In the fast-evolving world of cryptocurrency, selecting the right exchange can be challenging, especially for beginners. The latest Blum video focuses on this topic, highlighting key factors like security, liquidity, user experience, and fees. This article will guide you through these considerations and provide a comprehensive list of Blum codes. We’ll also explain why WEEX is an ideal choice for beginners, offering a user-friendly platform, strong security, and valuable educational resources. By the end, you’ll be equipped to make an informed decision for your crypto trading journey.

Contents

- 1 What is Choosing A Crypto Exchange Blum Code?

- 2 What is a Crypto Exchange?

- 3 How Do Cryptocurrency Exchanges Work?

- 4 Types of Cryptocurrency Exchanges

- 5 Key Factors for Choosing a Crypto Exchange

- 6 Choosing A Crypto Exchange: Why WEEX is the Best Choice for Beginners

- 7 Staying Informed: Recent Blum Code Updates on WEEX

- 8 Find us on:

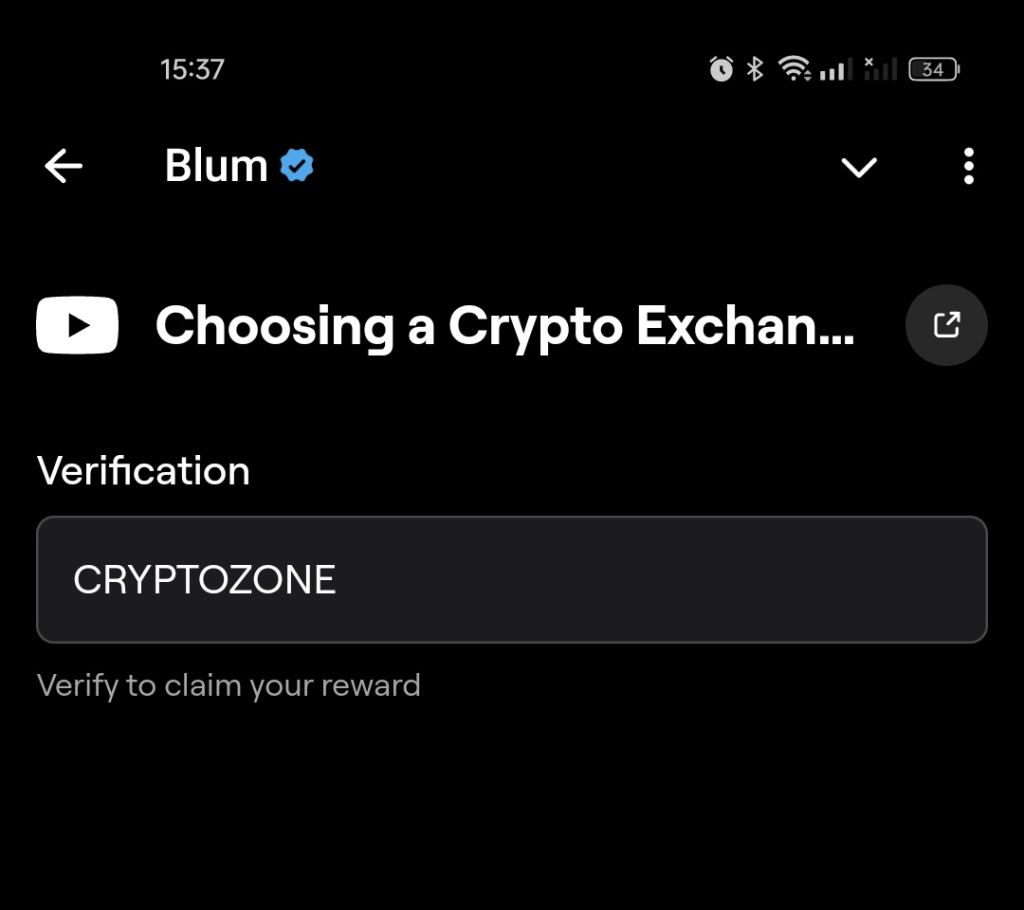

What is Choosing A Crypto Exchange Blum Code?

Blum Academy’s latest video, “How to Choose the Right Cryptocurrency Exchange: A Beginner’s Guide,” on November 4. Choosing A Crypto Exchange Blum video dives into everything you need to know about selecting the ideal platform for trading Bitcoin, Ethereum, and other digital assets. It breaks down five main types of exchanges: Centralized Exchanges (CEX) for reliability, Decentralized Exchanges (DEX) for direct trading without intermediaries, Hybrid Exchanges for a mix of security and liquidity, Brokerage Platforms for beginner-friendly ease, and Peer-to-Peer Platforms for flexible, private transactions.

To choose the right exchange, Blum Academy highlights the importance of considering security, liquidity, user experience, and crypto selection.

Choosing A Crypto Exchange Blum Code Task:

Video: Choosing A Crypto Exchange

Blum Code: CRYPTOZONE

What is a Crypto Exchange?

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade various cryptocurrencies. These exchanges serve as marketplaces where users can trade cryptocurrencies like Bitcoin, Ethereum, and others. By providing a user-friendly interface, exchanges simplify access to crypto markets and handle complex order matching, pricing, and liquidity management. Some exchanges offer a range of additional features, such as portfolio management tools, financial insights, and crypto-specific trading pairs.

How Do Cryptocurrency Exchanges Work?

Crypto exchanges operate as intermediaries, linking buyers and sellers through a secure online platform. When a user places a buy or sell order, the exchange matches it with a counterparty willing to trade at that price, ensuring that both parties’ assets are transferred securely. Here’s a closer look at the mechanics of how exchanges work:

- Order Books and Market Making: Exchanges use order books, which list all buy and sell orders for a particular trading pair, to facilitate trades. By matching orders based on price, exchanges help maintain liquidity and stabilize prices.

- Wallets and Security: Most exchanges offer integrated wallets where users can store their assets temporarily. However, because exchanges have been targets for cyber attacks, many recommend using personal crypto wallets for long-term storage. Security measures on exchanges may include two-factor authentication (2FA), cold storage (offline storage), and insurance policies.

- Fees: Exchanges typically charge transaction fees, either as a flat rate per trade or as a percentage of the trade volume. Fees can vary widely and often depend on the exchange’s liquidity, the user’s trading volume, and the asset being traded.

- Advanced Trading Options: Some exchanges offer more sophisticated trading options, like futures, margin trading, and staking, catering to experienced traders who seek more than basic buying and selling options.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges can be broadly categorized based on their structure and functionality:

- Centralized Exchanges (CEXs): These are the most common and user-friendly exchanges, operated by a centralized organization that oversees transactions. CEXs provide high liquidity, extensive features, and fast transactions. Examples include Binance, Coinbase, and Kraken. However, they often require user verification (KYC), and users must trust the exchange with their funds.

- Decentralized Exchanges (DEXs): In contrast, decentralized exchanges operate without a central authority, allowing users to trade directly with each other via blockchain technology. DEXs like Uniswap and SushiSwap are popular because they offer greater privacy and control over funds, although they may have lower liquidity and higher technical barriers for new users.

- Hybrid Exchanges: Hybrid exchanges combine features of both CEXs and DEXs, aiming to offer the liquidity and ease of centralized platforms along with the security of decentralized ones. Examples include Qurrex and Nash Exchange.

- Peer-to-Peer (P2P) Platforms: These allow users to trade directly with each other. The platform simply facilitates the transaction, often holding funds in escrow until both parties fulfill their obligations. Binance’s P2P network and LocalBitcoins are well-known examples of this exchange type.

Key Factors for Choosing a Crypto Exchange

When choosing a cryptocurrency exchange, it’s essential to weigh several factors for a safe and efficient trading experience. Here’s a refined guide to help you make an informed choice:

1. Security

Given the risk of cyberattacks on crypto exchanges, it’s crucial to choose one with robust security measures. Look for exchanges that offer two-factor authentication (2FA), use cold storage, and maintain a history of secure operations. Additionally, consider transferring assets to a personal “cold” wallet for extra protection.

2. Available Cryptocurrencies

Check the range of coins offered by each exchange. If you’re focused on major cryptocurrencies, a basic exchange will work. However, for access to a broad selection of altcoins, choose an exchange with more options.

3. Liquidity and Trading Volume

High liquidity ensures smoother trades and stable prices, especially important for large orders. Low-volume markets can lead to slippage, where the buying or selling price shifts unfavorably. Advanced traders should also ensure that the exchange supports order types like limit orders to help manage slippage.

4. Fees

Transaction, deposit, and withdrawal fees can vary widely. Choose an exchange with a transparent fee structure that aligns with your trading frequency and volume to avoid accumulating hidden costs.

5. User Experience

An intuitive interface and educational resources are invaluable, especially for beginners. Exchanges that provide tutorials, guides, and responsive customer support can help you gain confidence as you learn the ropes of crypto trading.

6. Regulation and KYC Requirements

Ensure the exchange complies with the regulations in your region. Some exchanges may require strict KYC verification, while others offer more privacy. Selecting a compliant exchange can safeguard you against potential legal issues.

7. Additional Features

Some platforms offer extra services like staking, lending, and integration with decentralized finance (DeFi) products, which can be beneficial for those looking to earn passive income or explore more complex trading strategies.

8. Accessibility

Not all exchanges are accessible in every region. Confirm that the platform operates in your country or state to avoid future access issues.

By considering these factors, you can select a crypto exchange that meets your security, usability, and trading needs effectively.

Choosing A Crypto Exchange: Why WEEX is the Best Choice for Beginners

WEEX is gaining recognition as an excellent crypto exchange for beginners due to its user-friendly platform, security measures, and extensive educational resources. Here’s why WEEX stands out as a great choice for newcomers in the crypto space:

● User-Friendly Interface: WEEX provides users with a user-friendly interface

for spot trading, making it easy for both novice and experienced traders to

navigate the platform and execute trades efficiently.

● Wide Range of Trading Pairs: WEEX offers a diverse selection of trading

pairs, allowing users to trade popular cryptocurrencies like Bitcoin (BTC/USDT),

Ethereum (ETH/USDT), and Litecoin (LTC/USDT), as well as lesser-known altcoins.

● Real-Time Market Data: Traders can access real-time market data and price

charts on WEEX, enabling them to make informed trading decisions based on

● Secure Trading Environment: WEEX prioritizes the security of its users’ funds

the latest market trends and price movements.

and employs advanced security measures to safeguard against unauthorized

access and fraudulent activities.

● Liquidity and Order Execution: With its extensive user base and liquidity pool,

WEEX ensures smooth order execution and minimal slippage for spot traders,

enhancing the overall trading experience.

Staying Informed: Recent Blum Code Updates on WEEX

Today’s Blum Video Codes November 5, 2024 — Choosing A Crypto Exchange

Crypto Slang Part 2 Blum Code: Key Crypto Slang You Need to Know

DeFi Risks Key Insights Blum: Navigating the Benefits, Risks, and Challenges of DeFi

Today’s Blum Video Code October 31, 2024: The Most Complete Blum Video Codes Summary

Pumptober Special Blum Code: Bitcoin Price Prediction From Pumptober to November

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: