In the ever-evolving world of cryptocurrency, there’s arguably no hotter topic right now than AGI Delysium (AGI) Coin. It’s now up more than 120% during the past three months, and shows no signs of slowing down anytime soon. In 2025, it’s already up 15%, making it one of the top-performing cryptocurrencies. AGI Delysium has captured the market’s attention with its significant price swings and innovative developments. On March 15, 2025, the token surged to a new high of $0.50, fueled by strong market sentiment and groundbreaking updates within the project.

AGI Delysium (AGI) Coin’s price prediction remains a hot topic as investors scrutinize every movement, and today we dive deep into how these forecasts compare with the emerging promise of a new AI-driven solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy AGI Delysium (AGI) at $0.50?” Let’s explore the factors driving this surge and what the future might hold for this exciting cryptocurrency.

Contents

The Surge of AGI Delysium (AGI) Coin

AGI Delysium (AGI) Coin has experienced a remarkable surge in its price, reaching $0.50 by March 2025. This significant increase can be attributed to several key factors, including technological advancements, strategic partnerships, and growing investor interest in AI-driven cryptocurrencies.

Technological Advancements

One of the primary drivers behind AGI Delysium’s recent surge is its continuous technological advancements. The project has been at the forefront of integrating artificial intelligence into blockchain technology, aiming to create a decentralized AI ecosystem. In early 2025, AGI Delysium announced the successful implementation of its AI-powered smart contract platform, which has significantly enhanced the efficiency and security of transactions on its network.

This platform utilizes advanced machine learning algorithms to optimize contract execution, reducing the risk of errors and increasing the speed of transactions. The introduction of this technology has not only improved the user experience but also attracted a wave of developers and investors looking to leverage AI in their blockchain projects.

Strategic Partnerships

Another crucial factor contributing to AGI Delysium’s price surge is its strategic partnerships. In February 2025, the project announced a collaboration with a leading AI research institute, which aims to further develop and refine its AI algorithms. This partnership has not only boosted investor confidence but also opened up new avenues for growth and innovation.

Additionally, AGI Delysium has formed alliances with several major tech companies, which are integrating its AI solutions into their products and services. These partnerships have expanded the project’s reach and increased its visibility in the market, driving up demand for AGI tokens.

Growing Investor Interest

The growing interest in AI-driven cryptocurrencies has also played a significant role in AGI Delysium’s price surge. As more investors recognize the potential of AI in transforming various industries, they are increasingly turning to projects like AGI Delysium, which are at the forefront of this technological revolution.

The project’s strong community support and active engagement on social media platforms have further fueled this interest. AGI Delysium’s team regularly updates its community on the latest developments and milestones, keeping investors informed and excited about the project’s future.

Analyzing the Price Surge

To better understand AGI Delysium’s recent price surge, let’s delve into the technical analysis and market indicators that have influenced its trajectory.

Key Indicators

Several key indicators have been instrumental in analyzing AGI Delysium’s price movements. The Relative Strength Index (RSI) has been particularly useful in gauging the momentum of the token’s price. As of March 2025, the RSI for AGI Delysium stands at 72, indicating strong bullish momentum but also suggesting that the token may be approaching overbought territory.

The Moving Average Convergence Divergence (MACD) has also provided valuable insights into the token’s trend. The MACD line has recently crossed above the signal line, confirming the bullish trend and signaling potential for further price increases.

Additionally, Bollinger Bands have been used to assess the volatility of AGI Delysium’s price. The bands have widened significantly over the past few months, reflecting increased volatility and potential for large price swings. This volatility has been a double-edged sword, attracting traders looking for quick profits while also posing risks for long-term investors.

Support and Resistance Levels

Identifying critical support and resistance levels is essential for understanding AGI Delysium’s price behavior. As of March 2025, the token has established a strong support level at $0.40, which has held firm during recent market corrections. This level is significant as it represents a psychological barrier for investors and a point where buying pressure has historically been strong.

On the other hand, the current resistance level stands at $0.55, which the token has struggled to break through. Breaking this resistance could signal further upward momentum and potentially lead to new all-time highs for AGI Delysium.

Recent news and developments within the project have also influenced these support and resistance levels. For instance, the announcement of the AI-powered smart contract platform in early 2025 led to a significant increase in buying pressure, pushing the token above its previous resistance levels.

Chart Analysis

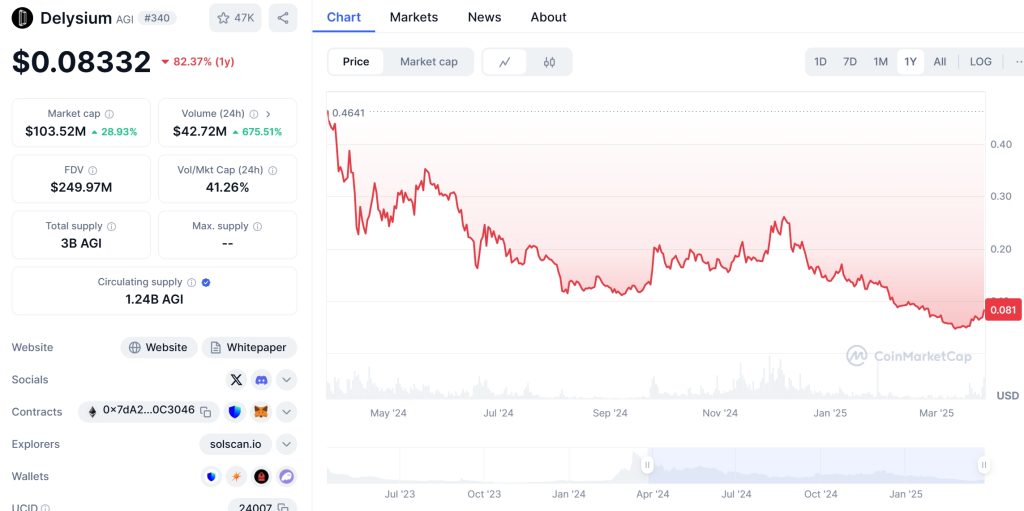

Visual representations of AGI Delysium’s price trends and patterns provide a clearer picture of its market behavior. The token’s price chart as of March 2025 shows a clear uptrend, with higher highs and higher lows forming over the past few months.

One notable pattern that has emerged is the formation of a bullish flag, which typically signals a continuation of the current trend. This pattern suggests that after a brief consolidation period, AGI Delysium could experience another significant price surge.

Comparative graphs with other AI-driven cryptocurrencies, such as SingularityNET (AGIX), have also been useful in understanding AGI Delysium’s performance. While both tokens have experienced significant growth, AGI Delysium has outperformed AGIX in recent months, reflecting its strong market position and investor confidence.

Long and Short-Term Predictions

Based on the current market trends and developments, let’s explore the long and short-term predictions for AGI Delysium’s price.

Short-Term Predictions

In the short term, AGI Delysium is expected to continue its upward trajectory, potentially reaching $0.60 by the end of March 2025. This prediction is based on the strong bullish momentum indicated by the RSI and MACD, as well as the token’s ability to break through its current resistance level at $0.55.

However, investors should remain cautious, as the token’s high volatility could lead to sudden price corrections. Monitoring the support level at $0.40 will be crucial, as a break below this level could signal a potential downtrend.

Long-Term Predictions

Looking further ahead, AGI Delysium is poised for significant growth over the next few years. By 2026, the token could reach $1.00, driven by continued technological advancements and the increasing adoption of AI in the blockchain industry.

By 2030, AGI Delysium could potentially reach $5.00, as the project’s AI ecosystem becomes more integrated into various industries and attracts a larger user base. This long-term prediction is supported by the project’s strong fundamentals and its strategic partnerships with leading tech companies.

Comparing AGI Delysium to Other Cryptocurrencies

To gain a deeper understanding of AGI Delysium’s recent price surge, let’s compare its trend to that of Ethereum (ETH), a popular cryptocurrency that has experienced similar price movements in the past.

Ethereum’s Price Movement

Ethereum experienced a significant price surge in 2021, reaching an all-time high of $4,891.70 in November. This surge was driven by the growing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs), both of which rely heavily on Ethereum’s blockchain.

However, Ethereum’s price subsequently dropped to around $2,000 in early 2022, influenced by market corrections and regulatory concerns. Despite this drop, Ethereum managed to recover and has since continued to grow, reaching new highs in 2025.

Similarities and Differences

AGI Delysium’s recent price surge shares some similarities with Ethereum’s 2021 surge. Both tokens have been driven by technological advancements and growing investor interest in their respective sectors. Additionally, both have experienced significant volatility, reflecting the speculative nature of the cryptocurrency market.

However, there are also key differences between the two. While Ethereum’s surge was primarily driven by the DeFi and NFT sectors, AGI Delysium’s growth is fueled by its AI-driven solutions and strategic partnerships. Furthermore, AGI Delysium’s market cap is significantly smaller than Ethereum’s, making it more susceptible to rapid price movements.

Potential Recovery Path

Given these similarities and differences, it’s possible that AGI Delysium could follow a similar recovery path to Ethereum. If the token can maintain its current momentum and continue to deliver on its technological promises, it could experience further growth and potentially reach new highs.

However, AGI Delysium may also take a different path, influenced by its unique focus on AI and its smaller market cap. Investors should closely monitor the project’s developments and market conditions to make informed decisions about its potential recovery and future growth.

Actionable Insights for Investors

For investors looking to capitalize on AGI Delysium’s recent price surge, here are some actionable insights and advice:

Monitor Key Indicators

Keep a close eye on key indicators such as the RSI, MACD, and Bollinger Bands to gauge the token’s momentum and volatility. These indicators can help you make informed decisions about when to buy or sell AGI Delysium.

Stay Informed

Stay up-to-date with the latest news and developments within the AGI Delysium project. The team’s regular updates and announcements can provide valuable insights into the token’s future trajectory and potential growth opportunities.

Diversify Your Portfolio

Given the high volatility of AGI Delysium, it’s essential to diversify your cryptocurrency portfolio. Consider investing in a mix of established and emerging projects to mitigate risk and maximize potential returns.

Set Realistic Expectations

While AGI Delysium’s recent surge is exciting, it’s important to set realistic expectations for its future growth. The cryptocurrency market is highly speculative, and prices can fluctuate rapidly. Be prepared for potential corrections and adjust your investment strategy accordingly.

AGI Delysium’s volatility presents both opportunities and challenges for investors. Here are some expert insights on how to navigate this volatility effectively:

Use Technical Analysis

Technical analysis can be a powerful tool for navigating AGI Delysium’s volatility. By studying price charts and indicators, you can identify potential entry and exit points, helping you make more informed trading decisions.

Implement Risk Management Strategies

Implementing risk management strategies is crucial when dealing with volatile assets like AGI Delysium. Consider setting stop-loss orders to limit potential losses and using position sizing to manage your exposure to the token.

Stay Patient and Disciplined

Navigating AGI Delysium’s volatility requires patience and discipline. Avoid making impulsive decisions based on short-term price movements, and stick to your long-term investment strategy. Remember that the cryptocurrency market can be unpredictable, and staying disciplined can help you weather the ups and downs.

Seek Professional Advice

If you’re new to cryptocurrency investing, consider seeking professional advice from a financial advisor or experienced trader. They can provide valuable insights and guidance on how to navigate AGI Delysium’s volatility and make informed investment decisions.

Conclusion

AGI Delysium (AGI) Coin’s recent surge to $0.50 in March 2025 has captured the attention of investors and enthusiasts alike. Driven by technological advancements, strategic partnerships, and growing investor interest in AI-driven cryptocurrencies, AGI Delysium is poised for significant growth in the coming years.

By analyzing key indicators, support and resistance levels, and chart patterns, investors can gain valuable insights into the token’s future trajectory. While short-term predictions suggest further growth, long-term forecasts indicate the potential for AGI Delysium to reach new heights by 2026 and beyond.

Comparing AGI Delysium’s trend to that of Ethereum provides additional context and insights into its potential recovery path. By monitoring key indicators, staying informed, diversifying their portfolios, and setting realistic expectations, investors can navigate AGI Delysium’s volatility and capitalize on its growth potential.

As the cryptocurrency market continues to evolve, AGI Delysium remains a promising project at the forefront of AI and blockchain technology. Whether you’re a seasoned investor or just starting your crypto journey, keeping an eye on AGI Delysium could lead to exciting opportunities in the years to come.