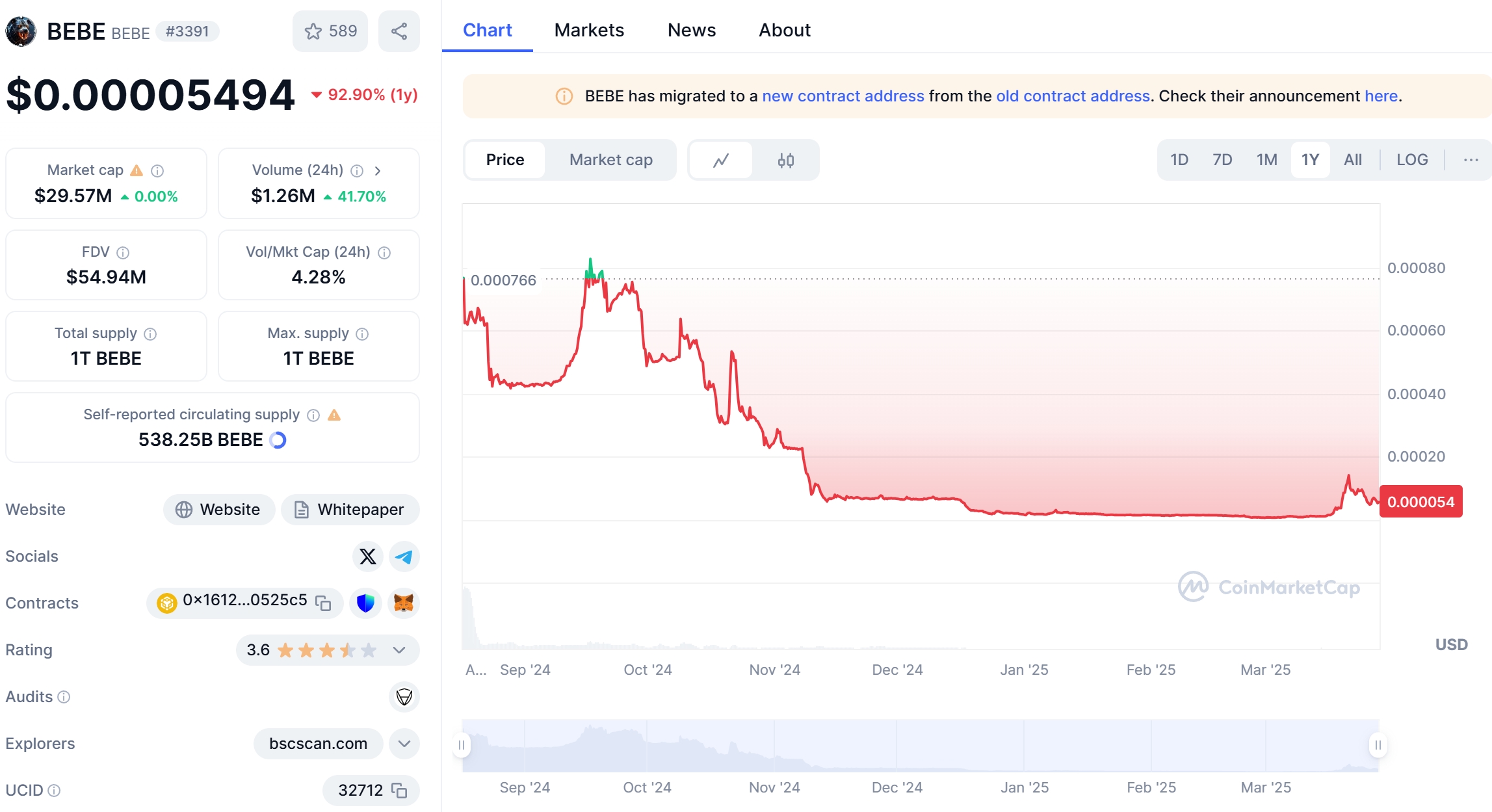

In the ever-evolving world of cryptocurrencies, BEBE Coin has recently captured the attention of investors and enthusiasts alike due to its significant price movement. As of March 2025, BEBE Coin has experienced a sharp decline, dropping from a high of $0.0012 to its current price of $0.0005. This 58% drop has left many wondering about the future of this digital asset and whether it can recover. Let’s dive into the details of this price drop, compare it to similar trends in other cryptocurrencies, and explore what the future might hold for BEBE Coin.

Contents

Can BEBE Coin Recover After Dropping to $0.0005?

The recent price drop of BEBE Coin from $0.0012 to $0.0005 has been a cause for concern among its investors. To understand whether BEBE Coin can recover, it’s essential to analyze the factors that led to this decline and compare it to similar situations in the crypto market.

What Caused BEBE Coin’s Price Drop, and Will It Bounce Back?

The price drop of BEBE Coin can be attributed to several factors. One significant influence was the broader market sentiment, which has been volatile due to regulatory news and macroeconomic factors. In early 2025, the crypto market experienced a correction after a period of rapid growth, affecting many altcoins, including BEBE Coin.

Another factor was the lack of significant developments or partnerships announced by the BEBE Coin team during this period. Investors often look for signs of growth and innovation, and the absence of such news can lead to a loss of confidence and subsequent selling pressure.

To assess the potential for recovery, let’s look at a similar situation with Dogecoin (DOGE). In 2021, DOGE experienced a massive surge, reaching an all-time high of $0.7376, only to plummet to $0.16 by the end of the year—a drop of over 78%. However, DOGE managed to recover some of its losses in subsequent months, driven by renewed interest and endorsements from high-profile figures.

The key difference between BEBE Coin and DOGE is the community and market perception. DOGE has a strong, dedicated community that has helped it weather multiple market cycles. BEBE Coin, while growing, may not have the same level of community support yet. However, if the BEBE Coin team can announce new developments or partnerships, it could reignite investor interest and lead to a recovery.

Lessons From Dogecoin: Could BEBE Coin Follow a Similar Path?

Dogecoin’s recovery after its significant drop in 2021 offers valuable lessons for BEBE Coin. One of the critical factors in DOGE’s recovery was the continued support from its community and the influence of social media. The “Doge Army” rallied behind the coin, and endorsements from figures like Elon Musk helped boost its visibility and value.

For BEBE Coin to follow a similar path, it would need to build a stronger community presence and perhaps leverage social media more effectively. Additionally, the BEBE Coin team could learn from DOGE’s strategy of engaging with its community through regular updates and transparent communication.

However, BEBE Coin’s recovery might take a different route. Unlike DOGE, which is often seen as a meme coin, BEBE Coin positions itself as a utility token with real-world applications. If the team can focus on developing and promoting these use cases, it could attract a different type of investor—one more interested in the long-term potential of the project rather than short-term speculation.

Navigating the volatility of BEBE Coin requires a strategic approach, especially for beginners in the crypto market. Here are some expert insights to help you make informed decisions:

Understanding Market Indicators

To better understand BEBE Coin’s price movements, it’s crucial to look at key market indicators. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. As of March 2025, BEBE Coin’s RSI is at 30, indicating that it might be oversold and due for a potential rebound.

The Moving Average Convergence Divergence (MACD) is another useful tool. Currently, BEBE Coin’s MACD line is below the signal line, suggesting a bearish trend. However, if the MACD line crosses above the signal line, it could signal a potential bullish reversal.

Bollinger Bands can also provide insights into volatility. BEBE Coin’s price is currently touching the lower Bollinger Band, which often indicates that the price might be due for a bounce back. However, it’s essential to combine these indicators with other analysis methods for a more comprehensive view.

Identifying Support and Resistance Levels

Support and resistance levels are critical price points that can influence BEBE Coin’s future movements. As of March 2025, BEBE Coin has a significant support level at $0.0004, which it has tested multiple times in the past. If the price can hold above this level, it could signal a potential recovery.

On the other hand, the resistance level to watch is at $0.0007. If BEBE Coin can break through this level, it could indicate a stronger bullish trend. Recent news, such as potential partnerships or regulatory developments, could impact these levels and should be monitored closely.

Chart Analysis and Visual Representation

Visual representations of BEBE Coin’s price trends can provide valuable insights. A candlestick chart of BEBE Coin’s price over the past month shows a clear downtrend, with lower highs and lower lows. However, there are signs of potential reversal patterns, such as a hammer candlestick at the current price level, which could indicate a possible bottom.

Comparative graphs with other cryptocurrencies, like DOGE or Ethereum (ETH), can also be helpful. For instance, while BEBE Coin has experienced a sharp decline, ETH has shown more resilience, suggesting that the broader market sentiment might not be as bearish as it seems for BEBE Coin.

Long and Short-Term Predictions

Looking ahead, BEBE Coin’s price movements could be influenced by several factors. In the short term, the next few months could see continued volatility as the market digests recent developments and regulatory news. If BEBE Coin can hold above its current support level and announce positive developments, it could see a recovery to around $0.0007 by the end of 2025.

In the long term, BEBE Coin’s potential for growth depends on its ability to establish itself as a utility token with real-world applications. If the team can successfully develop and promote these use cases, BEBE Coin could see significant growth by 2030, potentially reaching $0.002 or higher.

However, these predictions are speculative and should be taken with caution. The crypto market is highly unpredictable, and external factors like regulatory changes or macroeconomic shifts can significantly impact BEBE Coin’s price.

Actionable Insights for BEBE Coin Investors

For investors looking to navigate BEBE Coin’s volatility, here are some actionable insights:

Diversify Your Portfolio

Given BEBE Coin’s recent price drop, it’s essential to diversify your crypto portfolio. Investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, along with promising altcoins like BEBE Coin, can help mitigate risk.

Stay Informed

Keep an eye on the latest news and developments related to BEBE Coin. The team’s announcements, partnerships, and regulatory updates can significantly impact the price. Staying informed can help you make timely decisions.

Use Technical Analysis

Utilize technical analysis tools like RSI, MACD, and Bollinger Bands to understand BEBE Coin’s price movements better. These tools can help you identify potential entry and exit points, improving your trading strategy.

Consider Long-Term Potential

While BEBE Coin’s short-term volatility can be challenging, consider its long-term potential. If the team can successfully develop its utility and attract more users, BEBE Coin could see significant growth in the coming years.

Set Realistic Expectations

Finally, set realistic expectations for BEBE Coin’s price movements. The crypto market is known for its volatility, and while BEBE Coin has the potential for growth, it’s essential to be prepared for fluctuations.

Conclusion

BEBE Coin’s recent price drop to $0.0005 has raised questions about its future. By analyzing the factors behind this decline and comparing it to similar situations with other cryptocurrencies like Dogecoin, we can gain valuable insights into BEBE Coin’s potential recovery. While the short-term outlook may be uncertain, BEBE Coin’s long-term potential depends on its ability to develop and promote its utility. For investors, staying informed, using technical analysis, and maintaining a diversified portfolio can help navigate the volatility of BEBE Coin and make informed decisions.

As we move forward into 2025 and beyond, keeping an eye on BEBE Coin’s developments and market trends will be crucial. Whether BEBE Coin can recover and reach new heights remains to be seen, but with the right strategies and a bit of patience, investors can position themselves to take advantage of its potential growth.