Key Takeaways:

- Blum video code task November 10-11 : What’s Crypto DEX. Answer: DEXXX

- Previously, WEEX has provided detailed explanations on DeFi, AMMs, and how to choose a crypto exchange, offering a comprehensive understanding of both DeFi vs CeFi and DEX vs CEX.

- Most DEXs were initially launched on Ethereum but have since expanded to multiple blockchains, including Avalanche, Arbitrum, Optimism, and Polygon, a trend that can be observed through on-chain analysis.

DEXs, or decentralized exchanges, enable direct cryptocurrency trading on platforms where users can trade without central control. WEEX is dedicated to providing educational guides for crypto users and enthusiasts, and we will continue to update the Blum Daily Code, offering deeper insights into the latest Blum code, including “What’s Crypto DEX”.

Contents

- 1 What’s Crypto DEX Blum Code November 8

- 2 The Rise History of Decentralized Exchanges

- 3 What’s Crypto DEX (Decentralized Exchange)?

- 4 How Does a Crypto DEX Work?

- 5 CEX vs DEX: Key Differences Between Crypto Exchanges

- 6 Begin Your Crypto Journey on WEEX

- 7 What’s Crypto DEX Blum Code Updates on WEEX

- 8 Find us on:

What’s Crypto DEX Blum Code November 8

On November 8, Blum released the Blum code video, “What is a Crypto DEX? Decentralized Exchanges Made Simple“. What’s Crypto DEX video delves into the world of Decentralized Exchanges (DEXs), where you can trade cryptocurrencies without intermediaries, without sharing personal information, and with complete control over your assets.

What’s Crypto DEX Blum Code Task:

Video: What’s Crypto DEX

Blum Code: DEXXX

The Rise History of Decentralized Exchanges

Cryptocurrency trading began in 2009, exclusively through centralized exchanges (CEXs), with the first decentralized exchange (DEX) emerging in 2014. However, DEXs saw limited use during their early years.

The popularity of DEXs skyrocketed between 2017 and 2018 amid the ICO boom, which brought thousands of new tokens to market. Many of these tokens were primarily traded on DEXs, as the process for listing on CEXs was often cumbersome and selective.

The collapse of major centralized exchanges, such as FTX, in 2022, led to a wave of distrust and significant capital withdrawals from CEXs. Meanwhile, DEXs experienced a surge in trading activity, a rise in liquidity pool providers, and a boom in yield farming.

By 2024, the DeFi market entered a new phase, showing signs of recovery and a shift toward a more stable and efficient ecosystem. Institutional interest in crypto assets, particularly Bitcoin ETFs, is on the rise.

DeFi investors are now focused on safer, more predictable investments. According to recent data, 75% of funds locked in DeFi are in low-APY pools (0-5%), emphasizing a desire for stability. The Total Value Locked (TVL) in DeFi has grown from $26.5 billion in 2023 to $59.7 billion in 2024, reflecting a resurgence of confidence in the sector.

What’s Crypto DEX (Decentralized Exchange)?

A Decentralized Exchange (DEX) is a platform that allows users to trade cryptocurrencies directly with one another, using blockchain technology and smart contracts instead of a central authority. Unlike centralized exchanges (CEXs), DEXs don’t control users’ funds. Trades occur directly from the user’s wallet, providing greater privacy and security.

DEXs don’t require KYC verification, enabling fully private transactions. Users typically access these platforms via web browsers or smartphone apps. As of early 2023, nearly 300 decentralized exchanges operate across multiple blockchain networks, according to CoinMarketCap.

The core purpose of a DEX is to offer peer-to-peer (P2P) trading, removing the need for a central authority. By using publicly accessible and immutable smart contracts, DEXs give users more autonomy, transparency, and control over their assets.

How Does a Crypto DEX Work?

A crypto DEX functions through a decentralized network of nodes that communicate and execute transactions without a central governing body. Here’s a breakdown of how it works:

- Order Book or Automated Market Makers (AMMs):

- Order Books: Some DEXs operate similarly to centralized exchanges, where users can post buy or sell orders. These orders are matched when they meet at a certain price.

- AMMs: Most DEXs, however, use automated market makers (AMMs). In this system, users don’t need to wait for an order to match. Instead, they can trade directly with a liquidity pool, which contains reserves of different cryptocurrencies. These pools are funded by liquidity providers (LPs) who earn a share of transaction fees in return.

- Smart Contracts: Smart contracts automatically execute trades once certain conditions are met, removing the need for intermediaries. These contracts are publicly viewable and stored on the blockchain, ensuring transparency and security.

- Liquidity Pools: DEXs rely on liquidity pools, where users deposit cryptocurrency to create markets. This allows other traders to swap assets without needing a buyer or seller to be present. The liquidity provider earns a portion of the trading fees based on their contribution to the pool.

- Security and Privacy: With no central authority holding funds, users maintain full control of their assets throughout the trading process. DEXs are generally considered more secure because they are less vulnerable to hacking compared to centralized platforms.

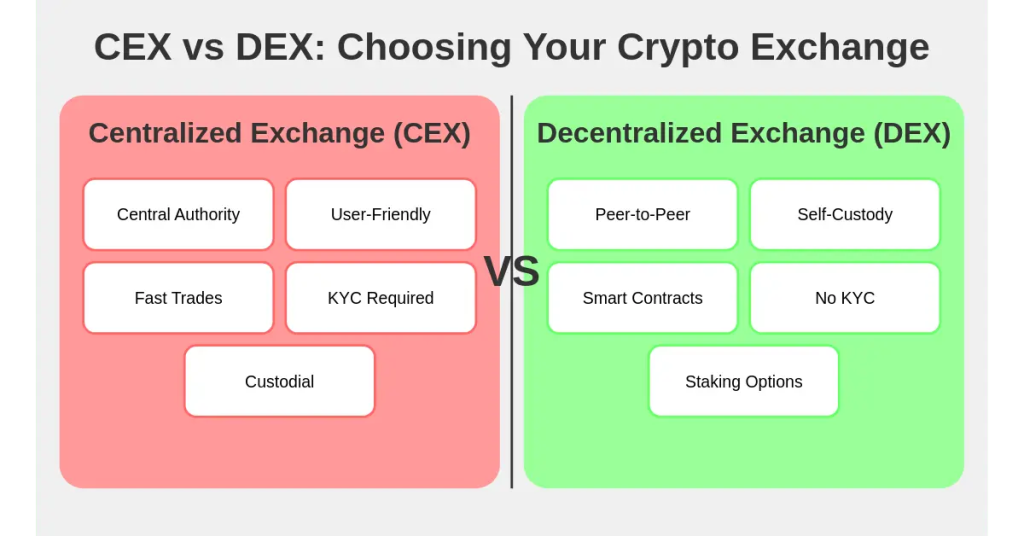

CEX vs DEX: Key Differences Between Crypto Exchanges

1. Centralization:

- CEX: Centralized exchanges are governed by a single entity, which holds control over user funds and the trading process.

- DEX: Decentralized exchanges have no central authority. Instead, they are powered by smart contracts and operate on a peer-to-peer basis.

2. Security:

- CEX: Centralized exchanges are often targets for hackers since they store user funds in centralized wallets. A successful hack can result in significant losses for users.

- DEX: DEXs are generally more secure in terms of custody since users maintain control over their funds. However, smart contract vulnerabilities can still pose risks.

3. Privacy:

- CEX: Users must go through Know Your Customer (KYC) verification processes on most centralized exchanges, which requires submitting personal information.

- DEX: DEXs allow for anonymous trading, as no personal information is required to access the platform.

4. Control Over Funds:

- CEX: When using a CEX, users must deposit their funds into the exchange, giving the platform control over the assets.

- DEX: On a DEX, users retain full control of their funds at all times, as they trade directly from their wallets.

5. Liquidity:

- CEX: Centralized exchanges generally offer better liquidity, allowing for faster and larger transactions with minimal slippage.

- DEX: While DEXs are improving, they may still struggle with liquidity, especially for newer or less-traded assets.

6. Fees:

- CEX: Centralized exchanges charge fees on trades, withdrawals, and sometimes for accessing certain features.

- DEX: DEXs generally have lower fees, though users must also account for gas fees when transacting on certain blockchains.

7. Speed:

- CEX: Trades on centralized exchanges are often faster because they don’t require the same blockchain confirmations as DEXs.

- DEX: Transaction speed can vary depending on the blockchain, and network congestion can slow down the process.

Begin Your Crypto Journey on WEEX

WEEX is gaining recognition as an excellent crypto exchange for beginners due to its user-friendly platform, security measures, and extensive educational resources. Whether you’re a beginner or a seasoned trader, WEEX offers a seamless trading experience with support for various cryptocurrencies, including BTC/USDT, ETH/USDT, DOGE/USDT, XRP/USDT, WXT/USDT SOL/USDT and other numerous altcoins. Beyond trading, WEEX is dedicated to educating its users, making it a trusted resource for those looking to stay informed in the fast-paced world of crypto.

What’s Crypto DEX Blum Code Updates on WEEX

Node Sales in Crypto Blum Codes: A Beginner’s Guide to Node Sales

Crypto Slang Part 2 Blum Code: Key Crypto Slang You Need to Know

DeFi Risks Key Insights Blum: Navigating the Benefits, Risks, and Challenges of DeFi

Pumptober Special Blum Code: Bitcoin Price Prediction From Pumptober to November

Find us on:

Sign up for a WEEX account now: https://www.weex.com/register

[Supported Platforms]: