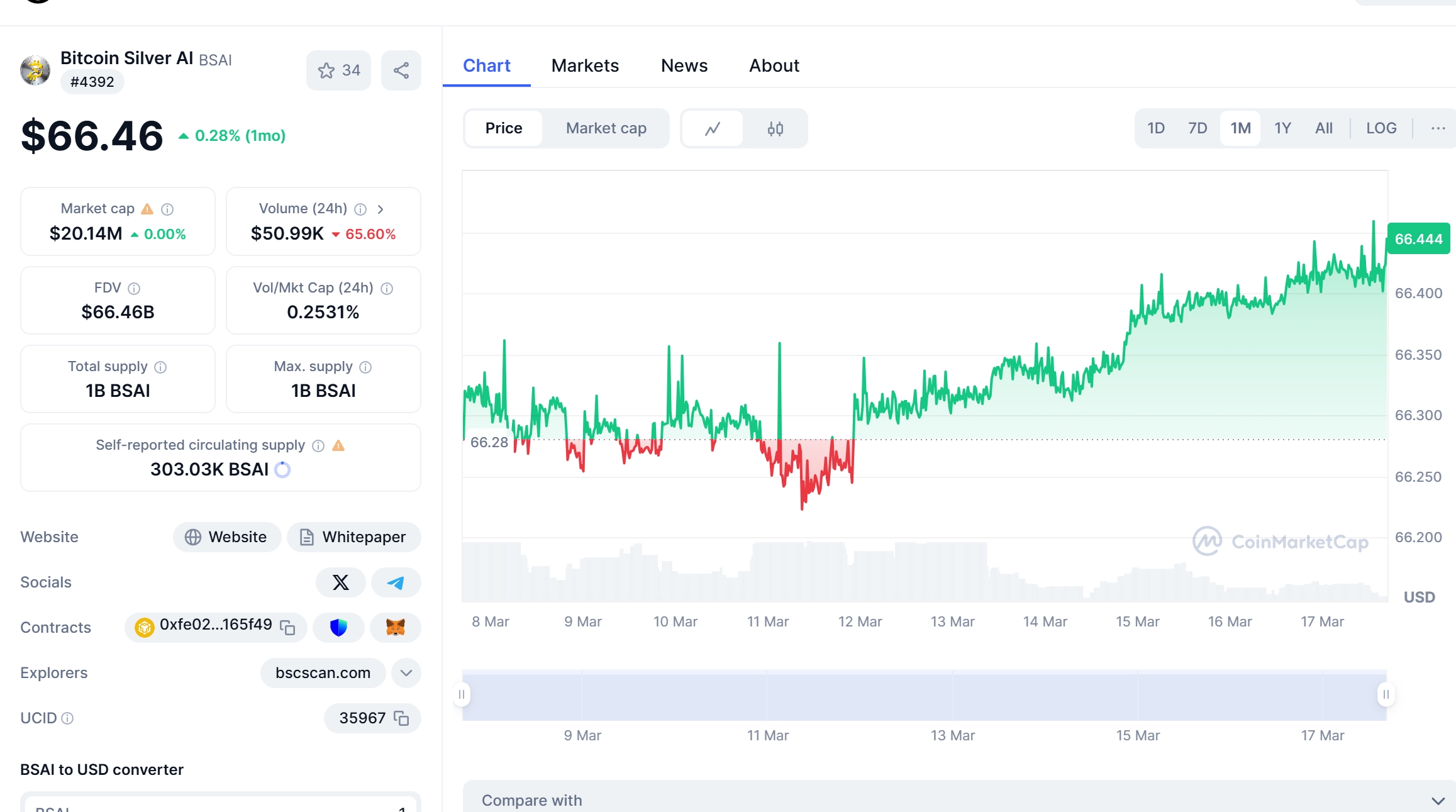

There’s arguably no hotter cryptocurrency on the planet right now than Bitcoin Silver AI (BSAI Coin). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In March 2025, it’s already up 14%, making it the top-performing major cryptocurrency. BSAI Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $66.43, fueled by strong market sentiment. However, the rally was short-lived. BSAI Coin Price Prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new digital asset solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy BSAI Coin at $66.43?”

As a seasoned investor in the crypto market, I’ve seen my fair share of price surges and drops. The recent trajectory of BSAI Coin has caught my eye, and I want to share with you not just the predictions, but the reasoning behind them. The world of cryptocurrency is often a blend of technology, finance, and a dash of speculation, and BSAI Coin is no exception. Its integration of AI and blockchain technology promises to revolutionize the way we think about digital currencies, but how does this translate into future value?

Contents

Can BSAI Coin Recover After Dropping to $66.43?

The dramatic price drop of BSAI Coin from its recent high to $66.43 has left many investors puzzled and a bit nervous. Let’s take a closer look at this drop and what it might mean for the future of the coin. When analyzing a cryptocurrency’s price movement, it’s crucial to consider the broader market context. For instance, let’s compare BSAI Coin’s trend to that of Ethereum, a popular cryptocurrency that has also seen its fair share of volatility.

Ethereum experienced a similar price drop in early 2023 due to regulatory uncertainties and market corrections. However, Ethereum managed to recover thanks to its strong fundamentals and the growing adoption of its blockchain for decentralized applications. The external events that caused Ethereum’s drop were primarily related to regulatory news and shifts in investor sentiment due to macroeconomic factors. In contrast, BSAI Coin’s drop seems to be more tied to internal project developments and market speculation around its AI integration.

So, what might this mean for BSAI Coin? One of the key aspects to consider is the project’s resilience and adaptability. If BSAI Coin can demonstrate strong fundamentals and continue to innovate in its AI applications, there’s a good chance it could follow a similar recovery path to Ethereum. However, the unique nature of BSAI Coin’s technology and market positioning means it could also take a different route. The AI component adds an extra layer of complexity and potential, which could either propel it to new heights or introduce new challenges.

For investors, the current price drop could be seen as a buying opportunity. If you believe in the long-term potential of BSAI Coin and its AI technology, now might be a good time to consider adding it to your portfolio. Just remember, as with any investment, always conduct thorough research and consider your risk tolerance.

What Caused BSAI Coin’s Price Drop, and Will It Bounce Back?

Understanding what led to BSAI Coin’s price drop is crucial for predicting its future movements. Let’s explore how this works in practice. The initial surge to $66.43 was driven by a combination of factors, including positive news about the project’s AI developments and increased market interest in AI-integrated cryptocurrencies. However, the subsequent drop can be attributed to several reasons.

Firstly, there was a market correction after the initial hype. Many investors who bought in at the peak began to sell off their holdings, leading to a rapid decline in price. Secondly, there were concerns about the project’s ability to deliver on its ambitious AI promises. While the technology is groundbreaking, some investors were skeptical about its immediate impact on the market.

Despite these challenges, there’s reason to believe that BSAI Coin could bounce back. The project’s team has been actively addressing these concerns, with recent updates indicating progress on their AI algorithms and partnerships with leading tech firms. These developments could restore investor confidence and drive the price back up.

One of the key indicators to watch is the Relative Strength Index (RSI), which can signal whether a cryptocurrency is overbought or oversold. Currently, BSAI Coin’s RSI suggests it may be oversold, which could be a precursor to a price rebound. Additionally, the Moving Average Convergence Divergence (MACD) and Bollinger Bands can provide further insights into potential price movements. By analyzing these technical indicators, investors can make more informed decisions about when to buy or sell.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.