Recently, the Pumptober Special Blum Code has been trending and capturing the attention of crypto enthusiasts. The “Pumptober Special Blum Code” is a new code in the Blum crypto game that grants users 250 BLUM points. In this article, the WEEX exchange will explain what the “Pumptober Special Blum Code” is and how to claim your free 250 $BLUM tokens. Additionally, we will explore the factors influencing Bitcoin‘s price movement and provide a guide for purchasing BTC/USDT on the WEEX exchange.

Contents

Pumptober Special Blum Code October

On October 28, “Pumptober Special: Why October is Big for Crypto in 2024!”, video has been released on Blum Academy. Known for making crypto concepts and slang easy to understand, Blum Academy introduced a fresh crypto term while examining Bitcoin’s unique price movements during October. The Pumptober Special video brings a new crypto word for us and explores Bitcoin’s price fluctuations. WEEX has accompanied Blummies to explore all the popular episodes, such as: “What is On-chain Analysis Blum Code”, and “ How to Trade Perps Blum Code”. For more details on these episodes, check out the resources on WEEX Help.

Pumptober Special Blum Code Task:

Video: Pumptober Special

Blum Code : PUMPIT

What Is Pumptober?

“Pumptober” has become a popular nickname among crypto enthusiasts for the month of October, where historically, Bitcoin (BTC/USDT) tends to perform especially well. The term reflects the market’s expectation of a potential “pump” in prices based on patterns observed over past years. But what makes October so special for Bitcoin, and why do we often see price surges during this time?

Over the past decade, October has marked impressive gains for Bitcoin, making it a month to watch closely. Analysts suggest this trend could be due to several factors, such as improved market sentiment after a typically slower summer season, increased institutional interest as financial institutions prepare for the year-end, and the anticipation of fourth-quarter growth. Altogether, these factors position October as a unique month in Bitcoin’s price cycle, attracting attention from both retail and institutional investors.

Historical Gains and Patterns of Bitcoin in October

Across the years, October has often seen significant gains and set the stage for Bitcoin’s upward momentum. Let’s explore the factors behind October’s recurring performance boosts:

- Market Sentiment Shift

October typically marks a psychological shift as investors move past Q3 results and look forward to the end of the year. This shift in sentiment often leads to renewed interest and optimism in Bitcoin and other cryptocurrencies. - Institutional Activity

Financial institutions frequently make year-end adjustments and may increase their cryptocurrency exposure as part of their broader portfolio strategies. This institutional interest can drive Bitcoin prices upward and increase trading volume. - Historical Performance

Historical data reveals that Bitcoin often begins an upward trend in October, which has become a self-fulfilling expectation for many investors. Each year’s performance builds upon previous October gains, solidifying the “Pumptober” reputation.

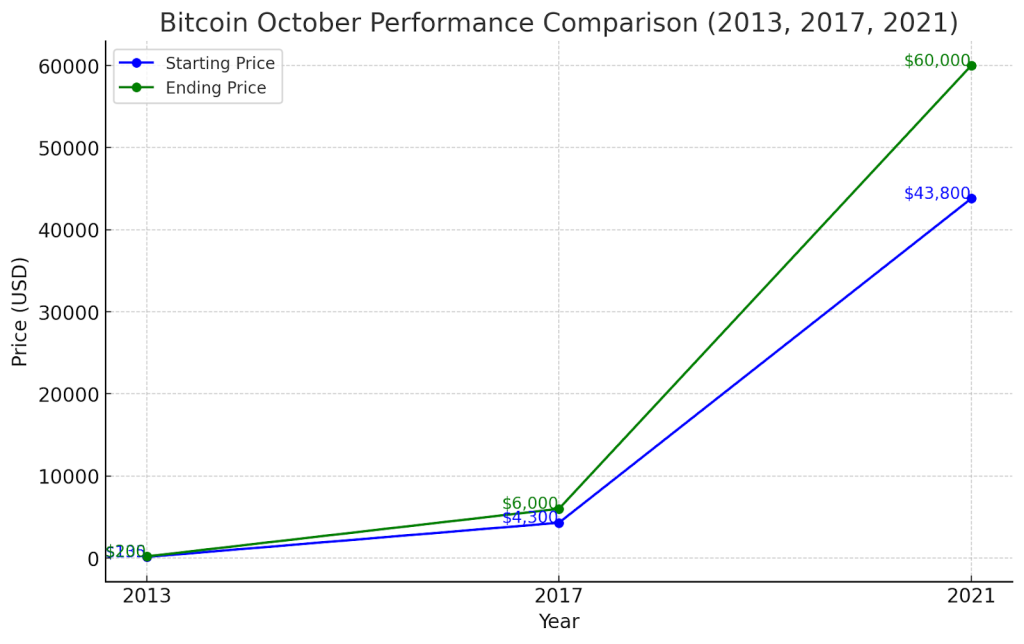

Bitcoin Key October Performance From 2013, 2017, And 2021

Examining some of Bitcoin’s most notable Octobers provides insight into the roots of the Pumptober concept. Here are three years where October delivered standout results:

- 2013

Performance: October 2013 was a breakout month, with Bitcoin’s price jumping from around $135 to nearly $200, marking one of its most significant early gains.

Driving Factors: Increasing awareness of Bitcoin, alongside early institutional interest, helped position it as a credible financial asset. - 2017

Performance: This year was iconic for Bitcoin, with October gains setting the stage for its all-time highs in December. The price rose from about $4,300 at the beginning of October to over $6,000 by month-end.

Driving Factors: Retail interest, major media coverage, and the ICO (Initial Coin Offering) boom contributed significantly to Bitcoin’s rise, establishing a strong foothold for the cryptocurrency in mainstream finance. - 2021

Performance: October 2021 was another powerful month, starting around $43,800 and ending above $60,000. The bullish trend continued into November, with Bitcoin reaching new all-time highs.

Driving Factors: Increased institutional investments, a surge in retail interest, and growth in the DeFi (Decentralized Finance) sector contributed to Bitcoin’s record-breaking performance.

These standout years show how October has consistently sparked Bitcoin’s bullish trends, often leading to higher valuations through the year’s end.

What About Pumptober 2024?

With October 2024 upon us, what can we expect from Bitcoin? The evolving crypto market presents both familiar patterns and new dynamics that could shape this year’s performance.

- Current Market Trends

Following a volatile year, Bitcoin is showing resilience. Growing institutional interest and mainstream adoption, especially with clearer regulatory guidance, could positively influence prices and drive October gains. - Regulatory Developments

Regulatory clarity has been a dominant theme in 2024, with several countries establishing more defined frameworks for cryptocurrency assets. Although new regulations can sometimes introduce uncertainty, stable guidelines ultimately make the crypto market more appealing to institutional investors. - Adoption and Technological Advancements

Bitcoin continues to attract attention as a hedge against inflation and a reliable store of value. Developments in scalability, sustainability, and interoperability with other blockchain networks could further strengthen Bitcoin’s market appeal among both retail and institutional investors. - Market Sentiment

As investors prepare for Q4, sentiment often shifts positively, with many seeking to capitalize on potential year-end gains. This shift could once again favor Bitcoin in October, reinforcing the Pumptober trend.

Start Earning Bitcoin on WEEX Today

Bitcoin (BTC/USDT) is currently trading at approximately $72,420 USD, reflecting a 5.78% increase over the past 24 hours. Earlier today, BTC reached an intraday high of $72,433, indicating strong bullish momentum.

This recent surge is influenced by several factors:

- Political Developments: The upcoming U.S. presidential election has fostered optimism among investors, with both major candidates expressing support for cryptocurrencies, potentially paving the way for a more favorable regulatory environment.

- Institutional Interest: Significant inflows into Bitcoin exchange-traded funds (ETFs) indicate growing institutional adoption, adding substantial liquidity to the market.

To buy Bitcoin on the WEEX exchange, start by creating an account and completing the necessary verification. Once logged in, navigate to the trading section and select the BTC/USDT trading pair. Enter the amount of Bitcoin you wish to purchase, review the transaction details, and confirm your order. WEEX supports various order types, allowing you to choose between market orders for immediate execution or limit orders for targeting specific prices. This flexibility helps you manage your investments effectively.

Recent Popular Blum Codes on WEEX

Crypto Slang Part 1 Blum: A Ultimate Guide to Crypto Slang 2024

How to Find Altcoins with Blum Code: A Step-by-Step Guide

What Are AMMs Blum Code? Current Summary of Blum Daily Codes

Comprehensive Summary of Blum AMMs Codes for October

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: