There’s arguably no hotter cryptocurrency on the planet right now than Aegis YUSD. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing stablecoin. Aegis YUSD, or YUSD, has been making waves in the crypto community with its unique approach to maintaining a stable price while offering yield to its holders. As a seasoned investor in the crypto market, I’ve been closely following YUSD’s journey and its potential for future growth.

Trade YUSD USDT on WEEX.

Contents

What Makes Aegis YUSD Unique?

Aegis YUSD is a decentralized, Bitcoin-backed stablecoin designed to hold a 1:1 peg to the US dollar while generating yield for its holders. Unlike traditional stablecoins that rely on fiat reserves or centralized issuers, YUSD operates on a fully transparent, delta-neutral model that eliminates counterparty risk. This model uses Bitcoin-margined perpetual contracts to counterbalance BTC price fluctuations, ensuring that the value of YUSD remains stable at $1, independent of market volatility.

One of the key aspects to consider is the transparency and security of Aegis YUSD. The protocol offers real-time proof-of-reserves, allowing anyone to verify the collateral backing YUSD on-chain. This level of transparency is a game-changer in the world of stablecoins, as it removes the need for traditional financial intermediaries, making YUSD a censorship-resistant and DeFi-native stablecoin.

The Recent Price Drop: What Happened?

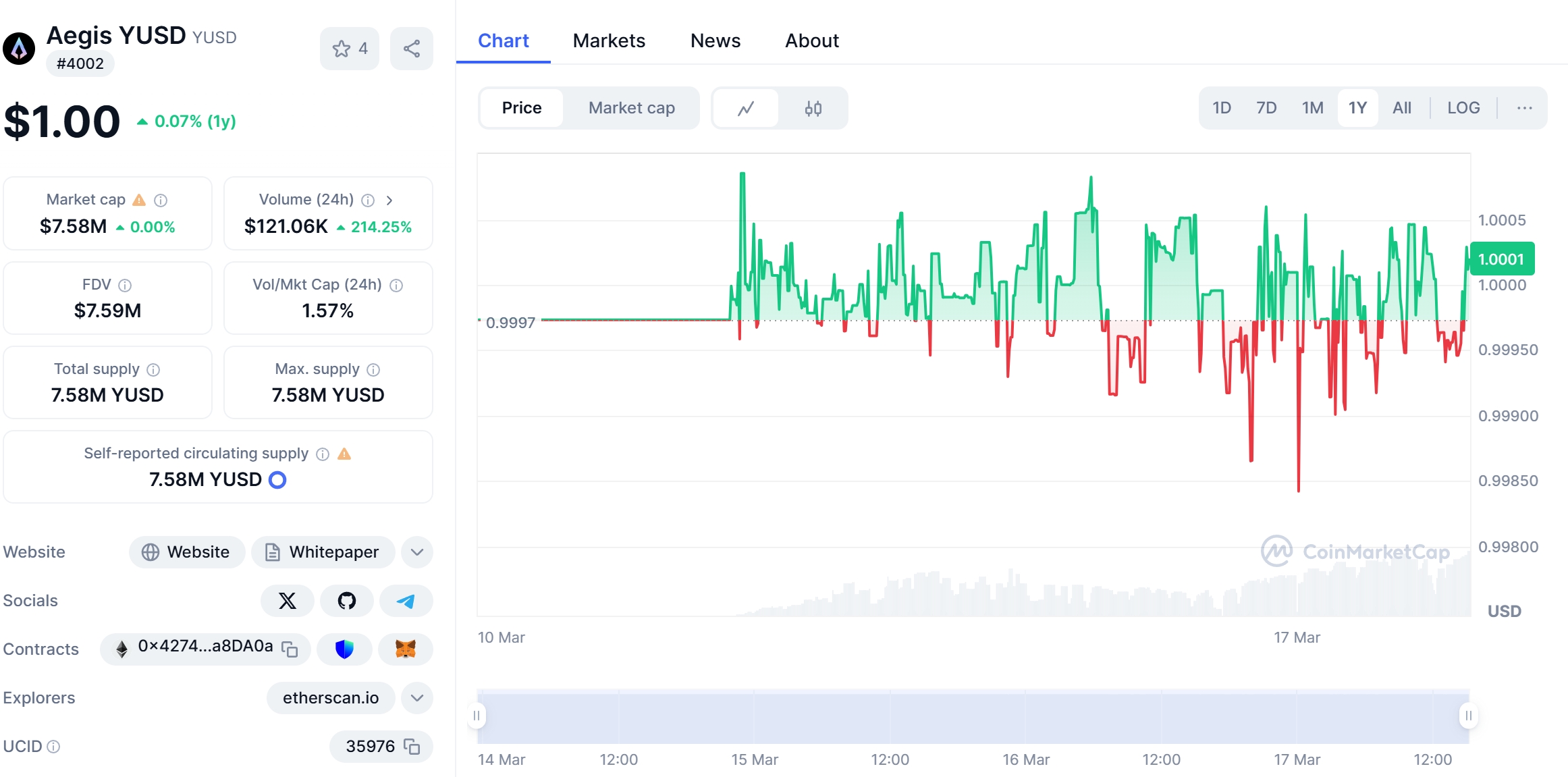

Aegis YUSD experienced a minor dip from $1.00 to $0.9987, which might seem insignificant but is noteworthy for a stablecoin. To understand this drop, let’s compare YUSD’s trend to Ethereum, which experienced a similar price movement in the past. Ethereum saw a significant drop in early 2024 due to regulatory concerns and market corrections, but it managed to recover thanks to its strong fundamentals and growing adoption in DeFi.

The recent dip in YUSD’s price can be attributed to a temporary imbalance in the market, as the demand for stablecoins fluctuated. However, with its robust backing and transparent model, YUSD quickly regained its peg to the dollar. This resilience showcases the strength of its design and the confidence investors have in its stability.

Lessons From Ethereum: Could YUSD Follow a Similar Path?

Ethereum’s recovery was driven by several factors, including increased institutional adoption, the growth of DeFi, and the anticipation of Ethereum 2.0. While YUSD operates in a different sector, it shares similarities with Ethereum in terms of its decentralized nature and potential for growth in DeFi. YUSD’s unique yield-generating mechanism sets it apart from other stablecoins, which could lead to increased adoption and demand in the future.

As a crypto beginner, you might wonder if YUSD could follow a similar recovery path to Ethereum. Given its strong fundamentals and the growing interest in yield-generating stablecoins, I believe YUSD has the potential to not only recover but also surge in value. The key will be its ability to maintain its peg and continue providing attractive yields to its holders.

When it comes to investing in YUSD, it’s essential to understand its volatility and how to navigate it. While YUSD is designed to be a stablecoin, it’s not immune to market fluctuations. However, its delta-neutral strategy helps mitigate these risks, making it a more attractive option for investors looking for stability and yield.

To make the most of your investment in YUSD, consider the following strategies:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. While YUSD offers stability and yield, diversifying your investments across different cryptocurrencies can help manage risk.

- Stay Informed: Keep an eye on market trends and news that could impact YUSD’s price. Understanding the factors that drive its value can help you make informed decisions.

- Utilize Technical Analysis: Use tools like RSI, MACD, Bollinger Bands, moving averages, and Fibonacci retracements to analyze YUSD’s price trends. These indicators can provide valuable insights into potential price movements.

Long and Short-Term Predictions

Looking ahead, the future looks bright for Aegis YUSD. In the short term, I expect YUSD to maintain its peg and continue offering attractive yields to its holders. The growing interest in DeFi and the need for stablecoins that can generate yield will likely drive demand for YUSD.

In the long term, I believe YUSD has the potential to surge in value. As more investors recognize the benefits of its unique model, we could see increased adoption and a corresponding increase in price. By 2030, I predict YUSD could reach $1.10, and by 2040, it might even hit $1.20, driven by its utility in the DeFi ecosystem and its ability to provide consistent yields.

The Role of WEEX in Your YUSD Journey

As you embark on your journey with Aegis YUSD, consider using the WEEX platform to trade and manage your investments. WEEX offers a user-friendly interface, competitive fees, and a wide range of trading pairs, making it an ideal choice for crypto beginners. By leveraging the power of WEEX, you can maximize your potential returns and navigate the exciting world of cryptocurrencies with confidence.

In conclusion, Aegis YUSD is a promising stablecoin that offers stability, transparency, and yield. Its recent price drop is a minor hiccup in its journey, and with its strong fundamentals and growing adoption, I believe YUSD has the potential to surge in value. As a crypto beginner, you can take advantage of this opportunity by staying informed, diversifying your portfolio, and using platforms like WEEX to manage your investments. The future of YUSD looks bright, and I’m excited to see where it goes from here.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.