In the ever-evolving world of cryptocurrency, there’s a buzz around a lesser-known token that’s suddenly making waves. Automatic Treasury Machine (ATM) on the Solana blockchain has recently caught the attention of not just crypto enthusiasts but also a notable critic, who unexpectedly forecasted a massive price surge. It’s a narrative filled with irony and speculation, sparking discussions throughout the crypto community. Let’s dive into what makes ATM a token to watch in 2025 and beyond.

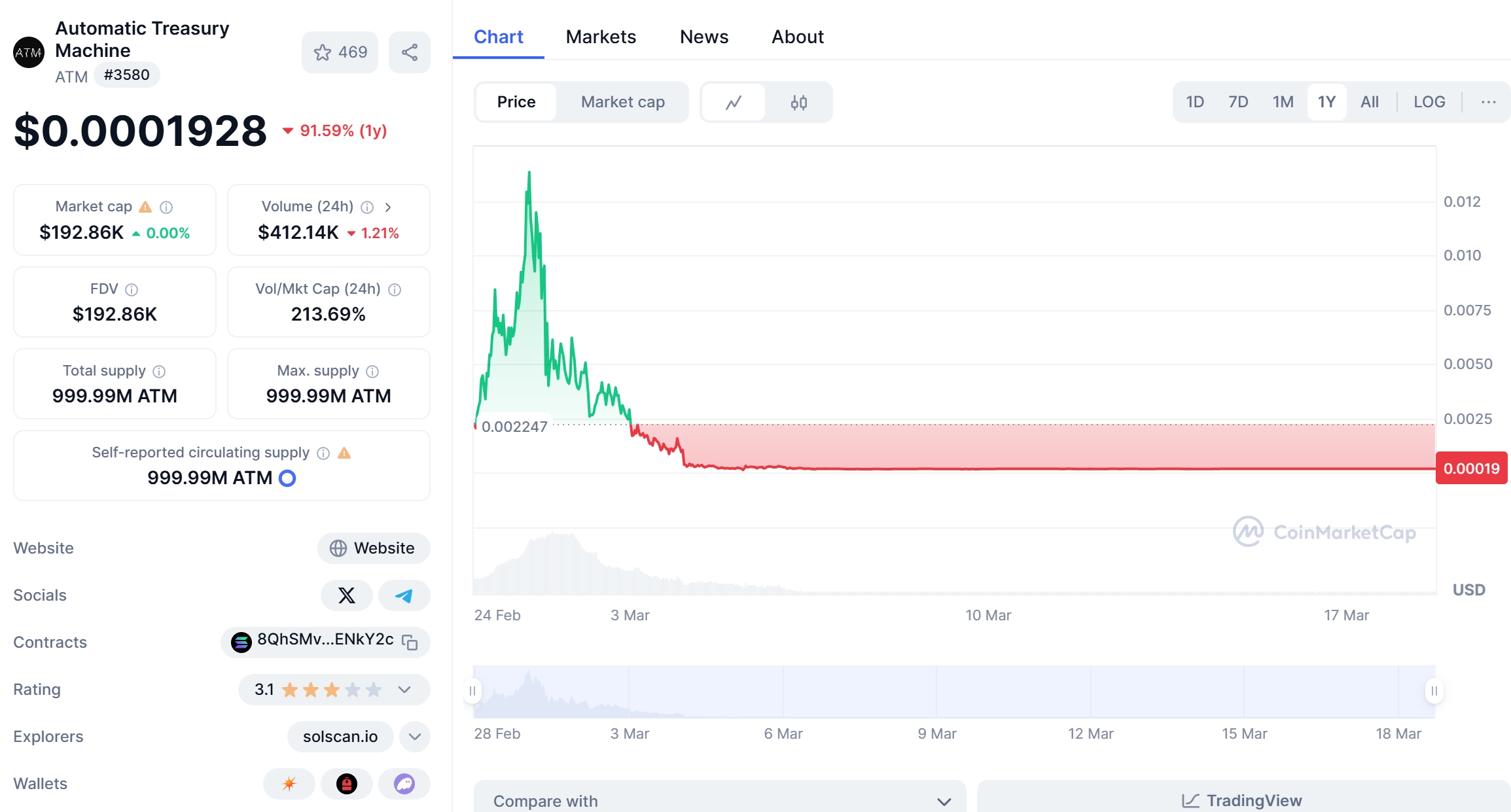

Imagine you’re new to the crypto scene, and you come across ATM. At a glance, its current price stands at $0.00005848, down 15.92% in the last 24 hours as of March 2025, with a 24-hour trading volume of $4,942 and a market cap of $58,429. It might seem like just another digital asset in a sea of cryptocurrencies. However, the story behind ATM is what makes it intriguing. Described as “the world’s fastest rewards system,” ATM aims to distribute USDC to its holders every few minutes, a concept that’s both ambitious and appealing to investors looking for passive income opportunities.

The recent price drop from $0.00006964 to $0.00005848 has left many wondering if ATM can recover. To understand this better, let’s compare ATM’s trend to that of Dogecoin (DOGE), which has seen its fair share of volatility. Back in 2021, DOGE experienced a significant surge and subsequent drop, influenced by social media hype and celebrity endorsements. Despite the fall, DOGE managed to recover partially, driven by its community and continued interest in meme coins. ATM, on the other hand, operates in a different niche, focusing on rewards and utility within the Solana ecosystem. This difference in market positioning could lead to a unique recovery path for ATM, potentially fueled by its innovative rewards system rather than speculative trading.

Using technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can provide insights into ATM’s potential movements. For instance, if the RSI indicates that ATM is currently in an oversold condition, it might suggest a potential upward correction in the near term. Similarly, if the MACD line crosses above the signal line, it could signal a bullish trend. These tools, combined with recent news about developments in the Solana ecosystem, could offer valuable clues about ATM’s future price action.

Looking at support and resistance levels, the $0.000058 mark seems to be a critical support level for ATM. Breaking below this could lead to further declines, while holding above it might signal a potential rebound. Recent updates from the Solana network, such as improvements in transaction speed and cost, could positively impact ATM’s utility and, by extension, its price. As an investor, keeping an eye on these developments can help you gauge ATM’s potential for recovery.

In terms of chart analysis, visualizing ATM’s price trends can be enlightening. A downward trend line from the recent peak to the current price might suggest a bearish outlook. However, if ATM can break above this trend line, it could indicate a shift in momentum. Including such visual representations in your analysis can make complex data more digestible, especially for those new to crypto investing.

When it comes to predicting ATM’s future price, it’s essential to consider both short-term and long-term scenarios. In the short term, if ATM can leverage its unique rewards system to attract more users and increase its utility within the Solana ecosystem, we might see a price surge back to $0.00007 or even higher by the end of 2025. Long-term, if ATM continues to develop its platform and gain traction, it could potentially reach $0.0001 by 2030, driven by increased adoption and market confidence.

For those looking to navigate ATM’s volatility, here are some actionable insights: First, consider diversifying your portfolio to mitigate risk. While ATM offers exciting potential, it’s wise not to put all your eggs in one basket. Second, stay informed about developments in the Solana ecosystem, as these can directly impact ATM’s performance. Finally, use technical analysis tools to identify entry and exit points, helping you make more informed investment decisions.

As we look to the future, the narrative around ATM remains one of intrigue and potential. With its innovative rewards system and the backing of the Solana blockchain, ATM has the ingredients for a significant price surge. Whether it can overcome its recent challenges and capitalize on these opportunities will be a story worth watching in the coming years. For crypto beginners, understanding ATM’s journey can provide valuable lessons in the dynamics of cryptocurrency markets and the importance of staying informed and adaptable in this ever-changing landscape.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.