There’s arguably no hotter cryptocurrency on the planet right now than OriginTrail TRAC (TRAC) Token. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. OriginTrail TRAC (TRAC) Token has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.55, fueled by strong market sentiment. However, the rally was short-lived. OriginTrail TRAC (TRAC) Token Price Prediction remains a hot topic as investors scrutinize every of its price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new trusted knowledge infrastructure solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy OriginTrail TRAC (TRAC) Token at $0.06?”

Contents

- 1 Can OriginTrail TRAC (TRAC) Token Recover After Dropping to $0.35?

- 2 What Caused OriginTrail TRAC (TRAC) Token’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could OriginTrail TRAC (TRAC) Token Follow a Similar Path?

- 4 How to Navigate OriginTrail TRAC (TRAC) Token’s Volatility: Expert Insights

Can OriginTrail TRAC (TRAC) Token Recover After Dropping to $0.35?

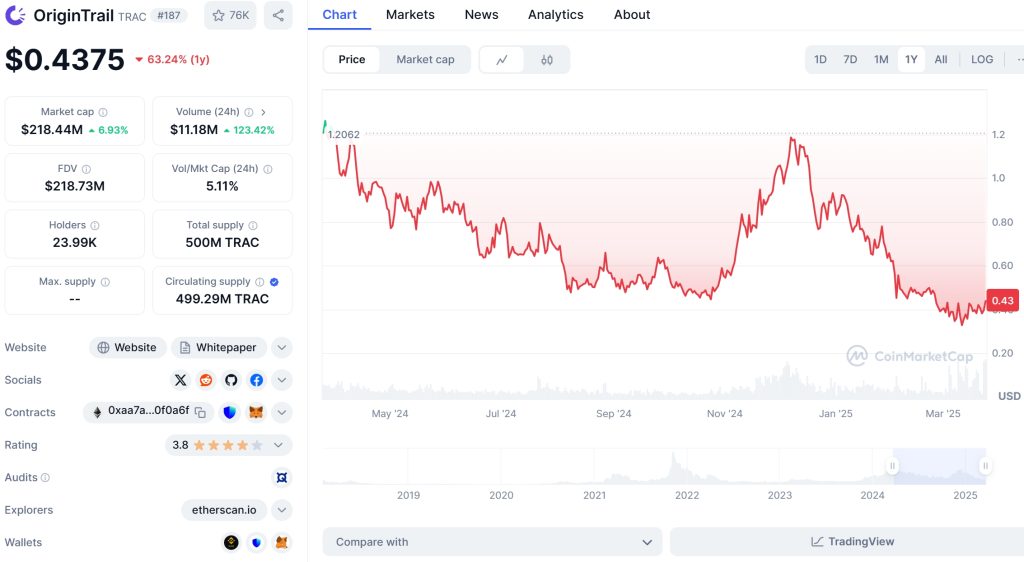

The recent dip in OriginTrail TRAC (TRAC) Token’s price from a high of $0.55 to $0.35 has left many investors wondering about the future trajectory of this promising cryptocurrency. Let’s dive into the factors that might be influencing this drop and explore the potential for recovery.

Understanding the Price Drop

The drop from $0.55 to $0.35 can be attributed to several factors. Market sentiment plays a significant role in cryptocurrency prices, and OriginTrail TRAC (TRAC) Token was no exception. A sudden shift in investor confidence, perhaps due to broader market trends or specific news related to OriginTrail, could have triggered the sell-off. Additionally, regulatory news or updates on the development of the OriginTrail ecosystem might have contributed to the volatility.

Comparing to Ethereum’s Past

If we look at Ethereum, which experienced a similar significant price drop in 2018, we can draw some parallels. Ethereum’s price plummeted from its all-time high of around $1,400 to below $100 due to a combination of regulatory fears, market corrections, and the fallout from the ICO boom. However, Ethereum managed to recover by focusing on its technological advancements and expanding its ecosystem, eventually reaching new highs.

Potential Recovery Path for OriginTrail TRAC (TRAC) Token

OriginTrail TRAC (TRAC) Token might follow a similar recovery pattern if it continues to build on its unique value proposition. The project’s focus on creating a trusted knowledge infrastructure for artificial intelligence is a compelling narrative that could attract more investors over time. The partnerships with world-class organizations like British Standards Institution, SCAN, and Polkadot further bolster its credibility and potential for growth.

What Caused OriginTrail TRAC (TRAC) Token’s Price Drop, and Will It Bounce Back?

Analyzing the Causes

The drop in OriginTrail TRAC (TRAC) Token’s price can be dissected into several key elements. Market sentiment, as mentioned earlier, is a primary driver. However, let’s delve deeper into the specifics.

Market Sentiment and Regulatory News

The crypto market is highly sensitive to regulatory news. Any hint of stricter regulations or crackdowns can lead to panic selling. For OriginTrail, any regulatory updates that could impact its operations or partnerships might have led to the recent price drop. Additionally, general market trends, such as a broader correction in the crypto space, could have played a role.

Technical Analysis

Using key indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, we can gain insights into the market trends. The RSI, for instance, can indicate whether a cryptocurrency is overbought or oversold. If the RSI for OriginTrail TRAC (TRAC) Token was above 70 before the drop, it might have signaled an impending correction.

Will OriginTrail TRAC (TRAC) Token Bounce Back?

The possibility of a bounce back hinges on several factors. First, the continued development and adoption of the OriginTrail ecosystem are crucial. The project’s roadmap aims to create the world’s largest verifiable web for AI, which could drive demand for TRAC tokens.

Support and Resistance Levels

Identifying key support and resistance levels can provide insight into potential recovery points. For instance, if $0.35 becomes a strong support level, it might indicate a bottoming out of the price. Conversely, if the price fails to hold above this level, it might signal further declines.

Chart Analysis

Visual representations of price trends can be incredibly useful. By examining the charts, we can identify patterns such as head and shoulders, double tops, or even bullish flags that might indicate a reversal. For beginners, understanding these patterns can be a valuable tool in predicting future movements.

Lessons From Ethereum: Could OriginTrail TRAC (TRAC) Token Follow a Similar Path?

Ethereum’s Journey

Ethereum’s recovery from its 2018 lows offers a valuable case study. The project focused on technological advancements, such as the transition to Ethereum 2.0, and expanded its ecosystem through decentralized finance (DeFi) and non-fungible tokens (NFTs). These developments helped restore investor confidence and drive the price upward.

Parallels with OriginTrail TRAC (TRAC) Token

OriginTrail TRAC (TRAC) Token is also focused on technological innovation, particularly in the realm of AI and trusted knowledge infrastructure. The project’s partnerships with major organizations and its ambitious roadmap suggest a similar potential for growth.

Differences and Unique Challenges

However, OriginTrail TRAC (TRAC) Token faces unique challenges. The project’s success is closely tied to the adoption of AI and the development of the verifiable web. Unlike Ethereum, which had a broad range of applications driving its recovery, OriginTrail’s growth might be more dependent on specific technological advancements and partnerships.

Understanding Volatility

Cryptocurrency markets are inherently volatile, and OriginTrail TRAC (TRAC) Token is no exception. Volatility can be both a risk and an opportunity for investors. Understanding the factors driving these fluctuations is crucial for making informed decisions.

Long-Term Investment

For those new to crypto investing, a long-term approach might be the safest bet. By focusing on the project’s fundamentals and long-term potential, investors can weather short-term volatility. OriginTrail’s focus on AI and trusted knowledge infrastructure suggests a strong long-term growth potential.

Diversification

Diversifying your crypto portfolio can help mitigate the risks associated with any single asset’s volatility. Consider investing in a range of cryptocurrencies, including stablecoins and more established projects, to balance risk and reward.

Staying Informed

Keeping up with the latest news and developments related to OriginTrail TRAC (TRAC) Token can provide valuable insights into potential price movements. Regularly checking updates from the project’s official channels and reputable crypto news sources can help you stay ahead of the curve.

Actionable Insights for Investors

For those looking to invest in OriginTrail TRAC (TRAC) Token, here are some actionable insights:

- Monitor Key Indicators: Keep an eye on technical indicators like RSI and MACD to gauge market sentiment and potential price movements.

- Understand Support and Resistance: Identify key support and resistance levels to anticipate potential reversal points.

- Stay Updated: Regularly check for updates on OriginTrail’s progress and partnerships to understand the project’s growth trajectory.

- Consider Long-Term Potential: Focus on the project’s long-term potential rather than short-term volatility.

In conclusion, while OriginTrail TRAC (TRAC) Token has experienced a recent price drop, the project’s unique value proposition and ambitious roadmap suggest a strong potential for recovery and growth. By understanding the factors driving its volatility and adopting a strategic approach to investing, you can navigate the ups and downs of this promising cryptocurrency.