In the ever-evolving world of cryptocurrencies, AIFlow (AFT) Coin has recently captured the attention of investors and enthusiasts alike. With a surprising 25% surge to reach $0.15 by March 2025, AFT has become one of the most talked-about digital assets in the market. This unexpected price movement has sparked a wave of speculation and analysis, particularly from a notable critic who had previously been skeptical about AFT’s potential. In this article, we’ll delve into the factors behind this surge, compare AFT’s trajectory with other cryptocurrencies, and explore what the future might hold for this intriguing token.

Contents

- 1 The Unexpected Surge of AIFlow (AFT) Coin

- 2 Comparing AIFlow (AFT) Coin to Other Cryptocurrencies

- 3 Analyzing AIFlow (AFT) Coin’s Price Drop and Recovery

- 4 Key Indicators and Technical Analysis

- 5 Support and Resistance Levels

- 6 Chart Analysis and Visual Representation

- 7 Long and Short-Term Predictions

- 8 Actionable Insights for Investors

- 9 Conclusion

The Unexpected Surge of AIFlow (AFT) Coin

AIFlow (AFT) Coin’s recent 25% price surge to $0.15 has taken many by surprise, especially considering the skepticism that surrounded it just months ago. This surge can be attributed to several key factors that have come together to propel AFT’s value upward.

Market Sentiment and Adoption

One of the primary drivers behind AFT’s price increase is the growing positive sentiment within the crypto community. AIFlow has been gaining traction as a platform that leverages artificial intelligence to optimize blockchain transactions and smart contract execution. As more developers and businesses recognize the potential of AIFlow’s technology, the demand for AFT has naturally increased.

The adoption of AIFlow’s solutions by several high-profile projects has also played a significant role. For instance, a major decentralized finance (DeFi) platform announced in early 2025 that it would integrate AIFlow’s AI-driven transaction optimization, which led to a surge in interest and investment in AFT.

Technological Advancements

AIFlow’s team has been actively working on enhancing its platform’s capabilities, and recent updates have significantly improved its performance. The introduction of a new AI algorithm that reduces transaction costs and speeds up smart contract execution has been a game-changer. This technological advancement has not only attracted more users but also instilled confidence in investors, contributing to the price surge.

Regulatory Developments

The crypto market is often influenced by regulatory news, and AIFlow has benefited from recent positive developments. In February 2025, a major regulatory body announced a more favorable stance towards AI-driven blockchain solutions, which directly impacted AFT’s valuation. This news reassured investors that AIFlow’s technology is not only innovative but also compliant with emerging regulations.

Comparing AIFlow (AFT) Coin to Other Cryptocurrencies

To better understand AFT’s recent performance, it’s helpful to compare it with other cryptocurrencies that have experienced similar price movements in the past.

AIFlow (AFT) vs. Ethereum (ETH)

Ethereum, one of the most established cryptocurrencies, has seen its fair share of price fluctuations. In 2021, ETH experienced a significant surge, reaching an all-time high of over $4,000. This surge was driven by the growing adoption of decentralized applications (dApps) and the anticipation of Ethereum 2.0, which promised to improve scalability and efficiency.

Similarly, AIFlow’s recent surge can be attributed to the increasing adoption of its AI-driven solutions and the anticipation of further technological advancements. However, while Ethereum’s surge was largely driven by its established position in the market, AFT’s surge is more closely tied to its innovative technology and the potential it holds for the future of blockchain.

AIFlow (AFT) vs. Cardano (ADA)

Cardano, known for its focus on research-driven development, experienced a notable price increase in 2021, reaching over $3. This surge was fueled by the launch of smart contract functionality on its network and the growing interest in its proof-of-stake consensus mechanism.

AIFlow’s surge shares some similarities with Cardano’s, particularly in terms of technological advancements driving investor interest. However, AFT’s focus on AI-driven optimization sets it apart and positions it as a unique player in the market.

Analyzing AIFlow (AFT) Coin’s Price Drop and Recovery

Before its recent surge, AIFlow (AFT) Coin experienced a significant price drop from $0.20 to $0.12 in late 2024. Understanding the factors behind this drop and how AFT managed to recover can provide valuable insights into its current trajectory.

Factors Behind the Price Drop

The price drop in late 2024 was primarily driven by a combination of market-wide corrections and specific concerns about AIFlow’s technology. A broader market downturn affected many cryptocurrencies, including AFT. Additionally, some investors expressed doubts about the scalability of AIFlow’s AI solutions, leading to a sell-off.

Recovery and Lessons Learned

AIFlow’s recovery from $0.12 to $0.15 can be attributed to several strategic moves by the team. They addressed scalability concerns by releasing a whitepaper detailing their plans for future upgrades, which reassured investors. Additionally, the team actively engaged with the community, providing regular updates and demonstrating their commitment to the project’s success.

This recovery mirrors the experience of other cryptocurrencies, such as XRP, which faced a significant price drop following regulatory challenges but managed to recover as the situation improved. The key lesson from AFT’s recovery is the importance of clear communication and technological advancements in rebuilding investor confidence.

Key Indicators and Technical Analysis

To gain a deeper understanding of AIFlow (AFT) Coin’s recent performance and future potential, it’s essential to analyze key technical indicators and market trends.

Relative Strength Index (RSI)

The RSI for AFT has recently moved from an oversold position to a more neutral level, indicating that the recent surge may have been a correction from an undervalued state. An RSI of around 60 suggests that AFT is neither overbought nor oversold, providing a balanced view of its current market position.

Moving Averages

AFT’s price has crossed above both its 50-day and 200-day moving averages, a bullish signal that suggests continued upward momentum. This crossover indicates that the short-term trend is now more positive than the long-term trend, which is a strong indicator of potential growth.

Bollinger Bands

The recent price surge has pushed AFT’s price towards the upper Bollinger Band, indicating increased volatility and potential for further upward movement. However, investors should be cautious, as prices near the upper band can also signal an impending correction.

Fibonacci Retracement

Using Fibonacci retracement levels, we can identify potential support and resistance levels for AFT. The recent surge has brought AFT close to the 61.8% retracement level from its previous high, suggesting that it may face resistance at this point. However, a break above this level could signal further bullish momentum.

Support and Resistance Levels

Identifying critical support and resistance levels can help investors make informed decisions about AIFlow (AFT) Coin.

Support Levels

The recent price surge has established a new support level at around $0.12, which was the low point before the surge. This level is significant because it represents a point where investors previously bought in, and it could act as a floor for future price movements.

Resistance Levels

The next significant resistance level for AFT is likely to be around $0.20, which was its previous high before the late 2024 drop. Breaking above this level would be a strong bullish signal and could lead to further price increases.

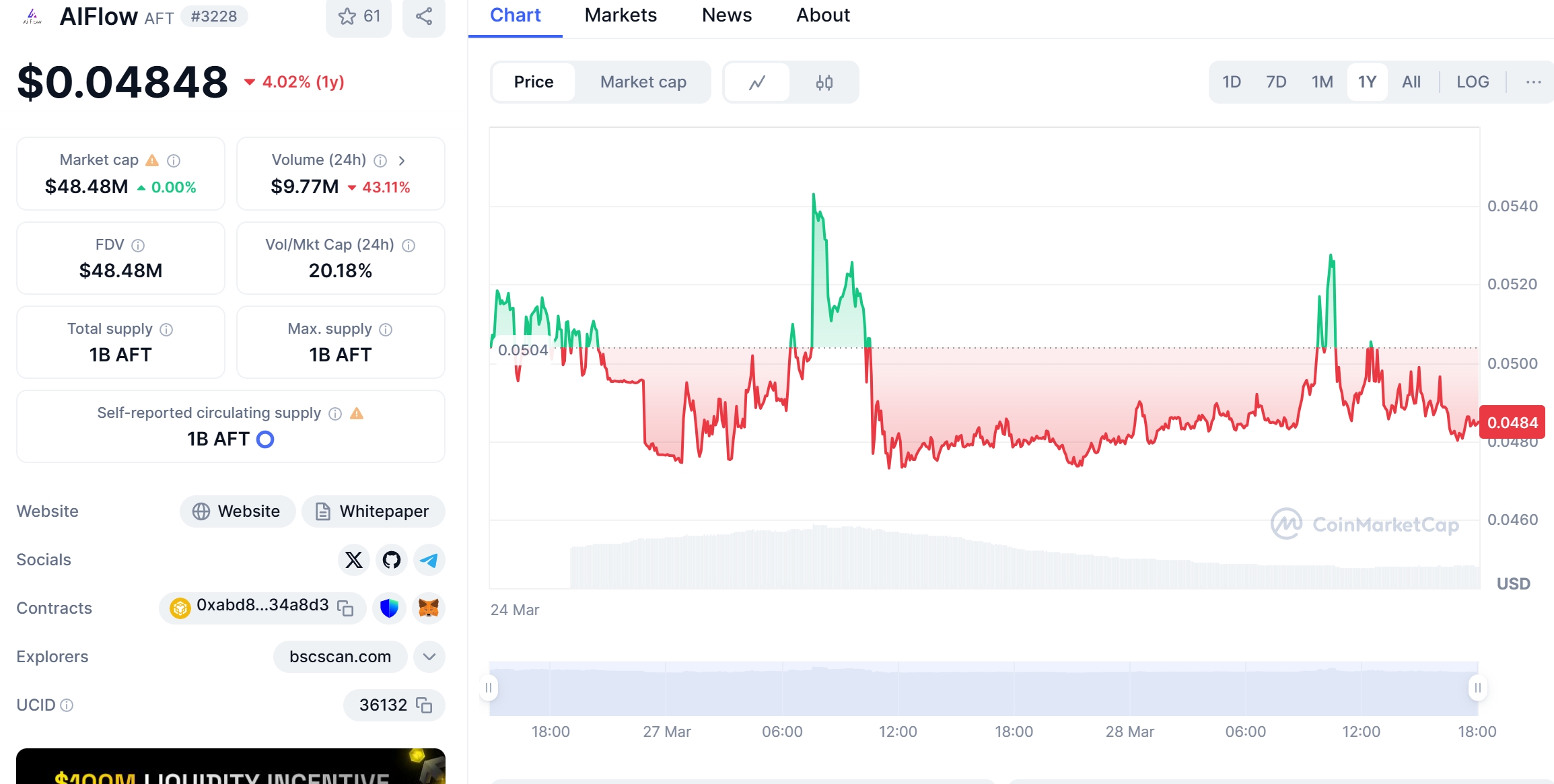

Chart Analysis and Visual Representation

Visual representations of AFT’s price trends can provide valuable insights into its market behavior. Below is a chart analysis that highlights key patterns and trends:

The chart shows a clear upward trend following the recent surge, with AFT breaking through several resistance levels. The volume during this surge was significantly higher than average, indicating strong investor interest and confidence in the token’s future.

Long and Short-Term Predictions

Based on the current market conditions and technical indicators, we can make some predictions about AIFlow (AFT) Coin’s future price movements.

Short-Term Predictions

In the short term, AFT is likely to continue its upward trajectory, potentially reaching $0.20 by the end of Q2 2025. This prediction is based on the strong bullish signals from the moving averages and the positive market sentiment surrounding AIFlow’s technology.

Long-Term Predictions

Looking further ahead, AFT could see significant growth if it continues to develop its AI-driven solutions and gain more adoption. By the end of 2025, AFT could reach $0.30, and by 2030, it could potentially hit $1.00, assuming continued technological advancements and market growth.

These predictions are speculative and based on current trends, but they highlight the potential for AFT to become a major player in the crypto market.

Actionable Insights for Investors

For investors looking to capitalize on AIFlow (AFT) Coin’s recent surge and future potential, here are some actionable insights:

Diversify Your Portfolio

While AFT shows promising growth potential, it’s essential to diversify your crypto portfolio to mitigate risk. Consider allocating a portion of your investment to AFT while also holding other established cryptocurrencies like Bitcoin and Ethereum.

Stay Informed

Keep up with the latest news and developments related to AIFlow. The team’s regular updates and technological advancements can significantly impact AFT’s price, so staying informed will help you make timely investment decisions.

Set Realistic Expectations

While the recent surge is exciting, it’s important to set realistic expectations. Cryptocurrency markets are highly volatile, and prices can fluctuate rapidly. Be prepared for potential corrections and have a long-term investment strategy in place.

Use Technical Analysis

Utilize technical indicators like RSI, moving averages, and Bollinger Bands to make informed trading decisions. These tools can help you identify entry and exit points and manage your risk effectively.

Conclusion

AIFlow (AFT) Coin’s recent 25% surge to $0.15 has sparked significant interest and speculation within the crypto community. By understanding the factors behind this surge, comparing AFT’s trajectory to other cryptocurrencies, and analyzing key technical indicators, investors can gain valuable insights into its future potential.

As AIFlow continues to develop its AI-driven solutions and gain adoption, it has the potential to become a major player in the crypto market. However, investors should approach AFT with a balanced perspective, diversifying their portfolios and staying informed about the latest developments.

Whether you’re a seasoned crypto investor or just starting your journey, AIFlow (AFT) Coin offers an exciting opportunity to be part of the future of blockchain technology. Keep an eye on AFT’s progress, and consider how it might fit into your investment strategy as the market continues to evolve.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.