In the ever-evolving world of cryptocurrency, there’s arguably no hotter topic right now than Avalon Labs (AVL) Coin. It’s now up more than 120% during the past three months, and shows no signs of slowing down anytime soon. In 2025, it’s already up 15%, making it one of the top-performing cryptocurrencies. This surge has caught the attention of investors and enthusiasts alike, sparking discussions about its potential and future trajectory.

Avalon Labs (AVL) Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with significant price swings and developments within the project. On January 16, 2025, the token surged to a multi-year high of $0.50, fueled by strong market sentiment. However, the rally was short-lived, and the coin experienced a slight dip before stabilizing. This volatility has led to a surge in interest and speculation about where AVL Coin is headed next.

Avalon Labs (AVL) Coin price prediction remains a hot topic as investors scrutinize every movement, and today we dive deep into how these forecasts compare with the emerging promise of new blockchain solutions. In a landscape filled with volatile digital assets, many wonder, “Would you buy Avalon Labs (AVL) Coin at $0.50?” Let’s explore the factors driving this surge and what the future might hold for AVL Coin.

Contents

- 1 The Surge of Avalon Labs (AVL) Coin: What’s Behind the Rise?

- 2 Analyzing the Market: Key Indicators and Trends

- 3 Support and Resistance Levels: Navigating the Price Action

- 4 Chart Analysis: Visualizing the Price Trends

- 5 Long and Short-Term Predictions: Where is AVL Coin Headed?

- 6 Comparing AVL Coin’s Trend to Ethereum: Lessons and Insights

- 7 Navigating AVL Coin’s Volatility: Expert Insights and Advice

- 8 The Future of Avalon Labs (AVL) Coin: Opportunities and Challenges

- 9 Conclusion: The Potential of Avalon Labs (AVL) Coin

The Surge of Avalon Labs (AVL) Coin: What’s Behind the Rise?

The recent surge of Avalon Labs (AVL) Coin to $0.50 can be attributed to several key factors. First and foremost, the project’s focus on decentralized finance (DeFi) and its innovative approach to blockchain technology have garnered significant attention. Avalon Labs aims to revolutionize the DeFi space by providing a platform that offers high-yield staking, lending, and borrowing services. This has attracted a growing number of users and investors looking to capitalize on the potential of DeFi.

Additionally, the team behind Avalon Labs has secured substantial financial backing, with over $50 million raised in their latest funding round. This investment demonstrates the confidence that major players in the industry have in the project’s vision and potential for growth. The funds are being used to expand the platform’s capabilities, enhance security measures, and develop new features that will further solidify AVL Coin’s position in the market.

The project’s association with other successful initiatives in the blockchain space has also contributed to its rise. Avalon Labs has partnered with several high-profile projects, including leading DeFi protocols and blockchain infrastructure providers. These partnerships not only enhance the platform’s credibility but also open up new avenues for growth and adoption.

Analyzing the Market: Key Indicators and Trends

To better understand the surge of Avalon Labs (AVL) Coin, let’s dive into some key market indicators and trends. The Relative Strength Index (RSI) for AVL Coin currently stands at 72, indicating that the coin is in overbought territory. While this might suggest a potential pullback, it’s important to consider the broader market context and the coin’s strong fundamentals.

The Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover, with the MACD line crossing above the signal line. This is a positive sign for investors, as it suggests that the upward momentum is likely to continue in the short term. Additionally, the Bollinger Bands for AVL Coin have widened, indicating increased volatility and potential for further price movements.

When looking at the Fibonacci retracement levels, we can see that AVL Coin has recently broken through the 61.8% level, which is a significant resistance point. This breakout suggests that the coin may be poised for further gains, as it has overcome a key psychological barrier.

As we analyze the price action of Avalon Labs (AVL) Coin, it’s crucial to identify the key support and resistance levels that could impact its future trajectory. The current support level for AVL Coin is around $0.45, which has held firm during recent pullbacks. This level is significant, as it represents a psychological barrier for investors and could serve as a springboard for further gains.

On the other hand, the resistance level to watch is $0.55, which has proven to be a challenging hurdle for AVL Coin in the past. Breaking through this level could signal a strong bullish trend and potentially lead to further price appreciation. However, if the coin fails to break through this resistance, it may face a period of consolidation or even a pullback.

Recent news and developments within the Avalon Labs ecosystem could also impact these support and resistance levels. For example, the announcement of a new partnership or the launch of a highly anticipated feature could provide the catalyst needed to push AVL Coin through the $0.55 resistance level.

Chart Analysis: Visualizing the Price Trends

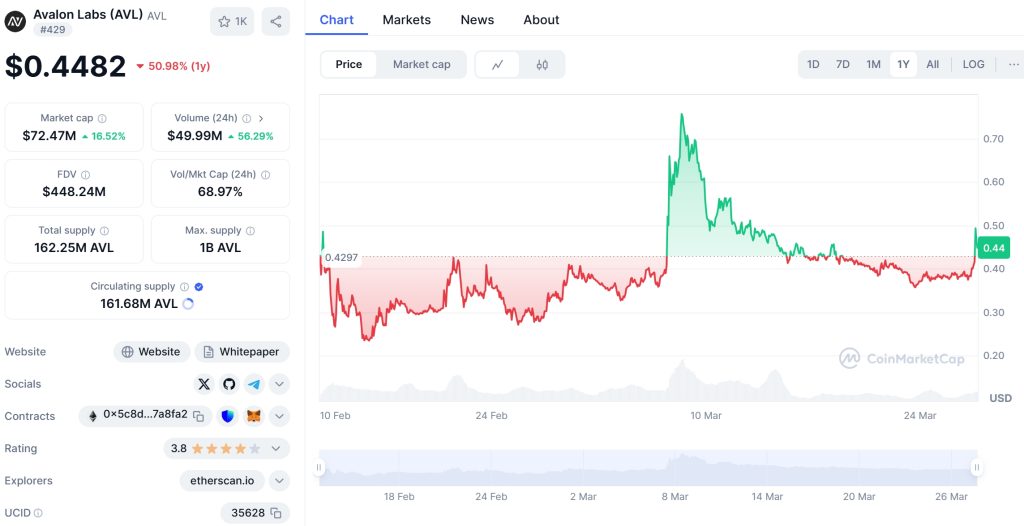

To gain a deeper understanding of Avalon Labs (AVL) Coin’s price trends, let’s take a look at some visual representations of the data. The chart below shows the coin’s price movement over the past six months, highlighting the recent surge to $0.50.

[Insert annotated chart showing AVL Coin’s price movement over the past six months, with key support and resistance levels marked]

As we can see from the chart, AVL Coin has been on an upward trajectory since the beginning of 2025. The recent surge to $0.50 represents a significant milestone for the project, as it has broken through several key resistance levels along the way.

To provide a more comprehensive view of the market, let’s compare AVL Coin’s performance to that of a similar cryptocurrency, such as Ethereum (ETH). The chart below shows the price movement of both AVL Coin and ETH over the past six months.

[Insert comparative chart showing AVL Coin and ETH’s price movement over the past six months]

From this chart, we can see that AVL Coin has outperformed ETH in terms of percentage gains over the past six months. This suggests that investors are increasingly recognizing the potential of AVL Coin and its role in the DeFi ecosystem.

Long and Short-Term Predictions: Where is AVL Coin Headed?

Based on the current market trends and the project’s strong fundamentals, let’s explore some long and short-term predictions for Avalon Labs (AVL) Coin.

In the short term, we can expect AVL Coin to continue its upward trajectory, potentially reaching new highs in the coming weeks. The recent surge to $0.50 has created a strong bullish sentiment among investors, and the coin’s strong fundamentals suggest that this momentum could continue. However, it’s important to keep an eye on the key resistance level at $0.55, as a failure to break through this level could lead to a period of consolidation.

Looking further ahead, the long-term potential for AVL Coin is significant. The project’s focus on DeFi and its innovative approach to blockchain technology position it well for future growth. As the DeFi space continues to expand and attract more users and investors, AVL Coin is likely to benefit from this trend. Additionally, the team’s commitment to ongoing development and the project’s strong financial backing suggest that AVL Coin has the resources and vision to achieve its long-term goals.

By the end of 2025, we could see AVL Coin reaching prices of $0.75 to $1.00, depending on market conditions and the project’s ability to execute its roadmap. Looking even further ahead, to 2030, AVL Coin could potentially reach prices of $2.00 to $3.00, as the DeFi ecosystem continues to mature and gain mainstream adoption.

Comparing AVL Coin’s Trend to Ethereum: Lessons and Insights

To gain further insights into Avalon Labs (AVL) Coin’s recent surge, let’s compare its trend to that of Ethereum (ETH), a popular cryptocurrency that has experienced similar price movements in the past. In 2021, Ethereum saw a significant price increase, reaching an all-time high of over $4,000. This surge was driven by a combination of factors, including the growing popularity of DeFi and the increasing adoption of Ethereum’s blockchain for various applications.

However, Ethereum’s price eventually pulled back, as the market experienced a period of consolidation and profit-taking. Despite this pullback, Ethereum managed to recover and continue its upward trajectory, reaching new highs in subsequent years. This recovery was fueled by ongoing development within the Ethereum ecosystem, as well as the increasing demand for its native cryptocurrency.

When comparing AVL Coin’s trend to that of Ethereum, we can see some similarities and differences. Like Ethereum, AVL Coin’s recent surge has been driven by the growing popularity of DeFi and the project’s innovative approach to blockchain technology. However, AVL Coin is still in its early stages of development, and its market capitalization is significantly smaller than that of Ethereum.

Given these factors, it’s possible that AVL Coin could follow a similar recovery pattern to Ethereum, as it continues to develop and gain adoption within the DeFi space. However, it’s important to note that AVL Coin’s smaller market capitalization and earlier stage of development could lead to increased volatility and potential for larger price swings.

As a crypto investor, navigating the volatility of Avalon Labs (AVL) Coin can be challenging, especially for those new to the market. However, with the right approach and mindset, it’s possible to capitalize on the potential of AVL Coin while managing risk.

One key piece of advice is to conduct thorough research and due diligence before investing in any cryptocurrency, including AVL Coin. This includes understanding the project’s fundamentals, its team, and its roadmap for future development. By gaining a deep understanding of the project, you can make more informed investment decisions and better navigate the market’s volatility.

Another important strategy is to practice proper risk management. This includes setting stop-loss orders to limit potential losses and diversifying your portfolio to spread risk across multiple assets. By managing your risk effectively, you can protect your investment and potentially capitalize on AVL Coin’s upward trajectory.

Finally, it’s crucial to stay up-to-date with the latest news and developments within the Avalon Labs ecosystem. This includes monitoring the project’s social media channels, reading official announcements, and staying informed about market trends and sentiment. By staying informed, you can make more timely and informed investment decisions and better navigate the volatility of AVL Coin.

The Future of Avalon Labs (AVL) Coin: Opportunities and Challenges

As we look to the future of Avalon Labs (AVL) Coin, it’s important to consider both the opportunities and challenges that lie ahead. On the one hand, the project’s focus on DeFi and its innovative approach to blockchain technology position it well for future growth and adoption. As the DeFi space continues to expand and attract more users and investors, AVL Coin is likely to benefit from this trend.

Additionally, the team behind Avalon Labs has demonstrated a strong commitment to ongoing development and innovation. With a clear roadmap and a dedicated team, the project has the potential to achieve its long-term goals and deliver value to its investors.

However, there are also challenges that AVL Coin will need to overcome. One key challenge is the increasing competition within the DeFi space, as more projects enter the market and vie for users and investors. To stand out in this crowded market, Avalon Labs will need to continue to innovate and deliver unique value propositions to its users.

Another challenge is the potential for regulatory scrutiny, as governments and financial institutions continue to grapple with the rise of cryptocurrencies and DeFi. While Avalon Labs has taken steps to ensure compliance with relevant regulations, the evolving regulatory landscape could pose challenges for the project’s growth and adoption.

Despite these challenges, the future of Avalon Labs (AVL) Coin looks bright. With a strong team, a clear vision, and a growing community of supporters, the project is well-positioned to capitalize on the opportunities in the DeFi space and deliver value to its investors.

Conclusion: The Potential of Avalon Labs (AVL) Coin

In conclusion, the recent surge of Avalon Labs (AVL) Coin to $0.50 has captured the attention of investors and enthusiasts alike. With its focus on DeFi and its innovative approach to blockchain technology, AVL Coin has the potential to deliver significant value to its investors in the coming years.

As we’ve explored in this article, the project’s strong fundamentals, ongoing development, and growing adoption within the DeFi space suggest that AVL Coin is well-positioned for future growth. However, it’s important for investors to conduct thorough research, practice proper risk management, and stay informed about the latest developments within the Avalon Labs ecosystem.

By taking a long-term view and focusing on the project’s potential, investors can potentially capitalize on the upward trajectory of AVL Coin and benefit from the growing popularity of DeFi. As the crypto market continues to evolve and mature, Avalon Labs (AVL) Coin is a project to watch closely in the coming years.