There’s arguably no hotter topic in the world of cryptocurrencies than the potential of Layer-2 solutions, and Solaxy’s $SOLX coin is at the forefront of this discussion. As of March 2025, $SOLX has been making waves in the crypto community, particularly due to its association with the Solana blockchain, which is known for its high-speed transactions and low fees. The excitement around $SOLX stems from its innovative approach to solving Solana’s congestion issues, with the promise of faster transaction speeds and seamless cross-chain transfers between Solana and Ethereum.

In recent months, $SOLX has experienced a rollercoaster ride, capturing the market’s attention with significant price movements. On January 16, 2025, the token surged to a multi-year high of $0.001844, fueled by strong market sentiment and the buzz around its presale. However, this rally was short-lived, with the price dropping to the current level of $0.001706. This recent price drop has sparked discussions and speculation among investors and enthusiasts alike.

$SOLX Price Prediction remains a hot topic as investors scrutinize every price movement, seeking to understand the potential trajectory of this ambitious project. Today, we dive deep into how these forecasts compare with the emerging promise of $SOLX as a payments solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy $SOLX at its current price?”

Trade SOLX USDT on WEEX.

Contents

Can $SOLX Recover After Dropping to $0.001706?

The recent price drop of $SOLX from $0.001844 to $0.001706 has left many investors questioning the coin’s future. To better understand this, let’s compare $SOLX’s trend to that of Dogecoin, a popular cryptocurrency that has experienced similar price movements in the past. In 2021, Dogecoin saw a significant surge in value, driven by social media hype and endorsements from high-profile figures. However, it also experienced a sharp decline, dropping from $0.73 to $0.20 in a matter of months.

The drop in Dogecoin’s price was largely attributed to market corrections and the cooling off of speculative fervor. Despite this, Dogecoin managed to recover over time, with its value fluctuating but generally trending upwards. This recovery was supported by continued community support and the coin’s inclusion in various payment platforms.

Similarly, $SOLX’s recent price drop can be attributed to market corrections following its presale surge. The coin’s value is closely tied to the development and adoption of the Solaxy Layer-2 solution on Solana. If Solaxy can successfully alleviate Solana’s congestion issues and increase transaction efficiency, $SOLX could see a similar recovery pattern to Dogecoin.

However, $SOLX’s path might differ due to its focus on utility rather than meme-driven speculation. The project’s emphasis on fast, low-cost transactions and its potential to bridge Solana and Ethereum could attract a different set of investors, potentially leading to a more stable and sustained recovery.

For investors considering $SOLX at its current price, it’s crucial to assess the project’s long-term vision and the team’s ability to execute their roadmap. The promise of a Solana Layer-2 solution is compelling, and if $SOLX can deliver on its technical promises, it could be a worthwhile investment.

What Caused $SOLX’s Price Drop, and Will It Bounce Back?

The price drop of $SOLX from $0.001844 to $0.001706 can be attributed to several factors. Firstly, after the initial hype of the presale, some investors may have taken profits, leading to a natural market correction. Additionally, broader market trends and sentiment towards Solana and Layer-2 solutions could have influenced $SOLX’s price.

However, the potential for $SOLX to bounce back is significant. The project’s roadmap includes key milestones such as the deployment of the Solaxy L2 chain, onboarding of dApps, and multi-chain integrations. These developments could drive increased demand for $SOLX, as the token is used to pay transaction fees on the Solaxy network.

Furthermore, the project’s tokenomics are designed to support long-term growth. With 50% of the token allocation dedicated to ecosystem development and the project’s treasury, Solaxy is well-positioned to expand its reach and utility. The focus on listings and early supporter rewards also reflects a commitment to building a loyal user base, which could contribute to price stability and growth.

Investors should keep an eye on Solaxy’s progress in alleviating Solana’s congestion issues. If the project can demonstrate tangible improvements in transaction speeds and costs, $SOLX could see a significant bounce back, driven by both speculative interest and real-world utility.

Lessons From Ethereum: Could $SOLX Follow a Similar Path?

Ethereum’s success with Layer-2 solutions offers valuable lessons for $SOLX. Ethereum’s L2 networks, such as Optimism and Arbitrum, have successfully increased transaction throughput and reduced costs, leading to a surge in total value locked (TVL) and attracting a wide range of dApps and users.

Solaxy aims to replicate this success on Solana, which currently lacks a robust Layer-2 ecosystem. By providing a solution to Solana’s scalability issues, $SOLX could follow a similar path to Ethereum’s L2 tokens, which have seen significant growth and adoption.

The key to $SOLX’s success will be its ability to integrate seamlessly with Solana’s existing ecosystem while offering compelling advantages in terms of speed and cost. If Solaxy can achieve this, $SOLX could attract developers and users looking to build and transact on a more efficient platform.

However, $SOLX’s journey will also be influenced by Solana’s broader market performance and the competitive landscape of Layer-2 solutions. As more projects enter this space, $SOLX will need to differentiate itself through technical innovation and strategic partnerships.

For investors, the lesson from Ethereum is clear: Layer-2 solutions can drive significant value creation. By closely monitoring Solaxy’s progress and the broader trends in the Solana ecosystem, investors can make informed decisions about $SOLX’s potential to follow a similar growth trajectory.

Navigating the volatility of $SOLX requires a strategic approach, especially for beginners in the crypto market. The first step is to understand the factors driving $SOLX’s price movements, such as market sentiment, project developments, and broader trends in the Solana ecosystem.

One key aspect to consider is $SOLX’s utility within the Solaxy network. As the token used for transaction fees, $SOLX’s value is directly tied to the network’s adoption and usage. Monitoring the growth of dApps and the overall transaction volume on Solaxy can provide valuable insights into $SOLX’s potential for long-term growth.

Additionally, investors should pay attention to technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools can help identify potential buy or sell signals and provide a more nuanced understanding of $SOLX’s market trends.

For those interested in long-term holding, staking $SOLX can be an attractive option. With staking rewards currently at 329% APY, investors can earn passive income while supporting the network’s security and stability. However, it’s important to consider the potential impact of staking on $SOLX’s circulating supply and price dynamics.

Finally, staying informed about the latest news and developments in the Solana ecosystem is crucial. As Solaxy continues to roll out its Layer-2 solution and expand its partnerships, these updates can provide valuable insights into $SOLX’s future potential.

By combining a deep understanding of $SOLX’s fundamentals, technical analysis, and staying informed about market trends, investors can navigate the coin’s volatility with greater confidence and make informed decisions about their investment strategy.

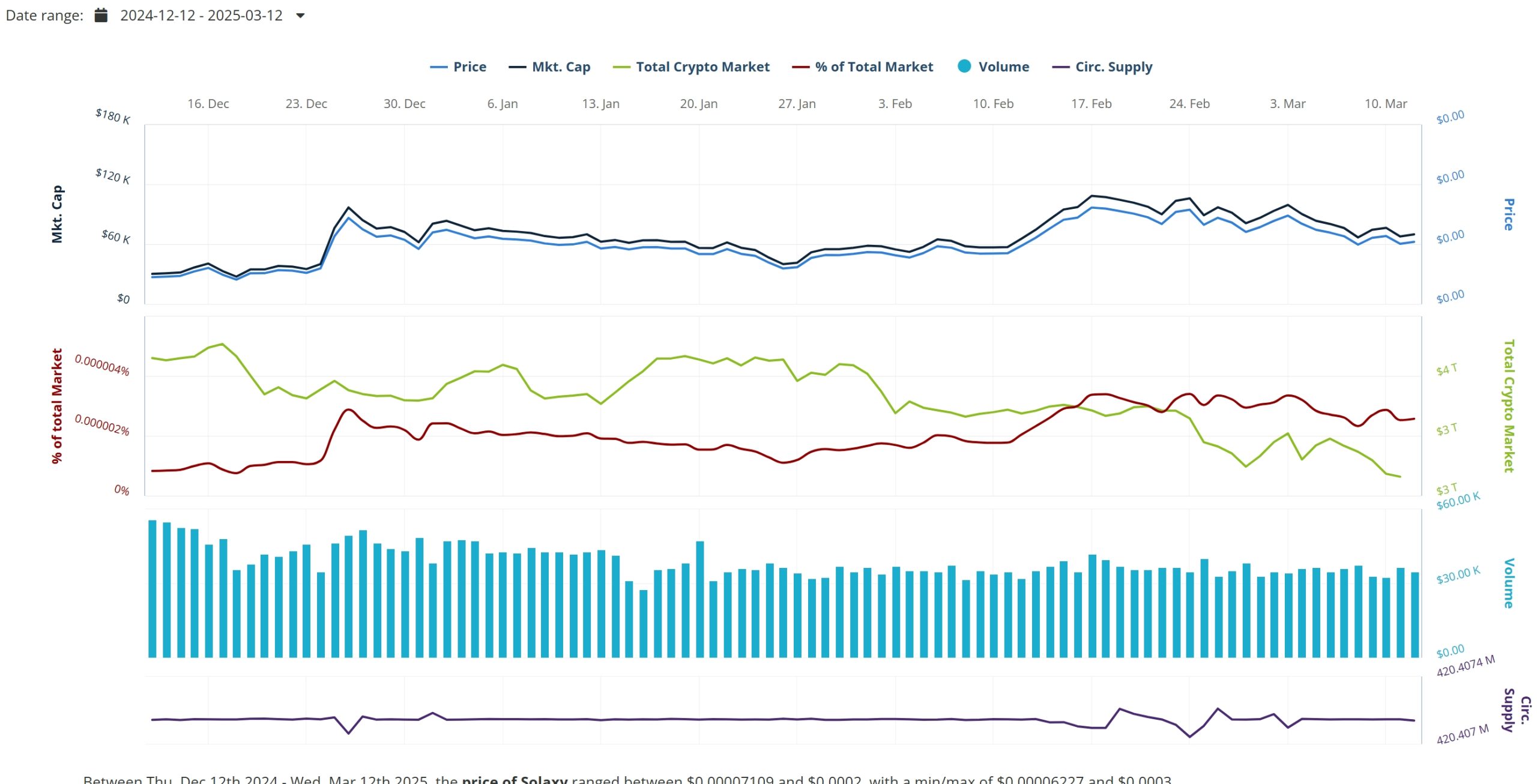

Chart Analysis

To visualize the recent price trends of $SOLX, we’ll create a line chart using Recharts, a popular charting library for React, styled with Tailwind CSS for a modern and responsive design. This chart will be placed directly after the discussion on $SOLX’s recent price drop to provide a clear visual representation of the data.

Reasoning for Chart Structure and Placement:

The line chart was chosen to effectively display the price trends of $SOLX over time, which is crucial for understanding the coin’s recent price drop and potential recovery. Recharts was selected for its ease of use in React environments, while Tailwind CSS ensures the chart is visually appealing and responsive across different devices. The chart is placed immediately after discussing the price drop to reinforce the narrative with visual data, aiding beginners in visualizing the price movements discussed in the article.