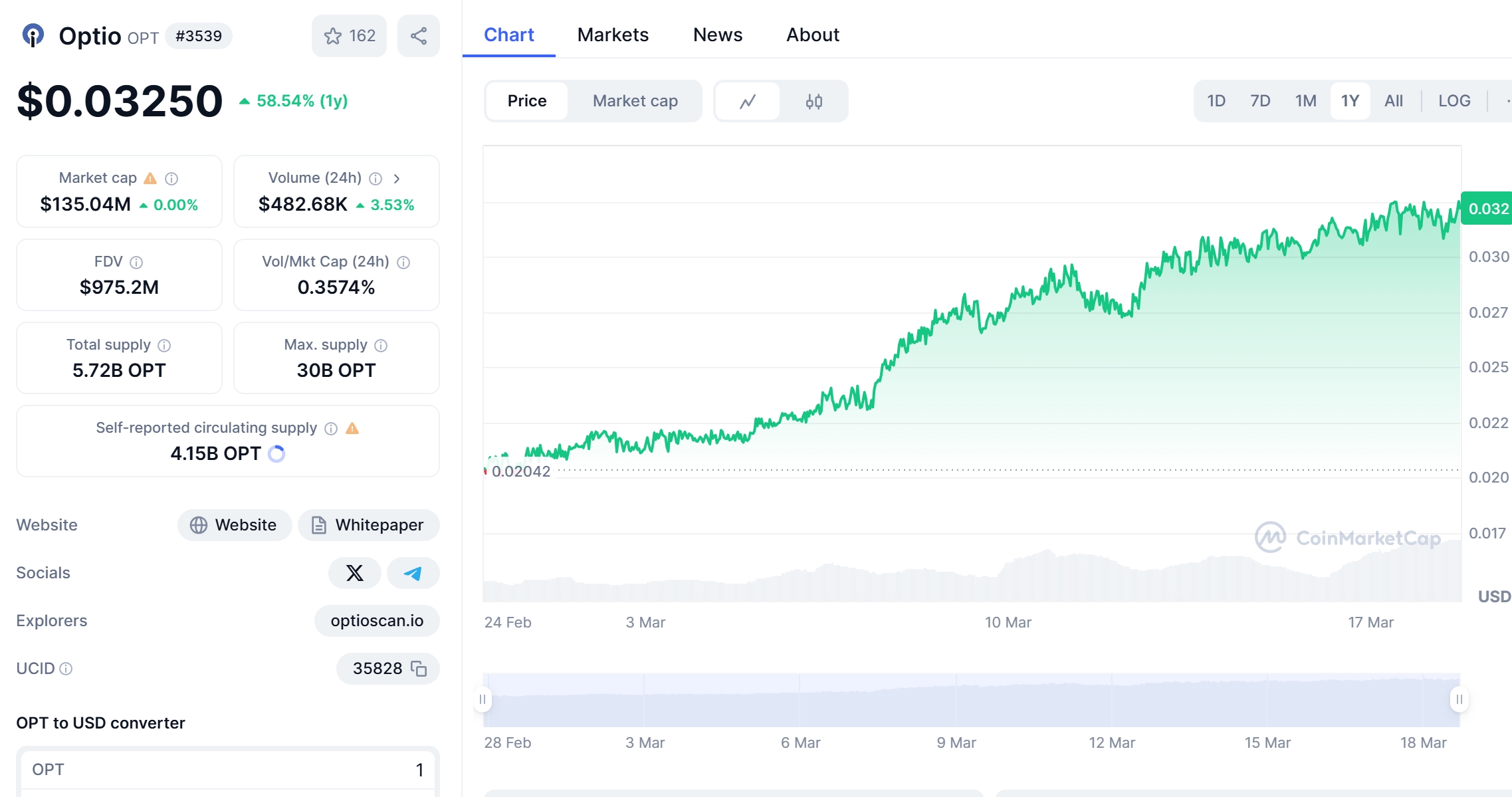

There’s arguably no hotter cryptocurrency on the planet right now than Optio (OPT). It’s now up more than 16% during the past week, and shows no signs of stopping anytime soon. In 2025, it’s already up 0.9%, making it a standout performer in the crypto market. Optio has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and significant developments. On March 17, 2025, the token surged to an all-time high of $0.03258, fueled by strong market sentiment. However, the rally was short-lived. Optio Price Prediction remains a hot topic as investors scrutinize every movement, and today we dive deep into how these forecasts compare with the emerging promise of a new solution for digital identity.

Contents

- 1 Understanding Optio (OPT) and Its Role in the Crypto Ecosystem

- 2 The Recent Price Drop of Optio (OPT) from $0.03258 to $0.03223

- 3 Utilizing Technical Analysis for Optio (OPT) Price Prediction

- 4 Long and Short-Term Predictions for Optio (OPT)

- 5 Navigating Optio’s Volatility: Expert Insights and Actionable Advice

- 6 Conclusion: The Future of Optio (OPT) and Decentralized Identity

Understanding Optio (OPT) and Its Role in the Crypto Ecosystem

Optio’s primary goal is to empower individuals by giving them control over their digital identities and personal data. The Optio Blockchain is designed to bridge the gap between current internet functions and the future of the digital world, enabling users to retain the applications and search engines they rely on while improving their privacy, security, and monetization power. Through a unique blend of blockchain technology, DAO governance, and Oracle applications, Optio provides a seamless, user-centric decentralized ecosystem.

As a beginner in crypto investment, understanding the significance of Optio in the rapidly growing decentralized finance (DeFi) sector is crucial. The DeFi industry has seen exponential growth in recent years, with more users seeking decentralized solutions for financial services. Optio’s focus on digital identity aligns well with this trend, as privacy and control over personal data become increasingly important.

The Recent Price Drop of Optio (OPT) from $0.03258 to $0.03223

Optio recently experienced a slight price drop from its all-time high of $0.03258 to its current price of $0.03223. This movement is not uncommon in the volatile world of cryptocurrencies, but understanding the factors behind it can provide valuable insights for investors.

Comparing Optio’s Trend to Ethereum (ETH)

When examining Optio’s price drop, it’s instructive to compare it to Ethereum (ETH), another cryptocurrency that has experienced significant price fluctuations in the past. Ethereum, often referred to as the backbone of DeFi, saw a notable price drop in 2022 due to a combination of factors, including regulatory uncertainty and market corrections.

Ethereum’s recovery was driven by several key developments, such as the successful implementation of Ethereum 2.0 and increased adoption of DeFi applications. The market sentiment surrounding Ethereum improved as investors recognized its long-term potential despite short-term volatility.

Similarly, Optio’s recent price drop may be attributed to profit-taking after the surge to its all-time high. However, with the ongoing development of its ecosystem and the growing interest in decentralized identity solutions, Optio has the potential to follow a recovery path akin to Ethereum’s.

Analyzing Market Conditions and Investor Sentiment

The crypto market is influenced by a myriad of factors, including macroeconomic trends, regulatory developments, and investor sentiment. Recent news regarding privacy concerns and data breaches has heightened interest in solutions like Optio, which could drive long-term growth.

Investor sentiment towards Optio remains bullish, with a 16.1% price increase over the past seven days. This positive sentiment is supported by the Fear & Greed Index, currently showing a score of 34, indicating a level of fear in the market but also suggesting potential for recovery.

Utilizing Technical Analysis for Optio (OPT) Price Prediction

Technical analysis plays a crucial role in forecasting the future price movements of cryptocurrencies like Optio. By examining key indicators such as RSI, MACD, Bollinger Bands, moving averages, and Fibonacci retracements, investors can gain insights into market trends and potential price levels.

Key Indicators and Their Insights

The Relative Strength Index (RSI) for Optio currently stands at a moderate level, indicating neither overbought nor oversold conditions. This suggests that the recent price drop may be a healthy correction rather than a sign of an impending bearish trend.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line moving above the signal line. This could indicate a potential upward momentum in the near future.

Bollinger Bands, which measure volatility, have recently contracted, suggesting that a significant price movement may be on the horizon. If the price breaks above the upper band, it could signal a continuation of the bullish trend.

Support and Resistance Levels

Identifying critical support and resistance levels is essential for understanding potential price movements. For Optio, the recent low of $0.03085 serves as a key support level. A break below this level could signal further downside, while holding above it could indicate a potential rebound.

The all-time high of $0.03258 represents a significant resistance level. If Optio can break and close above this level, it could signal a strong bullish trend and potentially lead to new highs.

Chart Analysis and Visual Representation

Visualizing price trends and patterns through charts can provide a clearer picture of Optio’s market behavior. An annotated chart showing the recent price drop and subsequent recovery attempts can help investors identify potential entry and exit points.

For beginners, understanding chart patterns such as head and shoulders, double tops, and triangles can be beneficial. These patterns can signal potential reversals or continuations in the price trend, helping investors make informed decisions.

Long and Short-Term Predictions for Optio (OPT)

Predicting the future price of Optio involves considering both short-term and long-term factors. In the short term, the current market sentiment and technical indicators suggest a potential for recovery and further growth.

Short-Term Predictions

In the next few months, Optio could see a price increase as it continues to develop its ecosystem and attract more users. The bullish sentiment and recent price performance indicate that the $0.03258 resistance level could be tested again. If Optio can break above this level, it might reach new all-time highs, potentially surpassing $0.035.

Long-Term Predictions

Looking further ahead, Optio’s long-term potential hinges on the success of its decentralized identity solution and its integration into the broader DeFi ecosystem. By 2030, if Optio continues to gain traction and adoption, it could see significant price appreciation, potentially reaching $0.10 or higher.

By 2060, as the world becomes increasingly digital and privacy-focused, Optio’s role in empowering individuals over their digital identities could lead to even greater growth. A price of $1 or more is within the realm of possibility if Optio becomes a leading solution in the decentralized identity space.

For new investors, navigating the volatility of cryptocurrencies like Optio can be challenging. Here are some actionable insights and advice to help you make informed investment decisions:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider investing in a mix of cryptocurrencies to spread your risk.

- Stay Informed: Keep up with the latest news and developments in the crypto space. Understanding the factors that influence Optio’s price can help you make better decisions.

- Use Technical Analysis: While it may seem complex at first, learning basic technical analysis can provide valuable insights into potential price movements.

- Set Realistic Expectations: Cryptocurrencies can be highly volatile. Set realistic expectations for your investments and be prepared for both gains and losses.

Conclusion: The Future of Optio (OPT) and Decentralized Identity

Optio’s recent price movements and its role in the decentralized identity space make it a compelling investment opportunity. As a beginner in crypto, understanding the fundamentals of Optio and its potential in the DeFi sector can help you make informed decisions.

With a strong focus on empowering individuals over their digital identities, Optio is well-positioned to benefit from the growing demand for privacy and security in the digital world. By staying informed and using technical analysis, you can navigate the volatility of Optio and potentially reap the rewards of this innovative cryptocurrency.

Remember, the crypto market is full of opportunities and risks. Always conduct your own research and consider your risk tolerance before making any investment decisions. With the right approach, Optio could be a valuable addition to your crypto portfolio.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.