As we step into March 2025, the buzz around Alibaba’s AI ventures continues to grow louder. The recent unveiling of Alibaba AI Agent, branded as ALIBABAAI, has stirred quite the conversation in the tech and investment circles. With its revamped AI assistant app powered by the Qwen AI reasoning model, Alibaba is signaling its intent to lead the AI race in China and beyond. But what does this mean for ALIBABAAI’s price trajectory? Let’s delve into the potential of ALIBABAAI to reach a staggering $100 by the end of 2025.

Alibaba’s strategic move into the AI domain, particularly with the launch of ALIBABAAI, showcases a clear ambition to redefine the landscape of artificial intelligence applications. The company’s massive $52.5 billion investment in AI and cloud computing over the next three years underscores a commitment to not just compete, but to dominate. This financial backing, combined with a partnership with Apple to integrate AI features into iPhones, positions ALIBABAAI in a unique spot at the intersection of tech giants and consumer technology.

The journey of ALIBABAAI, however, hasn’t been without its challenges. The AI sector in China is witnessing an aggressive race for supremacy, with competitors like DeepSeek and ByteDance pushing the boundaries of what’s possible with AI. Alibaba’s response has been both swift and sophisticated, launching the R1-Omni model capable of interpreting human emotions, and backing ventures like Manus AI, which promises advanced AI agent capabilities.

For beginners in the crypto investment world, understanding the potential of ALIBABAAI involves looking at the broader picture of Alibaba’s AI strategy. Alibaba’s AI agent is not just another tech product; it’s a gateway to endless possibilities, as Wu Jia, CEO of Quark and Alibaba vice president, envisions. The integration of chatbot functions, deep thinking, and task execution into a single platform aims to capture a significant share of the AI-powered application market.

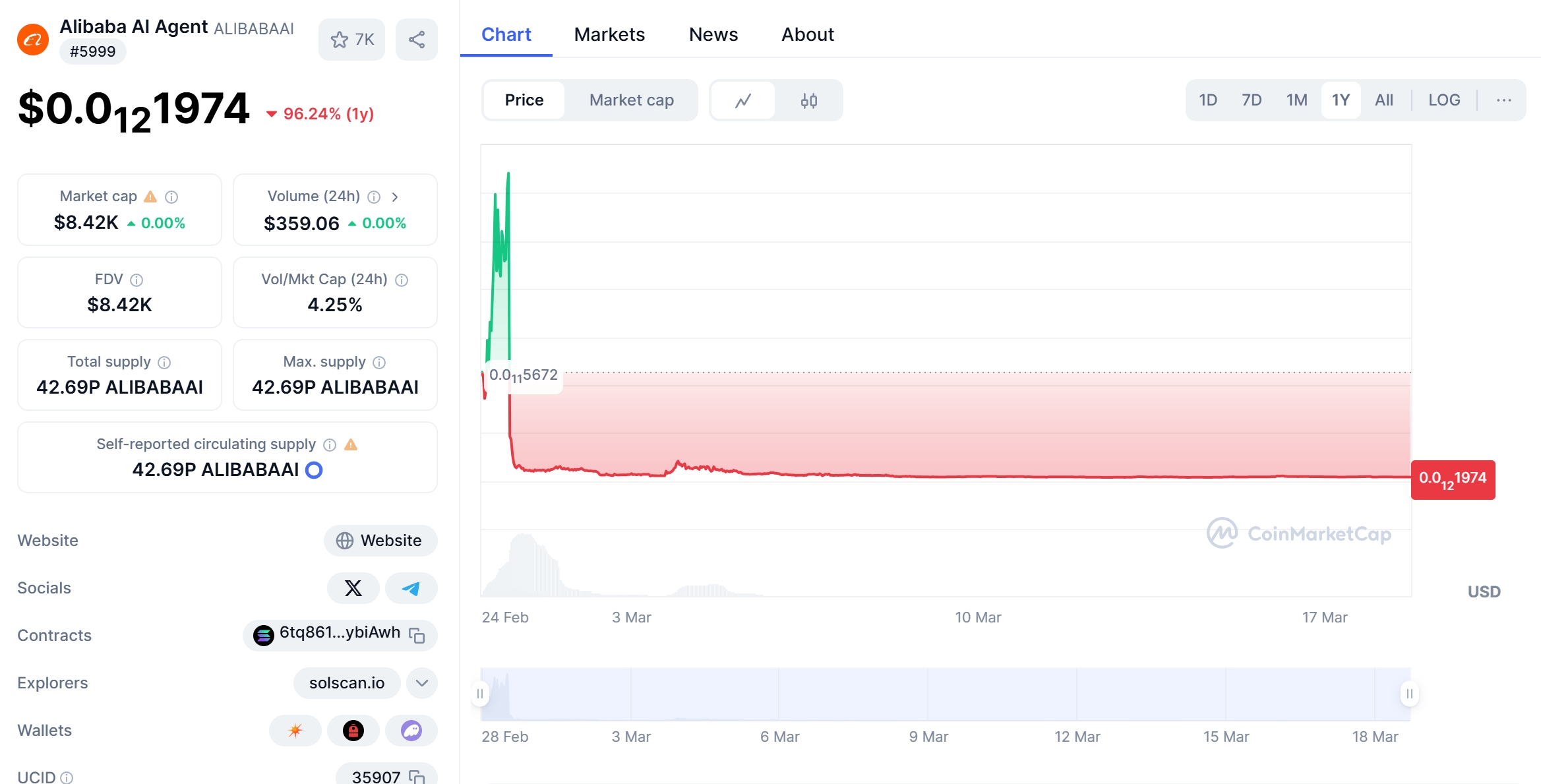

Now, let’s talk about the numbers. ALIBABAAI’s price has been on a rollercoaster ride, much like the broader crypto market. From its launch to March 2025, ALIBABAAI has seen a significant uptick, but the question remains: can it reach $100? To answer this, we need to consider several key indicators.

Technical analysis tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands offer insights into ALIBABAAI’s market trends. The RSI, for instance, helps us gauge whether the asset is overbought or oversold, providing crucial signals for potential price movements. As of March 2025, ALIBABAAI’s RSI suggests a balanced market, neither overbought nor oversold, indicating room for growth.

Support and resistance levels are another critical aspect. ALIBABAAI has demonstrated strong support levels around $50, with resistance hovering near $75. Breaking through this resistance could be a key trigger for a surge towards $100. Recent developments, like the partnership with Apple and the launch of new AI models, could serve as catalysts pushing ALIBABAAI past these levels.

Chart analysis further illuminates ALIBABAAI’s potential trajectory. A visual representation of the price trends over the past year shows a pattern of steady growth, punctuated by sharp increases following Alibaba’s AI announcements. This pattern suggests that ALIBABAAI’s price is closely tied to Alibaba’s broader AI strategy and market sentiment towards AI technologies.

Looking at long and short-term predictions, the consensus among analysts is cautiously optimistic. Short-term forecasts suggest ALIBABAAI could hit $80 by the end of Q2 2025, driven by the continued rollout of Alibaba’s AI initiatives and increasing adoption of AI technologies in consumer products. Long-term, the path to $100 is paved with Alibaba’s commitment to AI development and its potential to lead the AI ecosystem in China.

To put ALIBABAAI’s journey into perspective, let’s compare it to Ethereum, a well-established cryptocurrency that has navigated the volatile crypto market. Ethereum’s price drop in 2018, followed by a recovery fueled by the DeFi boom, offers valuable lessons. Both Ethereum and ALIBABAAI are influenced by technological advancements and market sentiment, but ALIBABAAI’s unique position within Alibaba’s AI ecosystem could lead to a different recovery path, more aligned with tech sector growth rather than pure crypto market dynamics.

So, can ALIBABAAI recover after dropping to its current price? The answer lies in Alibaba’s AI strategy and its ability to capture the market. The company’s investment in AI and cloud computing, combined with strategic partnerships, positions ALIBABAAI well for growth. However, navigating its volatility requires a keen eye on market trends and Alibaba’s AI announcements.

For investors, the advice is to keep a close watch on Alibaba’s AI developments and the broader tech sector’s embrace of AI technologies. ALIBABAAI’s potential to hit $100 by the end of 2025 is rooted in Alibaba’s ambitious AI roadmap and the global shift towards AI-driven applications. As a beginner, understanding these dynamics and staying informed can help you make informed investment decisions in the exciting world of crypto and AI.

In conclusion, Alibaba AI Agent (ALIBABAAI) stands at the forefront of a technological revolution, driven by Alibaba’s vision and investment in AI. Its journey to $100 is intertwined with the broader AI narrative, making it a compelling investment for those willing to ride the wave of innovation. As we continue to witness the evolution of AI, ALIBABAAI’s story is just beginning, promising exciting times ahead for investors and tech enthusiasts alike.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.