Key Takeaways:

- Swell L2, the restaking yield layer, is scaled and decentralized with infrastructure secured by restaking.

- SWELL-USDT is used for governance and restaking to secure Swell L2.

- The Proof of Restake flywheel boosts security, deepens liquidity, and rewards participants.

Swell Network is making waves with its innovative approach to yield farming and staking in DeFi. Built as a next-gen Layer 2 solution, Swell L2 tackles the challenges of liquidity scarcity, centralization, and lack of native yield. By implementing a pioneering new mechanism called Proof of Restake (PoR), Swell L2 introduces a restaking yield layer that drives network growth, enhances security, and creates a sustainable, capital-efficient ecosystem. Let’s explore how Swell L2 works, the role of Proof of Restake, and how SWELL and SWELL-USDT tokens empower users within this ecosystem.

Contents

Understanding Swell L2: The Restaking Yield Layer

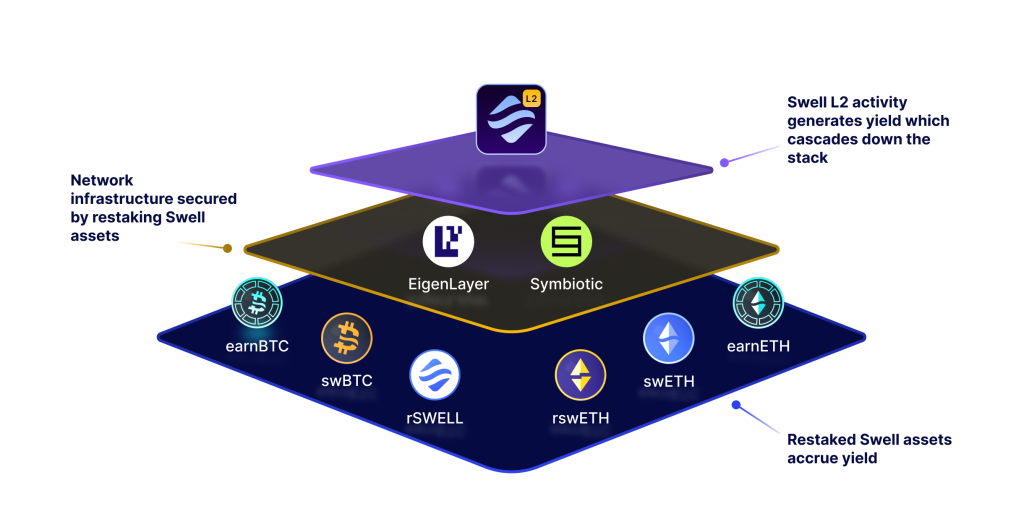

Swell L2 is designed to address the key limitations of existing Layer 2 solutions by creating a decentralized, scalable infrastructure secured by restaking. At the core of Swell’s infrastructure is Proof of Restake, a mechanism that maximizes the utility of staked assets by allowing them to secure the network while remaining liquid for DeFi activities.

Through this unique setup, staked assets can be reused across multiple layers and chains, aligning the incentives of validators, node operators, builders, and users. The result is a vertically integrated ecosystem where liquidity is continuously enhanced, security is strengthened, and revenue generated on-chain accrues directly to Swell asset holders.

The Mechanics of Proof of Restake (PoR)

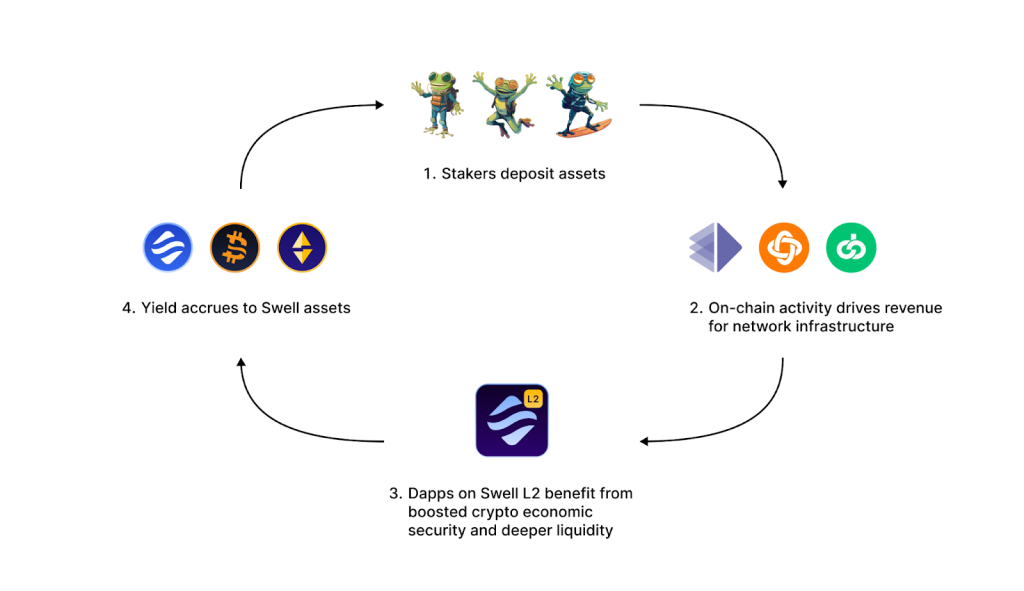

Proof of Restake (PoR) is a revolutionary mechanism that allows stakers to maximize their asset productivity by turning staked tokens into liquid restaked tokens (LRTs). These LRTs earn staking rewards and can be deployed across various DeFi applications within and beyond the Swell ecosystem, creating a virtuous cycle that propels Swell L2’s growth. Here’s how it works:

- Stakers Deposit Assets: When assets are staked on Swell, they are tokenized into liquid restaked tokens (LRTs). These tokens can be used across DeFi applications, providing stakers with ongoing yield while they participate in securing Swell L2’s infrastructure.

- On-Chain Revenue Generation: Restaked assets provide security for Swell L2’s infrastructure, supporting validators, relayers, node operators, and sequencers. In return, Swell’s infrastructure generates fees from transaction and sequencer activities, which fuel on-chain revenue.

- Yield Distribution: The revenue generated cascades down to Swell assets, converting it into native restaking yield for holders. This mechanism ensures that users who actively participate in securing the network are rewarded with enhanced returns.

- Enhanced Liquidity and Security: As more assets are staked and activity on Swell L2 grows, liquidity deepens across the ecosystem, benefiting decentralized applications (dApps) and attracting a broader user base. This added liquidity further strengthens network security.

Why Proof of Restake is a Game-Changer for Layer 2 Solutions

Proof of Restake empowers Swell Network to address common Layer 2 issues, delivering a high-performing, decentralized, and Ethereum-aligned network. Here’s why PoR matters:

- Modular Architecture: By utilizing modular AVS (Application Verification Systems) and network components, Swell L2 can continually adapt and evolve, allowing the network to remain lean, decentralized, and progressively more efficient.

- Ethereum Alignment: Swell L2 maintains strong security ties to Ethereum by restaking assets to secure key infrastructure components. This approach reduces censorship risk, eliminates single points of failure, and ensures robust uptime — avoiding pitfalls often associated with centralized solutions.

- Maximized Asset Productivity: PoR makes Swell L2 users direct recipients of the value generated by their network activity. Transaction fees, sequencer fees, and more contribute to the native restaking yield, allowing users to maximize the returns on their assets while fostering network growth.

- DeFi Innovation: With liquid restaked assets, dApps on Swell L2 can unlock new liquidity sources that are typically restricted by traditional staking models. PoR also allows these dApps to tap into decentralized infrastructure services, from zk-coprocessors to security protocols, driving DeFi innovation outside Ethereum’s virtual machine constraints while benefiting from Ethereum’s security foundation.

Unlocking New DeFi Possibilities Beyond Swell Network

Swell’s Proof of Restake mechanism extends beyond the bounds of its Layer 2 protocol, opening new pathways for DeFi applications and scaling blockspace across specialized networks. By leveraging a shared set of robust assets, Swell enables rollups to inherit the security of other chains within a collective network, simplifying cross-chain integrations and scaling blockspace.

Through this approach, Swell L2 lowers barriers for new rollups to join a decentralized, secure system of interconnected networks. This shared infrastructure accelerates rollup development and unlocks a powerful new model for Ethereum scalability.

Choosing A Crypto Exchange: Why WEEX Should Be Your First Choice

WEEX Exchange is a leading cryptocurrency trading platform known for its user-friendly interface, advanced trading tools, and commitment to security. Whether you’re a beginner or a seasoned trader, WEEX offers a seamless trading experience with support for various cryptocurrencies, including BTC/USDT, WXT/USDT , SWELL/USDT and other numerous altcoins. Beyond trading, WEEX is dedicated to educating its users, making it a trusted resource for those looking to stay informed in the fast-paced world of crypto.

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Cryptowisser.com| Coingecko|Coincarp