Tuesday is a pivotal day for the Eigenlayer $EIGEN token, as transfers will officially be enabled. This development opens new opportunities for ecosystem engagement and underscores the necessity of understanding the token’s utility and market dynamics. Below, we delve into key aspects of $EIGEN coin, focusing on its supply dynamics and market implications. Utilizing platforms like WEEX and WE-Launch can empower you to make informed decisions in the cryptocurrency market.

Contents

Eigenlayer Tokenomics — Token Supply Dynamics

At launch, the total supply of $EIGEN coin stands at 1,673,646,668 tokens. The circulating supply at launch is determined through two stakedrop events:

- Stakedrop 1: 6.75%

- Stakedrop 2: 5.2%

This leads to an estimated initial circulating supply of approximately 200,000,776 EIGEN, accounting for around 11.95% of the total supply. However, a deeper analysis reveals a more complex picture regarding the actual floating supply of tokens.

During the first stakedrop, only 85.4% of the tokens were claimed, resulting in approximately 95 million EIGEN being distributed. For the second season, claims are still ongoing, with only 21.7% (around 18.6 million EIGEN) having been claimed at the time of writing. Thus, the total circulating supply currently amounts to around 114 million EIGEN. Additionally, 73 million EIGEN has been restaked via EigenLayer, reducing the actual float to approximately 40.43 million EIGEN.

Chart: $EIGEN Supply Dynamics Overview

| Eigenlayer Metric | Eigenlayer Value |

|---|---|

| Eigenlayer Total Supply | 1,673,646,668 EIGEN |

| Eigenlayer Circulating Supply | 114,000,000 EIGEN |

| Eigenlayer Restaked Tokens | 73,000,000 EIGEN |

| Eigenlayer Actual Float | 40,430,000 EIGEN |

| Eigenlayer Current Price | $3.84 |

| Eigenlayer Market Cap | $155,000,000 |

| Eigenlayer Fully Diluted Valuation | $6,420,000,000 |

| Eigenlayer % of Supply Floating | 2.42% |

Eigenlayer Market Implications

With a pre-market price of $3.84 (according to HyperLiquid), this floating supply translates to a market capitalization of roughly $155 million and a fully diluted valuation (FDV) of about $6.42 billion. Given that only 2.42% of the total supply is currently in circulation, significant price volatility is expected as the market seeks to determine the true value of $EIGEN.

It’s important to note that operator claims will not be active until after October 6th, potentially contributing to the slower claims process. Additionally, the sluggishness may be influenced by tax considerations, as the claim window closes on March 25th of the following year.

Notable Eigenlayer Token Claim and Restking

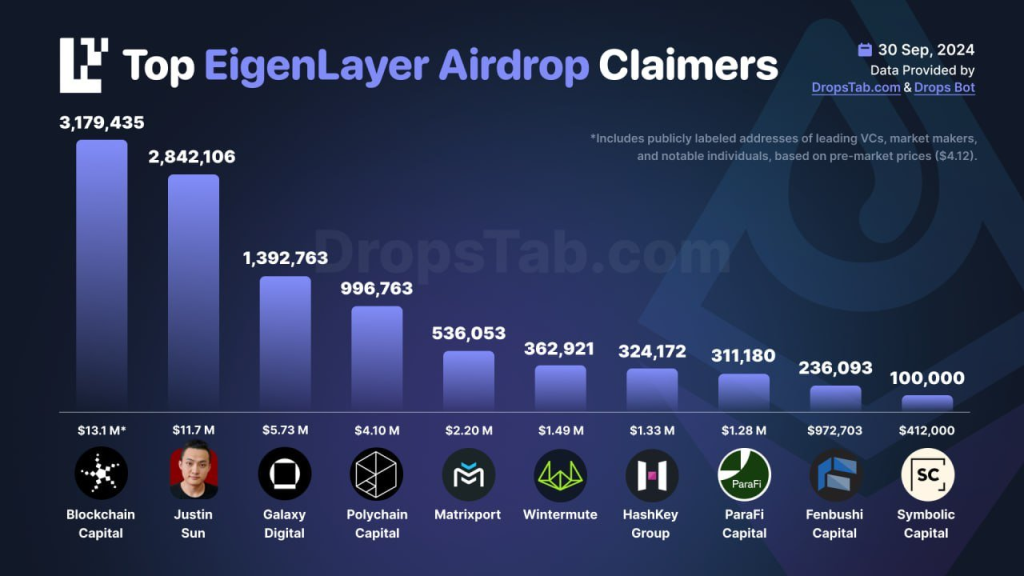

Analyzing data from Dune, we can identify some of the largest claimants of $EIGEN tokens across both stakedrop seasons. While there were minor discrepancies in the data, validation through Etherscan confirmed the validity of these claims. Entity tags for these wallets were derived from a combination of Arkham and Nansen tags, supplemented by tracking the origin of funds.

Given the low float of $EIGEN and the significant stakes held by these wallets, they possess the potential to exert considerable influence on market conditions. It is worth mentioning that several of these wallets have already restaked their tokens, which could further impact supply dynamics.

Future Supply and Unlocking Mechanisms

Crucially, the unlock schedule for $EIGEN tokens will not commence until one year from the upcoming Tuesday. During this interim period, there remains 3% of the total supply to be distributed through Stakedrop 2, along with programmatic incentives that will account for an additional 4% of the total supply during the first year.

As more tokens enter circulation, this will likely coincide with the introduction of enhanced platform functionalities, such as slashing mechanisms and other features. These developments will provide users and market participants with valuable insights into the demand drivers for $EIGEN.

Eigenlayer Futures on WEEX Futures Pro

WEEX is a leading cryptocurrency futures trading platform renowned for its focus on security and user-friendliness. The platform supports various cryptocurrencies, such as: DOGE, XRP, SOL and so on. WEEX Futures Pro will launch EIGENUSDT perpetual futures trading pairs at2024/10/01 8:00 (UTC+0).

Conclusion

As we approach the crucial launch of $EIGEN, understanding the token’s supply dynamics and market conditions becomes vital for ecosystem participants. The interplay of claim rates, market fluctuations, and supply unlocks will shape the future of $EIGEN coin.Keeping an eye on WEEX and WEEX Help, We will continue to monitor developments throughout the week, ensuring you stay well-informed.

Learn more about what is Eigenlayer:

EigenLayer Token Airdrop Date! Analysis of EigenLayer’s Current Valuation and Profit Expectations