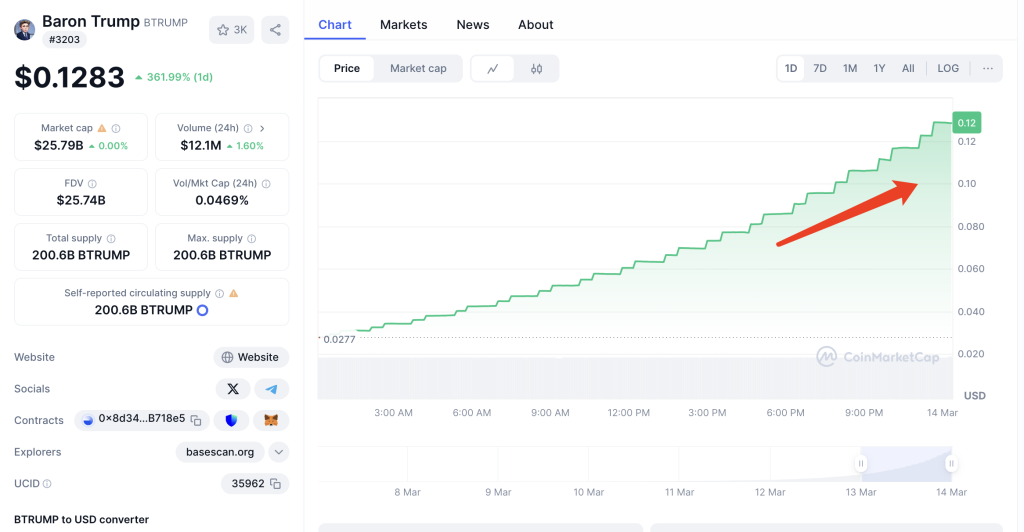

It’s 10:15 AM on March 13, 2025, and the crypto world is buzzing with one name: Baron Trump ($BTRUMP). In the past 24 hours alone, this audacious political meme coin has skyrocketed 112%, catapulting from $0.043 to a jaw-dropping $0.091. Social media is ablaze with screenshots of traders boasting gains like “8,216 USDT from #btrump,” while skeptics warn of an impending crash. But beneath the hype lies a fascinating story—a blend of election-year chaos, deflationary tokenomics, and a community riding the wave of political satire. Let’s unpack why $BTRUMP isn’t just another meme coin and whether its current surge is a fleeting pump or the start of a historic rally.

Contents

- 1 The Unlikely Rise of a Political Satire Token

- 2 Election Fever and the $BTRUMP Catalyst

- 3 Tokenomics: Scarcity as a Strategy

- 4 Regulatory Tightropes and the SEC’s Shadow

- 5 Price Predictions: Navigating the 2025 Rollercoaster

- 6 Why WEEX Exchange is the Smart Choice for $BTRUMP Traders

- 7 Mastering the $BTRUMP Trade: Strategies for Newcomers

- 8 The Bigger Picture: $BTRUMP and the Future of Political Crypto

- 9 Final Verdict: High Risk, Higher Stakes

The Unlikely Rise of a Political Satire Token

When $BTRUMP first launched in late 2023 as a parody of the Trump dynasty, few took it seriously. Critics dismissed it as a “low-effort meme” in a market already saturated with dog-themed tokens. Fast-forward to 2025, and the narrative has flipped. The coin’s developers—a pseudonymous team known only as “MAGA Devs”—have tapped into a potent mix of political fervor and crypto speculation, transforming $BTRUMP into a cultural lightning rod.

One of the key aspects to consider is how $BTRUMP diverges from traditional meme coins. While Shiba Inu and Dogecoin rely on cute mascots, $BTRUMP leans into divisive political symbolism. Its logo, a cartoonish depiction of Barron Trump wearing a “Make Crypto Great Again” hat, straddles the line between satire and homage. This duality has attracted both crypto degens and politically charged retail investors, creating a volatile but fiercely loyal community.

Election Fever and the $BTRUMP Catalyst

Let’s explore how this works in practice. The 2024 U.S. presidential election was a turning point. As Donald Trump clinched the Republican nomination, politically themed assets—from MAGA-themed NFTs to “Trump Trading Cards”—saw unprecedented demand. $BTRUMP rode this wave, positioning itself as the de facto crypto of the “MAGA movement.”

The token’s recent surge, however, stems from a perfect storm of catalysts:

- Polling Data: A March 10 Reuters/Ipsos poll showed Trump leading Biden by 6 points in key battleground states, igniting speculation that a Trump victory could legitimize $BTRUMP as a protest asset.

- Celebrity Whispers: Unverified rumors swirled this morning that Barron Trump himself had retweeted a $BTRUMP meme, though the tweet was swiftly deleted. The team denies any involvement but hasn’t discouraged the speculation.

- NFT Mania: The project’s “MAGA Memorabilia” NFT collection, launched on March 1, sold out in 12 hours, generating $2.1 million in secondary sales. Each NFT grants holders voting rights on future token burns—a clever gamification of politics and finance.

Tokenomics: Scarcity as a Strategy

At its core, $BTRUMP employs a hyper-deflationary model that rewards holders while punishing paper hands. Every transaction incurs a 5% burn and a 3% redistribution to existing wallets. Since January, over 28% of the total supply has been incinerated, shrinking circulation from 100 billion to 72 billion tokens. This artificial scarcity mirrors Bitcoin’s halving mechanics but operates at warp speed, creating a self-reinforcing cycle of supply shock and price appreciation.

To put this into perspective, if $BTRUMP maintains its current burn rate, its circulating supply could drop below 50 billion by 2026. For context, Dogecoin’s infinite supply inflation is often cited as a long-term headwind—a problem $BTRUMP sidesteps through its aggressive deflation.

Regulatory Tightropes and the SEC’s Shadow

No discussion of $BTRUMP is complete without addressing the regulatory elephant in the room. On February 28, 2025, SEC Chair Gary Gensler delivered a speech lambasting “politically themed speculative assets that lack fundamental value.” The remarks triggered a 15% sell-off in $BTRUMP, but the coin rebounded within hours as developers announced a partnership with a KYC-compliant NFT marketplace.

The team’s strategy appears twofold:

- Embrace Compliance: By requiring identity verification for NFT purchases, $BTRUMP distances itself from the “anonymous pump-and-dump” label.

- Utility Over Hype: The upcoming launch of a decentralized polling platform—where holders can vote on real-world political issues—aims to position $BTRUMP as a tool for civic engagement rather than pure speculation.

This balancing act recalls Ripple’s years-long battle with the SEC, where the argument hinged on whether XRP had “utility” beyond investment. $BTRUMP’s developers seem to be taking notes, betting that real-world use cases could shield them from regulatory crackdowns.

Predicting $BTRUMP’s price is akin to forecasting election results—volatile, emotionally charged, and prone to black swan events. That said, several scenarios could unfold in the coming months:

Bull Case ($0.45 by Q4 2025):

A Trump victory in November could legitimize $BTRUMP as the “official protest crypto” of his base, attracting media attention and institutional curiosity. If the token’s NFT platform gains traction as a hub for political discourse, a surge to $0.45 isn’t unrealistic. This would represent a 395% gain from current levels, turning a $1,000 investment into nearly $5,000.

Bear Case ($0.03 Regulatory Collapse):

Conversely, an SEC lawsuit or a Biden re-election could unravel $BTRUMP’s momentum. The token’s reliance on political sentiment makes it uniquely vulnerable to policy shifts. A crackdown on unregistered securities—similar to the 2023 cases against LBRY and Telegram—could erase 90% of its value overnight.

Long-Term Horizon ($1.50 by 2030):

Looking beyond the election cycle, $BTRUMP’s deflationary model could work in its favor. If the team sustains its burn rate and expands into decentralized governance tools, the token might evolve from a meme to a legitimate political engagement platform. Under this scenario, $1.50 becomes plausible—a 1,550% return for those who hold through the turbulence.

Why WEEX Exchange is the Smart Choice for $BTRUMP Traders

For traders chasing $BTRUMP’s parabolic moves, the right platform can mean the difference between catching the wave and wiping out. This is where WEEX Exchange shines. Unlike competitors that struggle with liquidity during meme coin pumps, WEEX’s zero-slippage order engine ensures traders can enter and exit positions at precise price points—critical when dealing with tokens that swing 20% in an hour.

WEEX also integrates real-time social sentiment indicators, allowing users to track trending hashtags like #BTRUMP and #MAGA2024 directly on their trading charts. This feature, paired with automated stop-loss tools, empowers both rookies and veterans to navigate $BTRUMP’s volatility with confidence. And for those willing to HODL, WEEX’s 12% APY staking rewards offer a rare opportunity to earn passive income on a meme coin—a perk that even top-tier exchanges rarely provide.

Mastering the $BTRUMP Trade: Strategies for Newcomers

The allure of quick profits draws many to $BTRUMP, but surviving its whiplash requires discipline. Here’s how savvy traders are approaching the chaos:

Dollar-Cost Averaging (DCA): Given the token’s volatility, allocating 1–2% of your portfolio weekly smooths out timing risks. For example, a $500 monthly investment could yield significant returns if $BTRUMP maintains its upward trajectory while minimizing losses during dips.

Sentiment-Driven Trading: $BTRUMP’s price often moves in lockstep with Trump’s polling numbers and media appearances. Setting Google Alerts for keywords like “Trump rally” or “SEC crypto” allows traders to anticipate pumps and dumps before they happen.

The Art of Taking Profits: As one Reddit user put it, “No one went broke selling at a 100% gain.” Setting incremental profit targets—say, cashing out 20% at $0.15, another 30% at $0.30—lets traders ride the momentum without overexposing themselves to a potential crash.

The Bigger Picture: $BTRUMP and the Future of Political Crypto

Beyond price charts and trading tactics, $BTRUMP raises provocative questions about the intersection of politics and decentralized finance. Could meme coins become a new form of political fundraising? Will regulators tolerate tokens that blur the lines between satire and activism?

The project’s experiments with NFT-based governance hint at a future where crypto communities influence real-world policy. Imagine a platform where $BTRUMP holders vote on which congressional bills to endorse or which charities to support—a vision that transforms holders from speculators into stakeholders.

Final Verdict: High Risk, Higher Stakes

As of 4:00 PM on March 13, $BTRUMP has pulled back to $0.084, a 20% dip from its morning high. Is this a buying opportunity or a warning sign? The answer depends on your appetite for risk.

For thrill-seekers, $BTRUMP offers a front-row seat to crypto’s most unpredictable show—a mix of political theater, tokenomics innovation, and pure gambling adrenaline. For cautious investors, it’s a reminder that in the meme coin arena, what goes up often comes down twice as fast.

But love it or hate it, $BTRUMP is more than a joke. It’s a cultural artifact of our times—a digital protest sign, a speculative vehicle, and a social experiment rolled into one. Whether it reaches $1 or crashes to zero, its story will be etched into crypto lore as the token that dared to merge MAGA with blockchain.

As the clock ticks toward November’s election, one thing’s certain: in 2025’s crypto circus, $BTRUMP isn’t just a sideshow. It’s the main event.