The cryptocurrency market has faced a sharp downturn, leaving many to ask, “Why did crypto crash today?” and “Why is crypto down today?” If you’re wondering why the crypto market is experiencing such turbulence, you’re not alone. This article explores the key factors driving today’s market crash and offers insight into why the crypto market is in turmoil.

Contents

Bitcoin’s Sudden Reversal from an All-Time High

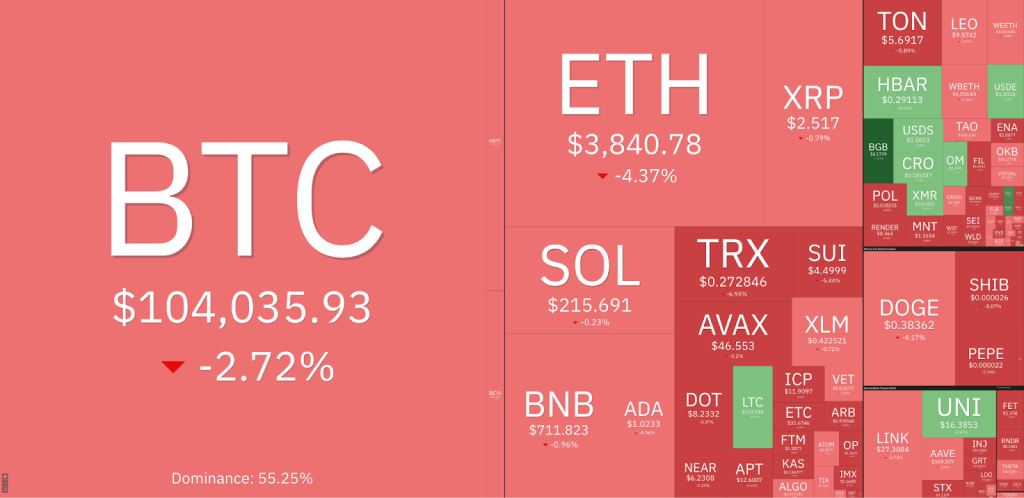

The crypto market crash today can largely be attributed to Bitcoin’s dramatic drop from its all-time high. On December 17, Bitcoin soared to $108,364 on Bitstamp. However, within hours, Bitcoin’s price plunged by over 5%, reaching a low of $103,173 by December 18. This swift decline triggered panic selling across the market, leading many to wonder, “Why did crypto crash today?”

Bitcoin’s correction sparked a broader market downturn, as other cryptocurrencies followed suit. Investor sentiment, which had been highly optimistic during Bitcoin’s recent rally, shifted quickly. Many overleveraged traders found themselves on the losing end of the trade, causing the crypto market to crash today. This sell-off has resulted in significant losses across the market, contributing to the sharp downturn.

Jerome Powell’s Speech and Its Impact on Crypto

A major factor behind the crypto crashing today is the recent speech by Federal Reserve Chairman Jerome Powell. Powell announced a 0.25% interest rate cut, lowering the federal funds rate to 4.5%. While rate cuts generally signal a more accommodative economic environment, Powell’s comments about the ongoing economic uncertainty triggered concerns in the market.

Bitcoin, the leading cryptocurrency, saw a sharp drop of more than 5%, with altcoins experiencing even steeper declines. Powell’s cautious tone about future rate cuts and economic growth has caused investor confidence to waver. Many are now asking, “Why did the crypto market crash today?” The answer lies in Powell’s mixed signals, which created a sense of uncertainty and instability, contributing to the market’s downturn.

Panic Selling and Market Volatility

The crypto market crash today is also a result of the market’s notorious volatility. Bitcoin’s rapid decline sparked a wave of panic selling among investors, which amplified the market downturn. When Bitcoin and other cryptocurrencies fall sharply, traders often sell off their holdings to limit losses, triggering even more sell-offs.

This emotional reaction to market declines is a hallmark of the cryptocurrency space, where sharp price fluctuations are common. The fear and uncertainty caused by Bitcoin’s drop led to widespread liquidation, exacerbating the crypto crashing today. As investors rushed to minimize losses, the market spiraled further down, reinforcing the broader market decline.

The Fed’s Rate Cut: A Double-Edged Sword

The Federal Reserve’s decision to cut interest rates by 0.25% on December 18 was aimed at supporting the economy. However, this decision, coupled with Powell’s cautious remarks, has had an unexpected effect on the crypto market crash today. While rate cuts generally help boost market sentiment, Powell emphasized that future cuts would depend on economic data and inflation trends. This uncertainty about future economic conditions has created doubt, which is reflected in the sharp decline in both traditional markets and cryptocurrencies.

In the aftermath of the Fed’s announcement, the crypto market crashed today as investors grew wary of the Fed’s future actions and the broader economic outlook. Powell’s mixed message about the health of the economy introduced volatility, making investors uneasy about holding riskier assets like cryptocurrencies.

Altcoins Take a Hit

The crypto market crash today wasn’t limited to Bitcoin. Altcoins, also, have faced significant losses. Ethereum (ETH/USDT) dropped more than 4.7%, XRP fell by 6.8%, and Dogecoin (DOGE/USDT) saw a 6.2% decline. Even large-cap assets like Cardano (ADA/USDT) and Solana (SOL/USDT) experienced losses of over 4%.

The altcoin market has been particularly vulnerable to the crypto market crash today due to its close correlation with Bitcoin. When Bitcoin prices tumble, altcoins often follow, amplifying the declines across the broader crypto market. The overleveraged positions in the altcoin space, combined with the uncertain macroeconomic environment, have contributed to the steep losses seen today.

What’s Next for the Crypto Market?

As the crypto market crashes today, many investors are left wondering what comes next. The outlook for cryptocurrencies will largely depend on the trajectory of inflation and future actions by the Federal Reserve. If the Fed continues with rate cuts but inflation remains a concern, the market may face more volatility in the coming months.

For now, investors should brace for more corrections and heightened volatility. The crypto market crash today serves as a reminder of the unpredictable nature of digital assets and their sensitivity to broader economic factors. Given the uncertainty surrounding inflation, interest rates, and market sentiment, it’s likely that further fluctuations will continue to shape the future of the crypto market.

Conclusion: Why Is Crypto Down Today?

In summary, the crypto market crash today is the result of a confluence of factors: Bitcoin’s sharp correction, uncertainty surrounding the Federal Reserve’s monetary policy, panic selling, and the broader market’s volatility. The decision by the Fed to cut rates, combined with Powell’s cautious stance on future rate cuts, has created an environment of uncertainty, causing investors to pull back.

As for why crypto is down today, the market’s overleveraged positions and emotional reactions to price declines have contributed to the sell-off. The crypto market crashing today highlights the fragility of the market and the unpredictable nature of digital asset prices in the face of global economic uncertainty.

With inflation concerns and regulatory issues still looming, investors should remain vigilant as the market adjusts to these evolving conditions. The road ahead for cryptocurrencies may be turbulent, but understanding the factors driving the crypto market crash today is the first step in navigating this volatile landscape.