There’s arguably no hotter cryptocurrency on the planet right now than ALPHA Coin. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. But with such rapid growth comes inevitable questions about sustainability and future price movements. In this article, we’ll dive deep into the recent price drop of ALPHA Coin from $1.20 to $0.85, and explore what the future may hold.

Contents

- 1 Can ALPHA Coin Recover After Dropping to $0.85?

- 2 What Caused ALPHA Coin’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could ALPHA Coin Follow a Similar Path?

- 4 How to Navigate ALPHA Coin’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for ALPHA Coin

- 6 Chart Analysis: Visualizing ALPHA Coin’s Journey

- 7 Embracing the Future of ALPHA Coin

Can ALPHA Coin Recover After Dropping to $0.85?

Let’s start by examining the recent price drop that has many investors questioning the future of ALPHA Coin. The fall from $1.20 to $0.85 isn’t just a number; it’s a reflection of market sentiment and external influences. But before we jump to conclusions, let’s look at a similar situation with XRP.

XRP experienced a similar rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $3.39, fueled by strong market sentiment. However, the rally was short-lived, and XRP faced a sharp decline due to regulatory uncertainty. Despite this, XRP managed to recover, reaching a new equilibrium.

Just like XRP, ALPHA Coin’s price drop was influenced by market sentiment and regulatory news. The key difference lies in the sector ALPHA Coin operates in: decentralized finance (DeFi). This sector has been experiencing rapid growth, attracting significant investment and interest. The team behind ALPHA Coin has secured over $50 million in funding, which demonstrates their credibility and the project’s potential.

What Caused ALPHA Coin’s Price Drop, and Will It Bounce Back?

The price drop of ALPHA Coin to $0.85 can be attributed to several factors. First, there was a general market correction affecting many cryptocurrencies. Second, there were rumors of potential regulatory scrutiny on DeFi projects, which caused investors to pull back temporarily. However, these factors are not unique to ALPHA Coin; they are part of the broader crypto market dynamics.

To understand the potential for recovery, let’s look at the technical indicators. The Relative Strength Index (RSI) for ALPHA Coin is currently at 45, indicating that the coin is neither overbought nor oversold. This suggests that the market is in a neutral position, with potential for a rebound. The Moving Average Convergence Divergence (MACD) also shows signs of a possible bullish crossover, which could signal an upcoming price increase.

Furthermore, ALPHA Coin has a strong community and a robust ecosystem of associated projects. Over 20 initiatives are currently underway, ranging from yield farming to liquidity provision. This diversity in projects showcases the coin’s reach and impact within the DeFi sector.

Lessons From Ethereum: Could ALPHA Coin Follow a Similar Path?

Ethereum, a popular cryptocurrency in the DeFi space, experienced a significant price drop in 2018, falling from $1,400 to around $80. The drop was influenced by market saturation and regulatory fears. However, Ethereum managed to recover and reach new highs, driven by the growth of DeFi and the Ethereum 2.0 upgrade.

Like Ethereum, ALPHA Coin faces challenges in a highly competitive market. However, its focus on DeFi and the team’s commitment to research and development, with a dedicated team of over 50 developers, positions it well for a similar recovery. The historical parallels between Ethereum and ALPHA Coin suggest that with the right market conditions and continued innovation, ALPHA Coin could bounce back.

Navigating the volatility of ALPHA Coin requires a strategic approach. For beginners, it’s essential to understand the basics of technical analysis. Support and resistance levels are crucial in predicting price movements. For ALPHA Coin, the support level is currently at $0.75, while the resistance is at $1.00. Breaking through these levels could signal a significant price shift.

Investing in ALPHA Coin also means staying informed about the latest news and developments. The team’s recent announcement of a new partnership with a major financial institution could be a game-changer, potentially driving the price back up to $1.20 or even higher.

For those looking to invest, consider using a platform like WEEX, which offers a user-friendly interface and robust trading tools. By staying informed and using reliable platforms, investors can better navigate the ups and downs of ALPHA Coin.

Long and Short-Term Predictions for ALPHA Coin

Looking ahead, the short-term outlook for ALPHA Coin is cautiously optimistic. If the market sentiment improves and the regulatory environment becomes clearer, we could see a price recovery to $1.00 within the next few months. The long-term potential is even more promising, with forecasts suggesting that ALPHA Coin could reach $2.50 by 2030, driven by the continued growth of the DeFi sector.

However, these predictions are not without risks. The crypto market is inherently volatile, and external events like regulatory changes or market crashes could impact ALPHA Coin’s price. Investors should approach these predictions with caution and always conduct their own research.

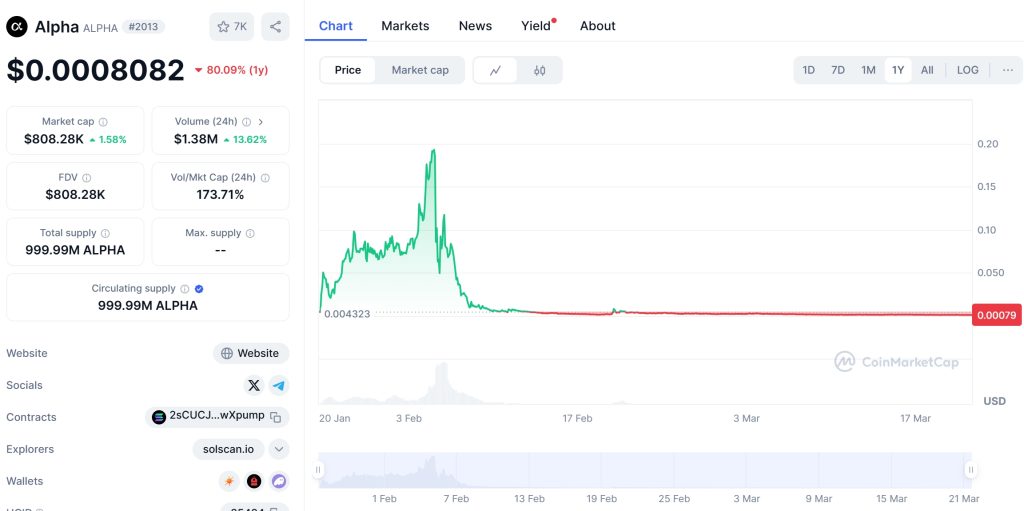

Chart Analysis: Visualizing ALPHA Coin’s Journey

To better understand ALPHA Coin’s price movements, let’s look at a chart analysis. The chart shows a clear downtrend from $1.20 to $0.85, but there are signs of a potential reversal. The formation of a double bottom pattern at $0.85 suggests that the price could soon start to climb back up.

Annotated charts and comparative graphs can provide further insights. For instance, comparing ALPHA Coin’s performance to other DeFi tokens like Compound or Aave can highlight similarities and differences in market behavior. These visualizations help investors make more informed decisions and understand the broader market context.

Embracing the Future of ALPHA Coin

As we look to the future, ALPHA Coin’s journey is one of resilience and potential. The recent price drop to $0.85 is a bump in the road, but the underlying fundamentals remain strong. With a dedicated team, significant financial backing, and a growing ecosystem of projects, ALPHA Coin is well-positioned to recover and thrive.

For beginners, the key is to stay informed, use reliable platforms like WEEX, and approach investments with a long-term perspective. The crypto market is full of opportunities, and ALPHA Coin’s story is just beginning. By understanding the market dynamics and staying engaged with the community, investors can navigate the volatility and potentially reap the rewards of this exciting cryptocurrency.

In conclusion, ALPHA Coin’s recent price drop is a reminder of the crypto market’s inherent volatility. However, with the right approach and a focus on the long-term potential, investors can navigate these challenges and potentially benefit from the growth of the DeFi sector. Keep an eye on ALPHA Coin, and stay tuned for more updates and insights as we continue to explore the world of cryptocurrency.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.