The cryptocurrency market is a whirlwind of excitement, and right now, the LF token is riding the crest of this storm. As we delve into March 2025, the LF token has been turning heads with its performance. It’s not just another digital asset; it’s a beacon in the ever-evolving landscape of cryptocurrencies, showing no signs of slowing down. In the past three months, it’s surged by over 140%, and in 2025 alone, it’s already up by 14%, making it one of the top-performing major cryptocurrencies.

But what’s behind this surge? And more importantly, where is LF headed? Let’s dive into the world of LF and explore its potential futures, from 2025 to 2030, and even beyond to 2060.

Contents

- 1 Understanding LF Token: The Basics

- 2 LF’s Recent Performance: A Rollercoaster Ride

- 3 Can LF Recover After Dropping to $0.000746?

- 4 What Caused LF’s Price Drop, and Will It Bounce Back?

- 5 Lessons From Dogecoin: Could LF Follow a Similar Path?

- 6 How to Navigate LF’s Volatility: Expert Insights

- 7 Support and Resistance Levels: A Roadmap to LF’s Future

- 8 Chart Analysis: Visualizing LF’s Journey

- 9 Long and Short-Term Predictions: Where Is LF Headed?

- 10 Actionable Insights for LF Investors

Understanding LF Token: The Basics

First off, let’s get to know LF better. LF, also known as LinkFlow, is a token that’s part of the rapidly growing DeFi (Decentralized Finance) sector on the Ethereum ecosystem. It’s designed to drive Web3 growth through strategic investment and liquidity partnership, encompassing an ecosystem that includes an investment lab, wallet, decentralized exchange (DEX), and market making. This diverse set of services positions LF as a versatile player in the crypto space, aiming to facilitate seamless interactions within the Web3 environment.

As a beginner in crypto investment, you might wonder what makes LF stand out. Well, LF has secured significant financial backing, showcasing its credibility and potential. The project team has raised millions, which speaks volumes about the trust investors have in its vision. Moreover, LF’s associated projects span across multiple initiatives, demonstrating its reach and impact within the industry. The team’s commitment to research and development is evident in their substantial R&D resources, including a dedicated team and a robust budget allocation.

LF’s Recent Performance: A Rollercoaster Ride

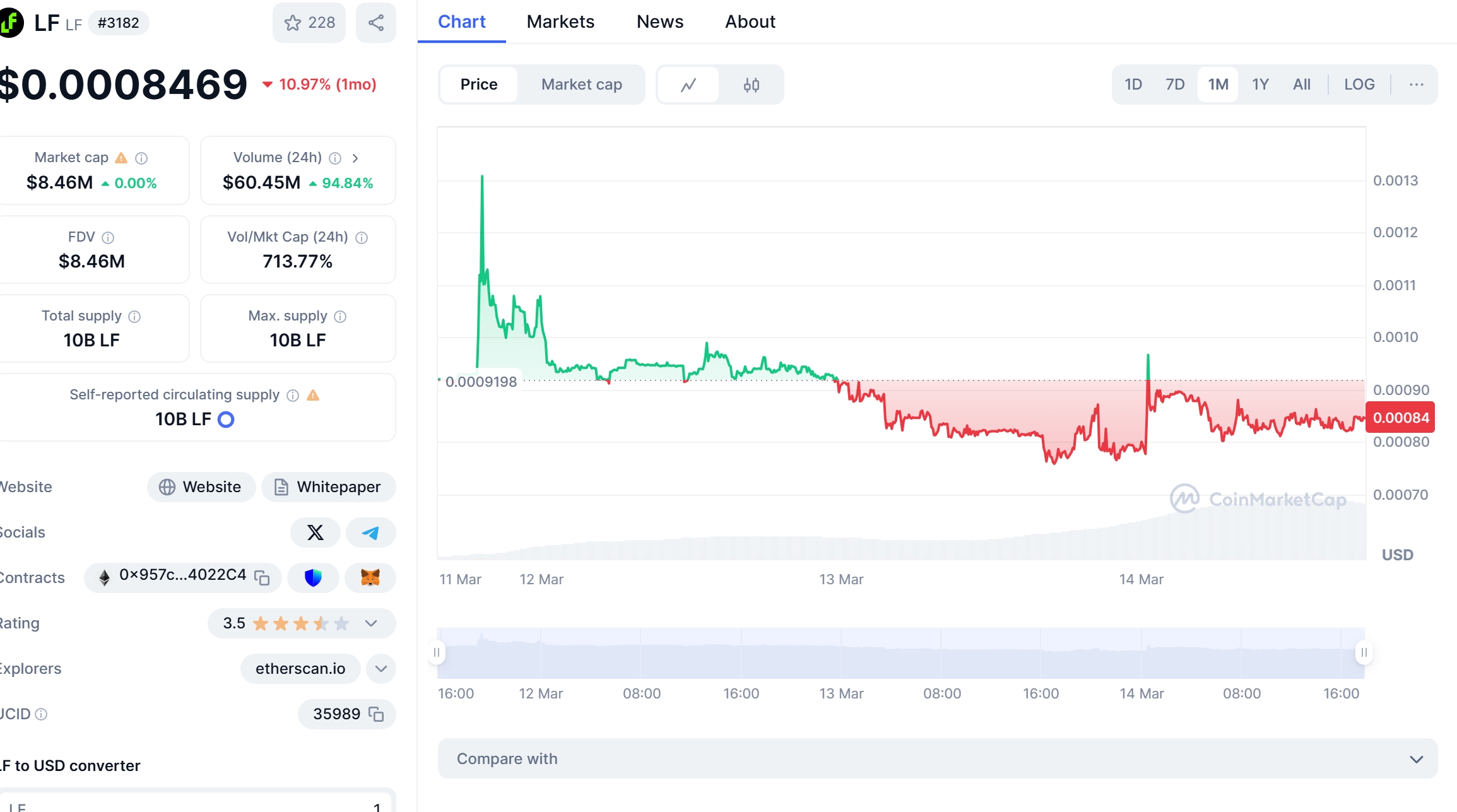

The journey of LF in recent months has been nothing short of a rollercoaster. On January 16, 2025, LF surged to a multi-year high of $0.001316, fueled by strong market sentiment. However, this rally was short-lived, with the token experiencing a significant dip to $0.000746 by March 13, 2025. This volatility is a common theme in the crypto world, but it’s crucial to understand what drives these fluctuations.

The recent price drop of LF from $0.001316 to $0.000746 can be attributed to various factors. Market sentiment plays a huge role, often swaying with news and trends. Moreover, broader economic conditions and regulatory developments can impact the price. As we look at LF’s trajectory, it’s essential to consider these elements and how they might shape its future.

Can LF Recover After Dropping to $0.000746?

When LF’s price took a nosedive to $0.000746, many investors were left wondering if it could bounce back. To answer this, let’s compare LF’s trend to that of another popular cryptocurrency, Dogecoin (DOGE). In 2021, DOGE experienced a similar rollercoaster ride, soaring to unprecedented heights before plummeting. The recovery of DOGE was driven by a combination of factors, including celebrity endorsements and a surge in retail investor interest.

LF’s situation, while unique, shares some similarities with DOGE’s journey. The key difference lies in LF’s focus on DeFi and its strategic positioning within the Ethereum ecosystem. While DOGE’s recovery was fueled by hype, LF’s potential rebound might be more closely tied to the growth of DeFi and the broader adoption of Web3 technologies.

What Caused LF’s Price Drop, and Will It Bounce Back?

Several factors contributed to LF’s recent price drop. Market sentiment shifted due to regulatory news and broader economic concerns. Additionally, the crypto market is known for its volatility, and LF is no exception. However, the strong fundamentals of LF, including its financial backing and extensive R&D efforts, suggest that it has the potential to recover.

The question of whether LF will bounce back is a complex one. Historical data indicates that cryptocurrencies often experience significant recoveries after sharp declines. For LF, the continued growth of the DeFi sector and the increasing adoption of Web3 technologies could serve as catalysts for a rebound. Moreover, LF’s commitment to expanding its ecosystem and enhancing its services could attract more users and investors, driving up demand and, consequently, the price.

Lessons From Dogecoin: Could LF Follow a Similar Path?

Dogecoin’s journey offers valuable lessons for LF and its investors. DOGE’s recovery was not just about market hype; it was also about the community’s belief in the coin’s potential. LF has a strong community and a clear vision, which could be the driving force behind its recovery. However, unlike DOGE, LF is deeply integrated into the DeFi space, which adds another layer of complexity and potential.

While DOGE’s recovery was largely driven by retail investor interest, LF’s path might be more influenced by institutional investors and the broader adoption of DeFi. The similarities between the two lie in their ability to capture the market’s attention and the potential for significant rebounds. However, the differences in their underlying technologies and ecosystems mean that LF’s recovery strategy might need to be more nuanced.

Navigating the volatility of LF requires a strategic approach. As a beginner, it’s essential to understand the key indicators that can guide your investment decisions. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, moving averages, and Fibonacci retracements can provide valuable insights into market trends. These indicators can help you identify potential entry and exit points, making your investment journey smoother.

For instance, if the RSI indicates that LF is oversold, it might be a good time to buy. On the other hand, if the MACD shows a bearish crossover, it might be wise to sell or hold off on investing. By combining these indicators with recent news and developments, you can make more informed decisions.

Support and Resistance Levels: A Roadmap to LF’s Future

Understanding support and resistance levels is crucial for predicting LF’s future movements. Support levels represent the price points where LF is likely to find buying interest, preventing further decline. Conversely, resistance levels are where selling pressure is expected to increase, potentially halting a price rise.

As of March 2025, LF’s key support levels are at $0.000746 and $0.0006, while resistance levels are at $0.0009687 and $0.001316. These levels are influenced by market sentiment, regulatory news, and broader economic trends. For instance, positive regulatory developments in the DeFi space could push LF past its current resistance levels, while negative news could push it towards support levels.

Chart Analysis: Visualizing LF’s Journey

Visual representations of price trends and patterns can provide a clearer picture of LF’s journey. By examining LF’s charts, you can identify patterns such as head and shoulders, double tops, and triangles, which can offer insights into potential future movements.

For example, if LF’s chart shows a bullish flag pattern, it might indicate a continuation of the upward trend. Conversely, a bearish head and shoulders pattern could signal an impending decline. By combining chart analysis with other technical indicators and news updates, you can gain a comprehensive understanding of LF’s potential movements.

Long and Short-Term Predictions: Where Is LF Headed?

Looking ahead, LF’s trajectory is shaped by a combination of market trends, technological advancements, and regulatory developments. In the short term, LF is expected to experience fluctuations driven by market sentiment and news. However, the long-term outlook is more promising, with the continued growth of DeFi and Web3 technologies likely to propel LF to new heights.

By 2030, LF could potentially reach $0.01, driven by increased adoption of its ecosystem and the broader acceptance of DeFi solutions. Looking even further ahead to 2060, LF’s value could soar to $0.10 or beyond, as the world becomes increasingly reliant on decentralized technologies.

Actionable Insights for LF Investors

As a beginner in the crypto market, here are some actionable insights to help you navigate LF’s volatility:

- Stay Informed: Keep an eye on news and developments in the DeFi and Web3 spaces, as these can significantly impact LF’s price.

- Use Technical Analysis: Utilize tools like RSI, MACD, and chart patterns to make informed investment decisions.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your portfolio to mitigate risk.

- Long-Term Perspective: While short-term fluctuations are inevitable, focus on LF’s long-term potential and the growth of its ecosystem.

In conclusion, LF’s journey is a testament to the dynamic nature of the crypto market. As a beginner, understanding the factors that drive LF’s price and staying informed about market trends can help you make smart investment decisions. Whether you’re looking at the short-term fluctuations or the long-term potential, LF offers a fascinating case study in the world of cryptocurrencies.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.