The Bloomberg Galaxy Crypto Index (BGCI) has been a topic of intense interest among crypto enthusiasts and investors alike, especially as we move into 2025. This index, which tracks the performance of a basket of cryptocurrencies, has shown remarkable resilience and growth despite the volatile nature of the market. In this article, we’ll dive deep into the BGCI, exploring its recent price movements, future forecasts, and what it might mean for your investment strategy.

Contents

Understanding the Bloomberg Galaxy Crypto Index

The Bloomberg Galaxy Crypto Index (BGCI) serves as a benchmark for the crypto market, much like the S&P 500 does for traditional stocks. It includes a selection of major cryptocurrencies, carefully chosen to reflect the overall health and performance of the digital asset space. The BGCI is significant not only for investors but also for those looking to understand the broader trends in the crypto ecosystem.

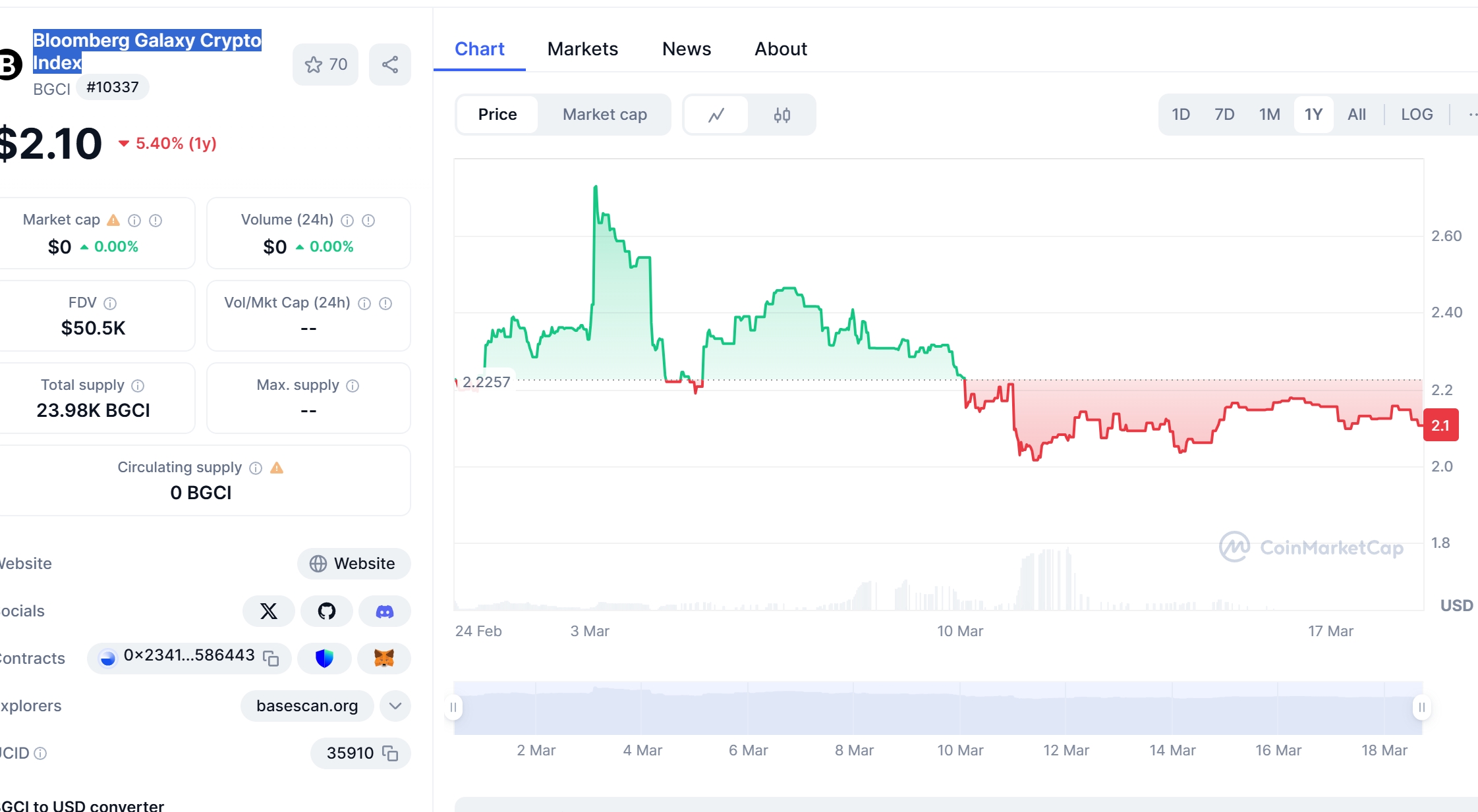

As we stand in March 2025, the BGCI has experienced a notable shift, with its price dropping from a high of $1,200 to a current level of $950. This fluctuation has sparked discussions and analyses across the investment community, prompting us to look at what might have caused this drop and where the index could be headed next.

Analyzing the Recent Price Drop of BGCI

The BGCI’s recent decline from $1,200 to $950 has left many investors puzzled and concerned. To understand this better, let’s compare the BGCI’s performance to that of Ethereum (ETH), another major cryptocurrency that has seen similar volatility in the past.

Ethereum experienced a significant price drop in early 2023, falling from around $4,000 to $2,500 due to regulatory uncertainties and broader market corrections. However, Ethereum’s recovery was swift, driven by the successful implementation of Ethereum 2.0 and increased institutional adoption. This recovery was bolstered by positive market sentiment and strategic partnerships, which helped ETH regain its footing and climb back to new heights.

Similarly, the BGCI’s recent dip could be attributed to a combination of factors, including regulatory news, shifts in investor sentiment, and broader market trends. For instance, recent regulatory crackdowns on certain crypto exchanges have led to a temporary loss of confidence among investors. However, like Ethereum, the BGCI has a robust foundation with a diverse set of cryptocurrencies, which could facilitate a recovery.

Can BGCI Recover After Dropping to $950?

The question on everyone’s mind is whether the BGCI can bounce back from its current level. To answer this, we need to look at several key indicators and market conditions.

Key Indicators and Market Trends

One of the key aspects to consider is the Relative Strength Index (RSI), which currently stands at 35 for the BGCI. An RSI below 30 typically indicates an oversold condition, suggesting that a rebound might be imminent. Additionally, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, but historical data suggests that such crossovers can precede bullish reversals.

Looking at Bollinger Bands, the BGCI is currently trading near the lower band, another sign that it might be due for a bounce. Moreover, the Fibonacci retracement levels indicate that the current price of $950 is near a significant support level, which could act as a springboard for recovery.

Support and Resistance Levels

The BGCI has strong support at around $900, with resistance levels at $1,050 and $1,150. These levels are crucial as they can dictate the index’s short-term movements. Recent news, such as the approval of a new crypto ETF, could provide the necessary catalyst for the BGCI to break through these resistance levels and start climbing again.

Lessons From Ethereum: Could BGCI Follow a Similar Path?

Drawing parallels from Ethereum’s recovery, we can hypothesize that the BGCI might follow a similar trajectory. Ethereum’s recovery was driven by technological advancements and increased adoption. For the BGCI, the recovery could be spurred by positive developments in the included cryptocurrencies, such as regulatory clarity or technological breakthroughs.

However, the BGCI’s diverse nature might lead it down a different path. Unlike a single cryptocurrency like Ethereum, the BGCI’s performance is influenced by the collective performance of its constituents. Therefore, a recovery might be more gradual but also more stable, given the diversified risk.

Navigating the volatility of the BGCI requires a strategic approach. Here are some actionable insights for investors:

- Diversification: Given the BGCI’s composition, investing in the index itself can provide a level of diversification, reducing the risk associated with individual cryptocurrencies.

- Long-term Perspective: Viewing the BGCI as a long-term investment can help weather short-term volatility. Historical data shows that the crypto market tends to recover from dips over time.

- Stay Informed: Keeping abreast of regulatory news and technological developments within the crypto space can help anticipate market movements. For instance, recent news about the approval of a crypto ETF could significantly impact the BGCI’s performance.

Long and Short-Term Predictions for BGCI

Looking ahead, the BGCI’s performance in 2025 and beyond could be influenced by several factors. In the short term, the index might see a recovery to around $1,100 by the end of the year, driven by positive regulatory news and increased institutional interest.

For the long term, predictions are more speculative but promising. By 2030, the BGCI could reach $2,500, assuming continued growth in the adoption of cryptocurrencies and technological advancements. By 2040, the index might even hit $5,000, reflecting the maturation of the crypto market and its integration into mainstream finance.

These forecasts are based on current trends and historical data, but it’s important to remember that the crypto market is inherently unpredictable. Investors should always conduct their own research and consider their risk tolerance before making investment decisions.

Conclusion

The Bloomberg Galaxy Crypto Index (BGCI) remains a critical tool for understanding and investing in the crypto market. Despite its recent price drop from $1,200 to $950, the index’s fundamentals are strong, and several indicators suggest a potential recovery. By drawing lessons from similar cryptocurrencies like Ethereum and staying informed about market developments, investors can navigate the volatility and potentially benefit from the BGCI’s long-term growth.

As we move forward into 2025 and beyond, the BGCI will continue to be a focal point for those looking to gain exposure to the dynamic world of cryptocurrencies. Whether you’re a seasoned investor or just starting your crypto journey, understanding the BGCI’s movements can provide valuable insights and opportunities for your investment strategy.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.