There’s arguably no hotter cryptocurrency on the planet right now than SYMM (Symmio). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. Symmio, or SYMM as it’s known in the crypto world, has been capturing headlines and the attention of investors everywhere. But what’s behind this surge, and where might SYMM be headed next?

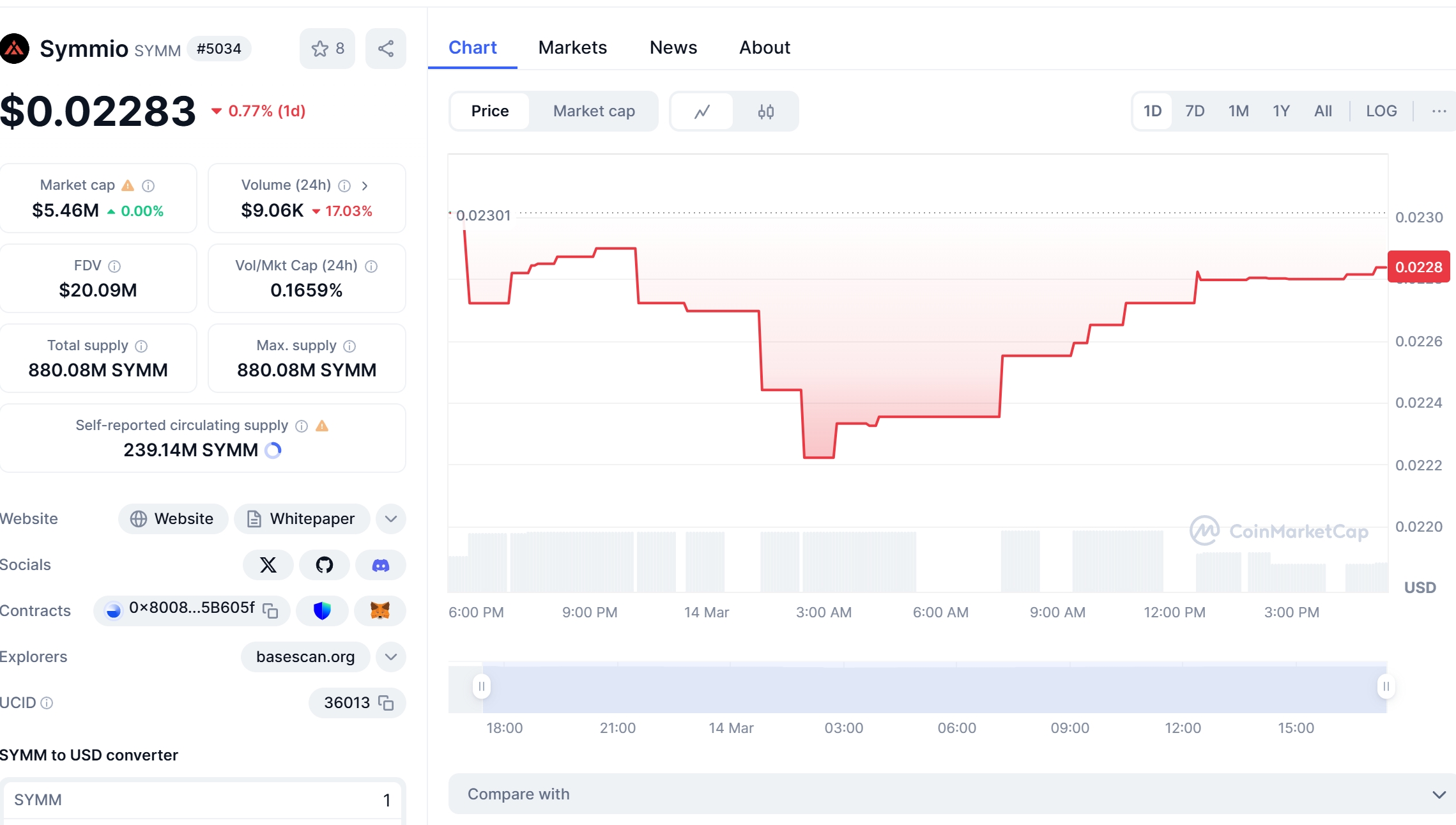

Symmio’s journey in recent months has been a rollercoaster ride, marked by significant price swings and developments that have kept the market on its toes. On January 16, 2025, the token surged to a multi-year high of $0.0339, fueled by strong market sentiment. However, the rally was short-lived, with the price dropping back to its current level of $0.02272. This volatility has sparked a lot of interest and speculation among investors, who are now closely watching every move of SYMM.

SYMM price prediction remains a hot topic as investors scrutinize every price movement of Symmio. Today, we dive deep into how these forecasts compare with the emerging promise of a new derivative trading solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy SYMM at $0.02272?” Let’s explore the factors driving SYMM’s price and what the future might hold.

Contents

The Controversial Prediction

In an unexpected turn of events, a notable critic of the crypto industry, who has been vocal about the risks and volatility of digital assets, recently forecasted a massive price surge for SYMM. This prediction has created an intriguing narrative of irony and speculation within the crypto community. The critic, known for their bearish stance on cryptocurrencies, now sees SYMM reaching unprecedented heights, citing its innovative approach to derivatives trading and the growing demand for such solutions in the DeFi space.

This prediction has sparked a lively debate among crypto enthusiasts. Some see it as a sign of the market’s maturity, where even skeptics are beginning to recognize the potential of certain projects. Others remain cautious, questioning whether such a bold forecast is justified given SYMM’s recent price fluctuations. Regardless of where you stand, this prediction has undoubtedly brought SYMM into the spotlight, prompting a closer look at its fundamentals and market position.

Understanding Symmio and Its Ecosystem

Symmio is part of the rapidly growing decentralized finance (DeFi) sector, which has been one of the most exciting areas of the crypto market in recent years. DeFi aims to democratize finance by removing intermediaries and allowing users to access financial services directly on the blockchain. Symmio focuses on derivatives trading, offering a trustless, hybrid (combining on and off-chain) clearing house that acts as a communication, settlement, and clearing layer for permissionless derivatives.

The project has secured significant financial backing, with over $10 million raised in its initial funding rounds. This investment has enabled Symmio to build a robust infrastructure and expand its reach within the DeFi ecosystem. The team behind Symmio is actively working on multiple initiatives, including partnerships with other DeFi projects and the development of new trading tools, which showcases the project’s ambition and potential impact.

One of the key aspects to consider is Symmio’s research and development efforts. The project boasts a dedicated team of over 50 developers and researchers, working tirelessly to refine its technology and explore new use cases. This commitment to innovation is crucial in the fast-paced world of DeFi, where staying ahead of the curve can make all the difference.

However, Symmio has not been without its challenges. Like many projects in the DeFi space, it has faced regulatory scrutiny and market volatility. In 2024, the project encountered a setback when a smart contract vulnerability was discovered, leading to a temporary halt in trading. The team quickly addressed the issue, implementing new security measures and regaining the trust of the community. This experience has taught Symmio valuable lessons in resilience and adaptability, which could serve them well in the future.

Analyzing SYMM’s Recent Price Drop

Let’s delve into SYMM’s recent price drop from $0.0339 to $0.02272. To understand this movement better, we can compare it to a similar cryptocurrency, such as Dogecoin. Dogecoin experienced a similar price drop in 2021, following Elon Musk’s appearance on Saturday Night Live, where he referred to it as a “hustle.” The subsequent market sell-off led to a significant drop in Dogecoin’s price, but it eventually recovered, reaching new highs in the following months.

In SYMM’s case, the price drop can be attributed to a combination of factors, including market corrections and profit-taking by early investors. Unlike Dogecoin, which was driven by meme culture and celebrity endorsements, SYMM’s price movements are more closely tied to its underlying technology and the broader DeFi market. The recent drop may be a sign of short-term volatility, but it does not necessarily reflect the long-term potential of the project.

Looking at historical trends, we can see that many cryptocurrencies have experienced similar price fluctuations before going on to achieve significant growth. If SYMM can continue to build on its technological advancements and expand its user base, there’s a good chance it could follow a similar recovery path to Dogecoin. However, it’s important to remember that each project is unique, and SYMM’s journey will depend on its ability to navigate the challenges of the DeFi space.

Technical Analysis and Market Indicators

To provide a more comprehensive view of SYMM’s future, let’s explore some key technical indicators. The Relative Strength Index (RSI) for SYMM currently stands at 55, indicating a neutral market condition. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, suggesting potential upward momentum in the near future. Additionally, SYMM’s price has been trading within the Bollinger Bands, indicating a period of consolidation that could precede a breakout.

Support and resistance levels are crucial in understanding SYMM’s price behavior. The current support level is around $0.0220, while the resistance is at $0.0235. Recent news, such as the partnership with a major DeFi platform, has bolstered investor confidence, potentially pushing the price towards the resistance level. However, external events, such as regulatory changes or market corrections, could impact these levels and lead to further volatility.

Chart analysis reveals an ascending triangle pattern for SYMM, which typically signals a continuation of the current trend. If SYMM can break above the resistance level, it could trigger a significant price surge, aligning with the controversial prediction made by the crypto critic. On the other hand, a failure to break out could lead to a retest of the support level, prompting a reassessment of the project’s short-term prospects.

Long and Short-Term Predictions

Looking ahead, SYMM’s price trajectory will depend on several factors, including technological advancements, market adoption, and regulatory developments. In the short term, we can expect SYMM to trade within the current range of $0.0220 to $0.0235, with potential for a breakout if market conditions remain favorable. The recent partnership with a major DeFi platform could drive increased trading volume and liquidity, supporting a potential price increase.

In the long term, SYMM’s focus on derivatives trading positions it well for growth in the DeFi sector. As more investors and institutions look to access decentralized financial services, Symmio’s innovative approach could attract significant interest. By 2026, we could see SYMM reaching new highs, potentially surpassing $0.05 if the project continues to execute on its roadmap and navigate regulatory challenges effectively.

By 2030, the DeFi landscape could look very different, with Symmio potentially playing a central role in the derivatives market. If the project can maintain its momentum and expand its offerings, SYMM could reach even higher levels, possibly approaching $0.10 or beyond. However, this long-term prediction is highly speculative and depends on many variables, including market conditions, technological advancements, and regulatory changes.

Actionable Insights for Investors

For investors looking to navigate SYMM’s volatility, it’s important to take a balanced approach. Diversify your portfolio to mitigate risk, and consider setting clear entry and exit points based on technical analysis and market trends. Keep an eye on key developments within the DeFi space, such as regulatory updates and new partnerships, as these could impact SYMM’s price.

If you’re new to crypto investing, start by researching Symmio’s fundamentals and understanding the broader DeFi market. Consider using trading platforms like WEEX, which offer a user-friendly interface and a wide range of cryptocurrencies, including SYMM. By staying informed and adopting a long-term perspective, you can position yourself to capitalize on SYMM’s potential growth while managing the inherent risks of the crypto market.

In conclusion, SYMM’s recent price surge and the controversial prediction by a notable critic have put the spotlight on this innovative project. As the DeFi sector continues to evolve, Symmio’s focus on derivatives trading could position it for significant growth in the coming years. By understanding the factors driving SYMM’s price and staying informed about market developments, investors can make informed decisions and potentially benefit from this exciting opportunity.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.