Are you curious about when Bitcoin first achieved a market cap of $1 trillion? The answer is :Bitcoin first reached a market capitalization of $1 trillion on February 19, 2021. Hope my article can help you well.

In this article, we explore the significance of when Bitcoin first achieved a market cap of $1 trillion and how it impacted the financial world.

Contents

- 0.1 Historical Context: When Did Bitcoin First Achieve a Market Cap of $1 Trillion?

- 0.2 Key Milestones Leading to When Bitcoin First Achieved a Market Cap of $1 Trillion

- 0.3 The Impact of When Bitcoin First Achieved a Market Cap of $1 Trillion

- 0.4 Conclusion: The Legacy of When Bitcoin First Achieved a Market Cap of $1 Trillion

- 1 FAQ

- 2 About Trade Bitcoin on WEEX

- 3 Find us on:

Historical Context: When Did Bitcoin First Achieve a Market Cap of $1 Trillion?

To comprehend when Bitcoin first achieved a market cap of $1 trillion, we need to delve into its historical context. The journey to when Bitcoin first achieved a market cap of $1 trillion was marked by significant market developments and growing interest from institutional investors. Understanding when Bitcoin first achieved a market cap of $1 trillion helps us appreciate the rapid growth of cryptocurrencies.

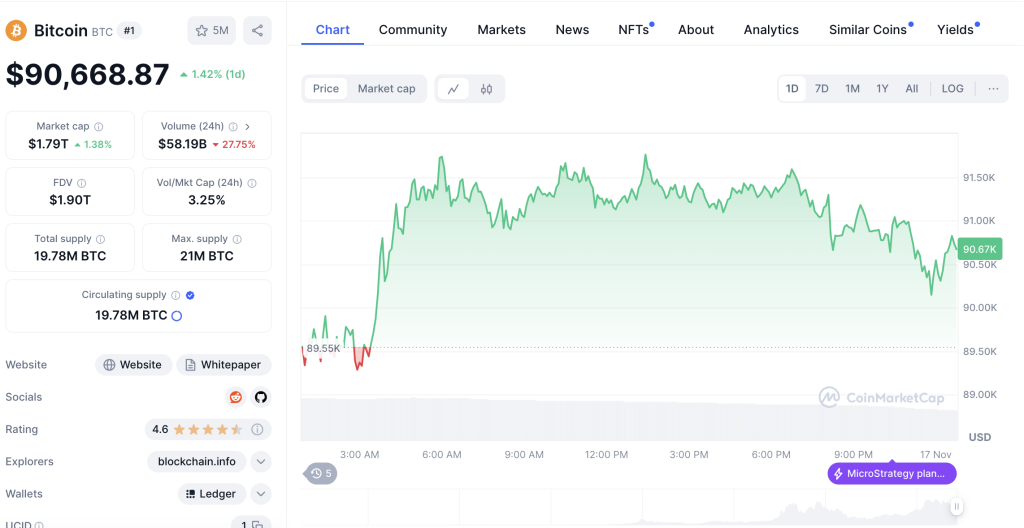

According to the historical data, we can found that Bitcoin first reached a market capitalization of $1 trillion on February 19, 2021. This significant milestone in the history of cryptocurrency highlighted Bitcoin’s growing acceptance and adoption as a digital asset. The surge in Bitcoin’s price leading up to this achievement was driven by several key factors, including increased institutional investment, the rise of decentralized finance (DeFi), and the broader acceptance of cryptocurrencies in mainstream finance.

Achieving a $1 trillion market cap underscored Bitcoin’s position as the leading cryptocurrency and sparked discussions about the future of digital currencies and their potential impact on the global financial system. Following this milestone, Bitcoin’s price experienced volatility, reflecting the speculative nature of the cryptocurrency market. However, this achievement also paved the way for further developments in blockchain technology and digital assets.

Key Milestones Leading to When Bitcoin First Achieved a Market Cap of $1 Trillion

Bitcoin first achieved a market cap of $1 trillion in February 2021. Here are some key milestones that led to this significant achievement:

- Early Adoption and Growth (2009-2013): Bitcoin was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. During its early years, Bitcoin was primarily used by tech enthusiasts and for niche transactions. The first real-world Bitcoin transaction occurred in 2010 when a programmer paid 10,000 BTC for two pizzas, marking the beginning of Bitcoin’s journey as a currency.

- Increased Awareness and Use (2013-2017): Bitcoin began gaining more attention as a potential investment and store of value. In 2013, Bitcoin’s price surged to over $1,000 for the first time, driven by increased media coverage and interest from investors. This period also saw the rise of Bitcoin exchanges and the development of a more robust infrastructure for trading and storing Bitcoin.

- Mainstream Attention and Institutional Interest (2017-2020): The year 2017 was pivotal for Bitcoin as its price skyrocketed to nearly $20,000, attracting significant media attention and interest from institutional investors. This period also saw the introduction of Bitcoin futures trading, which provided a regulated platform for institutional investors to engage with Bitcoin.

- Pandemic and Economic Uncertainty (2020): The COVID-19 pandemic led to unprecedented economic uncertainty, prompting investors to seek alternative assets. Bitcoin, often referred to as “digital gold,” benefited from this trend as investors looked for ways to hedge against inflation and currency devaluation.

- Surge in Price and Market Cap (2021): In early 2021, Bitcoin’s price surged past 50,000,drivenbyincreasedinstitutionaladoption,includinginvestmentsfromcompanieslikeTeslaandMicroStrategy.ThissurgeinpricepushedBitcoin′smarketcapitalizationpastthe50,000,drivenbyincreasedinstitutionaladoption,includinginvestmentsfromcompanieslikeTeslaandMicroStrategy.ThissurgeinpricepushedBitcoin′smarketcapitalizationpastthe1 trillion mark for the first time in February 2021

The Impact of When Bitcoin First Achieved a Market Cap of $1 Trillion

The moment when Bitcoin first achieved a market cap of $1 trillion had profound implications for the cryptocurrency market. Investors and financial institutions took note of when Bitcoin first achieved a market cap of $1 trillion, leading to increased mainstream acceptance. The significance of when Bitcoin first achieved a market cap of $1 trillion cannot be overstated, as it marked a turning point in digital asset recognition.

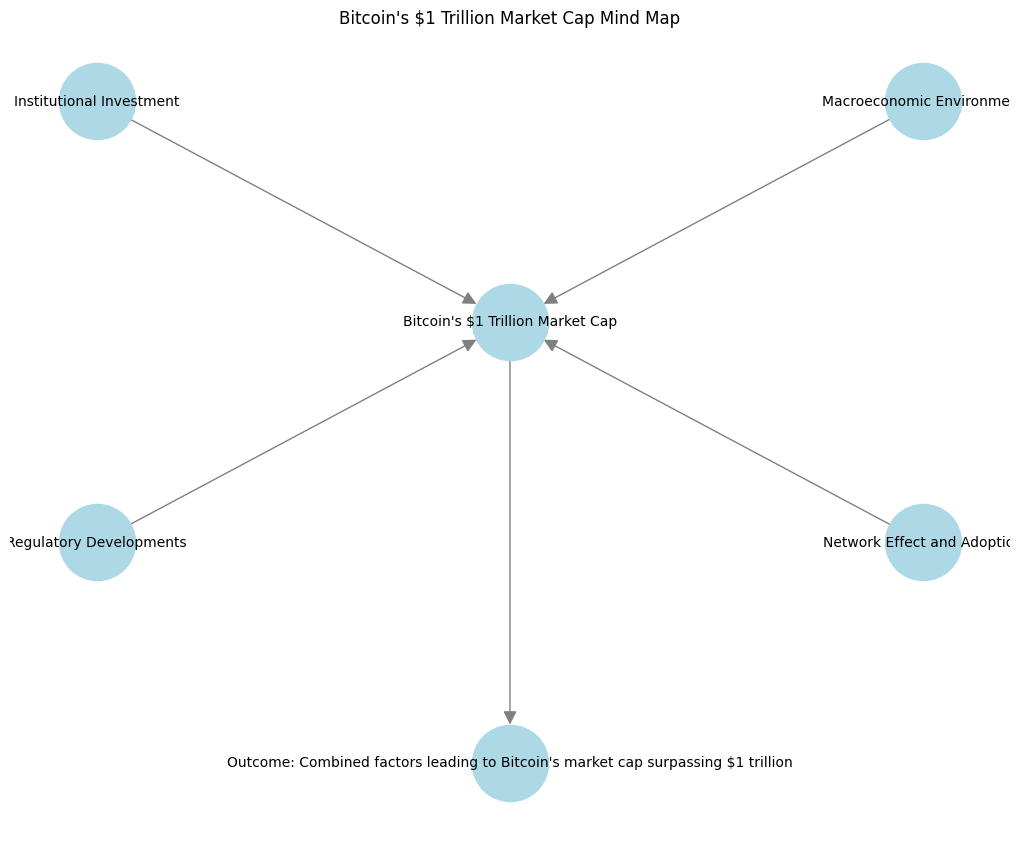

Several primary factors contributed to Bitcoin reaching a $1 trillion market cap:

- Institutional Investment: One of the most significant factors was the rising interest from institutional investors. Large companies and investment firms began to see Bitcoin as a viable asset class, leading to substantial investments. This institutional backing provided legitimacy and confidence in Bitcoin as a store of value.

- Macroeconomic Environment: The macroeconomic environment, characterized by low interest rates and concerns about inflation, drove investors to seek alternative assets. Bitcoin, often compared to gold as a hedge against inflation, benefited from this trend.

- Regulatory Developments: The introduction of Bitcoin ETFs (Exchange-Traded Funds) in the U.S. and other regions made it easier for investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency. This increased accessibility contributed to higher demand and price appreciation.

- Network Effect and Adoption: As more people and businesses adopted Bitcoin, its network effect grew stronger. This increased adoption not only drove up demand but also reinforced Bitcoin’s position as a leading digital asset.

- These factors combined to propel Bitcoin’s market cap to over $1 trillion, marking a significant milestone in its history.

Conclusion: The Legacy of When Bitcoin First Achieved a Market Cap of $1 Trillion

In conclusion, the event when Bitcoin first achieved a market cap of $1 trillion is a landmark moment in financial history. It signifies the growing importance of cryptocurrencies in global markets. As we reflect on when Bitcoin first achieved a market cap of $1 trillion, it becomes clear that this milestone paved the way for future innovations in digital finance.

FAQ

What role did macroeconomic factors play in Bitcoin achieving a $1 trillion market cap?

Macroeconomic factors played a crucial role in Bitcoin achieving a $1 trillion market cap. Here are some of the key ways these factors influenced Bitcoin’s rise:

- Inflation Concerns: As central banks around the world implemented expansive monetary policies in response to the COVID-19 pandemic, concerns about inflation grew. Investors sought assets that could serve as a hedge against inflation, and Bitcoin, often referred to as “digital gold,” became an attractive option due to its limited supply and decentralized nature.

- Low Interest Rates: The prolonged period of low interest rates made traditional savings and bonds less attractive, pushing investors to look for higher-yielding alternatives. Bitcoin, with its potential for significant price appreciation, attracted those seeking better returns.

- Currency Devaluation: With many countries experiencing currency devaluation due to economic stimulus measures, Bitcoin emerged as a store of value that was not tied to any single nation’s economy. This appeal as a global, decentralized currency drove more investors to consider Bitcoin as part of their portfolios.

- Economic Uncertainty: The overall economic uncertainty during the pandemic led investors to diversify their portfolios. Bitcoin’s unique properties as a decentralized and scarce asset made it an attractive option for those looking to mitigate risk in uncertain times.

These macroeconomic factors collectively contributed to increased demand for Bitcoin, driving its price and market capitalization to new heights.

By understanding when Bitcoin first achieved a market cap of $1 trillion, investors and enthusiasts can better appreciate the evolution of the cryptocurrency landscape. The story of when Bitcoin first achieved a market cap of $1 trillion continues to inspire and influence the world of finance.

By following these steps, you can find out that Bitcoin first achieved a market cap of $1 trillion on February 19, 2021.

About Trade Bitcoin on WEEX

WEEX, a leading cryptocurrency exchange, offers a seamless trading experience with advanced tools, low fees, and robust security measures. The platform prioritizes user protection through multiple layers of security, including a 1000 BTC investor protection fund, and complies with financial regulations across different regions. Supporting a wide range of cryptocurrencies such as DOGEUSDT, PNUT/USDT, and WXTUSDT, WEEX caters to both beginners and experienced traders who appreciate an easy-to-use trading interface.

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: