The phrase “What Are AMMs Blum Code” gained significant traction on Google, capturing the attention of both the cryptocurrency community and the broader public on September 24, 2024. Blum, a Telegram-based play-to-earn game and hybrid cryptocurrency exchange, aims to combine the advantages of centralized and decentralized platforms. The Blum daily code initiative is promoted as a way to grant users access to exclusive content and attractive prizes through YouTube. In this article, WEEX will guide you through the game’s mechanics and explain the broader factors behind its viral rise.

Contents

What Are AMMs Blum Code?

The truth, however, is much more straightforward. The phrase “AMMs Blum Code” refers to the title of an educational video produced as part of BLUM’s daily promotional strategy, designed to engage users with informative content about cryptocurrency investments. Released on September 24, 2024, the video, titled “What Are AMMs Blum Code,” focused on the risks associated with Automated Market Makers (AMMs), which are vital components of decentralized finance (DeFi).

As part of this initiative, BLUM encourages players to watch educational videos and answer related quiz questions to earn in-game rewards, such as BLUM tokens. The release of this video generated significant interest and speculation online, with many users mistakenly interpreting it as a financial warning or advice. Its viral nature largely stemmed from users searching for help with their quiz answers, combined with the intrigue generated by non-players who noticed the term trending.

Social media discussions further fueled the confusion, leading to a spike in searches related to the phrase. Ultimately, “AMMs Blum Code” serves as a reminder of the importance of understanding cryptocurrency and the dynamics of financial markets.

Current Summary of Blum Daily Code

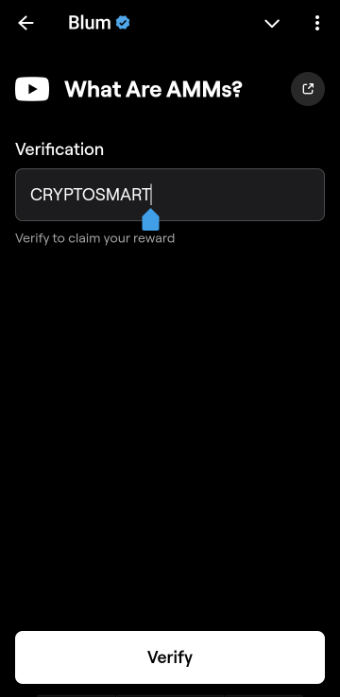

To find the daily secret code, start by navigating to the earn section and clicking on “Navigate Crypto.” Watch the entire YouTube video to uncover the hidden code. Once you locate the code mentioned in the video, click the “verify” button. Enter the secret code and verify it to redeem your Blum points.

| Task | Code |

| What Are AMMs? | CRYPTOSMART |

| Forks Explained code | GO GET |

| Navigating Crypto | HEYBLUM |

| How to Analyze Crypto? | VALUE |

| Secure your Crypto! | BEST PROJECT EVER |

| What are Telegram Mini Apps? | CRYPTOBLUM |

| Say No to Rug Pull! | SUPERBLUM |

| Liquidity Pools Guide | BLUMERSSS |

| $2.5M+ DOGS Airdrop | HAPPYDOGS |

What Does AMMs Stand for?

AMMs, or Automated Market Makers, is a decentralized exchange (DEX) protocol that has transformed asset trading in the cryptocurrency space by using mathematical formulas to price assets. Unlike traditional exchanges, where buyers and sellers directly interact, AMMs rely on liquidity pools, with asset prices automatically determined by predefined algorithms. This approach improves liquidity and removes the need for traditional order books, making decentralized trading more efficient and accessible.

AMMs are a key pillar of the decentralized finance (DeFi) ecosystem, enabling the permissionless and automated trading of digital assets. Users provide tokens to liquidity pools, which can be optimized for various purposes depending on the platform’s goals. Prominent AMM platforms like Uniswap and Balancer demonstrate the growing importance of AMMs as fundamental tools in the DeFi landscape.

What Is the Purpose of AMM?

The purpose of an Automated Market Maker (AMM) is to facilitate decentralized and automated trading of digital assets without the need for a traditional order book or direct interaction between buyers and sellers. AMMs use liquidity pools, where users contribute crypto assets, and asset prices are determined by mathematical algorithms. This system provides several key benefits:

- Increased Liquidity: AMMs ensure there is always liquidity available for trading, even in markets with fewer participants.

- Permissionless Trading: AMMs enable decentralized, trustless transactions without intermediaries, allowing anyone to trade assets without relying on centralized exchanges.

- Simplified Market Making: By automating the pricing of assets through algorithms, AMMs allow for continuous, real-time market making, eliminating the need for traditional market makers.

- Accessibility: AMMs make decentralized finance (DeFi) more accessible, providing users the ability to easily trade and provide liquidity with minimal technical barriers.

Overall, AMMs promote a more efficient, decentralized, and user-friendly trading experience within the cryptocurrency ecosystem.

What is Difference of AMM, CLMM and vAMM?

AMM, CLMM, and vAMM are all different types of market-making mechanisms used in decentralized finance (DeFi) protocols, each with unique characteristics. Here’s how they differ:

1. AMM (Automated Market Maker)

- Overview: AMM is the traditional decentralized exchange (DEX) protocol where assets are traded via liquidity pools, with prices determined by a mathematical formula (e.g., Uniswap uses the formula x * y = k).

- Key Feature: Liquidity providers deposit tokens into pools, and traders can swap tokens using these pools without needing to match with a specific counterparty. The formula ensures that the product of the pool’s token quantities remains constant.

- Strengths:

- Simple and effective.

- Ensures constant liquidity.

- Accessible to both liquidity providers and traders.

- Example: Uniswap, Balancer.

2. CLMM (Concentrated Liquidity Market Maker)

- Overview: CLMM is a more advanced version of AMM that allows liquidity providers to specify a price range in which their capital is allocated, concentrating liquidity within that range to maximize efficiency.

- Key Feature: Liquidity is no longer spread evenly across all price ranges; instead, providers focus on a specific range, optimizing capital efficiency, reducing slippage, and potentially offering higher returns.

- Strengths:

- Better capital efficiency than traditional AMMs.

- Higher returns for liquidity providers when trades occur in their specified range.

- Reduced slippage for traders.

- Example: Uniswap V3.

3. vAMM (Virtual Automated Market Maker)

- Overview: A Virtual AMM functions similarly to a traditional AMM but without the need for actual token swaps. Instead, it simulates liquidity, often used in derivatives trading and perpetual contracts. vAMMs maintain the pricing mechanisms of AMMs but don’t require large capital pools.

- Key Feature: vAMMs are primarily used for synthetic assets or perpetual contracts, where users trade positions (long or short) rather than swapping actual tokens. The virtual nature reduces the need for significant liquidity but can still ensure price discovery via formulas.

- Strengths:

- Efficient for derivative and leverage trading.

- Requires less capital, as it doesn’t involve actual liquidity pools.

- Ideal for synthetic assets and perpetual contracts.

- Example: Perpetual Protocol.

Key Differences:

- AMM: Traditional, uses real liquidity pools, suited for spot trading.

- CLMM: Concentrates liquidity within specific price ranges, optimizing capital efficiency.

- vAMM: Simulates liquidity for derivative products, reducing capital requirements and focusing on leveraged and synthetic trading.

Each of these market-making mechanisms addresses different needs within the DeFi space, from spot trading (AMM and CLMM) to derivatives (vAMM).

Viral Tap-to-Earn Cryptocurrency Initiatives on WEEX

A surge of play-to-earn projects has become increasingly popular since their inception, including Hamster Kombat and Notcoin. As noted earlier, the listing date for Blum is still unknown. In the meantime, consider checking out WEEX to trade other trending play-to-earn projects. You can log in to WEEX now to receive the HMSTR and CATI airdrops!

More Related Articles on WEEX

Blum Coin Price Prediction: Key Insights for Investors After the Blum Coin Listing

Discover Blum Crypto: A Hybrid Exchange Powered by Telegram

How Much Is Hamster Kombat Airdrop Token Worth?

Hamster Kombat Daily Code and HMSTR Token Airdrop for September 24

Find us on:

Twitter | Telegram | Medium | Facebook|LinkedIn|Blog

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]:

CoinMarketCap| Feixiaohao| Cryptowisser.com| Coingecko|Coincarp