For anyone involved in crypto, the terms “primary market” and “secondary market” come up often. While most trading happens on the secondary market (think buying Bitcoin on an exchange), the primary market is where the action begins. It’s where new cryptocurrencies are created and first offered to the public, presenting a world of high-risk, high-reward opportunities for the burgeoning web3 ecosystem.

Understanding the primary crypto market is crucial for investors who want to move beyond simply trading established coins. This guide will break down what it is, its advantages and risks, and the different ways you can gain early access to the next wave of crypto projects.

Contents

What is the Primary Crypto Market?

The primary crypto market is where new tokens make their debut. Think of it like the stock market’s Initial Public Offering (IPO), where a company offers its shares to the public for the first time. In the web3 space, this is where project developers sell their newly created tokens directly to early investors to raise capital for development.

This initial fundraising is the entire purpose of the primary market. Investors buy these tokens directly from the issuing team, hoping that the project will be successful and that the token’s value will increase significantly once it hits the secondary market for public trading.

Primary Crypto Market: Advantages and Risks

The main advantage of the primary market is the potential for exponential returns. Getting in on the ground floor of a project like Ethereum or Solana at a discounted, pre-listing price could have been life-changing. These opportunities, however, are the exception, not the rule.

The risks are equally significant. New projects have a high failure rate. Primary market investments often come with long lock-up periods, meaning you can’t sell your tokens even if the price is dropping. Furthermore, this space is less regulated, making it a fertile ground for scams. Thorough due diligence is not just recommended; it’s essential.

Key Distinctions: Primary vs. Secondary Crypto Markets

The most fundamental difference between the primary and secondary markets comes down to one simple question: Who are you buying from?

In the primary market, you are buying tokens directly from the project creators or issuers. This is a direct transaction between you and the team building the new cryptocurrency. The secondary crypto market refers to tokens that are already listed on an exchange, whether it’s a centralized exchange (CEX) or a decentralized exchange (DEX).

This core difference influences everything from price and liquidity to risk and accessibility.

| Feature | Primary Crypto Market | Secondary Crypto Market |

|---|---|---|

| Participants | Project teams, institutional investors, early backers | Retail traders, institutions, liquidity providers |

| Token Price | Fixed or discounted (early-stage) | Fluctuates based on supply & demand |

| Liquidity | Low (often has lock-up periods) | High (instant trading is usually possible) |

| Risk Level | High (unproven projects, potential for scams) | Varies (depends on the token and market conditions) |

| Accessibility | Often restricted (whitelists, KYC, high minimums) | Generally open to everyone |

| Ideal For | Investors confident in a project’s long-term prospects and willing to take on more risk. | Traders seeking short-term opportunities and liquidity. |

How to Access Crypto Primary Markets

So, how does an average investor get involved in the primary market? While some avenues are reserved for venture capitalists, several methods are open to the public.

Token Sales: ICO, IEO, and IDO

The most common way web3 projects raise funds is through a token sale, which allows you to purchase tokens directly before they are listed on major exchanges. The three main approaches are ICOs, IEOs, and IDOs.

An ICO (Initial Coin Offering) is a direct sale from the project team to the public. This is the riskiest method due to the lack of third-party vetting. Participation typically requires a personal crypto wallet to send funds and receive the new tokens.

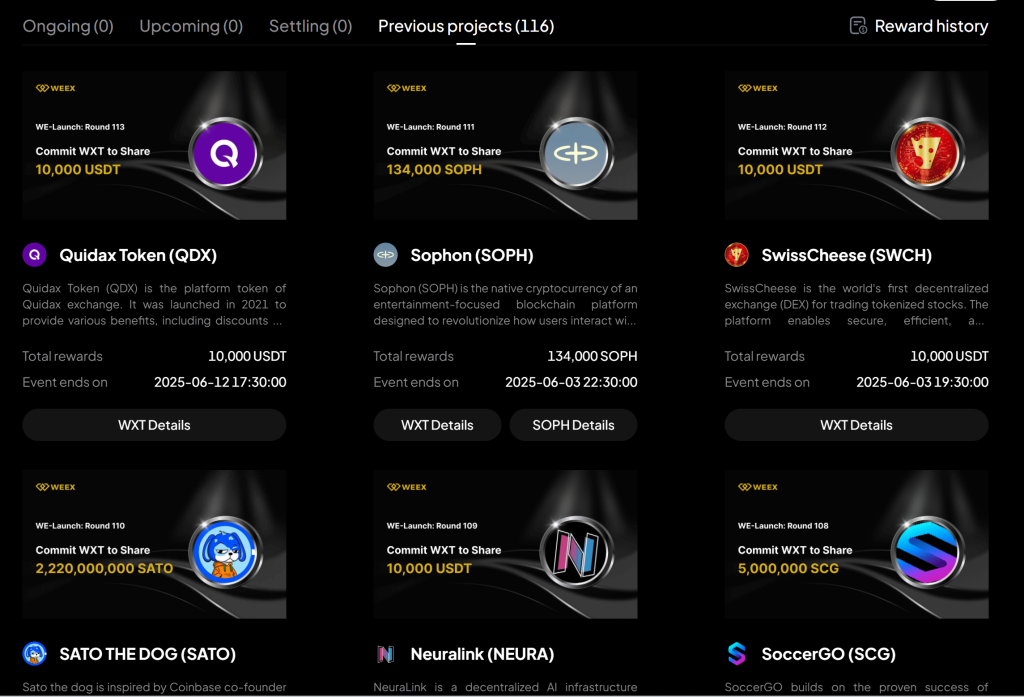

A more secure method is an IEO (Initial Exchange Offering), where a centralized exchange vets the project and hosts the sale, providing a layer of trust for investors. You can often discover early IEO projects on platforms like the WEEX We-Launch platform.

Finally, an IDO (Initial DEX Offering) is the decentralized version, conducted on a launchpad platform. This approach requires more technical familiarity with crypto wallets and dApps.

| Issuance Method | How It Works | Participation Standard | Security Level |

|---|---|---|---|

| ICO | Project sells tokens directly to investors. | Use native tokens (ETH, SOL) or stablecoins. | Highest risk; little user information. |

| IEO | Project sells tokens via a centralized exchange. | Hold or use exchange tokens (e.g., BNB) or stablecoins. | Safest; vetted by the exchange. |

| IDO | Project sells tokens via a decentralized exchange. | Hold or use the IDO platform’s native token. | Medium risk; vetted by the IDO platform. |

Airdrops and Mining: Earning Your First Tokens

Besides direct sales, there are other ways to acquire new tokens in the primary market, often with little to no direct financial cost.

Airdrops: This is a marketing strategy where web3 projects give away free tokens to early users for completing specific tasks, like testing the platform or being active in the community. It’s a popular way to acquire new tokens at no cost, but identifying which projects will offer airdrops and their requirements can be challenging.

Mining (in DeFi): In DeFi, “mining” or “yield farming” refers to earning reward tokens by providing your crypto assets to a protocol, such as supplying liquidity to a DEX. This is an advanced method that, while potentially rewarding, carries significant risks like impermanent loss and smart contract vulnerabilities.

Final Thoughts on the Primary Crypto Market

The primary crypto market is the engine of innovation in the web3 space, but it’s also where the highest risks lie. It offers the exciting prospect of getting in early on the “next big thing,” but it demands a level of diligence and risk tolerance far greater than trading established coins on the secondary market. For beginners, starting with IEOs on reputable exchanges like WEEX Exchange can be a safer entry point, while airdrops offer a low-cost way to explore new projects. Always remember the golden rule of crypto: do your own research (DYOR) before investing a single dollar.

DISCLAIMER: WEEX and affiliates provide digital asset exchange services, including derivatives and margin trading, only where legal and for eligible users. All content is general information, not financial advice-seek independent advice before trading. Cryptocurrency trading is high-risk and may result in total loss. By using WEEX services you accept all related risks and terms. Never invest more than you can afford to lose. See our Terms of Use and Risk Disclosure for details.