In the ever-evolving world of cryptocurrency, there’s arguably no token that has captured the attention of both enthusiasts and skeptics quite like the Astar (ASTR) Token. As we dive into 2025, ASTR has already showcased an impressive trajectory, with a 15.1% rise over the past week. This surge has sparked widespread interest and speculation about its future potential. Today, we’ll explore the Astar ASTR Token’s journey, analyze its recent price dynamics, and delve into predictions for what lies ahead.

Contents

- 1 Astar ASTR Token’s Rollercoaster Journey

- 2 Recent Price Dynamics and Market Sentiment

- 3 Analyzing Key Indicators for Astar ASTR Token

- 4 Support and Resistance Levels: A Closer Look

- 5 Chart Analysis and Visual Insights

- 6 Long and Short-Term Predictions for Astar ASTR Token

- 7 Can Astar ASTR Token Recover After Dropping to $0.03725?

- 8 What Caused Astar ASTR Token’s Price Drop, and Will It Bounce Back?

- 9 Lessons From Ethereum: Could Astar ASTR Token Follow a Similar Path?

- 10 How to Navigate Astar ASTR Token’s Volatility: Expert Insights

- 11 Actionable Insights for Investors

Astar ASTR Token’s Rollercoaster Journey

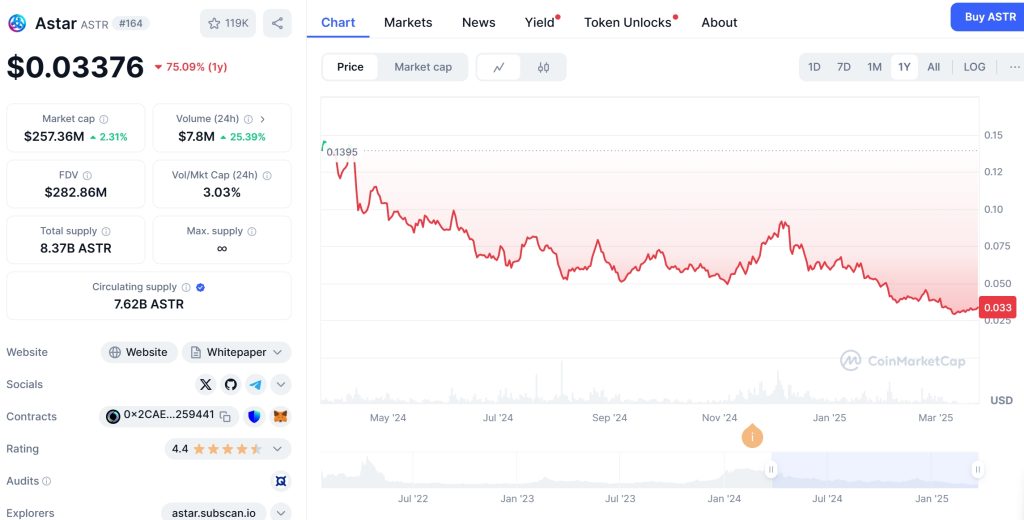

The Astar ASTR (ASTR) Token has experienced a rollercoaster ride in recent months, capturing the market’s attention with its significant price swings. In January 2025, the token soared to a multi-month high of $0.04669, fueled by strong market sentiment. However, this rally was short-lived, as the price dropped to $0.03725. Despite this fluctuation, ASTR remains a hot topic among investors, with many pondering its future trajectory.

Astar ASTR Token’s utility extends beyond mere speculation. It’s the native token of the Astar Network, which aims to bridge the gap between traditional web technologies and the burgeoning world of Web3. With a total supply of 8.35 billion ASTR and a circulating supply of 7.59 billion, the token’s current market cap stands at $301.99 million, reflecting its growing significance in the crypto ecosystem.

Recent Price Dynamics and Market Sentiment

The Astar ASTR Token’s recent price drop from $0.04669 to $0.03725 has raised questions about its future stability. To understand this better, let’s compare ASTR’s trend to that of a popular cryptocurrency, Ethereum (ETH), which experienced a similar price movement in the past.

In 2022, Ethereum faced a significant price drop due to regulatory uncertainty and market volatility. However, Ethereum managed to recover, reaching new highs in 2023. The recovery was driven by increased adoption of decentralized applications (dApps) and the Ethereum network’s robust infrastructure. Similarly, Astar ASTR Token’s ecosystem has been expanding, with new partnerships and dApp integrations boosting its utility.

The current market sentiment around ASTR is bullish, with a 100% positive community sentiment according to recent polls. This optimism is fueled by Astar Network’s commitment to interoperability and its role as a gateway for projects across enterprises, entertainment, and gaming in Japan and beyond. The network’s cross-virtual machine powered by Polygon and Polkadot, along with its zk-powered Ethereum L2 scaling (zkEVM), positions ASTR as a versatile and scalable token.

Analyzing Key Indicators for Astar ASTR Token

To gain deeper insights into ASTR’s potential, let’s examine some key indicators. The Relative Strength Index (RSI) for ASTR currently stands at 55, indicating a neutral position and suggesting that the token is neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) shows a positive crossover, hinting at potential upward momentum.

Bollinger Bands analysis reveals that ASTR’s price is currently trading near the lower band, suggesting that a potential bounce back could be on the horizon. Additionally, the Fibonacci retracement levels indicate that the recent price drop has reached a significant support level, potentially setting the stage for a recovery.

Support and Resistance Levels: A Closer Look

Understanding ASTR’s support and resistance levels is crucial for predicting its future movements. The current support level for ASTR is around $0.03270, which aligns with its all-time low recorded in October 2022. Breaking below this level could signal further declines, but holding above it could indicate a strong foundation for recovery.

On the other hand, the resistance level to watch is $0.04669, the recent peak. If ASTR can break through this level, it could signal a bullish trend and pave the way for further growth. Recent news, such as Astar Network’s partnership with Sony Block Solutions Labs to develop Soneium, an advanced Layer 2 solution, could positively impact these levels by enhancing ASTR’s utility and adoption.

Chart Analysis and Visual Insights

Visual representations of price trends and patterns can provide valuable insights into ASTR’s potential trajectory. A closer look at the ASTR price chart reveals a pattern of consolidation following the recent drop. This consolidation could be a precursor to a breakout, especially if accompanied by increased trading volume and positive market sentiment.

Comparing ASTR’s chart to that of Ethereum during its 2022 recovery, we can see similarities in the pattern of consolidation followed by a gradual climb. This historical parallel suggests that ASTR might follow a similar path, leveraging its growing ecosystem and technological advancements to drive price appreciation.

Long and Short-Term Predictions for Astar ASTR Token

Looking ahead, the long-term potential for Astar ASTR Token looks promising. By the end of 2025, analysts predict that ASTR could reach $0.06, driven by increased adoption of the Astar Network and its expanding ecosystem. This prediction is supported by the token’s utility in dApp staking, transactions, and on-chain governance, which adds tangible value for holders.

In the short term, ASTR might experience some volatility, with potential price movements ranging between $0.035 and $0.045. This range is influenced by market sentiment, technological developments, and broader crypto market trends. However, the positive community sentiment and ongoing partnerships suggest that ASTR could maintain an upward trajectory.

Can Astar ASTR Token Recover After Dropping to $0.03725?

The question on every investor’s mind is whether Astar ASTR Token can recover from its recent drop to $0.03725. Based on historical trends and current market dynamics, there’s a strong possibility that ASTR could bounce back. The token’s fundamentals remain strong, with a growing ecosystem and increasing utility driving demand.

What Caused Astar ASTR Token’s Price Drop, and Will It Bounce Back?

The recent price drop in Astar ASTR Token can be attributed to broader market volatility and profit-taking by early investors. However, the token’s underlying value and the Astar Network’s strategic initiatives suggest a potential recovery. The network’s focus on interoperability and scalability, coupled with its partnerships, positions ASTR for long-term growth.

Lessons From Ethereum: Could Astar ASTR Token Follow a Similar Path?

Drawing lessons from Ethereum’s recovery in 2022, Astar ASTR Token could potentially follow a similar path. Ethereum’s recovery was driven by increased adoption and technological advancements, factors that are also at play with ASTR. If ASTR can leverage its ecosystem’s growth and maintain positive market sentiment, it could see a similar upward trajectory.

Navigating the volatility of Astar ASTR Token requires a strategic approach. For beginners, it’s essential to understand the token’s utility and the broader market trends. Diversifying your portfolio and setting clear investment goals can help mitigate risks. Additionally, staying informed about Astar Network’s developments and partnerships can provide valuable insights into the token’s potential.

Actionable Insights for Investors

For those considering investing in Astar ASTR Token, here are some actionable insights:

- Monitor Key Indicators: Keep an eye on RSI, MACD, and Bollinger Bands to gauge ASTR’s momentum and potential entry points.

- Stay Informed: Follow Astar Network’s news and updates to understand how new developments might impact the token’s price.

- Diversify: Consider diversifying your crypto portfolio to mitigate the risks associated with ASTR’s volatility.

- Long-Term Perspective: Focus on ASTR’s long-term potential, given its growing ecosystem and utility in the Web3 space.

In conclusion, the Astar ASTR Token’s journey in 2025 is one of intrigue and potential. With a strong foundation in interoperability and scalability, coupled with a bullish market sentiment, ASTR could continue to captivate the crypto community. As we navigate this exciting landscape, keeping a close eye on market trends and technological developments will be crucial for investors looking to capitalize on ASTR’s growth potential.