Hey, Blum fans! Still unsure about the Blum daily video code for October 19, 2024? Don’t worry—WEEX is here to keep you updated on everything cryptocurrency, as always. Blum Academy has just launched a new educational video titled “Decentralized Finance (DeFi) Explained: The Future of Finance.” We’ll share the Blum DeFi explained codes and delve into the world of Decentralized Finance (DeFi) from every angle. Don’t forget to subscribe WEEX Help to receive first-hand crypto information!

Contents

- 1 Blum DeFi Explained Video Code October 19

- 2 Obtain All Blum Video Codes on WEEX

- 3 What is Decentralized Finance (DeFi)?

- 4 How DeFi Removes Intermediaries?

- 5 Difference Between Crypto And DeFi

- 6 Pros And Cons of DeFi Compared To Traditional Finance

- 7 Benefits of Centralized Exchanges (CEXs)

- 8 More Details of Blum Codes on WEEX

- 9 Find us on:

Blum DeFi Explained Video Code October 19

The Blum Academy recently launched its latest video, “Decentralized Finance (DeFi) Explained: The Future of Finance?” on October 18. This Blum DeFi Explained video offers an in-depth exploration of Decentralized Finance (DeFi) and its potential to transform traditional financial systems. Additionally, the Blum DeFi Explained video code has generated significant excitement among Blum fans, further highlighting the growing interest in this innovative financial landscape.

Blum DeFi Explained Video Code Task:

Video: Blum DeFi Explained

Blum Code : BLUMFORCE

Obtain All Blum Video Codes on WEEX

Unlike other video tasks in Tap2earn games, you don’t have to watch the entire video to access the code. Just head over to this page for the correct code, watch the YouTube video for a quick 15 to 30 seconds, and then go back to the game to enter the Blum code!

Alternatively, consider following WEEX Help for continuous updates on the latest Blum video codes. WEEX covered codes such as “BLUM Crypto Terms,” “BLUM Token Burning,” “BLUM Bitcoin Rainbow Chart Code,” “BLUM Play Type and Track Code,” and “What Are AMMs BLUM Code.”

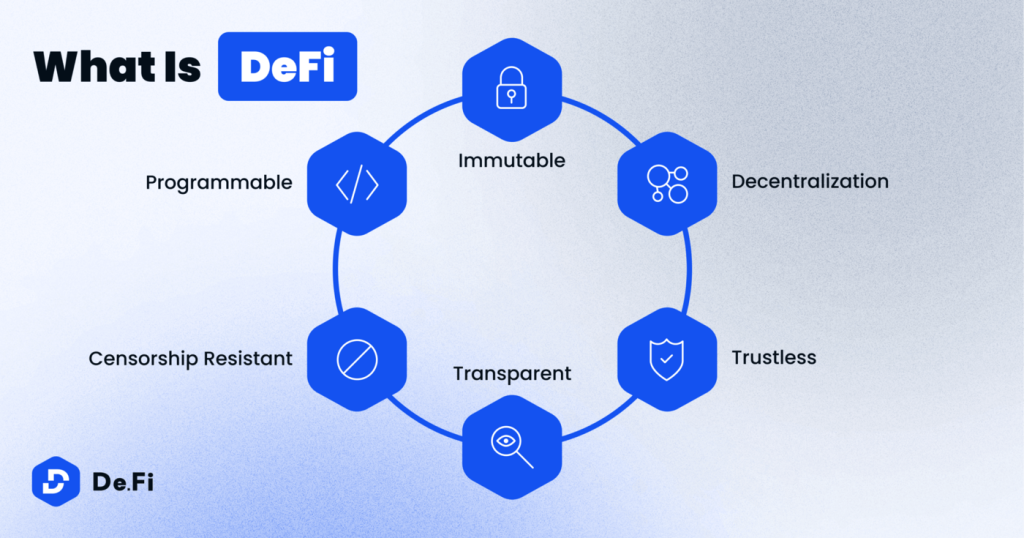

What is Decentralized Finance (DeFi)?

Decentralized Finance, often referred to as DeFi, is a financial system that leverages cryptocurrency and blockchain technology to facilitate transactions without relying on traditional centralized institutions. By creating peer-to-peer (P2P) relationships, DeFi offers a wide range of financial services, including banking, loans, and asset trading.

Unlike centralized finance (CeFi), which relies on a governing authority to oversee transactions and custody of assets, DeFi empowers individuals by eliminating intermediaries. Users maintain control over their private cryptographic keys, allowing them to manage their cryptocurrency directly. Transactions are executed through smart contracts on blockchain networks, primarily Ethereum, ensuring efficiency and security.

Overall, DeFi aims to democratize finance, providing greater control and accessibility for users in the digital financial landscape.

How DeFi Removes Intermediaries?

Decentralized Finance (DeFi) fundamentally changes how financial transactions are conducted by eliminating the need for intermediaries like banks and brokers. Here’s how it achieves this:

- Peer-to-Peer Transactions: DeFi platforms enable direct transactions between users without the involvement of intermediaries. By facilitating peer-to-peer (P2P) relationships, individuals can buy, sell, lend, and borrow directly with one another.

- Smart Contracts: DeFi relies on smart contracts—self-executing contracts with the agreement terms coded directly into the blockchain. These contracts automate and enforce agreements without the need for a third party, ensuring that transactions are executed exactly as intended when conditions are met.

- Decentralized Protocols: DeFi operates on decentralized protocols and blockchain networks (such as Ethereum), which allow for transparent and secure interactions. This infrastructure removes the need for trusted intermediaries, as all transactions are recorded on a public ledger, ensuring transparency and accountability.

- User-Controlled Custody: In DeFi, users maintain control over their private cryptographic keys, which secure their assets. This eliminates the need for centralized custody solutions, reducing risks associated with asset management and potential hacks that could affect traditional financial institutions.

- Open Access: DeFi platforms are accessible to anyone with an internet connection, enabling users worldwide to participate without needing bank accounts or intermediaries. This inclusivity fosters financial autonomy and empowers individuals to engage in financial activities independently.

- Reduced Costs and Increased Efficiency: By cutting out intermediaries, DeFi significantly lowers transaction fees and speeds up processing times. Users benefit from quicker settlements and fewer costs associated with traditional financial services.

In summary, DeFi removes intermediaries by enabling direct transactions through smart contracts, utilizing decentralized protocols, and providing users with control over their assets, leading to a more efficient, transparent, and accessible financial system.

Difference Between Crypto And DeFi

While cryptocurrency and DeFi are interconnected, they serve different purposes. Cryptocurrency refers to digital assets like Bitcoin and Ethereum, primarily used for transferring value. In contrast, DeFi refers to the financial services and products that utilize cryptocurrencies and blockchain technology to provide a wide range of financial functions.

In simple terms, cryptocurrencies are the currency of DeFi, while DeFi represents the broader ecosystem of financial applications that utilize these digital assets.

Pros And Cons of DeFi Compared To Traditional Finance

Pros:

- Accessibility: DeFi platforms are accessible to anyone with an internet connection, providing financial services to the unbanked and underbanked.

- Transparency: Blockchain technology ensures all transactions are publicly verifiable, enhancing trust and accountability.

- Lower Costs: By removing intermediaries, DeFi reduces transaction fees, making financial services more affordable.

- Innovation: The open-source nature of DeFi encourages continuous innovation, leading to new financial products and services.

Cons:

- Volatility: Cryptocurrencies are known for their price volatility, which can impact DeFi investments.

- Security Risks: While smart contracts are designed to be secure, they can still be vulnerable to hacks and bugs.

- Regulatory Uncertainty: DeFi operates in a gray area of regulation, and changes in laws could impact the viability of certain platforms.

- Complexity: Understanding DeFi protocols can be daunting for newcomers, leading to potential missteps.

Benefits of Centralized Exchanges (CEXs)

Decentralized exchanges (CEXs) play a crucial role in the Decentralized Finance (DeFi) ecosystem. Take WEEX as an example, it allows users to trade cryptocurrencies directly from their wallets without relying on a centralized authority. Here are some key benefits of DEXs:

- User Control: DEXs allow users to trade directly from their wallets, retaining control over their funds and minimizing risks associated with hacks or insolvency.

- Anonymity and Privacy: Many DEXs do not require personal information, enabling anonymous trading and enhancing user privacy.

- Greater Accessibility: DEXs are open to anyone with an internet connection, making financial services accessible to underbanked regions.

- Diverse Asset Listings: Users can trade a wider range of tokens and trading pairs, accessing more investment opportunities. You can directly trade DOGE/USDT, XRP/USDT, WXT/USDT and SOL/USDT, WEEX caters to both beginners and experienced traders looking for an intuitive environment. The platform offers advanced trading tools such as WEEX Futures Pro, WEEX We-Launch, and WEEX Copy Trading Pro.

- Reduced Fees: Lower trading fees are common on DEXs due to the elimination of intermediaries, saving users money.

- Liquidity Provision: Users can provide liquidity to trading pairs, earning rewards and helping maintain market liquidity.

- Transparency: All transactions are recorded on a public blockchain, enhancing trust through verifiable activities.

- Innovation and Flexibility: DEXs rapidly adopt new features and technologies, often incorporating innovative trading mechanisms.

- No Geographical Restrictions: Users from various regions can trade without facing the limitations of centralized exchanges.

More Details of Blum Codes on WEEX

Blum Drop Game: How to Earn Free $DOGS Rewards

Navigating Bitcoin’s Market Cycles Using the Rainbow Chart and Blum Code

Understanding the Blum CRYPTO TERMS Code: A Key Tool for Cryptocurrency Analysis

What Are AMMs Blum Code? Current Summary of Blum Daily Codes

What are AMMs Blum Code Today? October 5,2024

What Is Blum Doxxing Code? All Blum Video Codes October 1

Blum Liquidity Pool Code Guide: A Comprehensive Overview Guide to Liquidity Pools

Comprehensive Summary of Blum AMMs Codes for October

Find us on:

Twitter | Telegram | Facebook|LinkedIn|Blog

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Feixiaohao| Cryptowisser.com| Coingecko|Coincarp