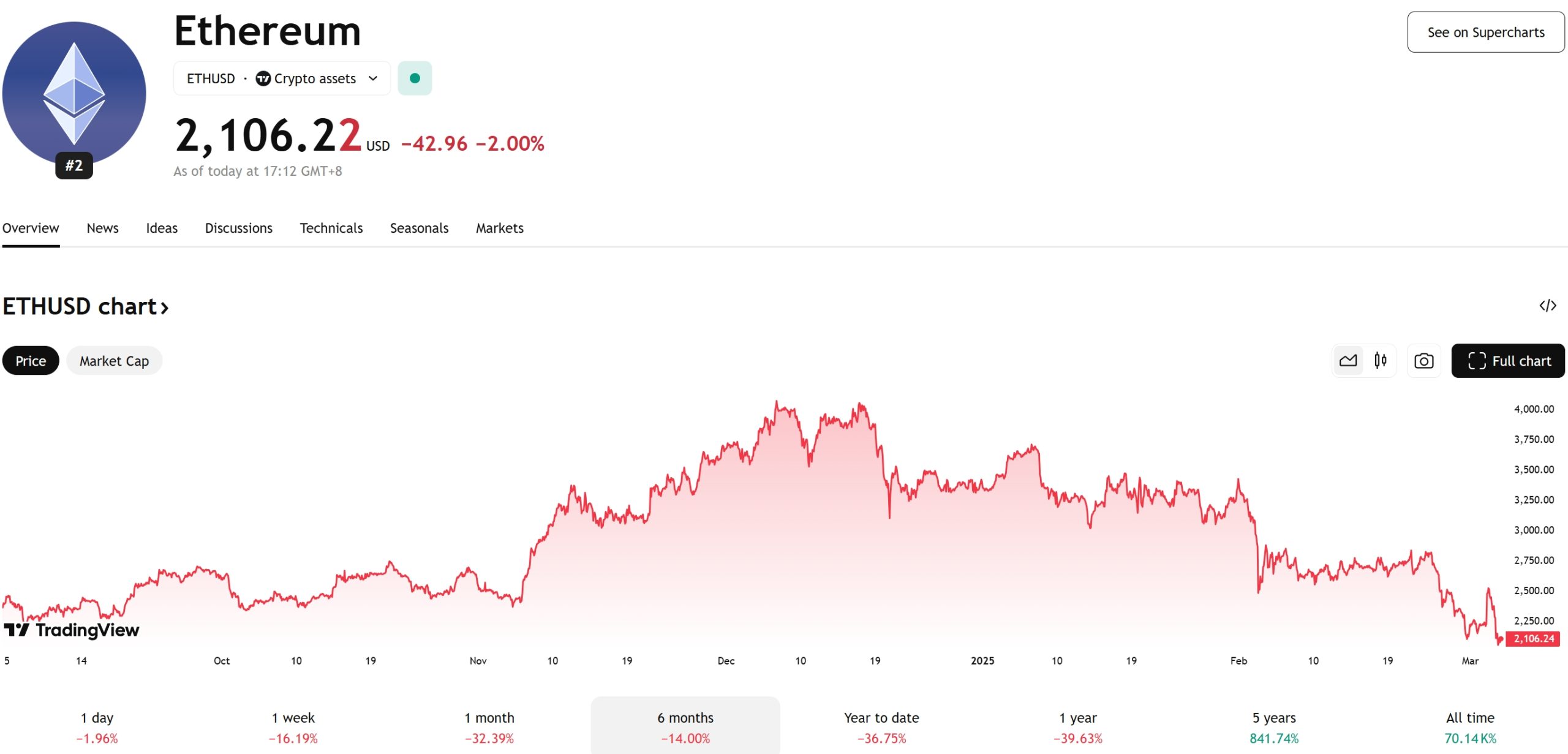

This chart is placed after the discussion on price predictions to provide a visual representation of the data, making it easier for readers to understand the forecasted price movements. The use of Recharts and Tailwind CSS ensures that the chart is responsive and visually appealing, enhancing the overall readability of the article.

In conclusion, while Ethereum ($ETH) faces challenges in the short term, its long-term potential remains strong. By understanding the factors driving its price movements and staying informed about key developments, investors can navigate the volatility and potentially reap significant rewards. As always, it’s important to conduct thorough research and consider your risk tolerance before making any investment decisions.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.