Key Takeaways:

- What is Slippage Blum Code video, Answer: CRYPTOBUZZ

- Blum What is Slippage: Slippage occurs when the price changes between order placement and execution, often due to volatility or low liquidity.

- Setting slippage tolerance and trading in liquid markets can help control price execution and minimize unexpected costs.

Slippage is an unavoidable aspect of cryptocurrency trading that can significantly impact the price at which trades are executed, especially in volatile markets. What is Slippage Blum code has brought the importance of understanding slippage to the public. In this article, we dive into the concept of slippage, explaining how it occurs, its impact on both decentralized and centralized exchanges, and how traders can manage or minimize it.

Contents

What is Slippage Blum Video Code Task

Blum Academy released its latest video, “What is Slippage on a DEX? Decentralized Exchange Slippage Explained“ on November 13. What is Slippage Blum code video breaks down slippage in crypto trading on DEXs. It explains how price changes between placing and executing an order can lead to less favorable prices, especially during volatile market conditions. The video covers the main causes, like low liquidity and large trade sizes, helping viewers understand why slippage happens and how to manage it.

What is Slippage Blum Video Code Task:

🎬Video: What is Slippage

✅Blum Code: CRYPTOBUZZ

What is Slippage in Crypto?

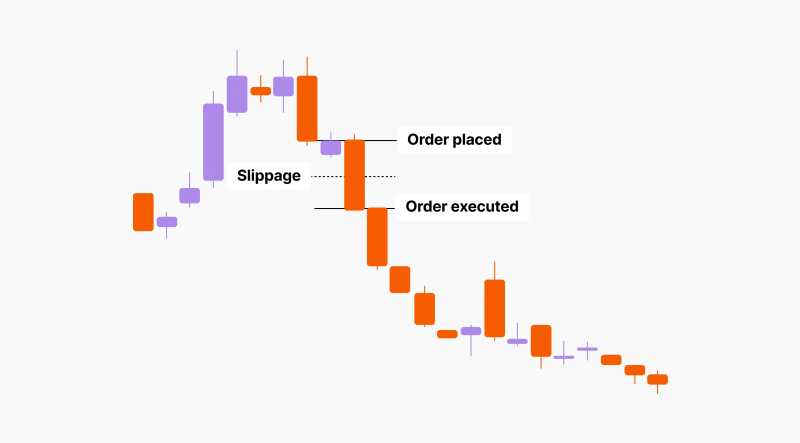

Slippage in crypto refers to the difference between the expected price of a trade and the actual price at which it is executed. This discrepancy arises when the price of an asset fluctuates between the time an order is placed and when it is processed. While slippage is a common phenomenon in traditional markets, it is particularly prevalent in cryptocurrency trading due to the sector’s high volatility and the decentralized nature of exchanges.

For example, if you place an order to buy a cryptocurrency at $100, but by the time the order is filled, the price has risen to $102, the slippage is $2. While slippage is an unavoidable aspect of trading, it is crucial for traders to understand its causes and how to mitigate its impact.

In the crypto market, slippage can be either positive or negative. Positive slippage occurs when a trade is executed at a better price than expected, while negative slippage happens when a trade is executed at a worse price than anticipated. Understanding and managing slippage is vital to minimizing trading costs and optimizing strategies in a fast-moving market.

Why Does Slippage Happen?

Several factors contribute to slippage, particularly in crypto markets:

- Market Volatility: Cryptocurrency markets are known for their extreme volatility, where prices can change rapidly within seconds. When the market is moving quickly, the price of an asset can shift before your order is filled, causing slippage.

- Liquidity Issues: In markets with low liquidity, there may not be enough buy or sell orders at the expected price. If you’re trying to execute a large order on a pair with low volume, the price may adjust as your order fills, leading to slippage.

- Order Size: Large trades, relative to the market size, are more likely to experience slippage. For example, if you’re trying to buy a significant amount of an illiquid asset, the market may not be able to absorb the trade at your intended price.

- Time of Execution: Slippage is also more common in fast-moving markets. The longer your order is open, the more likely the price will change, especially during times of high volatility or news events.

Understanding the Different Types of Slippage in Crypto

There are different types of slippage, categorized by the nature of the order or the timing of the price change.

- Market-Order Slippage:

This occurs when increased market volatility causes the price of an asset to shift while a market order is being executed. During volatile market conditions, prices can change rapidly, leading to slippage as the order fills at a different price than initially expected. - Stop-Loss and Take-Profit Order Slippage:

Slippage can also happen when a stop-loss or take-profit order is triggered, but the price moves so quickly that the execution occurs at a less favorable price. This type of slippage arises when the market fluctuates sharply, and the order is filled at a worse price than planned. - Limit-Order Slippage:

This type of slippage happens when sudden price changes prevent a limit order from being filled at the desired price. A limit order is meant to execute at the set price or better, but if the market moves too quickly, the order might not be filled at the specified price, resulting in slippage. - Weekend Slippage:

Weekend slippage occurs when a position is held over the weekend while the markets are closed. When trading resumes, the market may have adjusted significantly in response to events or news that occurred during the downtime, leading to price changes that cause slippage when the position is reopened or executed. - By understanding these types of slippage—market-order, stop-loss/take-profit, limit-order, and weekend slippage—traders can better manage their strategies and anticipate potential risks in a volatile market.

Slippage on DEXs vs. Centralized Exchanges

Slippage behaves differently on Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs) due to their structural differences. If you’re not familiar with DEXs, you can refer to our previous article, “What’s Crypto DEX Blum Code: What is a Decentralized Exchange (DEX)?”, to to get a complete understanding of how DEXs work:

- On DEXs: Slippage can be more pronounced because DEXs operate without a central authority to match buy and sell orders. Instead, trades occur directly between users (peer-to-peer), with prices determined by the available liquidity in decentralized pools. Low liquidity and large orders on DEXs are particularly prone to causing slippage, especially during periods of high volatility.

- On CEXs: Centralized exchanges, on the other hand, act as intermediaries and maintain a central order book. Liquidity is typically higher on CEXs, which reduces the chances of slippage for smaller orders. However, for larger trades, slippage can still occur, particularly during periods of market volatility.

In summary, slippage tends to be more noticeable on DEXs, where liquidity can vary significantly between trading pairs and market conditions. WEEX and other CEXs usually offer better liquidity, but slippage can still occur, particularly with large orders. WEEX provides strong liquidity across its trading pairs, including BTC/USDT, ETH/USDT, DOGE/USDT, XRP/USDT, and other numerous altcoins, ensuring smooth and efficient order executions. With a robust user base and deep order books, WEEX offers competitive pricing and minimal slippage, making it a reliable platform for both beginners and experienced traders. Whether you’re trading major cryptocurrencies or exploring new altcoins, WEEX’s liquidity helps facilitate quick and seamless transactions.

How to Avoid Slippage in Crypto?

Although slippage is a natural part of trading, there are strategies to minimize its impact:

- Set Slippage Tolerance: Many DEXs and CEXs allow you to set a slippage tolerance, which is the maximum percentage you’re willing to accept for price slippage. If the price moves beyond this threshold, the order won’t execute. Adjusting this setting helps you control how much slippage you’re willing to tolerate during a trade.

- Trade During Low Volatility: Avoid trading during times of extreme market volatility, such as during significant news events or when the market is rapidly changing. Slippage is more common when prices are fluctuating quickly.

- Use Limit Orders: On CEXs, limit orders allow you to specify the exact price at which you want to buy or sell an asset. This can prevent you from accepting a worse price due to slippage, though it may result in your order not being filled if the market price doesn’t reach your limit.

- Choose High Liquidity Pairs: Trading more liquid assets or pairs on both DEXs and CEXs can significantly reduce the risk of slippage. Higher liquidity means there are more buyers and sellers at each price level, making it easier for your order to be filled at the expected price.

- Break Up Large Orders: If you need to execute a large order, consider breaking it into smaller orders to minimize the impact on price. This can help avoid slippage, especially on DEXs with lower liquidity.

Staying Informed: Blum Video Code Updates on WEEX

Understanding Gas Fees Blum Code: What Are Gas Fees?

Node Sales in Crypto Blum Codes: A Beginner’s Guide to Node Sales

Crypto Slang Part 2 Blum Code: Key Crypto Slang You Need to Know

What’s Crypto DEX Blum Code: What is a Decentralized Exchange (DEX)?

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: