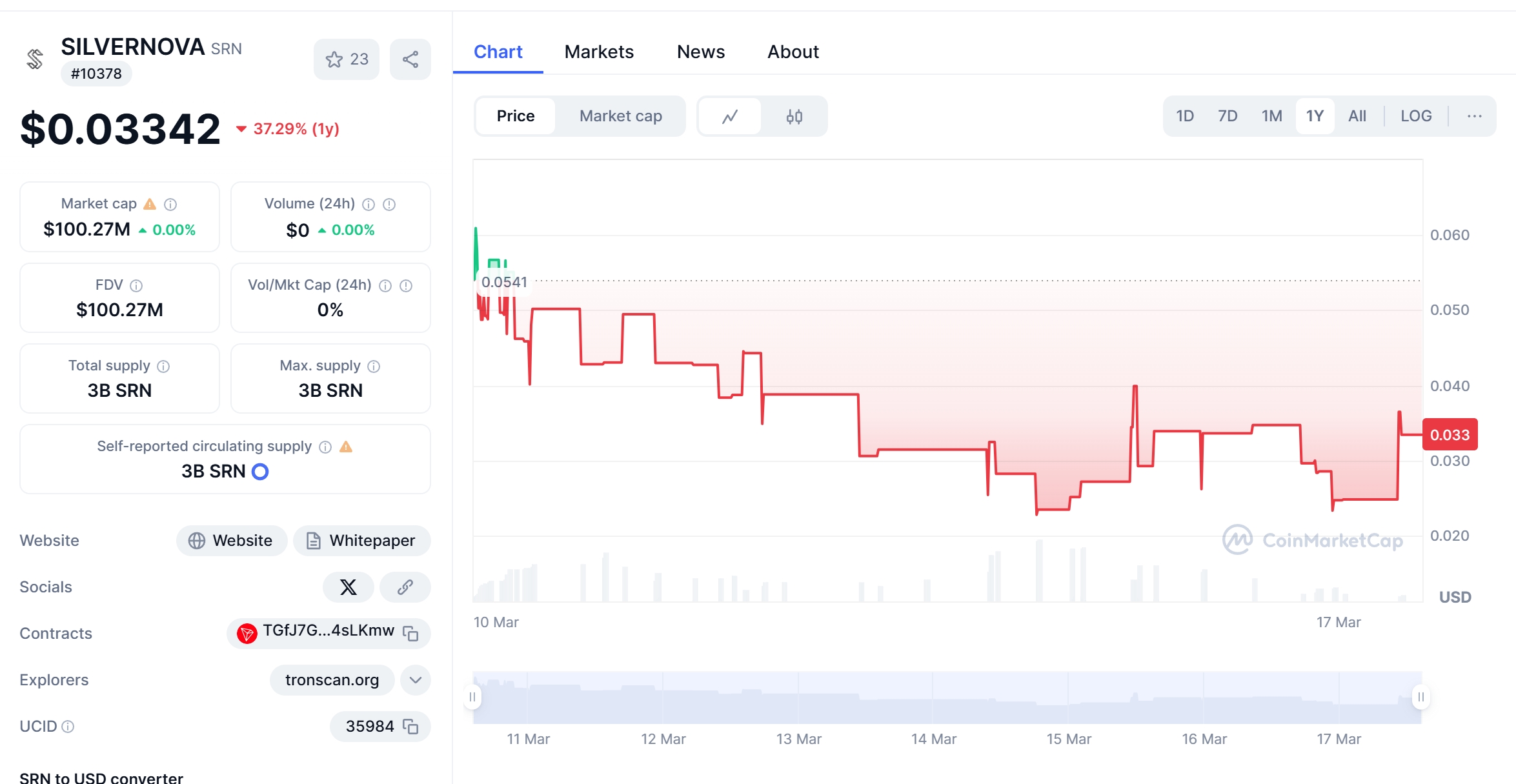

In the ever-shifting landscape of cryptocurrencies, the journey of SILVERNOVA (SRN) Coin has been nothing short of a rollercoaster. Just a few days ago, SRN was riding high at $0.060928, only to plummet to its current price of $0.028544. This dramatic price drop has left many investors wondering: Can SRN bounce back, and what might the future hold for this token?

Trade SRN USDT on WEEX.

Contents

What Caused SILVERNOVA’s Price Drop, and Will It Bounce Back?

To understand SRN’s recent price drop, let’s dive into the factors at play. The cryptocurrency market is notorious for its volatility, and SRN’s journey is a testament to this. On March 10, 2025, SRN reached its all-time high of $0.060928, fueled by optimism and increased trading activity. However, the market sentiment can shift rapidly, and within days, SRN’s price plummeted to $0.028544 by March 16, 2025.

One of the key aspects to consider is the broader market environment. During this period, there was a general downturn in the crypto market, with many altcoins experiencing similar declines. This suggests that SRN’s drop was not an isolated incident but part of a larger trend. Yet, the question remains: Will SRN be able to recover?

Historical trends offer some hope. Let’s look at a similar cryptocurrency, Dogecoin (DOGE), which experienced a significant price drop in the past. In early 2021, DOGE surged to an all-time high of $0.7376, only to fall to $0.05 within months. The drop was influenced by a combination of factors, including regulatory concerns and market corrections. However, DOGE managed to recover, reaching new highs later in the year, driven by increased adoption and community support.

SRN, like DOGE, is part of the rapidly growing decentralized finance (DeFi) sector. The DeFi market has seen substantial growth in 2025, with total value locked (TVL) reaching new highs. SRN’s integration with the Tron blockchain positions it well within this sector, offering fast, secure, and cost-effective transactions. This could be a significant factor in its potential recovery.

Lessons From Dogecoin: Could SILVERNOVA Follow a Similar Path?

Comparing SRN’s trajectory to DOGE’s, we can see some similarities. Both tokens experienced rapid rises followed by sharp declines. However, the recovery paths might differ due to unique project characteristics. DOGE’s recovery was bolstered by strong community support and high-profile endorsements, which SRN may not have to the same extent.

Yet, SRN has its own strengths. The project has secured significant financial backing, with investments aimed at expanding its ecosystem. This includes developing staking rewards, gaming utilities, and NFT integration, all of which can enhance SRN’s appeal to investors. The project’s team has also been transparent about past challenges, such as scalability issues, and has actively worked to address them, which builds trust among its user base.

Market indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide further insights. Currently, SRN’s RSI is at a level that suggests it may be oversold, indicating a potential buying opportunity for long-term investors. The MACD, while indicating a bearish trend, shows signs of divergence, which could signal an upcoming reversal.

Navigating the volatility of SRN requires a strategic approach. For those new to crypto investing, understanding key support and resistance levels is crucial. SRN’s current support level is around $0.019046, which it reached as its 24-hour low. Breaking below this level could lead to further declines, while holding above it might signal a potential recovery.

In terms of long-term predictions, analysts are cautiously optimistic. Some predict that SRN could reach $0.045315 by the end of 2025, a level it touched as its 24-hour high during the recent drop. This forecast is based on the project’s ongoing developments and the growing interest in DeFi solutions.

For short-term predictions, the next few months could see SRN stabilize around its current price, with potential for gradual increases if market conditions improve. Recent news, such as partnerships with other blockchain projects and updates to its ecosystem, could drive this growth.

Actionable Insights for Investors

So, what should investors do with SRN? If you’re considering investing in SRN, here are some actionable insights:

- Long-Term Holding: If you believe in SRN’s potential within the DeFi sector, consider holding for the long term. The project’s developments and the sector’s growth could lead to significant appreciation.

- Diversification: Given SRN’s volatility, diversify your portfolio to mitigate risks. Investing in a mix of established and emerging cryptocurrencies can balance potential gains and losses.

- Stay Informed: Keep an eye on market trends and SRN’s project updates. Being informed about the latest developments can help you make timely investment decisions.

In conclusion, while SRN’s recent price drop to $0.028544 has been significant, the project’s fundamentals and the broader market context suggest a potential for recovery. By understanding the factors influencing its price and adopting a strategic approach, investors can navigate SRN’s volatility and potentially reap rewards in the dynamic world of cryptocurrencies.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.