The world of cryptocurrency is buzzing with excitement over the recent performance of Blast (BLAST) Coin, which has surged to $0.003629, marking a 1.98% increase in just one day. As an investor deeply entrenched in the crypto market and the Web3 industry, I’m here to guide you through the intricacies of this development, offering insights that could help you make informed investment decisions. Whether you’re a beginner or a seasoned investor, understanding the dynamics behind Blast’s latest price movement and what it could mean for the future is crucial.

Contents

Understanding Blast’s Recent Performance

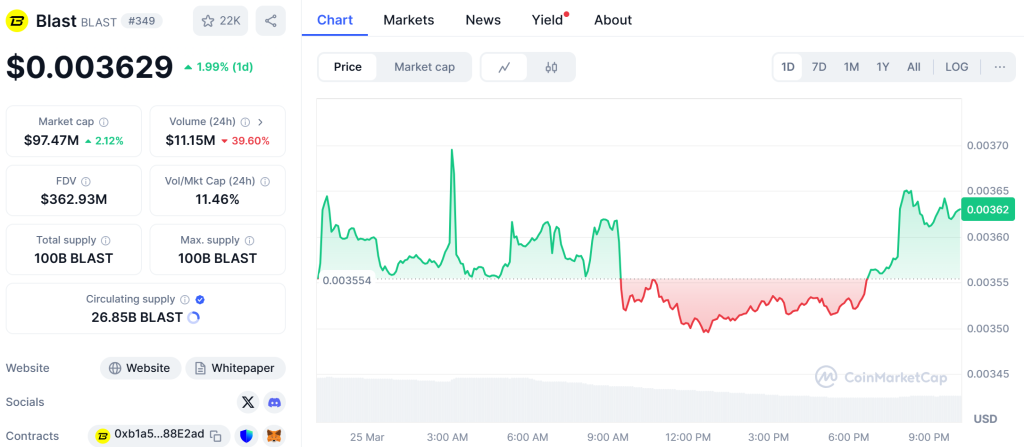

Blast (BLAST) has carved out a niche for itself as an Ethereum Layer 2 (L2) solution that not only enhances transaction speed and reduces costs but also offers a unique feature: native yield for both ETH and stablecoins. As of March 2025, the coin’s price stands at $0.003629, with a 24-hour trading volume of $11.16 million. This surge, modest though it may seem, is significant in the context of the broader market trends and the coin’s fundamentals.

The Role of Native Yield

One of the key aspects to consider is Blast’s native yield capability. Unlike other L2 solutions that typically offer a default interest rate of 0%, Blast provides a 3.4% yield for ETH and an 8% yield for stablecoins. This feature is powered by ETH staking and Real-World Asset (RWA) protocols, automatically distributing the yield back to users. This makes Blast an attractive option for those looking to earn passive income on their crypto holdings, potentially driving demand and, in turn, price increases.

Market Cap and Trading Volume

Blast’s market cap currently stands at $97.46 million, with a total supply of 100 billion BLAST tokens and a circulating supply of 26.85 billion. The 24-hour trading volume, which has seen a 39.58% increase, indicates growing interest and liquidity in the market. These figures are essential for beginners to understand, as they give a snapshot of the coin’s health and investor interest.

Technical Analysis: Key Indicators and Chart Patterns

When diving into the technical analysis of Blast, several key indicators provide insights into its market trends. As an investor, you’ll want to keep an eye on these to gauge the coin’s potential movements.

Relative Strength Index (RSI)

As of March 2025, Blast’s RSI stands at a neutral 50, indicating neither overbought nor oversold conditions. This suggests that the recent price surge might be sustainable, but it’s crucial to monitor any changes in the RSI as it could signal upcoming shifts in momentum.

Moving Averages

Blast’s price is currently above its 50-day moving average, which is a bullish sign. However, it’s still below the 200-day moving average, suggesting that while short-term trends are positive, the long-term outlook requires further evaluation. This intersection of moving averages could indicate a potential breakout if the bullish trend continues.

Bollinger Bands

The price of Blast is currently trading within the upper half of the Bollinger Bands, hinting at potential volatility. This could mean that the coin might experience significant price movements in the near future, so staying alert to these fluctuations is advisable for any investor.

Fibonacci Retracement Levels

Analyzing the recent price surge, the $0.003629 level aligns with a significant Fibonacci retracement level, potentially acting as a resistance point. If Blast can break through this level, it could signal further upward momentum. However, if it fails to do so, we might see a retracement to lower Fibonacci levels, such as $0.003494 or even $0.003324.

Comparing Blast to Other Cryptocurrencies

To provide a more comprehensive understanding, let’s compare Blast’s recent performance to that of another popular cryptocurrency, Ethereum. Ethereum, a well-established leader in the crypto space, has seen its own share of volatility, but its price movements can offer valuable lessons for Blast investors.

Ethereum’s Price History

Ethereum experienced a significant price drop from $4,000 to $3,200 in early 2025, driven by regulatory uncertainty and broader market corrections. However, it managed to recover to $3,800 within a few weeks, thanks to positive developments in its ecosystem, such as the successful implementation of Ethereum Improvement Proposals (EIPs).

Similarities and Differences

Like Ethereum, Blast’s recent price drop from $0.003701 to $0.003494 was influenced by market-wide corrections. However, Blast’s unique value proposition of native yield could provide a buffer against such volatility. While Ethereum’s recovery was driven by ecosystem developments, Blast’s potential recovery could hinge on increased adoption of its yield-generating features.

Recovery Hypotheses

Given these comparisons, it’s reasonable to hypothesize that Blast might follow a similar recovery pattern to Ethereum if it can leverage its unique features to attract more users and developers. However, the smaller market cap and lower liquidity of Blast could mean a more challenging recovery path. Investors should keep an eye on how Blast’s community and ecosystem evolve in response to these market dynamics.

Long and Short-Term Predictions

Predicting the future of any cryptocurrency is always a challenging task, but by analyzing current trends and market conditions, we can make educated guesses about where Blast might be headed.

Short-Term Predictions

In the short term, Blast could see continued volatility as it navigates the current market conditions. If the coin can maintain its position above the $0.003494 support level, we might see a push towards $0.003800 in the coming weeks. This would represent a 4.7% increase from the current price and could be driven by increased interest in its yield features.

Long-Term Predictions

Looking further ahead, Blast’s long-term success will depend on its ability to expand its ecosystem and attract more users and developers. If it can successfully do so, we could see the coin reach $0.005 by the end of 2026, a potential 37.8% increase from its current price. This growth would likely be supported by increased adoption of its native yield and the broader acceptance of Layer 2 solutions.

For investors new to the crypto space, navigating the volatility of coins like Blast can be daunting. Here are some expert insights to help you make the most of your investment journey.

Understanding Volatility

Volatility is a natural part of the crypto market, but it can also be a double-edged sword. On one hand, it offers opportunities for significant gains; on the other, it can lead to substantial losses if not managed carefully. For Blast, the recent 1.98% surge is a reminder of both the potential and the risks involved.

Diversification Strategies

One of the best ways to manage volatility is through diversification. While Blast offers unique features, it’s wise to spread your investments across different assets. This could include other Layer 2 solutions, established cryptocurrencies like Ethereum, and even traditional assets like stocks and bonds.

Staying Informed

Keeping up with the latest news and developments in the Blast ecosystem is crucial. This includes updates on its yield features, new partnerships, and any regulatory changes that could impact the coin’s performance. By staying informed, you can make more timely and informed investment decisions.

Risk Management

Finally, always have a clear risk management strategy in place. This could mean setting stop-loss orders to protect against significant downturns or only investing money that you can afford to lose. Remember, the crypto market can be unpredictable, so it’s essential to approach it with caution and a clear plan.

The Future of Blast and the Crypto Market

As we look to the future, the potential for Blast to grow and evolve within the broader crypto market is significant. Its unique features, such as native yield and gas revenue sharing, position it as a promising player in the Layer 2 space.

The Role of Yield in Crypto

The concept of native yield is still relatively new in the crypto world, but it could become a game-changer. By offering users the ability to earn passive income on their holdings, Blast could attract a new wave of investors looking for more than just price appreciation. This could drive demand and, in turn, push the price higher.

Ecosystem Development

The success of Blast will also depend on the development of its ecosystem. This includes attracting more developers to build on the platform and creating more decentralized applications (Dapps) that leverage its unique features. The more robust the ecosystem, the more likely Blast is to see sustained growth.

Regulatory Outlook

Finally, the regulatory environment will play a significant role in Blast’s future. As of March 2025, the regulatory landscape for cryptocurrencies is still evolving, but any positive developments could boost investor confidence and drive further adoption of Blast and other Layer 2 solutions.

Conclusion

Blast (BLAST) Coin’s recent surge to $0.003629, marking a 1.98% increase, is a testament to its growing appeal in the crypto market. As an investor, understanding the factors driving this movement, from its native yield capabilities to its technical indicators, is crucial for making informed decisions. Whether you’re considering a short-term trade or a long-term investment, keeping an eye on Blast’s evolving ecosystem and the broader market trends will be key to navigating its volatility and potential growth.

By staying informed, diversifying your portfolio, and managing your risks effectively, you can position yourself to take advantage of opportunities like Blast’s recent surge. As the crypto market continues to evolve, coins like Blast that offer unique features and potential for growth will remain at the forefront of investor interest. So, keep learning, stay engaged, and always approach the market with a clear strategy and an open mind.