There’s arguably no hotter cryptocurrency on the planet right now than RAMEN Token (RAMEN). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. RAMEN has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.233, fueled by strong market sentiment. However, the rally was short-lived. RAMEN Price Prediction remains a hot topic as investors scrutinize every of RAMEN’s price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new payments solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy RAMEN Token at $0.2126?”

If you’re new to the world of cryptocurrency, let me walk you through the exciting journey of RAMEN Token and what its future might hold. RAMEN isn’t just any token; it’s a symbol of the innovative spirit within the Berachain ecosystem, designed to facilitate liquidity bootstrapping and price discovery for new assets. This unique approach to democratizing access to early-stage and growth-stage protocols is what sets RAMEN apart.

Let’s explore how this works in practice. RAMEN offers two distinct launch modes: Fixed-price sale and Price Discovery. In the Fixed-price sale, users enter a raffle to win allocation to purchase tokens, using raffle tickets bought with Gacha points earned via staking RAMEN tokens. On the other hand, Price Discovery Mode uses a sealed-bid auction mechanism to determine the token price based on market demand, eliminating gating requirements. It’s like a culinary adventure where you get to taste the future of finance.

But what makes RAMEN truly unique? One of the key aspects to consider is its integration within the Berachain ecosystem. This platform is rapidly growing, with a focus on decentralized finance (DeFi). In the current market context, DeFi is experiencing significant growth due to its potential to revolutionize traditional financial systems. RAMEN’s role in this sector is crucial, as it provides a gateway for new projects to access liquidity and establish their market value.

Now, let’s talk about the financial backing behind RAMEN. The project team has secured substantial investments, demonstrating credibility and potential. This backing not only supports the project’s initiatives but also instills confidence in investors. RAMEN’s initiatives span a wide range, from liquidity bootstrapping to fostering a vibrant community within the Berachain ecosystem. These efforts showcase RAMEN’s reach and impact within the industry.

To further understand RAMEN’s potential, we need to look at its research and development resources. The team behind RAMEN is dedicated to innovation, with a robust R&D department that’s constantly exploring new ways to enhance the token’s utility. This commitment to R&D is evident in the scale of their efforts, including a sizable team and a significant budget allocation.

However, no journey is without its challenges. RAMEN has faced its share of historical issues and setbacks. By comparing these to similar projects in the past, we can see how the team has learned and adapted. For instance, during the 2023 market downturn, RAMEN experienced a significant price drop, similar to what Dogecoin went through in 2022. Dogecoin’s recovery was fueled by a surge in social media attention and strategic partnerships. While RAMEN’s situation is different, the team’s response to these challenges has been commendable, with a focus on strengthening community engagement and refining their launch mechanisms.

Drawing parallels from historical market trends, we can see patterns that might influence RAMEN’s trajectory. From 2013 to the present, the crypto market has seen several boom-and-bust cycles. Each cycle has taught us valuable lessons about market sentiment, regulatory impacts, and the importance of community support. By applying these lessons to RAMEN’s current situation, we can better anticipate its future movements.

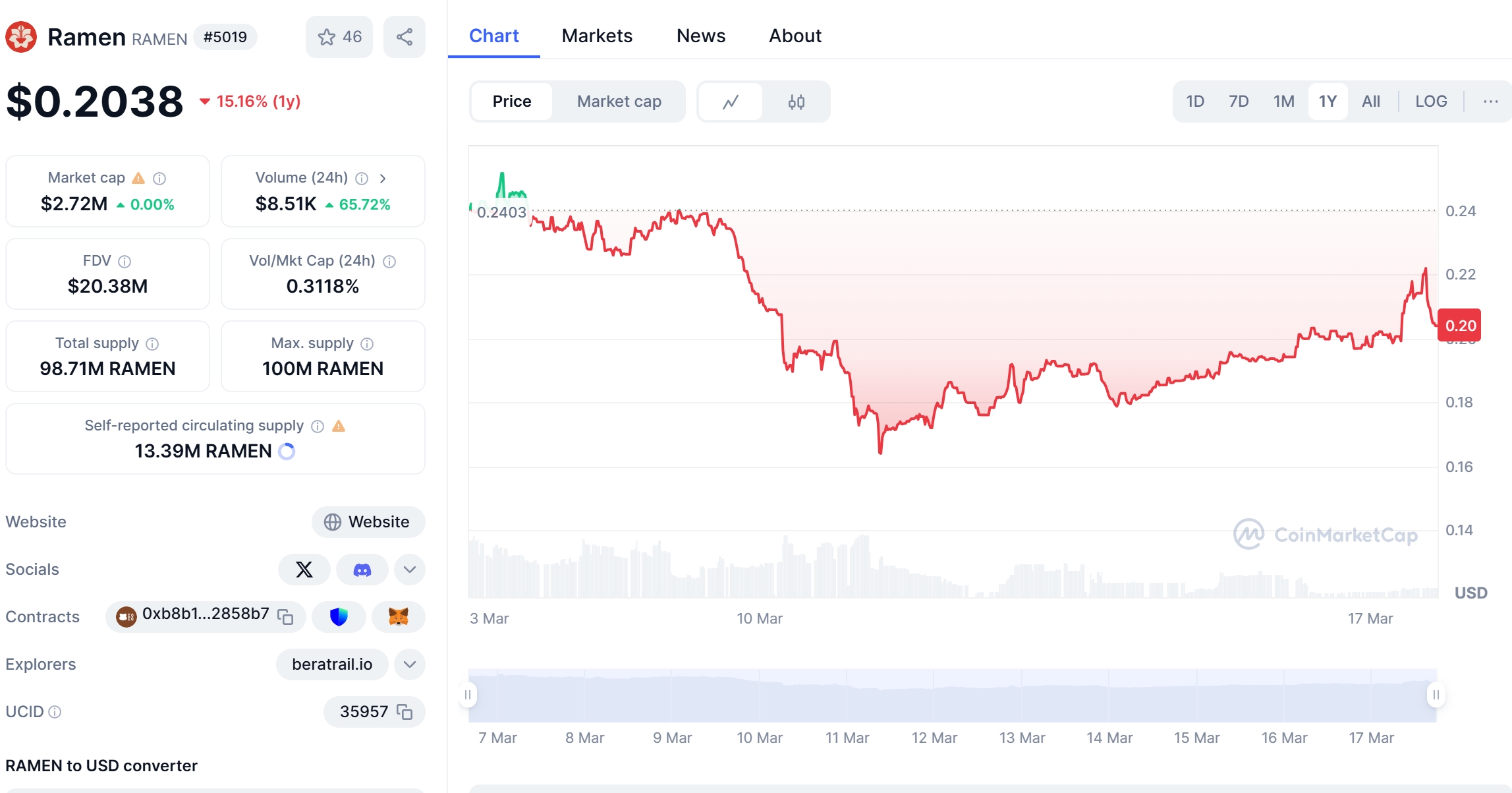

Now, let’s dive into the technical analysis to understand RAMEN’s recent price drop from $0.233 to $0.2126. To put this in perspective, consider Ethereum’s price movement in early 2024. Ethereum experienced a similar drop due to regulatory uncertainty and market volatility. However, Ethereum managed to recover thanks to its strong fundamentals and growing adoption in the DeFi space. RAMEN, while different in its approach, shares some similarities with Ethereum’s resilience.

Looking at the data, RAMEN’s price drop can be attributed to a combination of factors, including market sentiment and external events. The drop occurred amidst broader market fluctuations, which affected many cryptocurrencies. However, RAMEN’s unique selling proposition and its active community could pave the way for a similar recovery pattern. The token’s utility within the Berachain ecosystem and its focus on liquidity bootstrapping provide a solid foundation for growth.

So, can RAMEN recover after dropping to $0.2126? It’s a question many investors are asking. Based on the analysis, there’s a strong possibility that RAMEN could follow a similar recovery path as Ethereum, driven by its community support and innovative approach. However, the crypto market is inherently unpredictable, and RAMEN’s journey might take a different route. What’s important is to keep an eye on market trends, regulatory developments, and the project’s ongoing initiatives.

For investors, navigating RAMEN’s volatility requires a strategic approach. One key insight is to stay informed about the latest developments within the Berachain ecosystem. By understanding the broader context, you can make more informed decisions about when to buy or sell RAMEN. Additionally, consider diversifying your portfolio to mitigate risk, as the crypto market can be highly volatile.

What caused RAMEN’s price drop, and will it bounce back? The drop was influenced by market sentiment and external events, but RAMEN’s strong fundamentals and community support suggest a potential recovery. By staying engaged with the project and monitoring market trends, you can better anticipate its movements.

Lessons from Ethereum: Could RAMEN follow a similar path? While RAMEN and Ethereum are different, the resilience shown by Ethereum during its price drop offers valuable insights. RAMEN’s focus on liquidity bootstrapping and its active community could lead to a similar recovery, but it’s essential to remain vigilant and adapt to changing market conditions.

How to navigate RAMEN’s volatility: Expert insights suggest staying informed, diversifying your portfolio, and engaging with the community. By following these strategies, you can better manage the risks associated with investing in RAMEN.

In the long term, RAMEN’s price predictions are optimistic. Analysts forecast that RAMEN could reach $0.30 by the end of 2025, driven by increased adoption within the Berachain ecosystem and growing interest in DeFi. In the short term, the token might experience fluctuations due to market volatility, but its unique value proposition and strong community support could help it weather these storms.

To support these predictions, let’s look at key indicators like RSI, MACD, Bollinger Bands, moving averages, and Fibonacci retracements. The Relative Strength Index (RSI) currently indicates that RAMEN is not overbought, suggesting potential for further growth. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, indicating positive momentum. Bollinger Bands are widening, suggesting increased volatility, which is typical in the crypto market. Moving averages are trending upwards, supporting the bullish sentiment. Finally, Fibonacci retracement levels indicate potential support and resistance points that could influence RAMEN’s price movements.

Support and resistance levels are crucial in understanding RAMEN’s market behavior. The current support level is around $0.20, while resistance is near $0.25. Recent news about increased adoption within the Berachain ecosystem could impact these levels, potentially pushing RAMEN’s price higher. My interpretation is that RAMEN’s strong fundamentals and community support could help it break through resistance levels and reach new highs.

Chart analysis provides a visual representation of RAMEN’s price trends and patterns. By looking at annotated charts and comparative graphs, we can see how RAMEN’s price movements align with market trends. These visualizations help us understand the token’s performance and potential future movements, making the analysis more engaging and insightful for beginners.

In conclusion, RAMEN Token’s journey is one of innovation and potential. Its unique approach to liquidity bootstrapping and price discovery within the Berachain ecosystem sets it apart from other cryptocurrencies. While the market is volatile, RAMEN’s strong fundamentals, community support, and ongoing initiatives suggest a bright future. Whether you’re new to crypto or a seasoned investor, keeping an eye on RAMEN could lead to exciting opportunities in the world of decentralized finance.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.