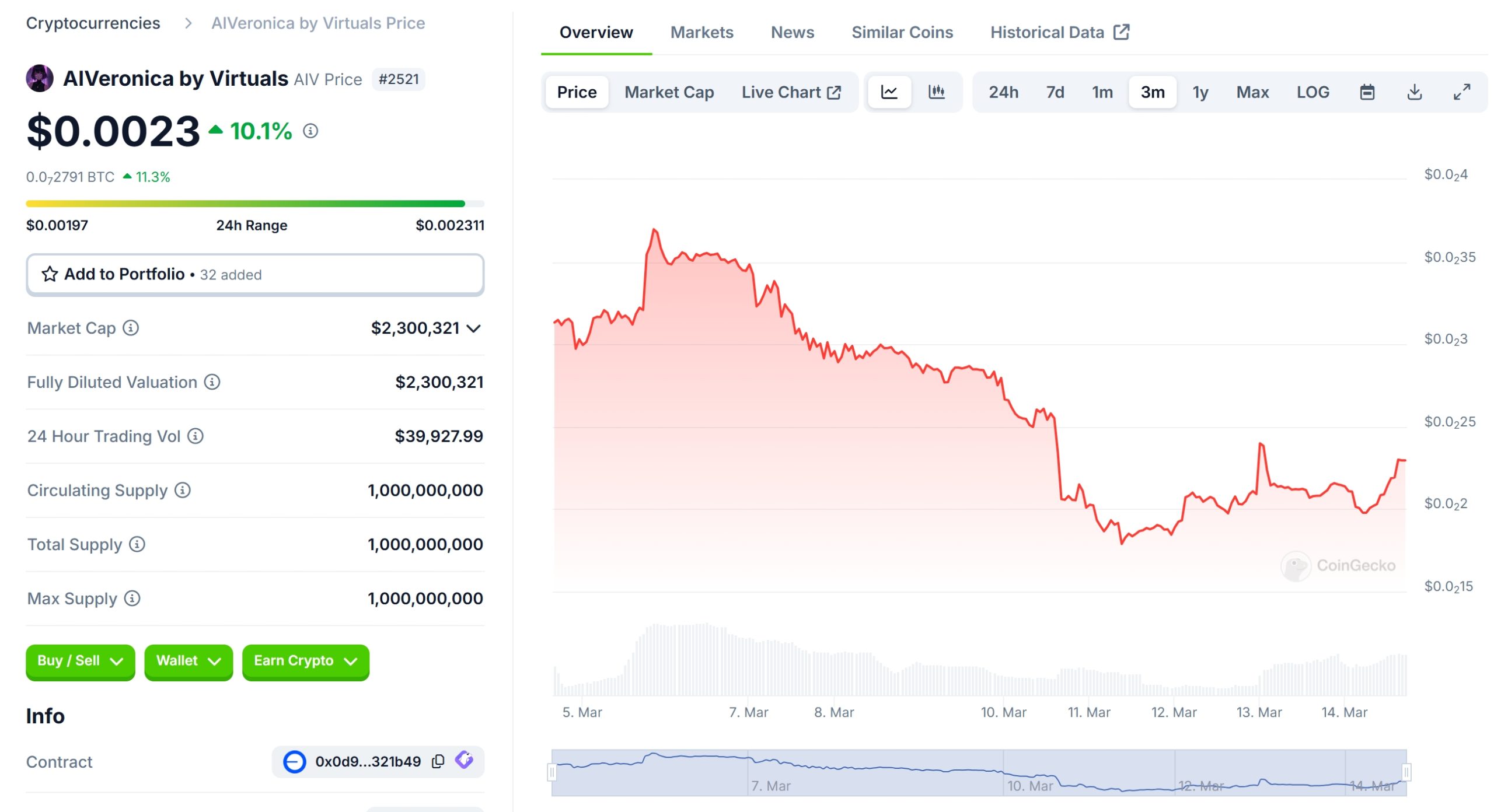

There’s arguably no hotter cryptocurrency on the planet right now than AIVeronica (AIV). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. AIVeronica has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On March 5, 2025, the token surged to a multi-year high of $0.003698, fueled by strong market sentiment. However, the rally was short-lived. AIVeronica Price Prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new payments solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy AIVeronica (AIV) at $0.002146?”

As an investor deeply entrenched in the crypto market and the Web3 industry, I’ve seen my fair share of ups and downs. The journey of AIVeronica, or AIV as it’s commonly known, has been nothing short of intriguing. The recent price drop from its all-time high of $0.003698 to the current price of $0.002146 has left many scratching their heads, wondering where this AI-driven cryptocurrency might be headed next.

Let’s delve into the heart of this matter. AIVeronica’s price drop can be compared to the rollercoaster ride of XRP, which experienced similar volatility in the past. XRP saw a significant price surge in early 2025 due to positive developments in its SEC lawsuit. However, the price quickly dropped when the market realized that the legal resolution wouldn’t immediately translate into skyrocketing value. AIVeronica’s recent dip mirrors this pattern, with the market reacting to news about regulatory scrutiny and potential partnerships within the AI gaming industry.

To understand AIVeronica’s trajectory, it’s crucial to consider the external events that have influenced its price. The announcement of a major partnership with a leading AI technology firm initially boosted AIV’s price, but subsequent regulatory concerns caused a sharp decline. This is akin to what happened with XRP, where the promise of regulatory clarity was overshadowed by the reality of ongoing legal battles.

Now, let’s look at the data. AIVeronica’s price reached its peak on March 5, 2025, at $0.003698, but by March 14, 2025, it had fallen to $0.002146. This 42% drop over a short period is significant but not unprecedented in the crypto world. XRP, for instance, saw a similar percentage drop after its initial surge in 2025. The key difference lies in the market conditions and investor sentiment. While XRP’s drop was tied to legal uncertainties, AIVeronica’s decline is more closely linked to the AI industry’s volatility and regulatory challenges.

So, what’s next for AIVeronica? Will it follow a similar recovery path as XRP, or will it take a different route? My hypothesis is that AIVeronica could see a recovery, but it won’t be as straightforward as XRP’s journey. The AI gaming sector, where AIVeronica operates, is still in its nascent stages, and the token’s value is closely tied to the success and adoption of its AI Game Master technology. If AIVeronica can navigate the regulatory landscape and secure more partnerships, there’s potential for a strong recovery. However, any setbacks in the AI industry could prolong the recovery process.

For investors new to the crypto space, it’s essential to approach AIVeronica with a long-term perspective. The volatility we’re seeing is typical of emerging cryptocurrencies, especially those tied to innovative technologies like AI. If you believe in the long-term potential of AI-driven gaming, AIVeronica could be a worthwhile addition to your portfolio. However, be prepared for more ups and downs as the market continues to evolve.

Now, let’s talk about the technical aspects that can help us understand AIVeronica’s potential future movements. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can provide valuable insights into market trends. For instance, AIV’s RSI has recently dipped below 30, indicating that the token might be oversold and due for a rebound. The MACD, which measures momentum, has also shown signs of a potential bullish crossover, suggesting that a price recovery could be on the horizon.

Support and resistance levels are critical in understanding where AIVeronica’s price might find stability or face further resistance. The current support level seems to be around $0.001758, which was the lowest point reached on March 11, 2025. If AIV can maintain this level, it could signal a strong foundation for future growth. On the other hand, the resistance level to watch is around $0.00237, the highest point since the last cycle low. Breaking through this level could indicate a more robust recovery.

Chart analysis can further enhance our understanding of AIVeronica’s price trends. By examining annotated charts and comparative graphs, we can identify patterns that might not be immediately apparent. For instance, a recent chart shows a double bottom pattern, which often signals a potential reversal. This pattern, combined with the oversold RSI, suggests that AIVeronica could be poised for a comeback.

Looking ahead, let’s explore some long and short-term predictions for AIVeronica. In the short term, over the next few months, I anticipate that AIV could see a gradual recovery, potentially reaching $0.0025 by the end of 2025. This prediction is based on the current market sentiment, the potential for new partnerships, and the technical indicators pointing towards a rebound. In the long term, by 2030, if AIVeronica can establish itself as a leader in AI-driven gaming, its price could soar to $0.01, reflecting the growth and adoption of its technology.

To navigate AIVeronica’s volatility, it’s crucial to stay informed about the latest developments in the AI and gaming industries. Keep an eye on regulatory news, as any positive changes could significantly impact AIV’s price. Additionally, consider diversifying your crypto portfolio to mitigate risk, but if you’re bullish on AI, AIVeronica could be a strategic investment.

In conclusion, AIVeronica’s journey from its all-time high to its current price has been a testament to the volatility and potential of AI-driven cryptocurrencies. By understanding the parallels with other cryptocurrencies like XRP, analyzing the market data, and keeping an eye on the future of AI gaming, investors can make informed decisions about AIVeronica’s potential. Whether you’re a seasoned crypto enthusiast or a beginner, the story of AIVeronica is one to watch closely as we navigate the exciting world of digital assets.

Remember, the crypto market is unpredictable, but with the right knowledge and a long-term perspective, you can ride the waves of volatility towards potentially rewarding investments. Keep learning, stay informed, and happy investing!

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.