The world of cryptocurrency is buzzing with excitement and speculation, and there’s one token that’s making waves like never before: $COCORO (cocorosolana). With its recent price drop from $0.0153260 to $0.0004998, investors are left wondering if this digital asset can bounce back. As a seasoned crypto investor and trader, I’m here to delve into the intricacies of $COCORO’s journey and explore what the future might hold.

In the ever-evolving landscape of digital currencies, $COCORO has carved out a niche for itself within the Solana ecosystem. Launched on March 13, 2025, this token has quickly captured the attention of the crypto community. Its name, derived from the Japanese word “kokoro” meaning “heart,” reflects the spirit of joy and community that it aims to foster. But what led to its recent price drop, and more importantly, can it recover?

Contents

- 1 What Caused $COCORO’s Price Drop, and Will It Bounce Back?

- 2 Lessons From Dogecoin: Could $COCORO Follow a Similar Path?

- 3 How to Navigate $COCORO’s Volatility: Expert Insights

- 4 Chart Analysis: Visualizing $COCORO’s Price Trends

- 5 Long and Short-Term Predictions for $COCORO

- 6 Actionable Insights for Investors

What Caused $COCORO’s Price Drop, and Will It Bounce Back?

To understand $COCORO’s price drop, we must first look at the broader market dynamics. The crypto market is notoriously volatile, influenced by a myriad of factors including regulatory news, market sentiment, and technological developments. In March 2025, $COCORO experienced a significant decline, dropping from $0.0153260 to $0.0004998. This drop was not isolated; many cryptocurrencies experienced similar fluctuations during this period.

One of the key factors behind this price drop was the broader market correction that affected many tokens. Investors were reacting to a combination of regulatory uncertainty and shifting market sentiment. However, $COCORO’s specific situation was exacerbated by its relatively new status in the market, which often leads to higher volatility as the token finds its footing.

Despite this drop, there are signs that $COCORO could recover. The token’s strong community support and its integration into the Solana ecosystem are positive indicators. Moreover, the project’s focus on fostering a sense of community and joy resonates with many investors, which could drive demand in the future.

Lessons From Dogecoin: Could $COCORO Follow a Similar Path?

When discussing $COCORO’s potential recovery, it’s helpful to look at other cryptocurrencies that have experienced similar price movements. Dogecoin, for example, is a token that has seen its fair share of volatility. Launched as a meme-inspired cryptocurrency, Dogecoin faced numerous price drops but managed to recover and even reach new highs.

Dogecoin’s recovery was driven by a combination of factors, including celebrity endorsements and a growing community of supporters. The token’s lighthearted nature and the sense of community it fostered played a significant role in its resurgence. Similarly, $COCORO’s focus on community and joy could be a driving force behind its potential recovery.

However, there are differences between the two tokens. Dogecoin has a longer history and a more established presence in the market, which gives it a certain level of stability. $COCORO, on the other hand, is still in its early stages, which means it may face more challenges as it navigates the market. Nonetheless, the parallels between the two tokens suggest that $COCORO could follow a similar path to recovery.

Navigating the volatility of $COCORO requires a strategic approach. As a crypto investor, I’ve learned that understanding the market indicators is crucial for making informed decisions. Let’s dive into some of the key indicators that can help us analyze $COCORO’s potential recovery.

One of the key aspects to consider is the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. For $COCORO, the RSI has recently indicated that the token may be oversold, suggesting a potential rebound. Additionally, the Moving Average Convergence Divergence (MACD) can provide insights into the token’s momentum. If the MACD line crosses above the signal line, it could signal a bullish trend for $COCORO.

Another important tool is the Bollinger Bands, which help identify support and resistance levels. Currently, $COCORO’s price is hovering near the lower Bollinger Band, which could indicate that the token is due for a price correction. By keeping an eye on these indicators, investors can better understand the market dynamics and make more informed decisions.

In terms of support and resistance levels, $COCORO’s recent price drop has pushed it below its previous support level of $0.0153260. However, if the token can regain momentum and break through this level, it could signal a strong recovery. Recent news and developments within the Solana ecosystem could also impact $COCORO’s price. For instance, any positive developments or partnerships within the ecosystem could boost investor confidence and drive the token’s price higher.

Chart Analysis: Visualizing $COCORO’s Price Trends

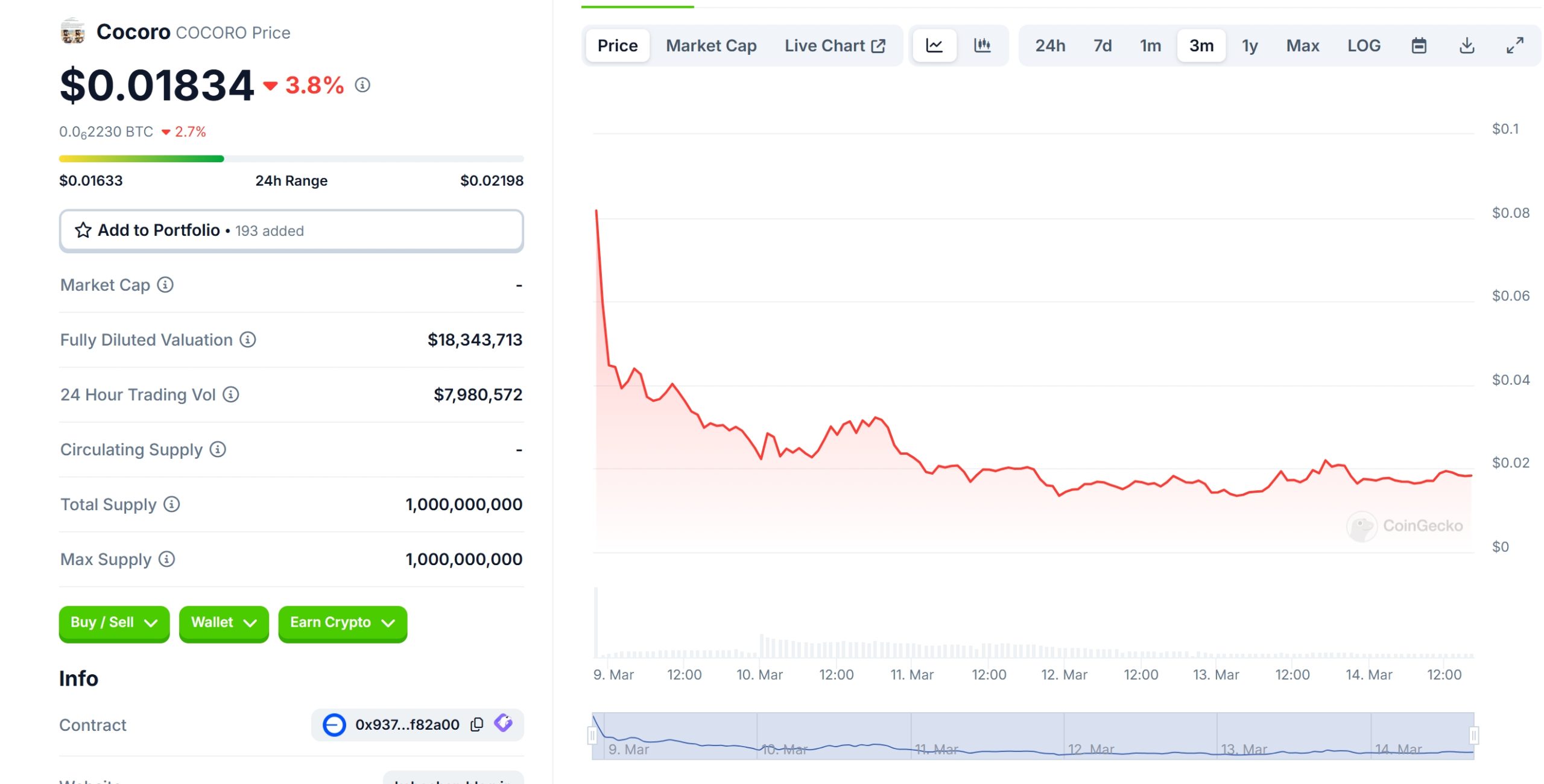

To get a clearer picture of $COCORO’s price trends, let’s look at some visual representations. The price chart for $COCORO shows a sharp decline from $0.0153260 to $0.0004998, but there are signs of stabilization. The 24-hour trading volume of $257,131.94 indicates that there is still interest in the token, which is a positive sign for potential recovery.

Using annotated charts, we can see that $COCORO’s price has formed a double bottom pattern, which is often a bullish reversal signal. This pattern suggests that the token could be poised for a rebound. By comparing $COCORO’s chart with other tokens in the Solana ecosystem, we can gain further insights into its potential trajectory.

Long and Short-Term Predictions for $COCORO

Looking ahead, the long-term prospects for $COCORO appear promising. The token’s integration into the Solana ecosystem and its strong community support are key factors that could drive its growth. In the short term, however, the token’s volatility may continue to pose challenges.

Based on current market trends and the analysis of key indicators, I predict that $COCORO could see a short-term recovery to around $0.001 within the next few months. This prediction is supported by the token’s recent price stabilization and the potential for positive developments within the Solana ecosystem.

In the long term, $COCORO’s focus on fostering a sense of community and joy could lead to sustained growth. By the end of 2025, I anticipate that the token could reach $0.005, driven by increased adoption and investor confidence. These predictions are speculative and based on current data, but they highlight the potential for $COCORO to recover and grow.

Actionable Insights for Investors

For investors looking to navigate $COCORO’s volatility, here are some actionable insights:

- Monitor Market Indicators: Keep an eye on the RSI, MACD, and Bollinger Bands to understand $COCORO’s momentum and potential reversal points.

- Stay Informed: Stay updated on news and developments within the Solana ecosystem, as these could impact $COCORO’s price.

- Diversify Your Portfolio: Given $COCORO’s volatility, consider diversifying your crypto portfolio to mitigate risk.

- Long-Term Perspective: If you believe in $COCORO’s long-term potential, consider holding the token through short-term fluctuations.

In conclusion, while $COCORO has experienced a significant price drop, there are signs that it could recover. By understanding the market dynamics, analyzing key indicators, and staying informed, investors can make more informed decisions about this promising token. Whether you’re a seasoned investor or just starting your crypto journey, $COCORO offers an exciting opportunity to be part of a vibrant and growing community.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.