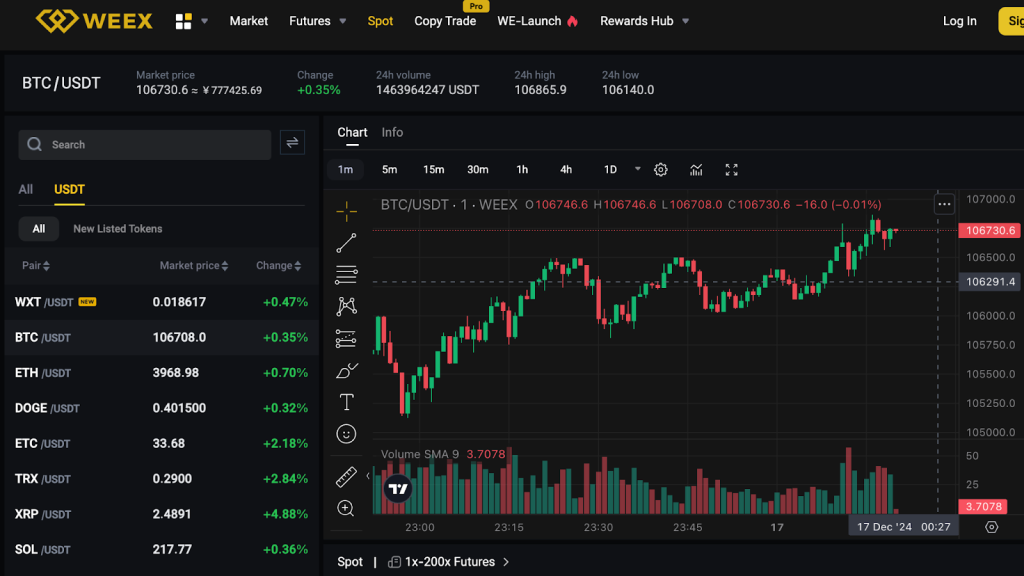

As Bitcoin’s price surges past the $100,000 milestone, discussions are intensifying about its role as a potential cornerstone of national financial strategies. This landmark achievement, fueled by growing institutional adoption, favorable economic conditions, and pro-crypto policies, has prompted several nations to consider Bitcoin as a strategic reserve asset.

Here’s a closer look at the countries leading the way in integrating Bitcoin (BTCUSDT) into their national reserves.

Contents

- 1 United States: Paving the Way for Strategic Bitcoin Reserves

- 2 Brazil: Diversifying with RESBit

- 3 Poland: A Vision for Crypto Leadership

- 4 Russia: A Gradual Shift Toward Bitcoin

- 5 Japan: Taking Early Steps Toward Bitcoin Reserves

- 6 Why Nations Are Turning to Bitcoin Reserves

- 7 Bitcoin’s Rising Role in Global Finance

- 8 Related Crypto Regulations Exploration on WEEX

United States: Paving the Way for Strategic Bitcoin Reserves

The United States is spearheading global interest in Bitcoin reserves. Wyoming Senator Cynthia Lummis has introduced the Bitcoin Act, a bold proposal for the U.S. to acquire 200,000 Bitcoins annually for five years. These holdings would be secured in a decentralized network of vaults managed by the U.S. Treasury.

At the BTC 2024 conference, former President Donald Trump endorsed the idea of a Strategic Bitcoin Reserve, committing to preserve federally held Bitcoin as a future financial asset. This momentum is mirrored at the state level, with Texas proposing a mandatory five-year holding period for state-held Bitcoin to strengthen its financial position. Similarly, Pennsylvania is considering legislation to create its own Bitcoin reserves.

Brazil: Diversifying with RESBit

Brazil has taken bold steps to explore Bitcoin as part of its international reserves. The proposed Bitcoin Sovereign Strategic Reserve (RESBit) seeks to allocate 5% of Brazil’s reserve assets to Bitcoin, aiming to protect the nation from currency fluctuations and geopolitical risks.

Under this initiative, the Central Bank of Brazil would oversee Bitcoin holdings stored in cold wallets, ensuring maximum security. RESBit also aligns with Brazil’s broader digital strategy by supporting the nation’s Central Bank Digital Currency (CBDC), Drex. Federal Deputy Eros Biondini emphasized Bitcoin’s potential to enhance Brazil’s economic resilience, positioning it as a key player in Latin America’s crypto adoption narrative.

Poland: A Vision for Crypto Leadership

In Eastern Europe, Poland is emerging as a potential hub for cryptocurrency innovation. Presidential candidate Sławomir Mentzen has called for strategic Bitcoin reserves to cement Poland’s place as a crypto-friendly nation.

Mentzen’s vision includes creating a favorable environment for cryptocurrency adoption through tax incentives, regulatory reforms, and support from financial institutions. While his proposals have sparked enthusiasm among crypto advocates, their implementation will depend on broader political backing.

Russia: A Gradual Shift Toward Bitcoin

Russia’s evolving stance on digital assets could pave the way for national Bitcoin reserves. While initial proposals for a “cryptocurrency reserve” met resistance, recent developments suggest a shift in policy.

In 2021, Russian Deputy Foreign Minister Alexander Pankin floated the idea of replacing some dollar-based reserves with digital assets, including Bitcoin. More recently, Russia legalized cryptocurrency mining and international digital payments, signaling openness to integrating Bitcoin into its financial framework. A Bitcoin reserve could offer Russia a hedge against economic sanctions and currency volatility.

Japan: Taking Early Steps Toward Bitcoin Reserves

Japan is gradually warming up to the idea of Bitcoin reserves. Legislator Satoshi Hamada recently called for parliamentary discussions on establishing a national Bitcoin reserve. Although his party holds limited influence, other lawmakers are advocating for cryptocurrency adoption.

Yuichiro Tamaki, leader of the Democratic Party for the People, has proposed tax reductions and regulatory changes to encourage Bitcoin use among individuals and businesses. Japan’s exploration of Bitcoin reserves reflects its broader strategy to create a crypto-friendly ecosystem.

Why Nations Are Turning to Bitcoin Reserves

The growing interest in Bitcoin as a national reserve asset stems from several key factors:

- Economic Diversification: Bitcoin provides a hedge against geopolitical risks and the devaluation of fiat currencies.

- Inflation Resistance: With its capped supply, Bitcoin offers a modern alternative to traditional inflation hedges like gold.

- Global Adoption Trend: As Bitcoin becomes increasingly mainstream, nations risk falling behind without proactive engagement.

Bitcoin’s Rising Role in Global Finance

Bitcoin’s climb to over $100,000 has solidified its position as a transformative asset in the global economy. From the U.S.’s pioneering proposals and Brazil’s RESBit initiative to Poland’s crypto-forward ambitions and Russia’s gradual policy shifts, nations are beginning to recognize Bitcoin’s potential to redefine financial paradigms.

As these discussions continue, the adoption of Bitcoin as a national reserve could reshape global financial strategies, offering countries a competitive edge in a rapidly evolving economic landscape. Whether these nations succeed in integrating Bitcoin into their frameworks will determine their readiness to navigate the future of finance.

Related Crypto Regulations Exploration on WEEX

RSR Token Surges 160%: The Impact of Paul Atkins and the Future of Crypto Regulation

Crypto Regulations #2 Blum Code: Blockchain & Crypto Regulations 2024