Key Highlights:

- Blum video code December 26: “Future of Telegram. Part 1 Blum Code”, Answer: TAPBLUM

- Blum video code December 23-24: “History of Bitcoin Blum Code”, Answer: BIGPIZZA

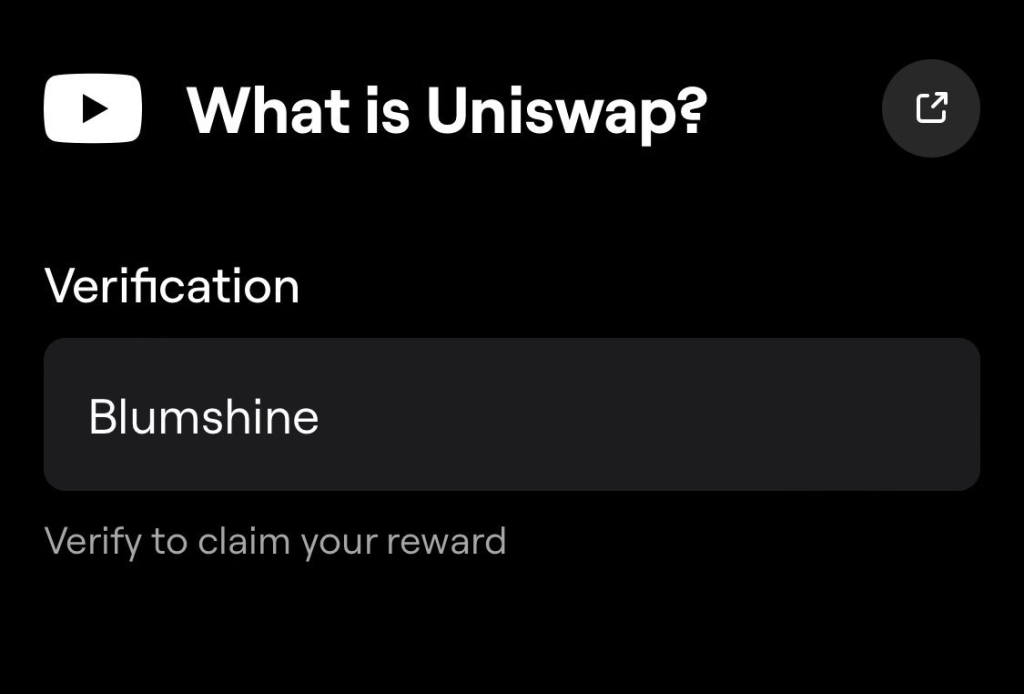

- Blum video code December 21: “What is Uniswap Blum Code”, Answer: BLUMSHINE

- Dec 18 News Blum Code: Mark

- Dec 17 News Blum Code: Kendrick

- Blum All Youtube Video Answers are available on WEEX, as always!

What is Uniswap Blum Code December 21

On December 20, Blum Academy unveiled the video “What is Uniswap? Ethereum DEX Explained”. What is Uniswap Blum video breaks down crypto debit cards—your gateway to turning Bitcoin, Ethereum, or even Doge into real-world spending power!

What is Uniswap Blum Code Task:

🎬Video: What is Uniswap Blum Code

✅Blum Code: BLUMSHIN

Contents

- 1 What Is Uniswap?

- 2 How Does Uniswap Work?

- 3 Uniswap vs. PancakeSwap: A Comparison of Two Leading DEXs

- 4 Advantages and Disadvantages of Uniswap

- 5 How Automated Market Makers (AMMs) Power Seamless Token Swap?

- 6 What is Uniswap Blum Code on WEEX

- 7 Staying Informed: What is Uniswap Blum Code Updates on WEEX

What Is Uniswap?

Uniswap is a leading decentralized exchange (DEX) built on the Ethereum blockchain that allows users to swap ERC-20 tokens directly with one another, bypassing traditional intermediaries. By leveraging an automated market maker (AMM) model, Uniswap enables seamless, permissionless, and decentralized cryptocurrency trading. Unlike centralized exchanges that rely on order books to match buyers and sellers, Uniswap uses liquidity pools, where users can provide liquidity and facilitate trades.

The platform is governed by the UNI token, which empowers its holders to vote on key protocol upgrades and changes, ensuring community-driven development. Since its launch, Uniswap has become the largest DEX on the Ethereum network, and its native governance token, UNI, has become one of the top cryptocurrencies by market capitalization.

Uniswap’s open-source nature means anyone can view, contribute to, or fork its code, making it a transparent and accessible platform for crypto enthusiasts and developers alike. As of April 2021, UNI’s market cap reached over $18 billion, cementing Uniswap’s position as a dominant player in the decentralized finance (DeFi) space.

How Does Uniswap Work?

Uniswap operates on a simple yet powerful concept—liquidity pools and smart contracts. Unlike traditional exchanges, which use order books to match buyers and sellers, Uniswap allows anyone to become a liquidity provider (LP) and deposit tokens into liquidity pools. These pools automatically determine the price of tokens based on supply and demand, and users can swap tokens directly from these pools.

Here’s a step-by-step breakdown of how Uniswap works:

- Liquidity Providers (LPs) deposit equal amounts of two tokens (e.g., ETH and DAI) into a pool.

- Traders can then swap one token for another, using the liquidity in the pool.

- Smart contracts execute the trades, ensuring that the price is set based on the ratio of tokens in the pool.

- LPs earn fees as a reward for providing liquidity, which is distributed based on the proportion of the pool they own.

This AMM model allows for token swaps without relying on centralized order books or market makers.

Uniswap vs. PancakeSwap: A Comparison of Two Leading DEXs

Both Uniswap and PancakeSwap are popular decentralized exchanges, but they differ in significant ways.

- Uniswap:

- Operates on the Ethereum blockchain.

- Supports ERC-20 tokens, the standard for Ethereum-based assets.

- Users pay gas fees for each transaction, which can be high depending on network congestion.

- PancakeSwap:

- Built on the Binance Smart Chain (BSC), a faster and cheaper blockchain.

- Offers lower transaction fees and faster swaps compared to Uniswap.

- Primarily supports BEP-20 tokens, which are the standard for BSC assets.

In summary, Uniswap excels in the Ethereum ecosystem but suffers from high gas fees, while PancakeSwap is a more affordable and faster option, especially for users who prefer the Binance Smart Chain.

Advantages and Disadvantages of Uniswap

Advantages of Uniswap:

- Decentralization and Security: Uniswap operates without a central authority, providing users with greater control over their funds.

- Liquidity Pools: Users can participate in liquidity pools and earn rewards through transaction fees.

- Large Ecosystem: Uniswap is one of the most widely used DEXs, with a broad range of tokens available for trade.

Disadvantages of Uniswap:

- High Gas Fees: Because it operates on the Ethereum blockchain, users often face high transaction fees during periods of congestion.

- Limited Token Support: Uniswap primarily supports ERC-20 tokens, which means that other tokens on different blockchains are not natively supported.

- Impermanent Loss for Liquidity Providers: LPs can suffer from impermanent loss if the price of the tokens in their liquidity pool changes significantly.

How Automated Market Makers (AMMs) Power Seamless Token Swap?

At the heart of Uniswap’s success is the Automated Market Maker (AMM) model. Unlike traditional exchanges that rely on order books to match buyers and sellers, AMMs use liquidity pools to enable token swaps. When a user wants to swap one token for another, they interact with a smart contract that executes the trade based on the current price determined by the liquidity pool.

AMMs are powered by algorithms that determine the price of tokens based on the ratio of tokens in the liquidity pool. As users trade, the pool’s ratio changes, which in turn adjusts the price. This system eliminates the need for an order book and allows for continuous, decentralized trading.

AMMs also allow liquidity providers to earn a share of the transaction fees, creating an incentive for users to contribute to the liquidity pools and support the platform’s overall efficiency.

What is Uniswap Blum Code on WEEX

WEEX is gaining recognition as an excellent crypto exchange for beginners due to its user-friendly platform, security measures, and extensive educational resources. Whether you’re a beginner or a seasoned trader, WEEX offers a seamless trading experience with support for various cryptocurrencies, including BTCUSDT, ETH/USDT, DOGE/USDT, XRP/USDT, WXT/USDT SOL/USDT and other numerous altcoins. Beyond trading, WEEX is dedicated to educating its users, making it a trusted resource for those looking to stay informed in the fast-paced world of crypto.

Staying Informed: What is Uniswap Blum Code Updates on WEEX

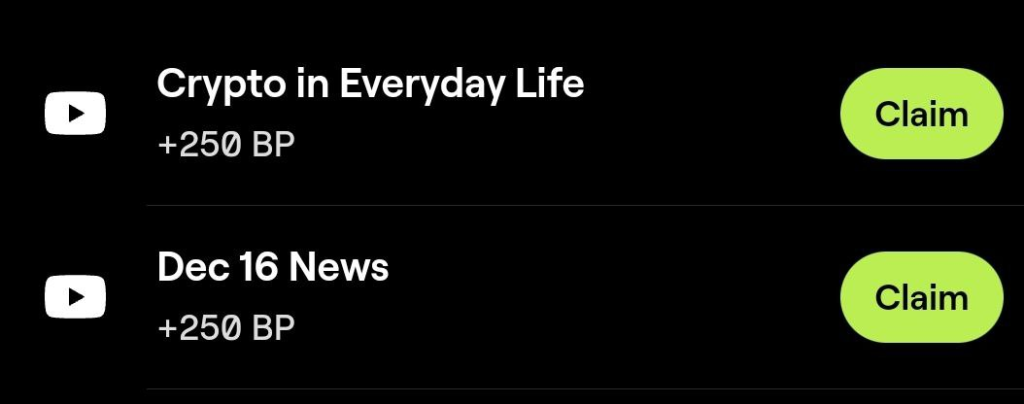

Crypto in Everyday Life Blum Code 17 December: What are Crypto Debit Cards?

Crypto Slang. Part 5 Blum Code 18-19 December: Shilling, Normies, NGMI & WAGMI Explained

Blum CMO @ Blockchain Life Blum Code: Blockchain Life in 2024

All Blum Verify Code Summary: DEX History #3 Blum Code December 12-13 Updated