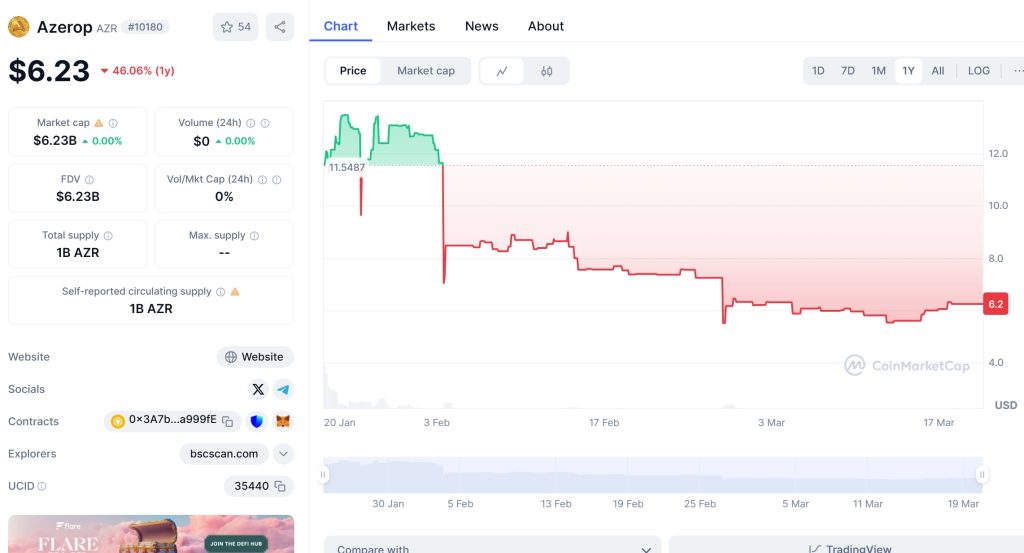

There’s arguably no more intriguing cryptocurrency on the market right now than Azerop (AZR). It’s currently trading at around $6.20, down from its all-time high of $13.79 in January 2025. But what’s fascinating about AZR is the unexpected bullish prediction from a well-known critic of the coin, sparking speculation and debate within the crypto community. In this article, we’ll dive deep into AZR’s price movements, explore the reasons behind its recent drop, and analyze whether it can bounce back to its former glory.

Azerop, built on the Binance Smart Chain, aims to create a decentralized ecosystem that integrates finance, crowdfunding, and gaming. It’s an ambitious project that seeks to empower users with a range of decentralized financial services, from lending and staking to participating in blockchain-based games. Despite its innovative approach, AZR has faced a rollercoaster ride in recent months, with its price experiencing significant fluctuations.

Let’s delve into the reasons behind AZR’s recent price drop from $13.79 to $6.20. One of the key factors was a broader market correction that affected many cryptocurrencies. However, AZR’s specific challenges stemmed from a combination of factors, including regulatory uncertainty and concerns about the project’s sustainability. In early 2025, news of regulatory scrutiny on decentralized finance platforms led to a sell-off in AZR, as investors feared potential restrictions that could impact its operations.

When comparing AZR’s price movement to other cryptocurrencies like Dogecoin (DOGE), we see some similarities. DOGE experienced a sharp drop in 2022 due to Elon Musk’s tweets and the broader crypto market’s volatility. However, DOGE managed to recover, buoyed by its strong community support and its integration into various payment systems. Similarly, AZR has a dedicated community and is actively working on expanding its ecosystem, which could help it regain its footing.

To understand AZR’s market trends better, let’s look at some key indicators. The Relative Strength Index (RSI) for AZR is currently at a moderate level, suggesting that the coin is neither overbought nor oversold. This could indicate a potential stabilization period before another move. The Moving Average Convergence Divergence (MACD) shows a bearish crossover, indicating that the short-term momentum is downward. However, if AZR can overcome this bearish signal, it might signal the beginning of a recovery.

Support and resistance levels are crucial in understanding where AZR’s price might head next. The $6.20 level has acted as a strong support, with the coin bouncing back from this point multiple times in recent weeks. On the other hand, resistance is seen around $8.00, a level that AZR has struggled to break through. If it can surpass this mark, it could signal a stronger bullish trend.

Chart analysis provides visual insights into AZR’s price trends. Looking at the daily chart, we can see a pattern of consolidation around the $6.20 mark, with occasional spikes towards $7.00. This consolidation could be a sign that the market is preparing for a significant move. If AZR can break out of this range, it could indicate a shift in investor sentiment.

Now, let’s discuss the long and short-term predictions for AZR. In the short term, over the next few months, I believe AZR could see a gradual increase, potentially reaching $7.50 by the end of 2025. This prediction is based on the project’s ongoing developments, such as the launch of new decentralized applications (dApps) and partnerships that could boost its utility. In the long term, by 2030, AZR could reach $15.00 if it successfully expands its ecosystem and gains wider adoption.

To provide a more in-depth analysis, let’s compare AZR’s situation to Ethereum (ETH), another cryptocurrency that has experienced significant price swings. After the 2018 bear market, ETH took several years to recover, driven by the growth of decentralized finance and non-fungible tokens (NFTs). AZR, with its focus on a similar sector, could follow a similar path if it can navigate the current challenges and capitalize on the growing interest in DeFi.

So, can AZR recover after dropping to $6.20? I believe it has the potential to do so, especially if it can address the regulatory concerns and continue to develop its ecosystem. The project’s focus on sustainability and innovation could attract more investors in the long run. However, it’s essential for investors to monitor the market closely and consider the broader economic factors that could impact AZR’s price.

For those new to crypto investing, here’s some advice: always do your research and understand the project’s fundamentals before investing. AZR’s drop to $6.20 might seem daunting, but it could also present a buying opportunity if you believe in the project’s long-term vision. Keep an eye on the key indicators we discussed, and consider setting stop-loss orders to manage your risk.

In conclusion, AZR’s journey from $13.79 to $6.20 has been a challenging one, but the coin’s innovative approach and dedicated community could pave the way for a recovery. Whether it follows a path similar to DOGE or ETH remains to be seen, but with the right developments and market conditions, AZR could surprise us with a significant price surge in the future.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.