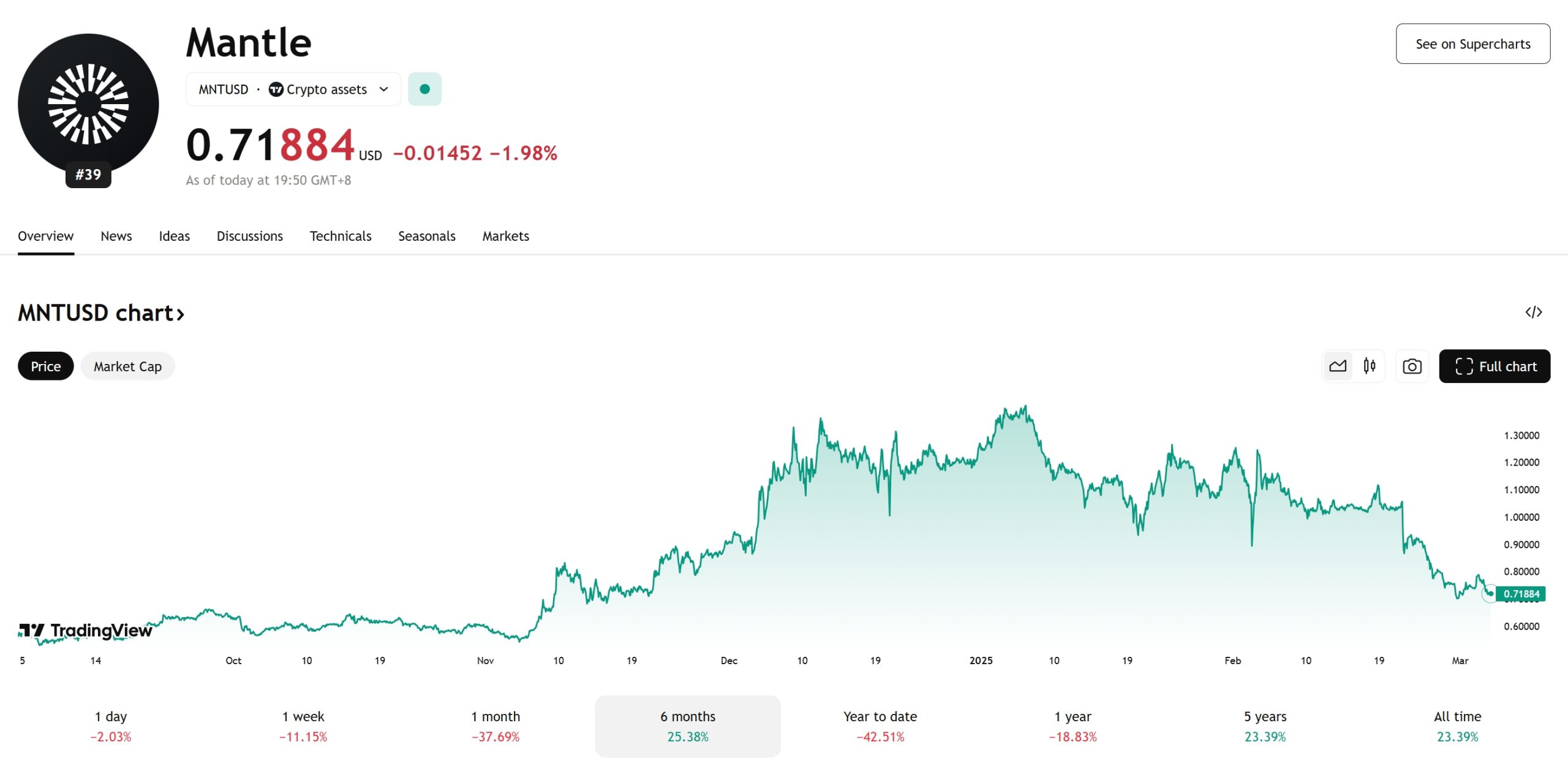

Mantle ($MNT) has been making headlines recently, but not for the reasons investors hoped. Following the shocking Bybit hack in February 2025, where $174 million worth of cmETH—a Mantle-based coin—was stolen, $MNT’s price plummeted by over 10%. This incident, linked to the notorious North Korean hacking group Lazarus, sent shockwaves through the crypto market, leaving many wondering: Can $MNT recover from this setback, or is this the beginning of a prolonged downtrend?

In this article, we’ll dive deep into the factors influencing $MNT’s price, analyze its technical indicators, and explore whether this token has the potential to bounce back. Whether you’re a seasoned trader or a crypto beginner, this guide will provide actionable insights to help you navigate $MNT’s volatile landscape.

Trade MNT USTD on WEEX Spot.

Contents

The Bybit Hack: A Major Blow to $MNT

The Bybit hack was one of the largest crypto heists in history, with the Lazarus Group stealing $1.5 billion in assets. Among the stolen funds was cmETH, a key component of Mantle’s ecosystem. This hack not only shook investor confidence but also highlighted vulnerabilities in the broader crypto infrastructure.

For $MNT, the immediate aftermath was brutal. The token’s Relative Strength Index (RSI) dropped to an oversold level of 22.9, signaling extreme panic selling. While the RSI has since rebounded to 39.9, it remains in bearish territory, indicating that investor sentiment is still cautious.

Technical Analysis: What Do the Indicators Say?

To understand $MNT’s potential for recovery, let’s break down its key technical indicators:

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI below 30 typically indicates oversold conditions, while an RSI above 70 suggests overbought conditions. As of February 2025, $MNT’s RSI is at 39.9, which is still bearish but shows signs of stabilization.

Chaikin Money Flow (CMF)

The CMF measures the flow of money into and out of an asset. A negative CMF indicates selling pressure, while a positive CMF suggests buying interest. Currently, $MNT’s CMF is slowly recovering but remains in negative territory, reflecting ongoing selling pressure.

Exponential Moving Averages (EMA)

The EMA lines for $MNT are trending downward, indicating persistent bearish momentum. The 50-day EMA is below the 200-day EMA, a classic bearish signal known as the “death cross.”

Price Levels to Watch: Support and Resistance

Understanding key support and resistance levels is crucial for predicting $MNT’s future price movements:

-

Support Level: $0.81

This level has historically acted as a strong floor for $MNT. If the price drops to this level, it could attract buyers looking for a bargain. -

Resistance Level: $0.98

Breaking past this resistance level would signal a potential reversal in $MNT’s downtrend. However, given the current bearish indicators, this seems unlikely in the short term.

Historical Parallels: Lessons from AAA Coin

To gain further insight into $MNT’s potential recovery, let’s compare it to AAA Coin, which experienced a similar price drop in 2023 due to a major security breach. AAA Coin’s price initially plummeted by 15% but eventually recovered by 40% over the next six months as investor confidence returned and the team implemented robust security measures.

While $MNT’s situation is unique, the parallels are striking. If Mantle’s team can address the vulnerabilities exposed by the Bybit hack and restore investor confidence, $MNT could follow a similar recovery trajectory.

Long-Term Price Prediction for $MNT

Despite the recent setbacks, $MNT has several factors working in its favor:

-

Strong Ecosystem: Mantle’s ecosystem is built on innovative technology, including its unique liquidity solutions for ETH. This positions $MNT as a key player in the DeFi space.

-

Growing Adoption: As more projects integrate with Mantle, demand for $MNT could increase, driving its price higher.

-

Market Recovery: The broader crypto market is expected to rebound in 2025, which could provide a tailwind for $MNT.

Based on these factors, here’s our price prediction for $MNT:

- Short-Term (2025): $MNT could stabilize around $0.90, with potential to break past $1.00 if market sentiment improves.

- Mid-Term (2026): With increased adoption and improved security measures, $MNT could reach $1.50.

- Long-Term (2030): If Mantle continues to innovate and expand its ecosystem, $MNT could surpass $3.00.

Actionable Insights for Investors

If you’re considering investing in $MNT, here are some tips to navigate its volatility:

- Dollar-Cost Averaging (DCA): Spread your investments over time to mitigate the impact of price fluctuations.

- Set Stop-Loss Orders: Protect your investments by setting stop-loss orders at key support levels.

- Stay Informed: Keep an eye on Mantle’s developments and market trends to make informed decisions.

Final Thoughts: Is $MNT a Good Investment?

While the Bybit hack has undoubtedly shaken investor confidence, $MNT’s strong fundamentals and innovative ecosystem suggest that it has the potential to recover. However, as with any investment, it’s essential to conduct thorough research and consider your risk tolerance before diving in.

By staying informed and adopting a strategic approach, you can navigate $MNT’s volatility and potentially capitalize on its long-term growth prospects. Whether $MNT hits $3 or beyond remains to be seen, but one thing is certain: the crypto market is full of opportunities for those willing to take calculated risks.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.