The latest Blum educational video, titled “Decentralized Finance (DeFi) Explained: The Future of Finance,” has garnered significant attention, especially with the phrase “Blum DeFi Explained”. Decentralized Finance, or DeFi, represents a revolutionary shift in the delivery of financial services, allowing users to bypass traditional banks and intermediaries through the use of blockchain technology.

WEEX will delve deeper into how DeFi operates and compile the most comprehensive Blum code to date.

Contents

- 1 Blum DeFi Explained: Blum Daily Video Code October 18-19

- 2 DeFi Explained Code: Current Summary of Blum Codes

- 3 Blum DeFi Explained: What Is Decentralized Finance (DeFi)?

- 4 Blum DeFi Explained: How Does DeFi Work?

- 5 Blum DeFi Explained: DeFi vs. CeFi (Centralized Finance)

- 6 Blum DeFi Explained: Is DeFi A Safe Investment?

- 7 Exploring the Advantages of Decentralized Exchanges (DEXs)

- 8 More Details of Blum Codes on WEEX

- 9 Find us on:

Blum DeFi Explained: Blum Daily Video Code October 18-19

The phrase “Blum DeFi Explained” gained significant traction on Google following its feature in the BLUM Daily Video Code on October 19, 2024. The integration of decentralized finance concepts in the tap-to-earn game sparked widespread interest among players and crypto enthusiasts. This surge in attention led to an increase in searches for related terms, including “blum crypto code” and “today’s blum code.”

Blum DeFi Explained Video Code Task:

Video: Blum DeFi Explained

Blum Code : BLUMFORCE

DeFi Explained Code: Current Summary of Blum Codes

| No. | Task | Code |

| 1 | Doxxing? What’s that? | NODOXXING |

| 2 | What Are AMMs? | CRYPTOSMART |

| 3 | Forks Explained code | GO GET |

| 4 | Navigating Crypto | HEYBLUM |

| 5 | How to Analyze Crypto? | VALUE |

| 6 | How to Secure Your Crypto! | BEST PROJECT EVER |

| 7 | What are Telegram Mini Apps? | CRYPTOBLUM |

| 8 | Say No to Rug Pull! | SUPERBLUM |

| 9 | Liquidity Pools Guide | BLUMERSSS |

| 10 | $2.5M+ DOGS Airdrop | HAPPYDOGS |

| 11 | Pre-Market Trading? | WOWBLUM |

| 12 | Play Track & type track | BLUM – BIG CITY LIFE |

| 13 | How to Memecoin? | MEMEBLUM |

| 14 | Token Burning: How & Why? | ONFIRE |

| 15 | Ton Voices Live | I LOVE BLUM |

| 16 | Bitcoin Rainbow Chart | SOBLUM |

| 17 | Liquidity Pool Guide | BLUMERSS |

| 18 | CRYPTO TERMS. Part 1 | BLUMEXPLORER |

| 19 | How To Trade Perps | CRYPTOFAN |

| 20 | Sharding Explained | BLUMTASTIC |

| 21 | DeFi Explained | BLUMFORCE |

Blum DeFi Explained: What Is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, is a rapidly growing sector within the cryptocurrency and blockchain ecosystem. At its core, DeFi leverages blockchain technology to recreate traditional financial services in a decentralized manner. This means there are no intermediaries like banks or brokers involved. Instead, DeFi relies on smart contracts—self-executing contracts with the terms of the agreement directly written into code.

DeFi enables users to borrow, lend, trade, and earn interest on their digital assets without needing to trust a central authority. Everything is controlled by decentralized applications (dApps) that run on public blockchains like Ethereum. This system aims to make financial services more accessible, transparent, and open to anyone with an internet connection.

Blum DeFi Explained: How Does DeFi Work?

DeFi operates on smart contracts, typically built on blockchain platforms such as Ethereum. These smart contracts automate financial services and remove the need for human intermediaries. Here’s how the key components of DeFi work:

- Lending and Borrowing: Users can lend their crypto assets to others and earn interest, or they can borrow assets by providing collateral, typically in the form of cryptocurrency. Platforms like Aave and Compound are popular DeFi protocols for lending and borrowing.

- Decentralized Exchanges (DEXs): Unlike centralized exchanges that require user verification and control the funds, DEXs like Uniswap and SushiSwap allow users to trade cryptocurrencies directly from their wallets using liquidity pools.

- Stablecoins: Stablecoins are a key component in DeFi. These are digital currencies pegged to stable assets like the US dollar, ensuring value stability. Stablecoins like USDC or DAI help mitigate the volatility that is common in the crypto markets.

- Yield Farming and Liquidity Mining: These are practices where users provide liquidity to DeFi platforms in exchange for rewards. Yield farming has gained popularity as users can earn high returns on their crypto assets by staking them in DeFi protocols.

- Insurance: DeFi insurance protocols like Nexus Mutual provide coverage against potential risks, including smart contract failures, offering users a safety net in an otherwise risky environment.

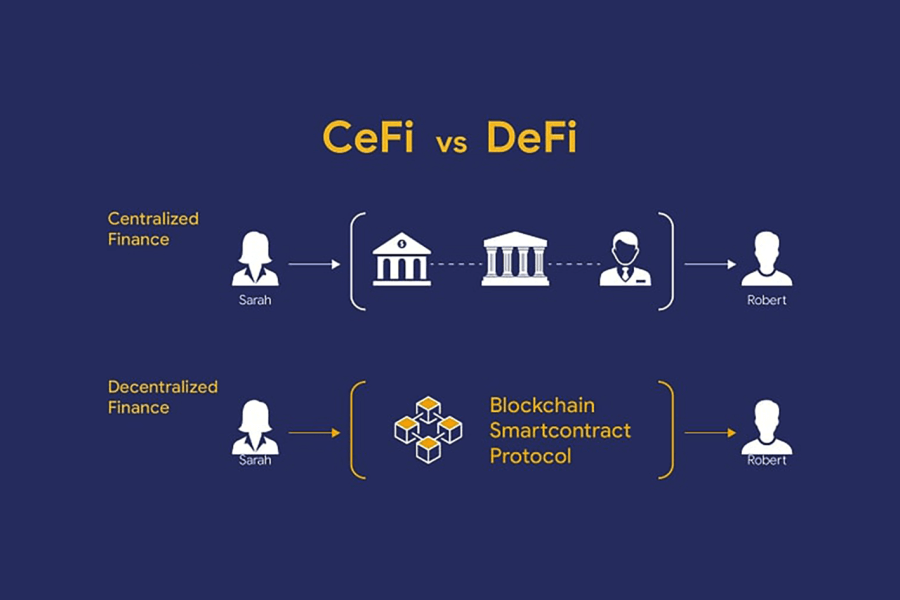

Blum DeFi Explained: DeFi vs. CeFi (Centralized Finance)

While DeFi offers numerous benefits, it’s essential to understand how it compares to Centralized Finance (CeFi), the traditional financial model:

- Control and Custody: In CeFi, financial institutions hold custody of your assets, and you trust them to manage and protect your funds. In DeFi, users have full control over their assets, stored in digital wallets they manage themselves.

- Transparency: CeFi is typically opaque, with financial institutions keeping their operations private. In contrast, DeFi protocols are open-source and transparent, allowing anyone to audit the code and track transactions on the blockchain.

- Access: CeFi services may have geographical or regulatory restrictions, while DeFi is open to anyone with an internet connection, offering more inclusivity, especially to the unbanked.

| Criteria | CeFi (Centralized Finance) | DeFi (Decentralized Finance) |

| Control | Relies on intermediaries | Users control their funds |

| Privacy | Requires personal data | Anonymity with digital wallets |

| Transaction Speed | Slower, may take days | Faster, near real-time |

| Operational Hours | Limited to business hours | 24/7, always available |

| Fees | Higher fees | Lower fees |

| Intermediaries | Involves banks and financial institutions | No intermediaries, trustless |

- Intermediaries: CeFi relies on intermediaries such as banks, brokers, and exchanges, which may charge fees and introduce delays. DeFi removes intermediaries, enabling faster transactions and lower costs.

- Risk: CeFi institutions are regulated and provide a layer of protection, such as deposit insurance. DeFi, being largely unregulated, exposes users to higher risks, including smart contract vulnerabilities and potential loss of funds due to protocol exploits.

Blum DeFi Explained: Is DeFi A Safe Investment?

While DeFi presents exciting opportunities for financial independence and high yields, it also comes with risks that investors must consider.

- Smart Contract Risks: Since DeFi is built on smart contracts, any vulnerability or bug in the code could lead to significant losses. Though many DeFi protocols undergo audits, no system is entirely foolproof.

- Market Volatility: The value of DeFi tokens and cryptocurrencies can fluctuate wildly, leading to potential financial losses. Even stablecoins can sometimes lose their peg during extreme market conditions.

- Lack of Regulation: DeFi operates outside the bounds of traditional financial regulations, meaning there are fewer protections for users. If you lose funds due to an exploit or error, there is little legal recourse.

- Impermanent Loss: This is a risk specific to liquidity providers who stake assets in liquidity pools. If the price of the staked asset changes significantly, you could suffer an impermanent loss, which may outweigh any rewards earned through yield farming.

Despite the risks, DeFi can be a worthwhile investment if approached with caution. Diversifying your assets, conducting thorough research, and staying informed about the protocols you’re using can help mitigate these risks.

Exploring the Advantages of Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are integral to the Decentralized Finance (DeFi) landscape, empowering users to trade cryptocurrencies directly from their wallets without relying on centralized authorities. One of the primary advantages of DEXs is user control; participants retain full ownership of their funds, significantly reducing the risks associated with hacks and insolvency. Furthermore, many DEXs promote anonymity by not requiring personal information, allowing users to engage in trading without sacrificing their privacy. With greater accessibility, anyone with internet access can utilize these platforms, making financial services available to underbanked populations worldwide.

In addition to enhanced control and privacy, DEXs offer diverse asset listings, enabling users to trade a wide array of tokens and trading pairs, such as DOGE/USDT, XRP/USDT, WXT/USDT and SOL/USDT. Platforms like WEEX cater to both novice and experienced traders, providing advanced tools like WEEX Futures Pro, WEEX We-Launch, and WEEX Copy Trading Pro to enhance the trading experience. Users also benefit from lower fees, as WEEX eliminate intermediaries, and can contribute liquidity to earn rewards while helping maintain market stability. With all transactions recorded on a public blockchain, WEEX foster transparency and trust, while their innovative nature allows them to quickly adapt to new technologies, ensuring a dynamic trading environment accessible to users globally.

More Details of Blum Codes on WEEX

Blum Drop Game: How to Earn Free $DOGS Rewards

Navigating Bitcoin’s Market Cycles Using the Rainbow Chart and Blum Code

Understanding the Blum CRYPTO TERMS Code: A Key Tool for Cryptocurrency Analysis

What Are AMMs Blum Code? Current Summary of Blum Daily Codes

What are AMMs Blum Code Today? October 5,2024

What Is Blum Doxxing Code? All Blum Video Codes October 1

Blum Liquidity Pool Code Guide: A Comprehensive Overview Guide to Liquidity Pools

Comprehensive Summary of Blum AMMs Codes for October

Find us on:

Twitter | Telegram | Facebook|LinkedIn|Blog

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Feixiaohao| Cryptowisser.com| Coingecko|Coincarp