There’s arguably no hotter topic in the crypto world right now than the potential of the ELX (Elixir) token. It’s already making waves in the industry, and some are even speculating about its potential to reshape the crypto landscape in the coming years. In 2025, as we look ahead to the next five years and beyond, it’s clear that ELX (Elixir) token is a project worth keeping an eye on.

The Elixir network has been experiencing a rollercoaster ride in recent months, capturing the market’s attention with significant price movements and exciting developments. On January 16, 2025, the token surged to a multi-year high of $0.05, fueled by strong market sentiment. However, the rally was short-lived. As we dive deep into the price prediction and forecasts for ELX (Elixir) token, it’s important to understand the factors driving its volatility and potential for growth.

One of the key aspects to consider is the role of ELX (Elixir) token within the Elixir ecosystem. As the native utility and governance token, ELX powers consensus and allows holders to direct the future of the network. With the launch of the mainnet, Elixir aims to fully decentralize, with community-led governance driven by ELX holders. This gives the token significant potential for growth as the network expands and matures.

The Elixir ecosystem is part of the rapidly growing decentralized finance (DeFi) sector, which has been experiencing unprecedented growth in recent years. DeFi platforms offer a wide range of financial services, from lending and borrowing to trading and yield farming, all without the need for traditional intermediaries. Elixir’s unique approach to bringing institutional liquidity to DeFi through its deUSD synthetic dollar has caught the attention of major players like BlackRock, Hamilton Lane, and Apollo. This institutional backing adds a layer of credibility and potential for the ELX (Elixir) token.

Let’s explore how this works in practice. Elixir’s network is secured by over 30,000 global validators, each required to stake a minimum of 9,000 ELX tokens. This staking mechanism not only creates demand for the token but also aligns the incentives of validators with the security and proper functioning of the network. The more validators participating, the more secure and decentralized the network becomes, potentially driving the value of ELX higher.

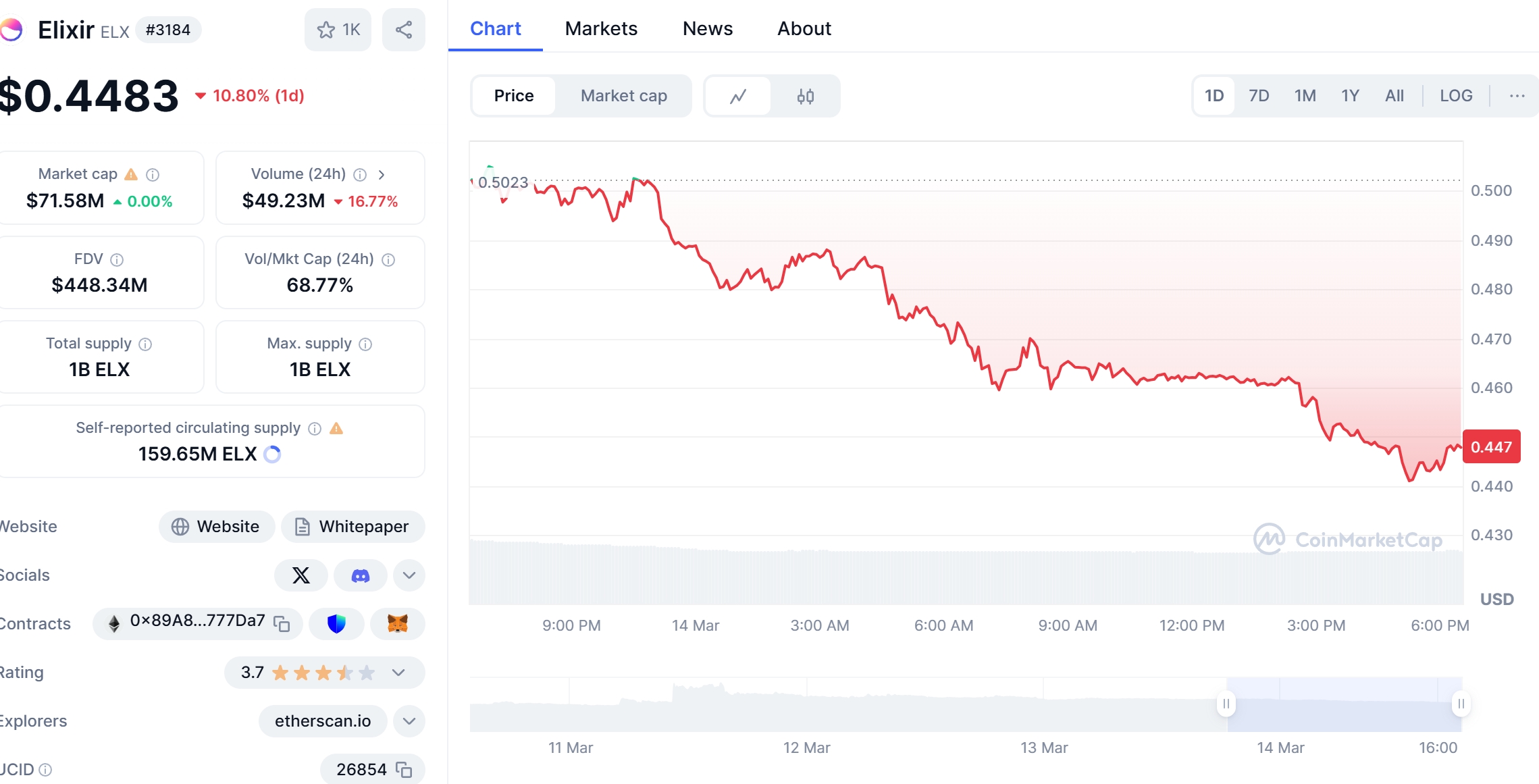

As we look at the price performance of ELX (Elixir) token, it’s important to consider the recent price drop from its high of $0.05 to its current price of $0.03. This drop can be compared to the price movement of Ethereum, which experienced a similar dip in early 2025 due to regulatory uncertainty and market consolidation. However, Ethereum managed to recover as the market sentiment improved and new use cases emerged.

The drop in ELX (Elixir) token’s price can be attributed to several factors, including profit-taking by early investors and the natural volatility of the crypto market. However, there are signs that ELX could follow a similar recovery path to Ethereum. The Elixir network has been actively working on expanding its partnerships and integrations, which could drive demand for the token in the coming months.

When analyzing the potential for ELX (Elixir) token to recover, it’s crucial to look at key indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These technical indicators can provide insights into the momentum and potential trend reversal of the token. For example, if the RSI shows that ELX is currently oversold, it could indicate a potential buying opportunity for investors.

In terms of support and resistance levels, the $0.03 price point has become a significant level of support for ELX (Elixir) token. If the token can hold above this level, it could signal a potential reversal and a move towards the next resistance level at $0.04. Recent news of Elixir’s partnership with a major financial institution could provide the catalyst needed for ELX to break through this resistance and continue its upward trajectory.

Chart analysis can also provide valuable insights into the potential future movements of ELX (Elixir) token. By looking at the historical price patterns and volume, we can identify potential trend lines and breakout points. For example, if ELX can break above the descending trend line that has been capping its price for the past few weeks, it could signal a potential bullish reversal and a move towards higher prices.

Looking ahead to the long and short-term predictions for ELX (Elixir) token, it’s important to consider both the fundamental and technical factors at play. In the short term, ELX could see a recovery to its previous high of $0.05 as the market sentiment improves and new developments are announced. In the longer term, as the Elixir network continues to grow and expand its reach, ELX could see significant price appreciation, potentially reaching $0.10 or higher by 2026.

Of course, these predictions are speculative and should be taken with a grain of salt. The crypto market is highly volatile, and many factors can influence the price of ELX (Elixir) token. However, by staying informed about the latest news and developments in the Elixir ecosystem and using technical analysis to identify potential buying opportunities, investors can position themselves for potential gains.

For those new to crypto investing, it’s important to approach ELX (Elixir) token with a long-term perspective. While the short-term price movements can be exciting, it’s the long-term potential of the Elixir network that could drive significant value for ELX holders. By staking their tokens and participating in the governance of the network, investors can not only potentially benefit from price appreciation but also play a role in shaping the future of DeFi.

In conclusion, the ELX (Elixir) token is a project with significant potential in the rapidly growing DeFi sector. While the recent price drop may have caused some concern among investors, there are signs that ELX could follow a similar recovery path to other major cryptocurrencies like Ethereum. By staying informed and using a combination of fundamental and technical analysis, investors can navigate the volatility of ELX and potentially position themselves for future gains. As the Elixir network continues to expand and mature, the ELX (Elixir) token could indeed surge to new heights in 2025 and beyond.