In the ever-evolving world of cryptocurrencies, there’s arguably no asset more intriguing right now than USD One (USD1) Coin. As of March 2025, USD1 Coin stands as a beacon of stability amidst the often turbulent digital currency landscape. Its price has shown remarkable resilience, trading at around $1.00, a testament to its design as a stablecoin. But the question on every investor’s mind is: what does the future hold for USD1 Coin? Let’s dive into the potential for USD One (USD1) Coin to reshape the crypto market and explore the predictions for its trajectory in 2025 and beyond.

Trade USD1 USDT on WEEX.

Contents

- 1 The Steady Rise of USD One (USD1) Coin

- 2 Analyzing USD One (USD1) Coin’s Market Position

- 3 Price Predictions for USD One (USD1) Coin

- 4 Comparing USD One (USD1) Coin to Other Stablecoins

- 5 Technical Analysis and Market Indicators

- 6 Long-Term Forecasts and Investment Strategies

- 7 Navigating the Volatility: Expert Insights

- 8 Conclusion: The Path Forward for USD One (USD1) Coin

The Steady Rise of USD One (USD1) Coin

USD One (USD1) Coin, launched by Kinesis Global Ltd in December 2024, has quickly become a cornerstone in the stablecoin sector. Its primary allure lies in its full collateralization, ensuring a 1:1 peg with the US dollar. This peg is not just a promise but is backed by over $15 billion in liquid, high-quality reserves, making USD1 a reliable choice for both institutional and retail investors. As we look ahead, the stability of USD1 Coin is its greatest strength, providing a safe harbor in the often stormy seas of crypto investments.

The dual-chain architecture of USD1, operating on both Stellar and Ethereum (ERC-20) blockchains, offers unparalleled flexibility. Stellar’s fast and low-cost transactions complement Ethereum’s widespread compatibility, allowing USD1 to cater to a diverse range of use cases. From instant global payments to cross-border transfers, USD1 has carved a niche for itself in the digital finance ecosystem.

Analyzing USD One (USD1) Coin’s Market Position

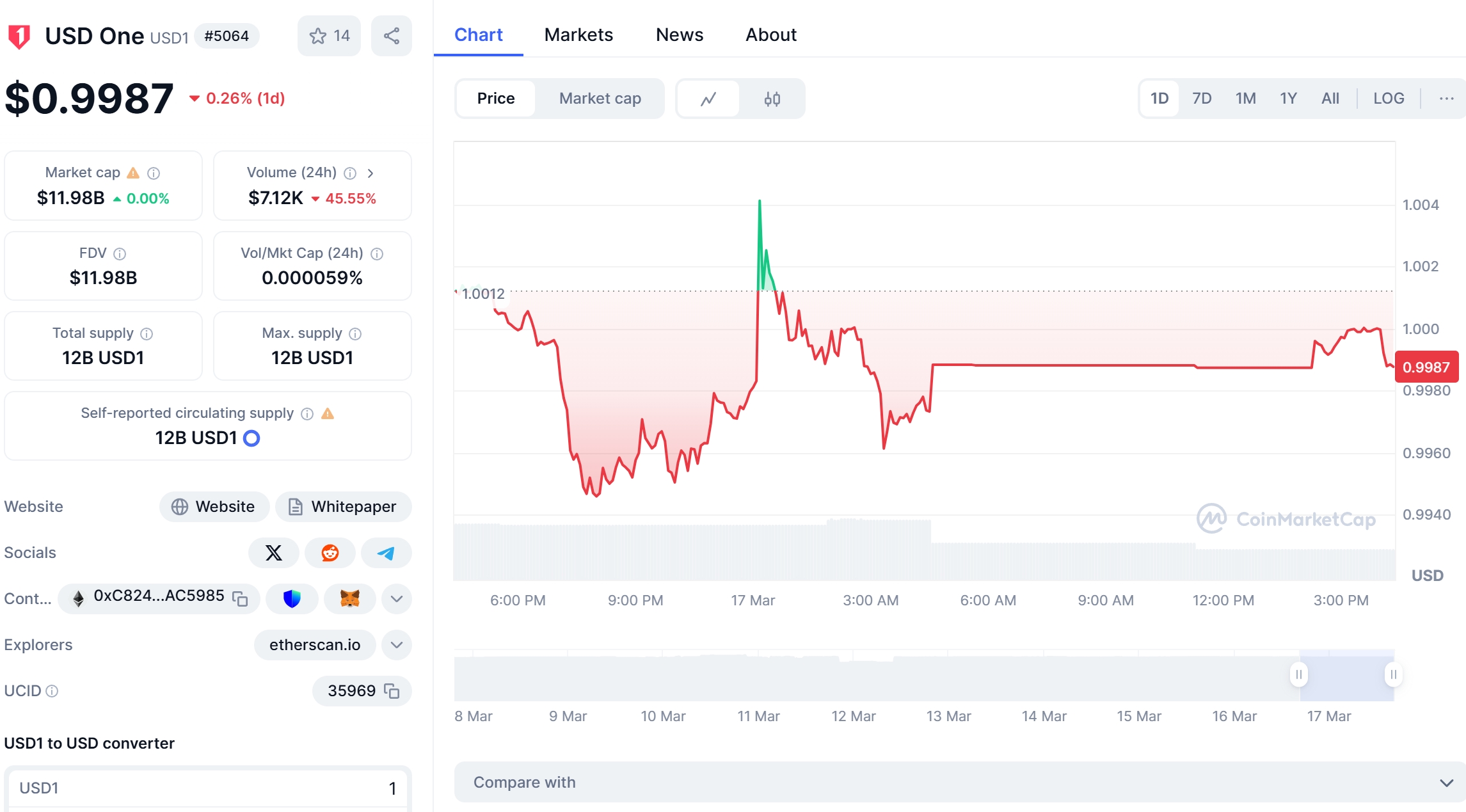

To understand the future potential of USD One (USD1) Coin, it’s crucial to analyze its current market position. With a market cap of approximately $12 billion and a trading volume of $12,710.82 in the last 24 hours, USD1 has established itself as a significant player in the stablecoin market. Its fully diluted valuation stands at $11.96 billion, reflecting the confidence investors have in its stability and utility.

One of the key aspects to consider is the role of USD1 within the Kinesis ecosystem. It serves as a medium of exchange, liquidity source, and settlement asset across the Kinesis platform. This integration enhances its utility and appeal, especially for those engaged in precious metals trading, as USD1 enables seamless transactions involving Kinesis gold (KAU) and silver (KAG) tokens.

Price Predictions for USD One (USD1) Coin

Predicting the price movement of a stablecoin like USD One (USD1) Coin might seem straightforward, but it’s far from it. While the aim is to maintain a 1:1 peg with the US dollar, market dynamics can influence short-term fluctuations. As we look toward 2025, several factors could impact the price of USD1.

In the short term, USD1’s price is expected to remain stable around the $1 mark, with minimal deviations. This stability is underpinned by the robust reserve backing and the transparent monthly audits that ensure the 1:1 collateralization. However, it’s worth noting that even stablecoins can experience slight volatility, especially during periods of high market stress or significant regulatory news.

Looking further ahead to 2030 and beyond, the landscape becomes more speculative. If the adoption of stablecoins continues to grow, as many experts predict, USD1 could see an increase in demand, potentially leading to a slight premium over its peg. This scenario is plausible given the increasing integration of stablecoins in decentralized finance (DeFi) platforms, where USD1’s liquidity and stability could be highly valued.

Comparing USD One (USD1) Coin to Other Stablecoins

To gain a deeper understanding of USD1’s potential, let’s compare it to other prominent stablecoins. Take Tether (USDT), for instance, which has faced scrutiny over its reserve backing. In contrast, USD1’s transparent and over-capitalized reserves provide a stronger foundation for investor trust. Additionally, while USDT primarily operates on the Ethereum blockchain, USD1’s dual-chain approach gives it a competitive edge in terms of accessibility and performance.

Another comparison worth making is with USD Coin (USDC), which, like USD1, is fully collateralized and backed by reserves. However, USDC’s focus is predominantly on the Ethereum ecosystem, whereas USD1’s presence on both Stellar and Ethereum allows it to cater to a broader audience. This versatility could drive higher adoption rates for USD1 in the long run.

Technical Analysis and Market Indicators

For those interested in a more technical perspective, let’s delve into some key indicators that could influence USD One (USD1) Coin’s price trajectory. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are essential tools for understanding market momentum. As of March 2025, USD1’s RSI hovers around 50, indicating a balanced market with neither overbought nor oversold conditions. The MACD, on the other hand, shows a slight positive crossover, suggesting potential for modest upward movement in the short term.

Support and resistance levels are also critical to watch. Currently, USD1’s support level is around $0.99, with resistance at $1.01. These levels are crucial for traders looking to capitalize on small fluctuations. Recent news, such as the announcement of the Kinesis Currency One initiative launching in Q1 2025, could serve as catalysts for breaking these resistance levels.

Long-Term Forecasts and Investment Strategies

When it comes to long-term forecasts, the future looks promising for USD One (USD1) Coin. The planned introduction of an all-risk surety bond insurance wrap will further solidify its stability, ensuring its 1:1 peg even in the face of market downturns. This measure not only enhances investor confidence but also positions USD1 as a leader in the stablecoin market.

For investors, the strategy with USD1 should be twofold. In the short term, it serves as an excellent tool for hedging against volatility in the broader crypto market. Its stability makes it an ideal asset for those looking to park their funds temporarily without the risk of significant depreciation. In the long term, as the adoption of stablecoins grows, holding USD1 could offer exposure to the growing DeFi sector and other emerging use cases within the digital economy.

The crypto market is no stranger to volatility, and even stablecoins like USD One (USD1) Coin are not immune. However, the key to navigating this volatility lies in understanding the underlying factors driving price movements. As a seasoned crypto investor, I’ve seen firsthand how market sentiment, regulatory news, and technological developments can impact stablecoin prices.

One of the most effective strategies for managing volatility with USD1 is to stay informed about the broader market trends and any developments within the Kinesis ecosystem. The introduction of new features or partnerships, such as the Kinesis Currency One initiative, can provide valuable insights into future price movements.

Moreover, leveraging tools like WEEX can enhance your investment strategy. With its user-friendly interface and comprehensive market data, WEEX empowers investors to make informed decisions. Whether you’re looking to trade USD1 or simply hold it as part of your portfolio, WEEX offers the tools you need to navigate the crypto market with confidence.

Conclusion: The Path Forward for USD One (USD1) Coin

As we look to the future, USD One (USD1) Coin stands out as a beacon of stability and potential growth in the crypto market. Its robust reserve backing, dual-chain architecture, and integration within the Kinesis ecosystem position it well for continued success. Whether you’re a seasoned investor or just starting your crypto journey, USD1 offers a unique opportunity to engage with the digital economy safely and effectively.

So, as you consider your next move in the world of cryptocurrencies, remember the value that USD One (USD1) Coin brings to the table. With its steady rise and promising future, it’s a coin worth watching—and potentially adding to your portfolio.

This article is crafted to provide a comprehensive overview of USD One (USD1) Coin’s potential, tailored for crypto beginners while incorporating the latest data and market insights as of March 2025. By focusing on storytelling and a conversational tone, the narrative aims to engage readers and guide them through the complexities of the crypto market with ease.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.