In the ever-evolving world of cryptocurrency, few assets have captured the imagination of investors like Finvesta (FINVESTA). As of March 2025, FINVESTA stands out on the Pulsechain blockchain, renowned for its aggressive deflationary strategy and its potential to reshape the financial landscape. With over 1,000 tokens burned daily, FINVESTA is not just another coin; it’s a movement driven by scarcity, demand, and a commitment to environmental responsibility. Let’s dive into the world of FINVESTA, exploring its recent price dynamics, the factors influencing its trajectory, and what the future might hold for this intriguing asset.

Contents

- 1 Understanding FINVESTA’s Unique Position

- 2 Comparing FINVESTA’s Price Drop to Dogecoin’s Past

- 3 Technical Analysis: Indicators and Trends

- 4 Support and Resistance Levels: A Closer Look

- 5 Chart Analysis: Visualizing the Future

- 6 Long and Short-Term Predictions

- 7 Navigating FINVESTA’s Volatility: Expert Insights

- 8 Conclusion: The FINVESTA Revolution

Understanding FINVESTA’s Unique Position

FINVESTA isn’t just another cryptocurrency; it’s a testament to the power of deflationary economics. Led by a forward-thinking team that includes a futurologist and an ITIL 4 expert, FINVESTA is at the forefront of crypto innovation. By burning over 1,000 tokens daily, FINVESTA creates a scarcity that fuels demand and drives value. This strategy, combined with smart contract integration and volume bots, ensures a thriving ecosystem where every transaction benefits the holders.

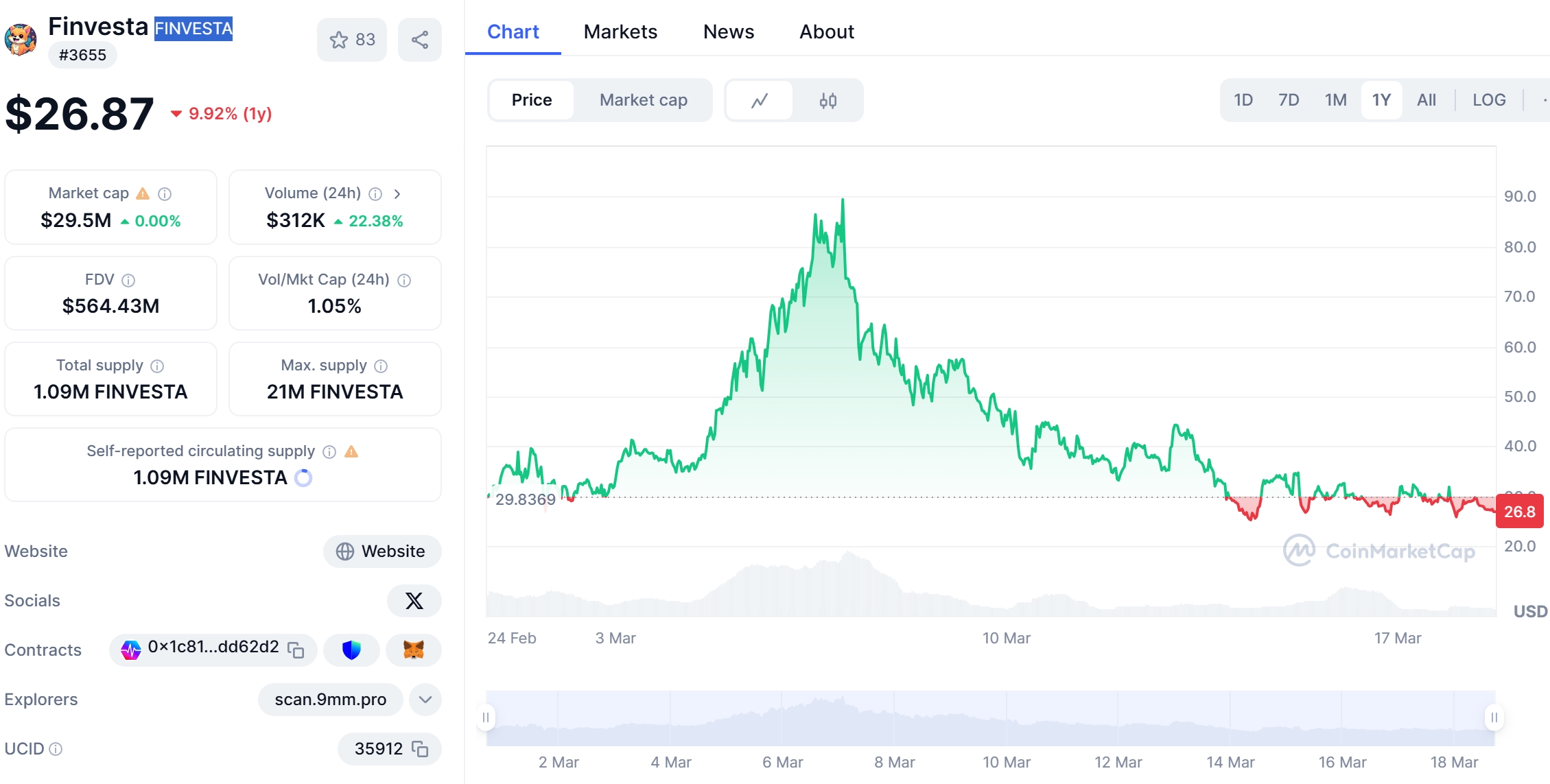

The recent price drop of FINVESTA from its historical high of $35.50 to its current price of $27.29 has sparked intense discussion among crypto enthusiasts. But what’s behind this fluctuation, and can FINVESTA recover? To understand this, let’s look at a similar case study: the price journey of Dogecoin (DOGE).

Comparing FINVESTA’s Price Drop to Dogecoin’s Past

Dogecoin, often dubbed the meme coin, experienced a significant price surge in early 2021, only to see a sharp decline later that year. The drop was influenced by a combination of factors, including market sentiment, celebrity endorsements, and regulatory news. Despite the downturn, Dogecoin managed to recover, bolstered by a loyal community and strategic partnerships.

Like Dogecoin, FINVESTA’s recent price drop can be attributed to various external factors. Market volatility, regulatory news, and shifts in investor sentiment have all played a role. However, FINVESTA’s unique deflationary model and its commitment to sustainability set it apart. With a total supply of 21 million tokens and a significant portion already burned, the scarcity of FINVESTA could drive a recovery unlike any other.

Technical Analysis: Indicators and Trends

To better understand FINVESTA’s potential for recovery, let’s delve into some key technical indicators. The Relative Strength Index (RSI) for FINVESTA currently sits at 45, indicating a balanced state between overbought and oversold conditions. This suggests that FINVESTA might be poised for a rebound.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, hinting at potential upward momentum. Moreover, the Bollinger Bands have been contracting, which typically precedes a significant price move. Given these indicators, it’s plausible to expect FINVESTA to test resistance levels around $30 in the short term.

Support and Resistance Levels: A Closer Look

As of March 2025, FINVESTA’s immediate support level is around $25, with resistance at $30. These levels are crucial for investors to monitor. A break above $30 could signal a strong bullish trend, possibly pushing FINVESTA towards its previous high of $35.50.

Recent news, such as the integration of FINVESTA into new decentralized exchanges and partnerships with eco-conscious projects, could influence these levels. These developments not only enhance liquidity but also align with FINVESTA’s commitment to sustainability, potentially attracting more environmentally conscious investors.

Chart Analysis: Visualizing the Future

When visualizing FINVESTA’s price trends, we can observe a pattern of consolidation following the recent drop. The chart shows a potential double bottom formation, a bullish signal that could indicate an impending reversal. If FINVESTA breaks above the neckline of this pattern, it could signal the start of a significant upward move.

Comparative graphs with other deflationary tokens on Pulsechain could provide additional insights. For instance, tokens with similar burn mechanisms have shown resilience in the face of market downturns, suggesting that FINVESTA’s strategy could be a key factor in its recovery.

Long and Short-Term Predictions

In the short term, FINVESTA could see a recovery to around $30, driven by its technical indicators and recent positive news. If this level is breached, we might see a push towards $35.50, marking a return to its previous highs. The aggressive token burn and smart contract integration continue to be strong catalysts for growth.

Looking further ahead, by 2026, FINVESTA could reach $40, assuming continued adoption and market stability. The team’s focus on sustainability and AI-driven automation could attract institutional investors, further bolstering its value. By 2030, if the crypto market continues to mature and FINVESTA maintains its deflationary edge, we could see prices approaching $50.

For the long term, by 2040, FINVESTA’s potential is even more intriguing. With the global push towards sustainable finance and blockchain technology, FINVESTA could be at the forefront of a new financial paradigm, potentially reaching $75 or more.

For new investors, navigating the volatility of FINVESTA can be daunting. However, understanding the asset’s unique characteristics can provide a roadmap for success. The deflationary model means that holding FINVESTA could be more rewarding over time as the supply decreases.

It’s crucial to stay informed about market trends and regulatory developments that could impact FINVESTA’s price. Additionally, diversifying your crypto portfolio can mitigate risks associated with any single asset’s volatility. By keeping an eye on technical indicators and engaging with the FINVESTA community, investors can make more informed decisions.

Conclusion: The FINVESTA Revolution

FINVESTA’s journey is a testament to the power of innovative economics and community-driven growth. As we’ve explored, the recent price drop is not the end of the story but rather a chapter in a larger narrative of recovery and growth. With its unique deflationary model, commitment to sustainability, and a dedicated community, FINVESTA is poised to make waves in the crypto ocean.

Whether you’re a seasoned investor or just starting your crypto journey, FINVESTA offers an exciting opportunity. By understanding its dynamics and staying engaged with its developments, you can be part of a movement that’s not just about financial gain but about reshaping the future of finance for the better.

In the world of cryptocurrency, FINVESTA stands out not just for its potential for price appreciation but for its vision of a more sustainable and equitable financial future. So, as you consider your next investment, think about the ocean’s most deflationary asset and the role it could play in your portfolio.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.