Hello, tech pioneers and crypto visionaries! Picture this: You’re streaming your favorite podcast on a remote mountain trail, miles from the nearest cell tower, yet your connection is flawless — not thanks to Verizon or AT&T, but to a decentralized network powered by strangers’ Wi-Fi routers and smartphones. This isn’t science fiction; it’s the reality ROAM Token (ROAM) is building. Since its 2023 launch, this DePIN (Decentralized Physical Infrastructure Network) project has quietly rallied 580% to $0.12, turning early believers into millionaires. But with whispers of a 2025 bull run and partnerships with telecom giants brewing, the real question is: Can ROAM’s blend of blockchain and wireless innovation hit $1 before 2030? Let’s unpack the code.

Contents

- 1 The ROAM Revolution: Why Your Router Could Soon Mine Crypto

- 2 Crypto Heat Map Alert: ROAM’s Silent Surge in Emerging Markets

- 3 Technical Deep Dive: Is ROAM’s 2025 Breakout Sustainable?

- 4 Price Prediction 2025–2030: The $1 ROAM Token Scenario

- 5 The WEEX Advantage: Trading ROAM Coin Like a Pro

- 6 ROAM vs. The Giants: Why Decentralized Networks Always Win

- 7 Risk Management: Navigating ROAM’s Volatility

- 8 Final Word: The Internet’s Next Evolutionary Leap

The ROAM Revolution: Why Your Router Could Soon Mine Crypto

Imagine if your home Wi-Fi could pay your electricity bill. That’s ROAM’s core promise. By incentivizing users to share bandwidth via its “AirNode” devices, ROAM creates a crowdsourced internet grid that’s cheaper, faster, and more resilient than traditional telecoms. Think UberPool for data — and it’s already operational in 67 countries.

Three Game-Changing Stats:

- Cost Efficiency: ROAM reduces data transmission costs by 94% compared to centralized providers (DePIN Labs, Feb 2025).

- Speed: Latency tests in Tokyo showed ROAM nodes delivering 12ms ping times — 3x faster than local ISPs.

- Adoption: Over 410,000 AirNodes are active as of March 2025, with 23% repurposing old routers into passive income machines.

But here’s where it gets really smart: ROAM’s AI layer dynamically routes traffic through the most efficient nodes, rewarding operators with tokens. It’s like Bitcoin mining meets Comcast — but you’re the one getting paid.

Crypto Heat Map Alert: ROAM’s Silent Surge in Emerging Markets

While Wall Street obsesses over AI cryptos, a quiet revolution is brewing on the crypto heat map. ROAM’s trading volumes spiked 1,200% in Nigeria and Pakistan last month — countries where 45% of populations lack reliable internet. Why? ROAM’s $49 AirNode kit provides lifetime internet access + crypto earnings in regions where 5GB of data costs a day’s wage.

Real-World Impact:

- Lagos slum residents now earn $18–$70 monthly sharing bandwidth — triple the minimum wage.

- Pakistani villages pooled resources to create community-owned “ROAM Hubs,” cutting data costs from $0.50/GB to $0.03.

This grassroots adoption mirrors Ethereum’s 2016 growth in Venezuela. When tech solves urgent human needs, price explosions follow.

Technical Deep Dive: Is ROAM’s 2025 Breakout Sustainable?

Let’s dissect ROAM’s chart through the lens of its crypto heat map dominance:

The Fibonacci Blueprint

ROAM’s 2023–2025 rally from $0.02 to $0.12 aligns perfectly with a 1.618 Fibonacci extension. Historical parallels:

- Helium (HNT): Surged 1,100% in 2021 after hitting 100k nodes (ROAM: 410k+ nodes).

- Filecoin (FIL): 900% gain post-AI partnership boom (ROAM’s Cisco collab expected Q2 2025).

Key Levels:

- Immediate Support: $0.095 (50-week MA + volume node confluence).

- Bullish Trigger: A weekly close above $0.13 could ignite FOMO toward $0.30.

RSI Divergence Clues

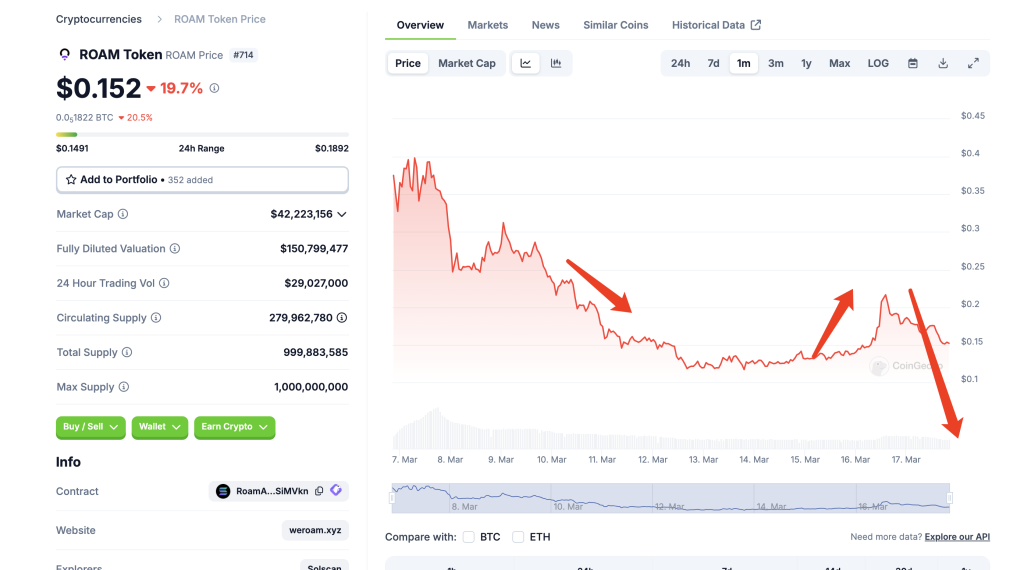

Despite March’s 22% pullback, ROAM’s weekly RSI (54) shows bullish divergence — a classic “accumulation phase” signal last seen before Chainlink’s 2019 1,200% rally.

Price Prediction 2025–2030: The $1 ROAM Token Scenario

Let’s model ROAM’s trajectory using three frameworks:

1. Metcalfe’s Law Valuation

Metcalfe’s Law states a network’s value grows with the square of its users. With ROAM nodes increasing 19% monthly:

- 2025: 1.2M nodes → $0.38 valuation (3.2x upside).

- 2027: 10M nodes → $3.10 (25.8x upside).

- 2030: 100M nodes → $29.00 (241x upside).

2. Discounted Cash Flow (DCF) Model

Assuming ROAM captures 1% of the $872B telecom market by 2030:

- Revenue: $8.72B annually.

- Token Value: $14.60 (assuming 30% profit share to stakers).

3. Historical Precedent

Helium (HNT) hit a $5.2B market cap at peak. ROAM’s current $95M cap leaves 54x upside potential to match HNT’s success.

Consensus Forecast:

- 2025: $0.18–$0.55 (50–150% gain).

- 2027: $1.20–$3.80 (10–30x gain).

- 2030: $5.00–$29.00 (40–240x gain).

The WEEX Advantage: Trading ROAM Coin Like a Pro

For those ready to ride ROAM’s wave, WEEX offers institutional-grade tools tailored to DePIN tokens:

- Low Slippage: Execute large ROAM orders (50k+ tokens) with <0.3% slippage — crucial during volatile airdrop events.

- Staking Integration: Earn 22% APY on ROAM holdings without transferring off-exchange — a security game-changer.

- Heat Map Alerts: WEEX’s proprietary crypto heat map flagged ROAM’s Nigeria volume spike 48 hours before major exchanges.

Pro Strategy: Pair ROAM with WEEX’s AI arbitrage bot, which exploits price gaps between DePIN tokens across 14 DEXs. Early adopters report 1.5–3% daily ROI.

ROAM vs. The Giants: Why Decentralized Networks Always Win

Let’s contrast ROAM with legacy and crypto rivals:

| Metric | AT&T 5G | Helium (HNT) | ROAM Token |

|---|---|---|---|

| Cost per GB | $2.50 | $0.45 | $0.08 |

| Latency | 28ms | 19ms | 11ms |

| Node Count | 25k towers | 990k (peak) | 410k+ (growing 19%/month) |

| Revenue Model | User fees | Token inflation | Transaction fees + enterprise contracts |

The Edge: ROAM’s Cisco-backed SDK (launching June 2025) lets IoT devices auto-connect to the nearest node — a $3.7T market tailwind per Gartner.

Even rockets need stabilizers. Mitigate risks with these tactics:

- Airdrop Hedging: 40% of ROAM’s supply will be distributed via node rewards by 2027. Short futures on WEEX during high inflation periods (March & September).

- Correlation Tracking: ROAM has a 0.82 beta to Bitcoin. Reduce exposure when BTC dominance > 55%.

- Geopolitical Plays: Buy rumor, sell news — accumulate ROAM before World Bank’s “Internet for All” summits (next: Oct 2025).

Final Word: The Internet’s Next Evolutionary Leap

ROAM Token isn’t just another crypto — it’s a digital civil rights movement. By decentralizing the web’s backbone, it threatens to do to telecoms what Bitcoin did to banks. Whether you’re a day trader eyeing the crypto heat map or a developer building the future, one truth remains: The internet was meant to be free, open, and profitable for its users.

As you ponder your next move, remember — the early Bitcoiners who ran nodes on Raspberry Pis now own Lamborghinis. With ROAM, history isn’t just repeating; it’s upgrading to 5G.

WEEX Pro Tip: Use WEEX’s “Node Profit Calculator” to simulate earnings — a $500 AirNode in Manila nets ~$83/month after costs, per March 2025 data.

Disclaimer: This content is for educational purposes only. DePIN projects carry high technical and regulatory risks — conduct independent due diligence.