As BLUM daily video codes continue to update, WEEX will stay on top of it, bringing you the latest BLUM video codes. Previously, we covered codes such as “BLUM Crypto Terms,” “BLUM Token Burning,” “BLUM Bitcoin Rainbow Chart Code,” “BLUM Play Type and Track Code,” and “What Are AMMs BLUM Code.” Now, on October 16, WEEX will shift focus to the code “How to Trade Perps” and dive into how perpetual futures work, exploring both the pros and cons.

Contents

- 1 How To Trade Perps Blum Codes – October 15-16, 2024

- 2 What Are Perpetual Futures?

- 3 How Perpetual Futures Work?

- 4 Steps to Start Trading Perpetual Futures Contracts.

- 5 Advantages And Risks o fTrading Perpetual Contracts.

- 6 What Is The Difference Between Traditional Futures and Crypto Futures?

- 7 Explore the Full Potential of Blum Coins on WEEX

- 8 Related Blum Article on WEEX

- 9 Find us on:

How To Trade Perps Blum Codes – October 15-16, 2024

The “How to Trade Perps” BLUM video code attracted significant attention from both cryptocurrency enthusiasts and casual internet users on October 16, 2024, after being highlighted in the BLUM Code Daily Combo within a popular Telegram-based tap-to-earn game. Originally released on October 15, 2024, the video, titled “What Are Perpetual Futures? The Crypto Trader’s Guide,” introduced the concept of perpetual futures, explained how the funding rate mechanism operates, and highlighted the flexibility these contracts provide for traders

Earn 250 BP BLUM Points Daily Video Tasks:

Video: How To Trade Perps

Answer : CRYPTOFAN

How To Use Blum Daily Video Codes

You can use your BLUM Daily Video Code by following these steps:

- Log in to the BLUM website or open the BLUM app.

- Go to the “Daily Video Codes” section.

- Enter your code in the provided field. Unlock today’s special video and enjoy your exclusive access!

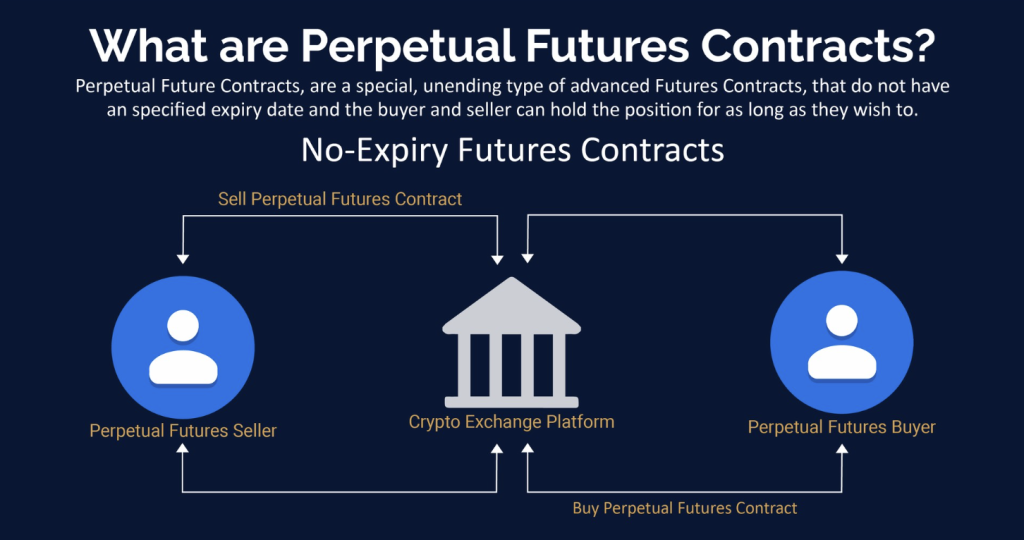

What Are Perpetual Futures?

Perpetual futures, or Perps, are a type of futures contract with no expiration date, meaning traders can hold these positions indefinitely. Unlike traditional futures contracts, which are tied to a specific expiration or settlement date, perpetual futures are designed to reflect the spot price of the underlying asset and can be traded continuously.

This lack of an expiration date is a game-changer, allowing traders to speculate on the price of an asset for as long as they want without worrying about contract expiration or rollover costs. Perpetual futures are particularly popular in the cryptocurrency market, where assets like Bitcoin and Ethereum are traded with these contracts on many exchanges.

How Perpetual Futures Work?

Perpetual futures are a type of derivative contract that allows traders to speculate on the price of an asset, such as a cryptocurrency, without a fixed expiration date. Here’s how they work:

1. No Expiration Date

Unlike traditional futures contracts, perpetual futures do not have an expiration or settlement date. Traders can hold their positions indefinitely, as long as they maintain sufficient margin to cover potential losses.

2. Funding Rate Mechanism

To keep the contract price close to the spot price of the underlying asset, exchanges use a funding rate. This rate is a small fee that is periodically exchanged between long and short positions:

- Positive funding rate: When the contract price is higher than the spot price, traders in long positions pay a fee to those in short positions.

- Negative funding rate: When the contract price is lower than the spot price, short traders pay long traders.

This mechanism helps ensure that perpetual futures prices don’t stray too far from the spot market.

3. Leverage

Perpetual futures often allow traders to use leverage, meaning they can control a large position with a relatively small amount of capital. For example, with 10x leverage, a trader can enter a position worth $10,000 with only $1,000. While this amplifies potential profits, it also increases the risk of losses.

4. Mark Price

Exchanges use the mark price (an index price calculated from various market data) to trigger liquidations rather than the last traded price of the perpetual contract. This prevents forced liquidations from sudden market manipulations or spikes.

5. Liquidation

If a trader’s margin falls below the required maintenance level, their position may be liquidated. This occurs if the price moves against the trader’s position, and they do not have enough funds to cover potential losses.

6. Continuous Trading

Because perpetual futures don’t expire, traders can hold their positions as long as they want and participate in markets 24/7, which is especially common in cryptocurrency exchanges.

7. Flexibility

Perpetual futures offer traders the ability to go long (bet on price increases) or short (bet on price decreases), making them versatile tools for both speculation and hedging.

In summary, perpetual futures work by enabling continuous trading without expiration, using a funding rate mechanism to align the contract price with the spot price, and offering leverage for enhanced trading potential. However, traders must manage risks, particularly those related to leverage and liquidation.

Steps to Start Trading Perpetual Futures Contracts.

- Choose a Reliable Exchange: To begin trading perpetual futures, you’ll need to select a platform that offers them, for example: WEEX exchange. As a premier cryptocurrency exchange, WEEX provides a smooth trading experience with sophisticated tools, competitive fees, and strong security protocols.

- Open an Account: Sign up for an account on WEEX exchange. You may need to complete KYC (Know Your Customer) verification depending on the platform’s regulations.

- Deposit Funds: Deposit cryptocurrency or fiat into your account to start trading. Some exchanges only accept crypto, while others offer the ability to deposit traditional currencies.

- Understand Leverage: Perpetual futures often allow for leverage, which can amplify your gains or losses. Be sure to understand how leverage works and the risks involved. Start with low leverage if you’re new to futures trading.

- Place Your Trade: After funding your account, navigate to the perpetual futures section, select your asset, choose the amount you wish to trade, and enter your position. You can go long (buy) if you expect the price to rise, or go short (sell) if you anticipate a price drop.

- Monitor the Funding Rate: Keep an eye on the funding rate to avoid unexpected fees. The rate fluctuates based on market conditions and affects your position if held over time.

Advantages And Risks o fTrading Perpetual Contracts.

Advantages:

- No Expiration Date: You can hold your position as long as desired, giving traders more flexibility in timing their exits.

- Leverage: Traders can control larger positions with a smaller amount of capital, increasing potential returns.

- High Liquidity: Perpetual futures markets, especially in crypto, are highly liquid, allowing for quick execution of trades.

- Hedging: Perpetual futures offer a way for traders to hedge their existing positions, protecting against adverse price movements.

Risks:

- High Volatility: Crypto markets, where perpetual futures are common, can experience extreme price swings, which can amplify both gains and losses.

- Leverage Risk: While leverage can enhance profits, it also increases the potential for significant losses. A small unfavorable move can quickly wipe out a position.

- Funding Rate: Holding positions long-term can result in the accumulation of fees due to the funding rate, especially if the market moves against your position.

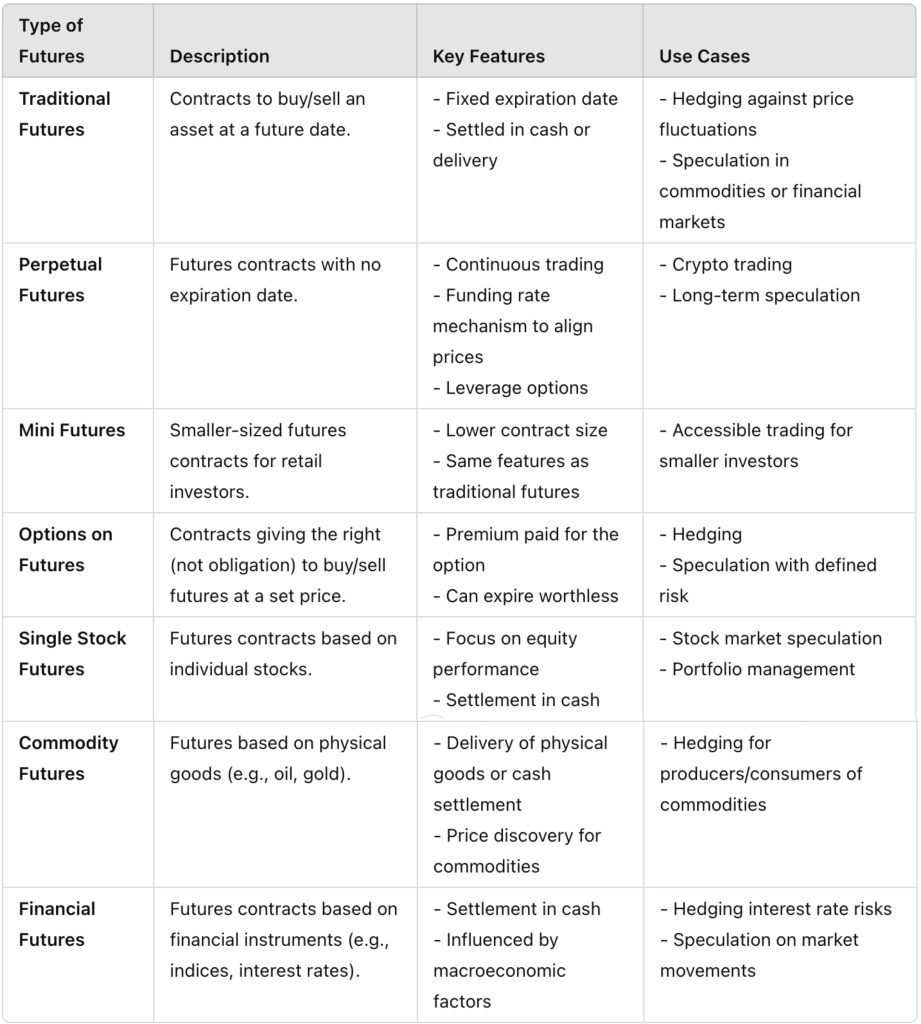

What Is The Difference Between Traditional Futures and Crypto Futures?

While both traditional futures and crypto futures allow traders to speculate on asset prices, they have several key differences:

- Expiration: Traditional futures have a fixed expiration date, meaning contracts must be settled by that date. Perpetual futures, common in crypto markets, do not have expiration dates and can be held indefinitely.

- Underlying Assets: Traditional futures typically cover assets like commodities (oil, gold), stock indices, or interest rates. Crypto futures are based on digital assets such as Bitcoin, Ethereum, and other cryptocurrencies.

- Leverage: Crypto futures tend to offer much higher leverage compared to traditional futures markets, allowing traders to magnify their trades significantly, but with increased risk.

- Funding Mechanism: Traditional futures markets settle periodically, while perpetual crypto futures use the funding rate mechanism to align the contract price with the spot price of the asset.

Explore the Full Potential of Blum Coins on WEEX

WEEX stands out as a leading cryptocurrency exchange, offering a seamless trading experience enhanced by sophisticated tools, competitive pricing, and robust security measures. The platform prioritizes user protection with multi-layered security features, including a 1000 BTC investor protection fund, and adheres to financial regulations in multiple jurisdictions. Catering to both newcomers and experienced traders, WEEX supports a diverse range of cryptocurrencies, such as DOGEUSDT, XRP/USDT, and SOL/USDT, creating an intuitive trading environment. Users can also benefit from advanced trading options like WEEX Futures Pro, WEEX We-Launch, and WEEX Copy Trading Pro

Related Blum Article on WEEX

Liquidity Pools Guide Blum Code|Blum Code 27 September,2024

What Are AMMs Blum Code? Current Summary of Blum Daily Codes

What Is Blum Doxxing Code? All Blum Video Codes October 1

Blum Play Type and Track Code: Complete Summary of Blum Daily Codes

Find us on:

Twitter | Telegram | Facebook|LinkedIn|Blog

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Feixiaohao| Cryptowisser.com| Coingecko|Coincarp