There’s arguably no hotter cryptocurrency in the niche sector right now than Anryton (MOL). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it one of the top-performing cryptocurrencies in its category. Anryton’s unique approach to blockchain technology, focusing on conservation efforts, has caught the eye of investors looking for ethical investments with solid growth potential.

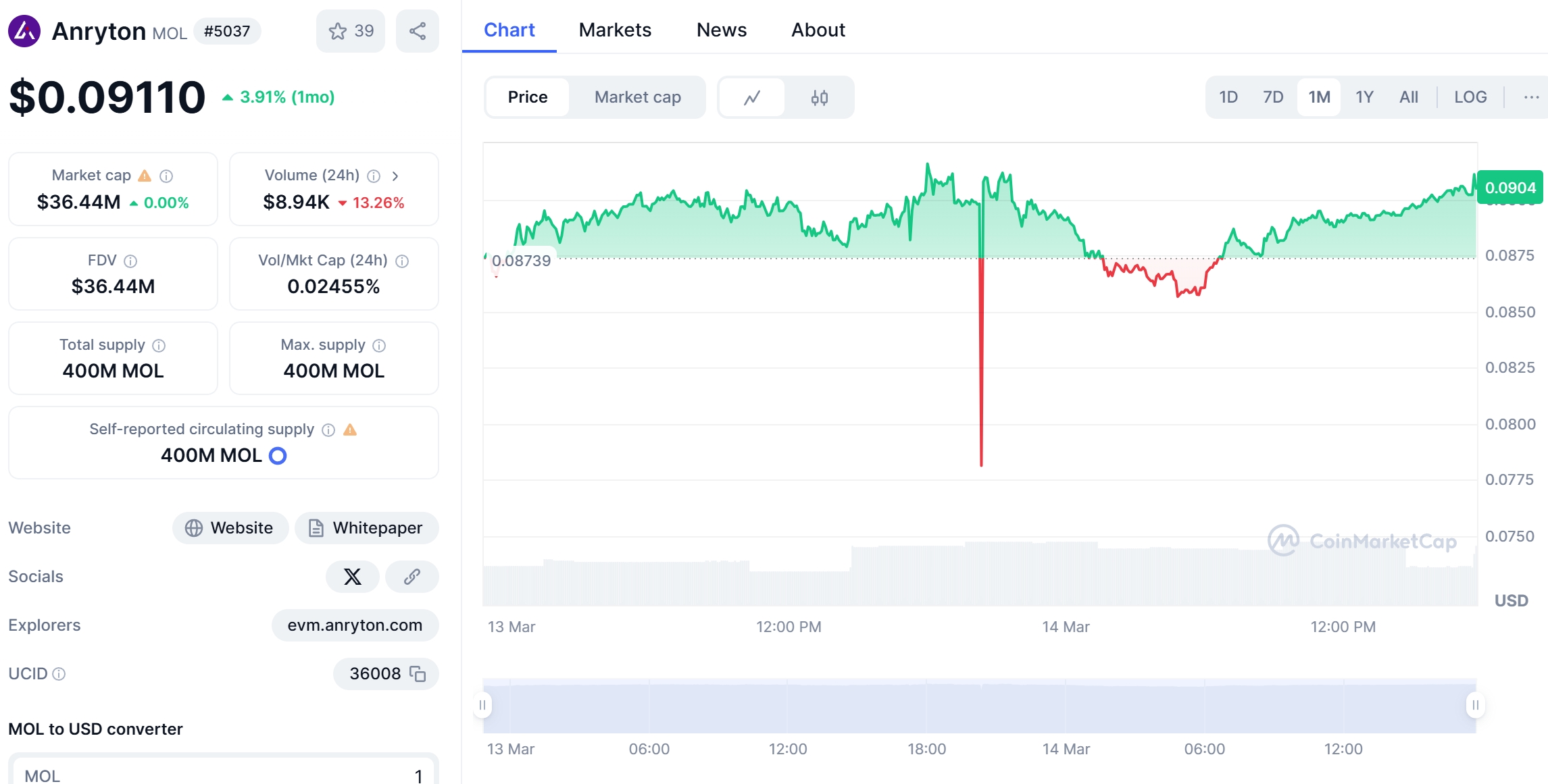

Anryton, or MOL, has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and significant developments in its project ecosystem. On March 13, 2025, the token surged to a new high of $0.0915, fueled by strong market sentiment and exciting news about their ongoing conservation initiatives. However, the rally was short-lived, and the price quickly dropped to $0.0781 within hours.

Anryton price prediction remains a hot topic as investors scrutinize every movement of this eco-conscious cryptocurrency. Today, we dive deep into how these forecasts compare with the emerging promise of a new blockchain solution for conservation. In a landscape filled with volatile digital assets, many wonder, “Would you buy Anryton (MOL) at $0.0900?”

Contents

- 1 Can Anryton (MOL) Recover After Dropping to $0.0781?

- 2 What Caused Anryton’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Dogecoin: Could Anryton Follow a Similar Path?

- 4 How to Navigate Anryton’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for Anryton (MOL)

- 6 Actionable Insights for Anryton Investors

Can Anryton (MOL) Recover After Dropping to $0.0781?

Anryton’s recent price drop from its peak of $0.0915 to $0.0781 has left many investors wondering about its future prospects. To understand this better, let’s compare Anryton’s trend to that of Dogecoin (DOGE), which experienced a similar price movement in the past.

Dogecoin, known for its meme origins, saw a significant price drop in May 2021, falling from a high of $0.73 to around $0.25 within weeks. This drop was largely influenced by market sentiment and the influence of social media. However, Dogecoin managed to recover over time, supported by renewed interest and community support.

Anryton’s price drop, on the other hand, was influenced by a combination of market dynamics and project-specific news. The initial surge to $0.0915 was driven by positive developments in their conservation efforts and partnerships. The subsequent drop to $0.0781 was likely due to profit-taking and broader market corrections.

What Caused Anryton’s Price Drop, and Will It Bounce Back?

The primary catalyst for Anryton’s price drop was a broader market correction that affected many cryptocurrencies. While Anryton’s project-specific news was positive, the overall market sentiment shifted, leading to a sell-off. However, the unique value proposition of Anryton’s focus on conservation could help it recover.

Anryton’s commitment to using blockchain technology for conservation efforts sets it apart from other cryptocurrencies. The project has secured significant financial backing, with over $10 million in investments to support its initiatives. This financial support demonstrates credibility and potential for growth.

Furthermore, Anryton has launched several associated projects, including partnerships with environmental organizations and the development of a decentralized platform for tracking conservation efforts. These initiatives showcase the project’s reach and impact within the industry.

Lessons From Dogecoin: Could Anryton Follow a Similar Path?

Dogecoin’s recovery was driven by community support and renewed interest. Anryton, with its focus on conservation, could potentially follow a similar path if it can maintain and grow its community’s enthusiasm. The project’s emphasis on research and development, with a dedicated team working on innovative solutions, could also play a crucial role in its recovery.

One of the key aspects to consider is Anryton’s R&D resources. The project has allocated a significant budget to develop cutting-edge technologies that enhance its conservation efforts. This commitment to innovation could attract more investors and contribute to a price recovery.

However, Anryton faces its own set of challenges. Historically, the project has faced setbacks in scaling its initiatives, which could impact investor confidence. By learning from past mistakes and adapting their strategies, Anryton could overcome these challenges and see a price increase.

Investing in Anryton requires a strategic approach, especially given its volatility. Let’s explore how this works in practice. One of the key indicators to watch is the Relative Strength Index (RSI), which helps determine if Anryton is overbought or oversold. Currently, the RSI for Anryton is around 45, indicating a neutral position.

Another important tool is the Moving Average Convergence Divergence (MACD), which can signal potential trend changes. The MACD for Anryton shows a bearish crossover, suggesting possible downward momentum. However, these indicators should be used in conjunction with other analysis tools, such as Bollinger Bands and Fibonacci retracements, to gain a comprehensive view of the market.

Support and resistance levels are crucial for understanding Anryton’s price behavior. The current support level is around $0.0781, while the resistance is at $0.0915. Recent news about Anryton’s partnerships and conservation efforts could influence these levels, potentially pushing the price above resistance if positive developments continue.

Chart analysis can provide visual insights into Anryton’s price trends. By examining the price chart, we can identify patterns such as the recent double top formation, which could indicate a potential reversal. However, these patterns should be interpreted cautiously, as they are not always reliable predictors of future price movements.

Long and Short-Term Predictions for Anryton (MOL)

Looking ahead, Anryton’s price could see significant movement based on its ongoing initiatives and market conditions. In the short term, the price could fluctuate between $0.0781 and $0.0915, depending on market sentiment and project developments. If Anryton can successfully launch its new decentralized platform and secure additional partnerships, we could see the price break above $0.0915.

For the long term, Anryton’s focus on conservation and blockchain technology could position it for substantial growth. By 2026, the price could reach $0.15 if the project continues to expand its initiatives and attract more investors. By 2030, the price might even surpass $0.30, driven by increased adoption and the success of its conservation efforts.

However, these predictions come with risks. The cryptocurrency market is notoriously volatile, and external events such as regulatory changes or shifts in investor sentiment could impact Anryton’s price. Investors should carefully consider these factors and diversify their portfolios to mitigate risk.

Actionable Insights for Anryton Investors

For those considering investing in Anryton, here are some actionable insights based on the analysis:

- Monitor Project Developments: Keep an eye on Anryton’s conservation initiatives and partnerships. Positive news could signal a potential price increase.

- Use Technical Analysis: Utilize tools like RSI, MACD, and chart patterns to make informed trading decisions. These indicators can help identify entry and exit points.

- Diversify Your Portfolio: Given Anryton’s volatility, consider diversifying your investments to reduce risk. This could include other cryptocurrencies or traditional assets.

- Stay Informed: Regularly check for updates on Anryton’s official channels and reliable news sources to stay informed about the project’s progress and market conditions.

In conclusion, Anryton’s price prediction is closely tied to its unique focus on conservation and blockchain technology. While the recent price drop to $0.0781 was a setback, the project’s strong fundamentals and ongoing initiatives could pave the way for a recovery. By understanding the market dynamics and using a strategic approach, investors can navigate Anryton’s volatility and potentially benefit from its growth potential.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.